Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

October 26 2020 - 9:03AM

Edgar (US Regulatory)

FILED PURSUANT TO RULE 433

File No. 333-224495

CITIGROUP INC.

$2,500,000,000

0.776%

FIXED RATE / FLOATING RATE CALLABLE AFFORDABLE HOUSING SENIOR NOTES DUE 2024

Terms and Conditions

|

|

|

|

|

Issuer:

|

|

Citigroup Inc.

|

|

|

|

|

Ratings*:

|

|

A3 / BBB+ / A (Stable Outlook / Stable Outlook / Negative Outlook) (Moody’s / S&P / Fitch)

|

|

|

|

|

Ranking:

|

|

Senior

|

|

|

|

|

Trade Date:

|

|

October 23, 2020

|

|

|

|

|

Settlement Date:

|

|

October 30, 2020 (T+5 days)

|

|

|

|

|

Maturity:

|

|

October 30, 2024

|

|

|

|

|

Par Amount:

|

|

$2,500,000,000

|

|

|

|

|

Treasury Benchmark:

|

|

0.125% due October 15, 2023

|

|

|

|

|

Treasury Price:

|

|

$99-25 1⁄4

|

|

|

|

|

Treasury Yield:

|

|

0.196%

|

|

|

|

|

Re-offer Spread to Benchmark:

|

|

T3+58 bp

|

|

|

|

|

Re-offer Yield:

|

|

0.776%

|

|

|

|

|

Fixed Rate Coupon & Payment Dates:

|

|

0.776%, payable semiannually in arrears on each April 30 and October 30 from, and including, the Settlement Date to, but excluding,

October 30, 2023 (the “fixed rate period”).

Following business day

convention during the fixed rate period. Business days during fixed rate period New York.

|

|

|

|

|

Floating Rate Coupon & Payment Dates:

|

|

From, and including, October 30, 2023 (the “floating rate period”), an annual floating rate equal to SOFR (as defined in the

Issuer’s preliminary prospectus supplement dated October 23, 2020 (the “Preliminary Prospectus Supplement”) and compounding daily over each interest period as described in the Preliminary Prospectus Supplement) plus 0.686%,

payable quarterly in arrears, on the second business day following each interest period end date, beginning on February 1, 2024 and ending at Maturity or any earlier redemption date. An “interest period end date” means the 30th of each January, April, July and October, beginning on January 30, 2024 and ending at Maturity or any earlier redemption date.

Modified following business day convention during the floating rate period. Business

days during floating rate period New York and U.S. Government Securities Business (as defined in the Preliminary Prospectus Supplement).

|

|

|

|

|

Public Offering Price:

|

|

100.000%

|

|

|

|

|

Net Proceeds to Citigroup:

|

|

$2,493,750,000 (before expenses)

|

|

|

|

|

Day Count:

|

|

30/360 during the fixed rate period, Actual/360 during the floating rate period

|

|

|

|

|

Defeasance:

|

|

Applicable. Provisions of Sections 12.02 and 12.03 of the Indenture apply

|

|

|

|

|

Redemption at Issuer Option:

|

|

We may redeem the notes, at our option, in whole at any time or in part from time to time, on or after April 30, 2021 (or if additional

notes are issued after October 30, 2020, beginning six months after the issue date of such additional notes) and prior to October 30, 2023 at a redemption price equal to the sum of (i) 100% of the principal amount of the notes being

redeemed plus accrued and unpaid interest thereon to, but excluding, the date of redemption; and (ii) the Make-Whole Amount (as defined in the Issuer’s base prospectus dated June 27, 2019 (the “Prospectus”)), if any, with

respect to such notes. The Reinvestment Rate (as defined in the Prospectus) will equal the Treasury Yield defined therein calculated to October 30, 2023, plus 0.100%.

We may redeem the notes, at our option, (i) in whole, but not in part, on October 30, 2023, or (ii) in whole at any time or in part from time to

time, on or after September 30, 2024 at a redemption price equal to the sum of 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to, but excluding, the date of redemption. SOFR for each calendar

day from, and including, the Rate Cut-Off Date to, but excluding, the redemption date will equal SOFR in respect of the Rate Cut-Off Date.

|

CITIGROUP INC.

$2,500,000,000

0.776%

FIXED RATE / FLOATING RATE CALLABLE AFFORDABLE HOUSING SENIOR NOTES DUE 2024

|

|

|

|

|

Rate Cut-Off Date:

|

|

The second U.S. Government Securities Business Day prior to a redemption date and Maturity.

|

|

|

|

|

Redemption for Tax Purposes:

|

|

We may redeem the notes, at our option, in whole at any time, but not in part at a redemption price equal to 100% of the principal amount of

the notes plus accrued and unpaid interest thereon to, but excluding, the date of redemption, if, as a result of changes in U.S. tax law, withholding tax or information reporting requirements are imposed on payments on the notes to non-U.S. persons.

SOFR for each calendar day from,

and including, the Rate Cut-Off Date to, but excluding, the redemption date will equal SOFR in respect of the Rate Cut-Off Date.

|

|

|

|

|

Use of Proceeds:

|

|

An amount equal to the net proceeds of the sale of the notes will be allocated exclusively to finance or refinance in whole or in part a portion of Citigroup’s portfolio of affordable housing assets. This portfolio consists of

selected eligible financing instruments primarily intended to finance the construction, rehabilitation, and/or the preservation of quality affordable housing for low- and moderate-income populations in the

United States, as further described in Citigroup’s Social Bond Framework for Affordable Housing, available on Citigroup’s Investor Relations website.

|

|

|

|

|

Sinking Fund:

|

|

Not applicable

|

|

|

|

|

Minimum Denominations/Multiples:

|

|

$1,000 / multiples of $1,000 in excess thereof

|

|

|

|

|

CUSIP:

|

|

172967 MT5

|

|

|

|

|

ISIN:

|

|

US172967MT50

|

|

|

|

|

Sole Book Manager (83.00%):

|

|

Citigroup Global Markets Inc.

|

|

|

|

|

Joint Lead Managers (3.00% each):

|

|

Blaylock Van, LLC

CastleOak Securities,

L.P.

Loop Capital Markets LLC

Samuel A. Ramirez &

Company, Inc.

|

|

|

|

|

Co-Managers (1.00% each):

|

|

Academy Securities, Inc.

Great Pacific

Securities

MFR Securities, Inc.

Roberts & Ryan

Investments Inc.

Siebert Williams Shank & Co., LLC

|

|

*

|

Note: A securities rating is not a recommendation to buy, sell, or hold securities and may be subject to

revision or withdrawal at any time.

|

Citigroup Inc. has filed a registration statement (including a prospectus) with the Securities and

Exchange Commission for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and the other documents Citigroup has filed with the SEC for more complete information about

Citigroup and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. The file number for Citigroup’s registration statement is No. 333-224495.

Alternatively, you can request the prospectus by calling toll-free in the United States 1-800-831-9146.

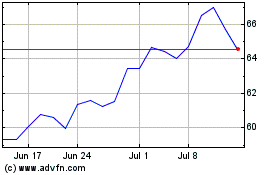

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024