Current Report Filing (8-k)

November 06 2019 - 8:10AM

Edgar (US Regulatory)

false0001091883

0001091883

2019-11-06

2019-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2019

CIRCOR INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-14962

|

04-3477276

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

30 CORPORATE DRIVE, SUITE 200

|

|

|

|

|

|

|

Burlington,

|

MA

|

01803-4238

|

|

(Address of principal executive offices and Zip Code)

|

(Zip Code)

|

(781) 270-1200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

|

CIR

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On November 6, 2019, the Board of Directors of CIRCOR International, Inc. (“CIRCOR” or the “Company”) disclosed a series of enhancements to the Company’s governance, certain of which are subject to shareholder approval and will be proposed in the Company’s proxy materials in connection with CIRCOR’s 2020 Annual Meeting of Shareholders (the “2020 Annual Meeting”).

The CIRCOR Board is committed to driving value for shareholders and believes these enhancements will help ensure that the Company’s governance better aligns with best practices and shareholder interests.

The governance enhancements include the following:

|

|

|

|

•

|

Board Declassification. The CIRCOR Board plans to recommend to its shareholders at the 2020 Annual Meeting the elimination of its classified board and transition to a single class of directors to be elected annually. If shareholders approve the proposal, beginning with the 2020 Annual Meeting, directors will be elected for one-year terms following their current terms in office.

|

The declassification proposal will require the approval of shareholders representing at least two-thirds of all shares of the Company’s common stock entitled to vote on the declassification proposal.

|

|

|

|

•

|

Majority Voting Standard. The CIRCOR Board plans to recommend to its shareholders at the 2020 Annual Meeting the adoption of a majority voting standard for uncontested director elections. A majority voting standard requires each nominee standing for election to the CIRCOR Board in an uncontested election to receive a majority of the votes cast in favor of such nominee. CIRCOR’s Board, in 2016, adopted a resignation policy requiring each director standing for election to offer to resign in the event that less than a majority of the votes cast were in favor of election. At the 2020 Annual Meeting, shareholders will be asked to approve reflecting a majority vote standard in CIRCOR’s charter and bylaws.

|

The majority voting proposal will require the approval of shareholders representing at least two-thirds of all shares of the Company’s common stock entitled to vote on the majority voting proposal.

|

|

|

|

•

|

Rotation for Board Chair and Committee Chairs. The CIRCOR Board intends to adopt a policy for the periodic rotation of the chair of the Board and the chair of each Board committee. This policy will not be subject to shareholder approval and will become effective in connection with the 2020 Annual Meeting, at which time a new Board chair will be named.

|

The proposals that the CIRCOR Board intends to submit for shareholder approval at the 2020 Annual Meeting will be detailed in CIRCOR’s 2020 proxy statement, which will be filed in advance of the 2020 Annual Meeting. A date for the 2020 Annual Meeting has not yet been scheduled.

The information in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934 (the “Exchange Act”), nor shall it be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, except as expressly set forth by special reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

CIRCOR INTERNATIONAL, INC.

|

|

November 6, 2019

|

/s/ Chadi Chahine

|

|

|

Chadi Chahine

|

|

|

Senior Vice President and Chief Financial Officer

|

CIRCOR (NYSE:CIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

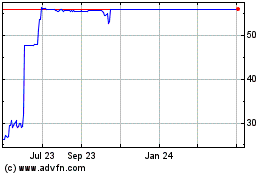

CIRCOR (NYSE:CIR)

Historical Stock Chart

From Apr 2023 to Apr 2024