Civeo Corporation (NYSE:CVEO) today reported financial and

operating results for the first quarter ended March 31, 2019.

Highlights include:

- Delivered first quarter revenues of $108.6 million

- Reported first quarter net loss of $17.5 million and Adjusted

EBITDA of $15.9 million

- Generated $6.3 million in operating cash flow during the

quarter

- Significantly improved year-over-year results from the U.S.

segment

- Expanded our Sitka Lodge in British Columbia to 754 rooms

during the quarter with 1,100 total rooms expected to be on site by

June 2019

“Despite recent macroeconomic headwinds and winter seasonality,

we are pleased to deliver first quarter revenue and Adjusted EBITDA

in-line with our expectations. Our U.S. business generated

significantly improved year-over-year results as our efforts to

relocate well site assets into the Permian and Mid-Con regions over

the past eighteen months produced materially improved utilization

of those assets. Our Australia business also produced improved

year-over-year revenues and Adjusted EBITDA as Bowen Basin activity

increased with conducive metallurgical coal prices. Our first

quarter Canadian Adjusted EBITDA was up year-over-year, primarily

due to proceeds from an insurance claim, a full quarter of

contribution from the Noralta acquisition and the impact of British

Columbia LNG activity, partially offset by lower activity in our

core oil sands lodges. We will continue to remain vigilant in

adapting to dynamic market conditions in a way that maximizes the

value of our company for our shareholders,” stated Bradley J.

Dodson, Civeo's President and Chief Executive Officer.

Mr. Dodson added, “We expect a sequentially improved second

quarter as increased turnaround and maintenance activity in Canada

and Australia start up for the year coupled with growing

contributions from LNG-related work at our Sitka Lodge in British

Columbia. Looking forward, we seek to continue delivering on our

strategic priorities: generating free cash flow, managing our

balance sheet, investing in attractive growth opportunities in key

end markets and continuing our best-in-class service offerings to

customers.”

First Quarter 2019 Results

In the first quarter of 2019, Civeo generated revenues of $108.6

million and reported a net loss of $17.5 million, or $0.11 per

share. During the first quarter of 2019, Civeo produced operating

cash flow of $6.3 million and Adjusted EBITDA of $15.9 million.

The first quarter of 2019 was in-line with the Company's

expectations as a result of solid operational execution in the U.S.

and Australia.

By comparison, in the first quarter of 2018, Civeo generated

revenues of $101.5 million and reported a net loss of $55.5

million, or $0.42 per share. The net loss included a pre-tax $28.7

million impairment charge and $1.0 million in costs associated with

Civeo’s acquisition of Noralta. During the first quarter of 2018,

Civeo generated operating cash flow of $2.8 million and Adjusted

EBITDA of $10.0 million.

(EBITDA is a non-GAAP financial measure that is defined as net

income plus interest, taxes, depreciation and amortization, and

Adjusted EBITDA is defined as EBITDA adjusted to exclude impairment

charges and certain costs associated with Civeo's acquisition of

Noralta. Please see the reconciliations to GAAP measures at the end

of this news release.)

Business Segment Results

(Unless otherwise noted, the following discussion compares the

quarterly results for the first quarter of 2019 to the results for

the first quarter of 2018. The Adjusted EBITDA amounts discussed

below exclude the fixed asset impairment and Noralta-related

expenses in the first quarter of 2018 noted above.)

Canada

During the first quarter of 2019, the Canadian segment generated

revenues of $66.8 million, operating loss of $11.6 million and

Adjusted EBITDA of $10.2 million, compared to revenues of $63.4

million, operating loss of $40.3 million and Adjusted EBITDA of

$8.9 million in the first quarter of 2018. The first quarter of

2019 results reflect the impact of a weakened Canadian dollar

relative to the U.S. dollar, which decreased revenues by $3.4

million. Included in first quarter 2019 Adjusted EBITDA for the

Canadian segment is $1.5 million of other income for proceeds from

an insurance claim related to the closure of a lodge in 2018 for

maintenance-related operational issues.

The Canadian segment saw softening room demand from major

customers in the core oil sands lodges related to extended holiday

downtime and the continued impact of provincially imposed oil

production curtailments. These headwinds were partially offset by

the inclusion of the Noralta assets, improving contribution of

LNG-related occupancy in British Columbia and a recently announced

food service contract.

Australia

During the first quarter of 2019, the Australian segment

generated revenues of $28.4 million, operating loss of $0.4 million

and Adjusted EBITDA of $9.9 million, compared to revenues of $27.9

million, operating loss of $3.2 million and Adjusted EBITDA of $9.1

million in the first quarter of 2018.

The first quarter of 2019 results reflect the impact of a

weakened Australian dollar relative to the U.S. dollar, which

decreased revenues by $2.9 million. On a constant currency basis,

the Australian segment experienced a 2% period-over-period increase

in revenues driven by strong occupancy with billed rooms up 12%

year-over-year primarily due to continued improvement in

metallurgical coal activity across our Bowen Basin villages.

U.S.

The U.S. segment generated revenues of $13.4 million, operating

loss of $1.0 million and Adjusted EBITDA of $2.8 million in the

first quarter of 2019, compared to revenues of $10.2 million,

operating loss of $3.3 million and an Adjusted EBITDA loss of $0.7

million in the first quarter of 2018. The year-over-year revenue

improvement was primarily driven by increased drilling and

completion activity in the Permian Basin and Mid-Con regions. The

significant year-over-year Adjusted EBITDA improvement in the first

quarter of 2019 is also due to lower year-over-year relocation

expenses for the well site business, which was spent most of 2018

moving well site assets out of legacy northern markets into the

Permian and Mid-Con regions.

Income Taxes

Civeo recognized an income tax benefit of $4.5 million, which

resulted in an effective tax rate of 20.8%, in the first quarter of

2019. During the first quarter of 2018, Civeo recognized an income

tax benefit of $0.7 million, which resulted in an effective tax

rate of 1%.

Financial Condition

As of March 31, 2019, Civeo had total liquidity of

approximately $66.0 million, consisting of $58.0 million available

under its revolving credit facilities and $8.0 million of cash on

hand.

Civeo’s total debt outstanding on March 31, 2019 was $383.5

million, a $4.3 million increase since December 31, 2018. The

increase resulted primarily from a negative foreign currency

translation impact of $7.5 million, partially offset by debt

repayments of $3.2 million made during the quarter.

During the first quarter of 2019, Civeo invested $9.7 million in

capital expenditures, up from $2.7 million during first quarter of

2018. The increase was primarily related to the expansion of its

Sitka lodge in Canada to support LNG Canada related contracts, as

well as selected room reactivations in Australia in anticipation of

increased customer demand in the second half of 2019 going into

2020.

Second Quarter and Full Year 2019 Guidance

For the second quarter of 2019, Civeo expects revenues of $113.0

million to $118.0 million and Adjusted EBITDA of $21.0 million to

$23.5 million. For the full year of 2019, Civeo expects revenues of

$475.0 million to $485.0 million and Adjusted EBITDA of $95.0

million to $101.0 million.

Conference Call

Civeo will host a conference call to discuss its first quarter

2019 financial results today at 11:00 a.m. Eastern time. This call

is being webcast and can be accessed at Civeo's website at

www.civeo.com. Participants may also join the conference call by

dialing (800)-289-0438 in the United States or (323)-794-2423

internationally and using the conference ID 9872605#. A replay will

be available after the call by dialing (844) 512-2921 in the United

States or (412) 317-6671 internationally and using the conference

ID 9872605#.

About Civeo

Civeo Corporation is a leading provider of hospitality services

with prominent market positions in the Canadian oil sands and the

Australian natural resource regions. Civeo offers comprehensive

solutions for lodging hundreds or thousands of workers with its

long-term and temporary accommodations and provides food services,

housekeeping, facility management, laundry, water and wastewater

treatment, power generation, communications systems, security and

logistics services. Civeo currently operates a total of 33 lodges

and villages in operation in Canada and Australia, with an

aggregate of approximately 33,000 rooms. Civeo is publicly traded

under the symbol CVEO on the New York Stock Exchange. For more

information, please visit Civeo's website at www.civeo.com.

Forward Looking Statements

This news release contains forward-looking statements within the

meaning of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements are

those that do not state historical facts and are, therefore,

inherently subject to risks and uncertainties. The forward-looking

statements in this news release include the statements regarding

Civeo’s future plans, priorities, contracted revenues and borrowing

needs; growth opportunities and ability to adapt to market

conditions; expectations about activity, market demand and

commodity price environment in 2019; expected benefits of the

agreement with LNG Canada and LNG-related activity and second

quarter and full year 2019 guidance. The forward-looking statements

included herein are based on then current expectations and entail

various risks and uncertainties that could cause actual results to

differ materially from those expressed or implied by these

forward-looking statements. Such risks and uncertainties include,

among other things, risks associated with the general nature of the

accommodations industry, risks associated with the level of supply

and demand for oil, coal, iron ore and other minerals, including

the level of activity and developments in the Canadian oil sands,

the level of demand for coal and other natural resources from

Australia, and fluctuations in the current and future prices of

oil, coal, iron ore and other minerals, risks associated with

currency exchange rates, risks associated with the Noralta

acquisition, risks associated with the development of new projects,

including whether such projects will continue in the future, and

other factors discussed in the "Management’s Discussion and

Analysis of Financial Condition and Results of Operations" and

"Risk Factors" sections of Civeo’s annual report on Form 10-K for

the year ended December 31, 2018 and other reports the Company may

file from time to time with the U.S. Securities and Exchange

Commission. Each forward-looking statement contained in this news

release speaks only as of the date of this release. Except as

required by law, Civeo expressly disclaims any intention or

obligation to revise or update any forward-looking statements,

whether as a result of new information, future events or

otherwise.

- Financial Schedules Follow -

CIVEO

CORPORATIONUNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS(in thousands, except per share

amounts)

| |

|

Three Months Ended March 31, |

| |

|

2019 |

|

2018 |

| |

|

|

|

|

| Revenues |

|

$ |

108,550 |

|

|

$ |

101,504 |

|

| |

|

|

|

|

| Costs and

expenses: |

|

|

|

|

| Cost of

sales and services |

|

79,630 |

|

|

77,701 |

|

| Selling,

general and administrative expenses |

|

16,096 |

|

|

16,514 |

|

|

Depreciation and amortization expense |

|

30,782 |

|

|

30,764 |

|

|

Impairment expense |

|

— |

|

|

28,661 |

|

| Other

operating expense (income) |

|

(65 |

) |

|

379 |

|

| |

|

126,443 |

|

|

154,019 |

|

| Operating loss |

|

(17,893 |

) |

|

(52,515 |

) |

| |

|

|

|

|

| Interest expense |

|

(6,635 |

) |

|

(5,822 |

) |

| Interest income |

|

27 |

|

|

58 |

|

| Other income |

|

2,978 |

|

|

2,259 |

|

| Loss

before income taxes |

|

(21,523 |

) |

|

(56,020 |

) |

| Income tax benefit |

|

4,484 |

|

|

685 |

|

| Net loss |

|

(17,039 |

) |

|

(55,335 |

) |

|

Less: Net income attributable to noncontrolling interest |

|

— |

|

|

122 |

|

| Net loss attributable

to Civeo Corporation |

|

(17,039 |

) |

|

(55,457 |

) |

| Less:

Dividends attributable to Class A preferred shares |

|

459 |

|

|

— |

|

| Net loss attributable

to Civeo Corporation common shareholders |

|

$ |

(17,498 |

) |

|

$ |

(55,457 |

) |

| |

|

|

|

|

| Net loss

per share attributable to Civeo Corporation common

shareholders: |

|

|

|

Basic |

|

$ |

(0.11 |

) |

|

$ |

(0.42 |

) |

|

Diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.42 |

) |

| |

|

|

|

|

| Weighted average number

of common shares outstanding: |

|

|

|

|

|

Basic |

|

165,330 |

|

|

131,631 |

|

|

Diluted |

|

165,330 |

|

|

131,631 |

|

|

|

|

|

|

|

|

|

CIVEO

CORPORATIONCONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands)

| |

|

March 31, 2019 |

|

December 31, 2018 |

| |

|

(UNAUDITED) |

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

7,992 |

|

|

$ |

12,372 |

|

| Accounts

receivable, net |

|

73,513 |

|

|

70,223 |

|

|

Inventories |

|

4,276 |

|

|

4,313 |

|

| Assets

held for sale |

|

8,058 |

|

|

10,297 |

|

| Prepaid

expenses and other current assets |

|

9,267 |

|

|

10,592 |

|

| Total

current assets |

|

103,106 |

|

|

107,797 |

|

| |

|

|

|

|

| Property, plant and

equipment, net |

|

650,919 |

|

|

658,905 |

|

| Goodwill, net |

|

119,158 |

|

|

114,207 |

|

| Other intangible

assets, net |

|

111,542 |

|

|

119,409 |

|

| Operating lease

right-of-use assets |

|

22,225 |

|

|

— |

|

| Other noncurrent

assets |

|

1,048 |

|

|

1,359 |

|

| Total

assets |

|

$ |

1,007,998 |

|

|

$ |

1,001,677 |

|

| |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

30,053 |

|

|

$ |

28,334 |

|

| Accrued

liabilities |

|

13,371 |

|

|

15,956 |

|

| Income

taxes |

|

572 |

|

|

310 |

|

| Current

portion of long-term debt |

|

34,068 |

|

|

33,329 |

|

| Deferred

revenue |

|

3,598 |

|

|

3,035 |

|

| Other

current liabilities |

|

9,407 |

|

|

5,719 |

|

| Total

current liabilities |

|

91,069 |

|

|

86,683 |

|

| |

|

|

|

|

| Long-term debt |

|

346,841 |

|

|

342,908 |

|

| Deferred income

taxes |

|

13,838 |

|

|

18,442 |

|

| Operating lease

liabilities |

|

18,529 |

|

|

— |

|

| Other noncurrent

liabilities |

|

16,404 |

|

|

18,220 |

|

| Total

liabilities |

|

486,681 |

|

|

466,253 |

|

| |

|

|

|

|

| Shareholders'

equity: |

|

|

|

|

| Preferred

shares |

|

56,739 |

|

|

56,280 |

|

| Common

shares |

|

— |

|

|

— |

|

|

Additional paid-in capital |

|

1,564,667 |

|

|

1,562,133 |

|

|

Accumulated deficit |

|

(728,748 |

) |

|

(710,551 |

) |

| Treasury

stock |

|

(5,471 |

) |

|

(1,189 |

) |

|

Accumulated other comprehensive loss |

|

(365,870 |

) |

|

(371,249 |

) |

| Total

Civeo Corporation shareholders' equity |

|

521,317 |

|

|

535,424 |

|

| Noncontrolling

interest |

|

— |

|

|

— |

|

| Total

shareholders' equity |

|

521,317 |

|

|

535,424 |

|

| Total

liabilities and shareholders' equity |

|

$ |

1,007,998 |

|

|

$ |

1,001,677 |

|

| |

|

|

|

|

|

|

|

|

CIVEO

CORPORATIONUNAUDITED CONSOLIDATED STATEMENTS OF

CASH FLOWS(in thousands)

| |

|

Three Months Ended March 31, |

| |

|

2019 |

|

2018 |

| |

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

| Net loss |

|

$ |

(17,039 |

) |

|

$ |

(55,335 |

) |

| Adjustments to

reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

|

Depreciation and amortization |

|

30,782 |

|

|

30,764 |

|

|

Impairment charges |

|

— |

|

|

28,661 |

|

| Deferred

income tax provision (benefit) |

|

(4,745 |

) |

|

2 |

|

| Non-cash

compensation charge |

|

2,534 |

|

|

2,200 |

|

| Gain on

disposals of assets |

|

(1,452 |

) |

|

(2,147 |

) |

| Provision

for loss on receivables, net of recoveries |

|

(32 |

) |

|

(35 |

) |

| Other,

net |

|

(410 |

) |

|

2,047 |

|

| Changes

in operating assets and liabilities: |

|

|

|

|

| Accounts

receivable |

|

(2,377 |

) |

|

4,837 |

|

|

Inventories |

|

87 |

|

|

2,190 |

|

| Accounts

payable and accrued liabilities |

|

(1,417 |

) |

|

(10,352 |

) |

| Taxes

payable |

|

262 |

|

|

(1,358 |

) |

| Other

current assets and liabilities, net |

|

148 |

|

|

1,364 |

|

| Net cash

flows provided by operating activities |

|

6,341 |

|

|

2,838 |

|

| |

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

| Capital

expenditures |

|

(9,679 |

) |

|

(2,696 |

) |

| Payments

related to acquisitions, net of cash acquired |

|

— |

|

|

(23,771 |

) |

| Proceeds

from disposition of property, plant and equipment |

|

4,457 |

|

|

2,718 |

|

| Other,

net |

|

1,518 |

|

|

110 |

|

| Net cash

flows used in investing activities |

|

(3,704 |

) |

|

(23,639 |

) |

| |

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

| Term loan

repayments |

|

(8,608 |

) |

|

(4,079 |

) |

| Revolving

credit borrowings (repayments), net |

|

5,396 |

|

|

35,641 |

|

| Taxes

paid on vested shares |

|

(4,282 |

) |

|

(594 |

) |

| Net cash

flows provided by (used in) financing activities |

|

(7,494 |

) |

|

30,968 |

|

| |

|

|

|

|

| Effect of exchange rate

changes on cash |

|

477 |

|

|

(837 |

) |

| Net change in cash and

cash equivalents |

|

(4,380 |

) |

|

9,330 |

|

| |

|

|

|

|

| Cash and cash

equivalents, beginning of period |

|

12,372 |

|

|

32,647 |

|

| Cash and cash

equivalents, end of period |

|

$ |

7,992 |

|

|

$ |

41,977 |

|

| |

|

|

|

|

|

|

|

|

CIVEO CORPORATIONSEGMENT

DATA(in

thousands)(unaudited)

| |

|

Three Months Ended March 31, |

| |

|

2019 |

|

2018 |

| Revenues |

|

|

|

|

| Canada |

|

$ |

66,770 |

|

|

$ |

63,390 |

|

| Australia |

|

28,421 |

|

|

27,875 |

|

| United

States |

|

13,359 |

|

|

10,239 |

|

| Total revenues |

|

$ |

108,550 |

|

|

$ |

101,504 |

|

| |

|

|

|

|

| EBITDA (1) |

|

|

|

|

| Canada |

|

$ |

10,173 |

|

|

$ |

(20,026 |

) |

| Australia |

|

9,853 |

|

|

9,107 |

|

| United

States |

|

2,796 |

|

|

(738 |

) |

| Corporate and

eliminations |

|

(6,955 |

) |

|

(7,957 |

) |

| Total EBITDA |

|

$ |

15,867 |

|

|

$ |

(19,614 |

) |

| |

|

|

|

|

| Adjusted EBITDA

(1) |

|

|

|

|

| Canada |

|

$ |

10,173 |

|

|

$ |

8,903 |

|

| Australia |

|

9,853 |

|

|

9,107 |

|

| United

States |

|

2,796 |

|

|

(738 |

) |

| Corporate and

eliminations |

|

(6,955 |

) |

|

(7,259 |

) |

| Total adjusted EBITDA |

|

$ |

15,867 |

|

|

$ |

10,013 |

|

| |

|

|

|

|

| Operating income

(loss) |

|

|

|

|

| Canada |

|

$ |

(11,595 |

) |

|

$ |

(40,303 |

) |

| Australia |

|

(385 |

) |

|

(3,166 |

) |

| United

States |

|

(961 |

) |

|

(3,264 |

) |

| Corporate and

eliminations |

|

(4,952 |

) |

|

(5,782 |

) |

| Total operating loss |

|

$ |

(17,893 |

) |

|

$ |

(52,515 |

) |

| |

|

|

|

|

| (1) Please

see Non-GAAP Reconciliation Schedule. |

| |

CIVEO

CORPORATIONNON-GAAP

RECONCILIATIONS(in

thousands)(unaudited)

| |

|

Three Months Ended March 31, |

| |

|

2019 |

|

2018 |

| |

|

|

|

|

| EBITDA (1) |

|

$ |

15,867 |

|

|

$ |

(19,614 |

) |

| Adjusted EBITDA

(1) |

|

$ |

15,867 |

|

|

$ |

10,013 |

|

| Free Cash Flow (2) |

|

$ |

1,119 |

|

|

$ |

2,860 |

|

| |

|

|

|

|

|

|

|

|

(1) The term EBITDA is defined as net income (loss) attributable

to Civeo Corporation plus interest, taxes, depreciation and

amortization. The term Adjusted EBITDA is defined as EBITDA

adjusted to exclude impairment charges and certain costs associated

with Civeo's acquisition of Noralta. EBITDA and

Adjusted EBITDA are not measures of financial performance under

generally accepted accounting principles and should not be

considered in isolation from or as a substitute for net income or

cash flow measures prepared in accordance with generally accepted

accounting principles or as a measure of profitability or

liquidity. Additionally, EBITDA and Adjusted EBITDA may not be

comparable to other similarly titled measures of other companies.

Civeo has included EBITDA and Adjusted EBITDA as supplemental

disclosures because its management believes that EBITDA and

Adjusted EBITDA provide useful information regarding its ability to

service debt and to fund capital expenditures and provide investors

a helpful measure for comparing the Civeo's operating performance

with the performance of other companies that have different

financing and capital structures or tax rates. Civeo uses EBITDA

and Adjusted EBITDA to compare and to monitor the performance of

its business segments to other comparable public companies and as a

benchmark for the award of incentive compensation under its annual

incentive compensation plan.

The following table sets forth a reconciliation of EBITDA and

Adjusted EBITDA to net loss attributable to Civeo Corporation,

which is the most directly comparable measure of financial

performance calculated under generally accepted accounting

principles (in thousands) (unaudited):

| |

|

Three Months Ended March 31, |

| |

|

2019 |

|

2018 |

| |

|

|

|

|

| Net income (loss)

attributable to Civeo Corporation |

|

$ |

(17,039 |

) |

|

$ |

(55,457 |

) |

| Income tax provision

(benefit) |

|

(4,484 |

) |

|

(685 |

) |

| Depreciation and

amortization |

|

30,782 |

|

|

30,764 |

|

| Interest income |

|

(27 |

) |

|

(58 |

) |

| Interest expense |

|

6,635 |

|

|

5,822 |

|

| EBITDA |

|

$ |

15,867 |

|

|

$ |

(19,614 |

) |

| Adjustments to

EBITDA |

|

|

|

|

| Impairment

expense (a) |

|

— |

|

|

28,661 |

|

| Noralta

transaction costs (b) |

|

— |

|

|

966 |

|

| Adjusted EBITDA |

|

$ |

15,867 |

|

|

$ |

10,013 |

|

(a) Relates to the first quarter 2018 impairment of assets in

Canada. We recorded a pre-tax loss of $28.7 million ($20.9

million after-tax, or $0.13 per diluted share), which is included

in Impairment expense on the unaudited statements of

operations.

(b) Relates to costs incurred associated with Civeo's

acquisition of Noralta. During the first quarter 2018, the

$1.0 million of costs ($0.9 million after-tax, or $0.01, per

diluted share), which are primarily corporate in nature, are

included in Selling, general and administrative expenses on the

unaudited statements of operations.

(2) The term Free Cash Flow is defined as net cash flows

provided by operating activities less capital expenditures plus

proceeds from asset sales. Free Cash Flow is not a measure of

financial performance under generally accepted accounting

principles and should not be considered in isolation from or as a

substitute for cash flow measures prepared in accordance with

generally accepted accounting principles or as a measure of

profitability or liquidity. Additionally, Free Cash Flow may not be

comparable to other similarly titled measures of other companies.

Civeo has included Free Cash Flow as a supplemental disclosure

because its management believes that Free Cash Flow provides useful

information regarding the cash flow generating ability of its

business relative to its capital expenditure and debt service

obligations. Civeo uses Free Cash Flow to compare and to

understand, manage, make operating decisions and evaluate Civeo's

business. It is also used as a benchmark for the award of

incentive compensation under its Free Cash Flow plan.

The following table sets forth a reconciliation of Free Cash

Flow to Net Cash Flows Provided by Operating Activities, which is

the most directly comparable measure of financial performance

calculated under generally accepted accounting principles (in

thousands) (unaudited):

| |

|

Three Months Ended March 31, |

| |

|

2019 |

|

2018 |

| |

|

|

|

|

| Net Cash Flows Provided

by Operating Activities |

|

$ |

6,341 |

|

|

$ |

2,838 |

|

| Capital

expenditures, including capitalized interest |

|

(9,679 |

) |

|

(2,696 |

) |

| Proceeds from

disposition of property, plant and equipment |

|

4,457 |

|

|

2,718 |

|

| Free Cash

Flow |

|

$ |

1,119 |

|

|

$ |

2,860 |

|

| |

|

|

|

|

|

|

|

|

CIVEO

CORPORATIONNON-GAAP RECONCILIATIONS -

GUIDANCE(in

millions)(unaudited)

| |

|

Three Months

Ending June 30, 2019 |

|

Year Ending

December 31, 2019 |

| EBITDA Range (1) |

|

$ |

21.0 |

|

|

$ |

23.5 |

|

|

$ |

95.0 |

|

|

$ |

101.0 |

|

(1) (1) The following table sets forth a reconciliation of

estimated EBITDA to estimated net loss, which is the most directly

comparable measure of financial performance calculated under

generally accepted accounting principles (in millions)

(unaudited):

| |

|

Three Months

Ending June 30, 2019 |

|

Year Ending

December 31, 2019 |

| |

|

(estimated) |

|

(estimated) |

| |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(16.0 |

) |

|

$ |

(14.5 |

) |

|

$ |

(53.0 |

) |

|

$ |

(50.0 |

) |

| Income tax provision

(benefit) |

|

(3.0 |

) |

|

(2.0 |

) |

|

(12.0 |

) |

|

(9.0 |

) |

| Depreciation and

amortization |

|

33.5 |

|

|

33.5 |

|

|

135.0 |

|

|

135.0 |

|

| Interest expense |

|

6.5 |

|

|

6.5 |

|

|

25.0 |

|

|

25.0 |

|

| EBITDA |

|

$ |

21.0 |

|

|

$ |

23.5 |

|

|

$ |

95.0 |

|

|

$ |

101.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIVEO

CORPORATIONSUPPLEMENTAL QUARTERLY SEGMENT AND

OPERATING DATA(U.S. dollars in thousands, except

for room counts and average daily

rates)(unaudited)

| |

|

Three Months Ended March 31, |

| |

|

2019 |

|

2018 |

| |

|

|

|

|

| Supplemental Operating

Data - Canadian Segment |

|

|

|

|

| Revenues |

|

|

|

|

| Accommodation revenue

(1) |

|

$ |

57,652 |

|

|

$ |

50,647 |

|

| Mobile facility rental

revenue (2) |

|

781 |

|

|

7,794 |

|

| Food and other services

revenue (3) |

|

8,337 |

|

|

3,739 |

|

| Manufacturing revenue

(4) |

|

— |

|

|

1,210 |

|

| Total Canadian revenues |

|

$ |

66,770 |

|

|

$ |

63,390 |

|

| |

|

|

|

|

| Costs |

|

|

|

|

|

Accommodation cost |

|

$ |

42,217 |

|

|

$ |

37,038 |

|

| Mobile

facility rental cost |

|

649 |

|

|

7,404 |

|

| Food and

other services cost |

|

8,236 |

|

|

3,218 |

|

|

Manufacturing cost |

|

189 |

|

|

1,239 |

|

| Indirect

other cost |

|

3,356 |

|

|

2,997 |

|

| Total

Canadian cost of sales and services |

|

$ |

54,647 |

|

|

$ |

51,896 |

|

| |

|

|

|

|

| Average daily

rates (5) |

|

$ |

92 |

|

|

$ |

88 |

|

| |

|

|

|

|

| Billed rooms

(6) |

|

625,992 |

|

|

572,888 |

|

| |

|

|

|

|

| Canadian dollar

to U.S. dollar |

|

$ |

0.752 |

|

|

$ |

0.791 |

|

| |

|

|

|

|

| Supplemental Operating

Data - Australian Segment |

|

|

|

|

|

Accommodation revenue (1) |

|

$ |

28,421 |

|

|

$ |

27,698 |

|

|

Food and other services revenue (3) |

|

— |

|

|

177 |

|

|

Total Australian revenues |

|

$ |

28,421 |

|

|

$ |

27,875 |

|

| |

|

|

|

|

| Costs |

|

|

|

|

|

Accommodation cost |

|

$ |

14,397 |

|

|

$ |

14,506 |

|

| Food and

other services cost |

|

— |

|

|

163 |

|

| Indirect

other cost |

|

602 |

|

|

664 |

|

| Total

Australian cost of sales and services |

|

$ |

14,999 |

|

|

$ |

15,333 |

|

| |

|

|

|

|

| Average daily

rates (5) |

|

$ |

74 |

|

|

$ |

81 |

|

| |

|

|

|

|

| Billed rooms

(6) |

|

382,581 |

|

|

341,579 |

|

| |

|

|

|

|

| Australian

dollar to U.S. dollar |

|

$ |

0.712 |

|

|

$ |

0.786 |

|

| |

|

|

|

|

|

|

|

|

(1) Includes revenues related to lodge and village rooms and

hospitality services for owned rooms for the periods presented.(2)

Includes revenues related to mobile camps for the periods

presented.(3) Includes revenues related to food service, laundry

and water and wastewater treatment services for the periods

presented.(4) Includes revenues related to modular construction and

offshore manufacturing services for the periods presented.(5)

Average daily rate is based on billed rooms and accommodation

revenue.(6) Billed rooms represents total billed days for the

periods presented.

CONTACT:

Frank C. SteiningerCiveo CorporationExecutive Vice President

& Chief Financial Officer713-510-2400

Jeffrey SpittelFTI Consulting713-353-5407

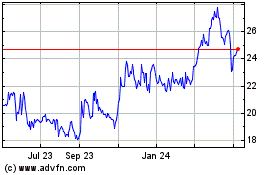

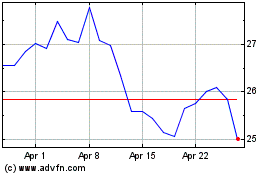

Civeo (NYSE:CVEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Civeo (NYSE:CVEO)

Historical Stock Chart

From Apr 2023 to Apr 2024