UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14D-9

(Amendment No. 4)

(Rule 14d-101)

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

CIRCOR INTERNATIONAL, INC.

(Name of Subject Company)

CIRCOR INTERNATIONAL, INC.

(Name of Persons Filing Statement)

Common Stock, Par Value of $0.01 Per Share

(Title of Class of Securities)

17273K109

(CUSIP Number of Class of Securities)

Scott A. Buckhout

President and Chief Executive Officer

CIRCOR International, Inc.

30 Corporate Drive, Suite 200

Burlington, MA 01803

(781) 270-1200

(Name, address and telephone number of person authorized to receive notices and communications on behalf of the

persons filing statement)

COPIES TO:

Tara M. Fisher

Paul M. Kinsella

Ropes & Gray LLP

800 Boylston Street

Boston, MA 02199

(617) 951-7000

o

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Introductory Note

This Amendment No. 4 amends the Solicitation/Recommendation Statement on Schedule 14D-9 of CIRCOR International, Inc., a Delaware corporation (the “Company”) filed with the Securities and Exchange Commission (the “SEC”) on June 24, 2019 (as amended, the “Schedule 14D-9”), relating to the unsolicited tender offer by Crane Co., a Delaware corporation, through its wholly owned subsidiary, CR Acquisition Company, a Delaware corporation, to purchase all of the outstanding shares of the Company’s common stock, par value $0.01 per share (the “Shares”), at a price of $48.00 per Share, net to the seller in cash, without interest and less any required withholding taxes, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated June 17, 2019 (the “Offer to Purchase”) and the related letter of transmittal that accompanies the Offer to Purchase (the “Letter of Transmittal”) (which, together with any amendments or supplements thereto, collectively constitute the “Offer”).

All information in the Schedule 14D-9 is incorporated into this Amendment No. 4 by reference and, except as otherwise set forth below, the information set forth in the Schedule 14D-9 remains unchanged. Capitalized terms used in this Amendment No. 4 without definition have the respective meanings set forth in the Schedule 14D-9.

Item 1.

Subject Company Information.

In Item 1 of the Schedule 14D-9, the first full paragraph under the subsection titled “

Securities

” is hereby amended and restated in its entirety to read as follows:

The title of the class of equity securities to which this Statement relates is the Company’s common stock, par value $0.01 per share (the “Shares”). As of July 9, 2019 there were 19,901,725 Shares issued and outstanding (not including 1,372,488 Shares there were held in the treasury of the Company). In addition, as of July 8, 2019, 729,667 Shares were subject to outstanding options to purchase Shares (each, an “Option”), 300,064 Shares were subject to outstanding restricted stock unit awards (each, an “RSU”) and 135,148 Shares were subject to outstanding performance share units (each, a “PSU”), at target.

Item 2.

Identity and Background of Filings Person.

In Item 2 of the Schedule 14D-9, the first full paragraph under the subsection titled “

Tender Offer

” is hereby amended and restated in its entirety to read as follows:

The Original Tender Offer.

On June 17, 2019, Crane Co., a Delaware corporation (“Crane”), through its wholly owned subsidiary, CR Acquisition Company, a Delaware corporation (the “Purchaser”) commenced an unsolicited tender offer to purchase all of the outstanding Shares at a price of $45.00 per Share, net to the seller in cash, without interest and less any required withholding taxes. The tender offer was made subject to the terms and conditions set forth in the Tender Offer Statement on Schedule TO (together with the exhibits thereto, as amended from time to time, the “Schedule TO”), originally filed jointly by the Purchaser and Crane with the Securities and Exchange Commission (the “SEC”) on June 17, 2019. The value of the original consideration offered, together with all of the terms and conditions applicable to the tender offer as modified through July 7, 2019, is referred to in this Statement as the “Original Offer.”

The Revised Tender Offer.

On July 8, 2019, Crane announced that it was revising its tender offer price to $48.00 per Share, net to the seller in cash, without interest and less any required withholding taxes and extending the Expiration Date to 12:00 midnight, New York City time, on the night of Friday, July 19, 2019 (which is the end of the day on July 19, 2019). The value of the consideration offered, together with all of the terms and conditions applicable to the tender offer, as revised, is referred to in this Statement as the “Revised Offer.” Either the Original Offer or the Revised Offer is referred to in this Statement as the “Offer.”

2

Item 3.

Past Contacts, Transactions, Negotiations and Agreements.

Item 3 of the Schedule 14D-9 is hereby amended and restated in its entirety to read as follows:

Except as described in this Statement or in the excerpts from the Company’s Definitive Proxy Statement on Schedule 14A, dated and filed with the SEC on March 29, 2019 (the “2019 Proxy Statement”), relating to the Company’s 2019 annual meeting of stockholders, which excerpts are filed as Exhibit (e)(1) to this Statement and are incorporated herein by reference, to the knowledge of the Company as of the date of this Statement, there are no material agreements, arrangements or understandings, nor any actual or potential conflicts of interest, between the Company or any of its affiliates, on the one hand, and (i) the Company or any of its executive officers, directors or affiliates or (ii) the Purchaser or any of its executive officers, directors or affiliates, on the other hand. Exhibit (e)(1) to this Statement is incorporated herein by reference and includes the following sections from the 2019 Proxy Statement: “Certain Relationships and Related Transactions,” “Compensation Discussion and Analysis,” “Summary of Cash and Certain Other Compensation and Other Payments to the Named Executive Officers,” “Severance and Other Benefits Upon Termination of Employment or Change of Control” and “Director Compensation.”

Any information contained in the excerpts from the 2019 Proxy Statement incorporated by reference herein is modified or superseded for purposes of this Statement to the extent that any information contained herein modifies or supersedes such information.

Relation

ship with the Purchaser

According to the Schedule TO, as of June 17, 2019, Crane and its subsidiaries beneficially owned 260,255 Shares, in the aggregate, representing approximately 1.3% of the outstanding Shares.

Consideration Payable Pursuant to the Offer and the Proposed Merger

If the Company’s executive officers and directors were to tender any Shares they own pursuant to the Offer, they would receive the same cash consideration on the same terms and conditions as the Company’s other stockholders. As of July 9, 2019, the Company’s executive officers and directors were deemed to beneficially own an aggregate of 596,690 Shares (inclu

ding 397,676 Shares issuable upon the exercise of outstanding options that will be exercisable within sixty (60) days of July 9, 2019, and 7,201 Shares issuable within sixty (60) days of July 9, 2019, on account of RSUs that will have vested). If the Company’s executive officers and directors were to tender all of such Shares for purchase pursuant to the Offer and those Shares were accepted for purchase and purchased by the Purchaser, the Company’s executive officers and directors would receive an aggregate amount of approximately $11,813,887 in cash (net of the exercise price of Shares subject to Options that are exercisable within sixty (60) days of July 9, 2019, and subject to any applicable withholding). To the knowledge of the Company after making reasonable inquiry, none of the Company’s executive officers or directors currently intends to tender Shares held of record or beneficially owned by such person for purchase pursuant to the Offer.

The following table summarizes the aggregate cash consideration that would be payable, based on the Offer price of $48.00 per Share, in respect of Shares beneficially owned by the Company’s executive officers and directors as of July 9, 2019 (excluding any Shares subject to Options, RSUs and PSUs, which are discussed below):

|

Name

|

|

Shares

|

|

Aggregate

Value ($)

|

|

|

Executive Officer

|

|

|

|

|

|

|

Scott Buckhout

|

|

28,826

|

|

1,383,648

|

|

|

Chadi Chahine

|

|

—

|

|

—

|

|

|

Sumit Mehrotra

|

|

4,735

|

|

227,280

|

|

|

Tony Najjar

|

|

1,343

|

|

64,464

|

|

|

Lane Walker

|

|

2,325

|

|

111,600

|

|

|

Andrew Farnsworth

|

|

988

|

|

47,424

|

|

|

Arjun Sharma

|

|

14,700

|

|

705,600

|

|

|

David F. Mullen

|

|

2,701

|

|

129,648

|

|

|

Tanya Dawkins

|

|

940

|

|

45,120

|

|

|

Director

|

|

|

|

|

|

|

David F. Dietz

|

|

87,064

|

|

4,179,072

|

|

|

Samuel R. Chapin

|

|

—

|

|

—

|

|

|

Tina M. Donikowski

|

|

3,351

|

|

160,848

|

|

|

Helmuth Ludwig

|

|

10,555

|

|

506,640

|

|

|

John (Andy) O’Donnell

|

|

14,082

|

|

675,936

|

|

|

Peter M. Wilver

|

|

20,203

|

|

969,744

|

|

3

As of July 9, 2019, the Company’s executive officers and directors held Options to purchase an aggregate of 646,223 Shares, with exercise prices ranging from $32.76 per Share to $71.56 per Share and an aggregate weighted average exercise price of $42.45 per Share, 397,676 of which were vested and exercisable as of that date. In addition, as of July 9, 2019, the Company’s executive officers and directors held 149,691 RSUs and 122,811 PSUs, at target. All Options, RSUs and PSUs held by the Company’s executive officers and directors were issued pursuant to either the CIRCOR International, Inc. Amended and Restated 1999 Stock Option and Incentive Plan, as amended (the “1999 Plan”), the CIRCOR International, Inc. 2014 Stock Option and Incentive Plan, as amended (the “2014 Plan”), the 2019 Stock Option Plan (the “2019 Plan”), or, with respect to RSUs only, the CIRCOR International, Inc. Amended and Restated Management Stock Purchase Plan (the “Management Plan”), filed as Exhibits (e)(5), (e)(10), (e)(16) and (e)(30) to this Statement and incorporated herein by reference. All outstanding Options granted under the 1999 Plan are fully vested as of July 9, 2019.

Treatment of Stock Options

Upon the effective time of the consummation of the Proposed Merger (the “Effective Time”), each then-outstanding Option, whether or not vested, may be cancelled in exchange for a payment equal to the number of Shares then underlying such Option multiplied by the difference between the Offer price and the applicable exercise price of such Option, subject to any applicable withholding.

The following table summarizes the aggregate cash consideration that would be payable, based on the Offer price of $48.00 per Share, in respect of Options held by the Company’s executive officers and directors as of July 9, 2019 that are cashed out by Crane:

|

Name

|

|

Shares

Subject to

Vested

Options

(#)(1)

|

|

Cash

Consideration

for Vested

Options ($)(2)

|

|

Shares

Subject to

Unvested

Options

(#)(1)

|

|

Cash

Consideration

for Unvested

Options ($)(2)

|

|

Total Cash

Consideration

Options in

Proposed

Change of

Control ($)

|

|

|

Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott Buckhout

|

|

262,902

|

|

1,930,227

|

|

181,983

|

|

2,023,104

|

|

3,953,331

|

|

|

Chadi Chahine

|

|

—

|

|

—

|

|

8,025

|

|

115,319

|

|

115,319

|

|

|

Sumit Mehrotra

|

|

5,336

|

|

44,374

|

|

9,031

|

|

109,350

|

|

153,724

|

|

|

Tony Najjar

|

|

3,298

|

|

27,926

|

|

5,360

|

|

66,811

|

|

94,737

|

|

|

Lane Walker

|

|

—

|

|

—

|

|

6,336

|

|

91,048

|

|

91,048

|

|

|

Andrew Farnsworth

|

|

6,312

|

|

54,324

|

|

5,928

|

|

69,866

|

|

124,190

|

|

|

Arjun Sharma

|

|

15,337

|

|

153,093

|

|

7,120

|

|

85,773

|

|

238,866

|

|

|

David F. Mullen

|

|

4,788

|

|

43,619

|

|

—

|

|

—

|

|

43,619

|

|

|

Tanya Dawkins

|

|

840

|

|

7,652

|

|

—

|

|

—

|

|

7,652

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

David F. Dietz

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Samuel R. Chapin

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Tina M. Donikowski

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Helmuth Ludwig

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

John (Andy) O’Donnell

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Peter M. Wilver

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

4

(1) The number of Shares in this table subject to Options, whether vested or unvested, as of July 9, 2019 includes those Options with an exercise price below $48.00 and does not include any Options with an exercise price equal to or greater than $48.00 per Share.

(2) Calculated based on (i) the number of Shares subject to the Options as of July 9, 2019, multiplied by (ii) the excess of $48.00 over the per Share exercise price applicable to the Options.

Treatment of Restricted Stock Units and Performance Share Units

Upon the Effective Time, each then-outstanding RSU granted prior to 2019 will become vested and may be cancelled in exchange for a payment equal to the Offer price and each then-outstanding PSU granted prior to 2019 will vest and may be cancelled in exchange for a payment equal to the Offer price, assuming that the performance vesting conditions associated with such PSU were satisfied at target (or at a greater level based on actual achievement as of the Effective Time), in each case, subject to applicable withholding.

The following table summarizes the aggregate cash consideration that would be payable, based on the Offer price of $48.00 per Share, in respect of RSUs and PSUs (assuming that the performance vesting conditions associated with such PSU were satisfied at target) held by the Company’s executive officers and directors as of July 9, 2019:

|

Name

|

|

Number

of RSUs

|

|

Number

of PSUs

|

|

Cash

Consideration

for RSUs

|

|

Cash

Consideration

for PSUs

|

|

|

Executive Officer

|

|

|

|

|

|

|

|

|

|

|

Scott Buckhout

|

|

33,776

|

|

86,751

|

|

1,621,248

|

|

4,164,048

|

|

|

Chadi Chahine

|

|

9,870

|

|

5,652

|

|

473,760

|

|

271,296

|

|

|

Sumit Mehrotra

|

|

14,727

|

|

8,327

|

|

706,896

|

|

399,696

|

|

|

Tony Najjar

|

|

8,554

|

|

4,150

|

|

410,592

|

|

199,200

|

|

|

Lane Walker

|

|

9,957

|

|

4,461

|

|

477,936

|

|

214,128

|

|

|

Andrew Farnsworth

|

|

4,760

|

|

5,966

|

|

228,480

|

|

286,368

|

|

|

Arjun Sharma

|

|

16,041

|

|

7,504

|

|

769,968

|

|

360,192

|

|

|

David F. Mullen

|

|

5,823

|

|

—

|

|

279,504

|

|

—

|

|

|

Tanya Dawkins

|

|

3,226

|

|

—

|

|

154,848

|

|

—

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

David F. Dietz

|

|

11,155

|

|

—

|

|

535,440

|

|

—

|

|

|

Samuel R. Chapin

|

|

3,123

|

|

—

|

|

149,904

|

|

—

|

|

|

Tina M. Donikowski

|

|

4,174

|

|

—

|

|

200,352

|

|

—

|

|

|

Helmuth Ludwig

|

|

6,694

|

|

—

|

|

321,312

|

|

—

|

|

|

John (Andy) O’Donnell

|

|

13,415

|

|

—

|

|

643,920

|

|

—

|

|

|

Peter M. Wilver

|

|

4,396

|

|

—

|

|

211,088

|

|

—

|

|

Potential Cash Severance and Change of Control Benefits

The Company has entered into agreements with each of its executive officers (other than Ms. Dawkins, who is a participant in the Company’s Change in Control Severance Plan) providing for the cash termination benefits described below if the executive officer’s employment is terminated by the executive officer for good reason or by the Company other than for cause. For a quantification of estimated cash severance payments that could become payable to our named executive officers, see “

Item 8—Additional Information—Golden Parachute Compensation

,” and for our other executive officers, using the same assumptions in such table, see below.

5

·

Scott Buckhout is entitled to a lump sum equal to his current base salary plus target bonus in effect during the fiscal year in which the termination occurs and the Company shall pay contributions for COBRA coverage at the same rate of employer contributions prior to termination of employment for up to twelve (12) months, in the event his employment is terminated by the Company other than for cause, death or disability, or if Mr. Buckhout resigns his employment for good reason, in each case subject to Mr. Buckhout’s execution of a release of claims. In the event that, within twelve (12) months following a change of control, Mr. Buckhout’s employment is terminated by the Company other than for cause or Mr. Buckhout resigns his employment for good reason, then, instead of the foregoing benefits, Mr. Buckhout will be eligible to receive a lump sum payment equal to two (2) times his base salary at the time of termination plus his target annual incentive compensation under the Company’s Executive Bonus Compensation Plan and the Company shall pay for the cost of COBRA premiums for up to two (2) years.

·

Each of Chadi Chahine, Sumit Mehrotra, Lane Walker and Arjun Sharma is entitled to a lump sum payment equal to his base salary in effect during the fiscal year in which the termination occurs and a prorated bonus based on actual performance in the year of termination, and the Company shall pay contributions for COBRA coverage at the same rate of employer contributions prior to termination of employment for up to twelve (12) months, in the event the executive’s employment is terminated by the Company other than for cause, death or disability, or if the executive resigns his employment for good reason, in each case subject to the executive’s execution of a release of claims.

·

In the event that, within twelve (12) months following a change of control, Mr. Mehrotra’s employment is terminated by the Company other than for cause or Mr. Mehrotra resigns his employment for good reason, then, instead of the foregoing benefits, Mr. Mehrotra will be eligible to receive a lump sum payment equal to two (2) times his base salary at the time of termination plus his target annual incentive compensation under the Company’s Executive Bonus Compensation Plan and the Company shall pay for the cost of COBRA premiums for up to two (2) years.

·

In the event that, within twelve (12) months following a change of control, Mr. Chahine’s or Mr. Walker’s employment is terminated by the Company other than for cause or either executive resigns his employment for good reason, then, instead of the foregoing benefits, each such executive will be eligible to receive a lump sum payment equal to two (2) times his base salary plus his target annual incentive compensation under the Company’s Executive Bonus Compensation Plan and the Company shall pay for the cost of COBRA premiums for up to two (2) years.

·

In the event that, within twelve (12) months following a change of control, Mr. Sharma’s employment is terminated by the Company other than for cause or Mr. Sharma resigns his employment for good reason, then, instead of the foregoing benefits, Mr. Sharma will be eligible to receive a lump sum payment equal to two (2) times his base salary at the time of termination plus his highest actual annual incentive compensation under the Company’s Executive Bonus Compensation Plan in the three (3) immediately preceding fiscal years and the Company shall pay for the cost of COBRA premiums for up to two (2) years.

·

Each of David Mullen and Andrew Farnsworth are entitled to receive a lump sum payment equal to two (2) times his base salary at the time of termination plus his target annual incentive compensation under the Company’s Executive Bonus Compensation Plan and the Company shall pay for the cost of COBRA premiums for up to two (2) years in the event that, within twelve (12) months following a change of control, his employment is terminated by the Company other than for cause or he resigns his employment for good reason. Using the assumptions set forth in “

Item 8—Additional Information—Golden Parachute Compensation

,” we estimate that the aggregate value of cash severance that could become payable to Mr. Mullen is $857,205 and Mr. Farnsworth is $932,131.

6

·

Tony Najjar is entitled to receive a lump sum payment equal to two (2) times his base salary plus his target annual incentive compensation under the Company’s Executive Bonus Compensation Plan and the Company shall pay for the cost of COBRA premiums for up to two (2) years. Using the assumptions set forth in “

Item 8—Additional Information—Golden Parachute Compensation

,” we estimate that the aggregate value of cash severance that could become payable to Mr. Najjar is $1,005,985.

Tanya Dawkins is a participant in the Company’s Change in Control Severance Plan, which provides that in the event that, within twelve (12) months following a change of control, Ms. Dawkins’s employment is terminated by the Company other than for cause or Ms. Dawkins resigns her employment for good reason, she is entitled to receive a lump sum payment equal to her current base salary plus her current annual incentive target award. In addition, she is entitled to receive a prorated bonus for the year of termination based on actual performance and the Company shall pay a cash payment equal to the COBRA premium for the highest level of coverage available under the Company’s health plans prior to termination of employment (reduced by the monthly amount she would have paid for such coverage if she had remained employed) for up to twelve (12) months (such amounts only to be payable if Ms. Dawkins participates in the Company’s health plans as of the date of termination of employment), in each case subject to her execution of a release of claims. Ms. Dawkins is not currently a participant in the Company’s health plans so she is not expected to receive any cash payments with respect to COBRA premiums. Using the assumptions set forth in “

Item 8—Additional Information—Golden Parachute Compensation

” and assuming Ms. Dawkins’s prorated bonus for the year of termination is earned at target, we estimate that the aggregate value of cash severance that could become payable to Ms. Dawkins is $254,340.

The treatment of Options, RSUs and PSUs for the executive officers is addressed above under “

Item 3—Past Contacts, Transactions, Negotiations and Agreements—Consideration Payable Pursuant to the Offer and the Proposed Merger—Treatment of Stock Options and Treatment of Restricted Stock Units and Performance Share Units

” above. See also “

Item 8—Additional Information—Golden Parachute Compensation

.”

Directors’ Compensation

For a description of the compensation earned by the Company’s directors, reference is made to the “Director Compensation” section of the 2019 Proxy Statement, which is filed as Exhibit (e)(1) to this Statement, incorporated by reference herein and qualified the foregoing in its entirety.

Indemnification and Limitation of Liability of Directors and Officers

The Company’s amended and restated bylaws (the “bylaws”) provide that the Company will indemnify and hold harmless each director and officer to the fullest extent authorized by the DGCL against any and all expenses, judgments, penalties, fines and amounts reasonably paid in settlement that are incurred by such director or officer or on such director’s or officer’s behalf in connection with any threatened, pending or completed action, suit, arbitration, alternate dispute resolution mechanism, inquiry, investigation, administrative hearing or other proceeding, whether civil, criminal, administrative, arbitrative or investigative or any claim, issue or matter therein, which such director or officer is, or is threatened to be made, a party to or participant in by reason of such director’s or officer’s corporate status, if such director or officer acted in good faith and in a manner such director or officer reasonably believed to be in or not opposed to the best interests of the Company and, with respect to any criminal proceeding, had no reasonable cause to believe his or her conduct was unlawful. The rights of indemnification provided by the bylaws will continue as to any director or officer after he or she has ceased to be a director or officer and shall inure to the benefit of his or her heirs, executors, administrators and personal representatives. The Company will indemnify a director or officer seeking indemnification in connection with a proceeding initiated by such director or officer only if such proceeding was authorized by the Board, unless such proceeding was brought to enforce a director’s or officer’s rights to indemnification under the bylaws. The bylaws require the advancement of expenses incurred by directors in relation to any action, suit or proceeding and permit such advancement of expenses incurred by officers provided the advancement of expenses is accompanied by an undertaking by the applicable director or officer to repay any expenses so

7

advanced if it is ultimately determined that such director or officer is not entitled to be indemnified against such expenses. The bylaws also provide that if the DGCL is amended to expand the indemnification permitted to directors and officers, then the Company will indemnify such persons to the fullest extent permitted by the DGCL as amended.

In addition to the indemnification provided in the bylaws, the Company has entered into indemnification agreements with each of its directors and executive officers reflecting the foregoing. Under these agreements, the Company’s directors and officers are indemnified for certain expenses and liabilities incurred in connection with any threatened, pending or completed claim, action, suit, arbitration, alternate dispute resolution process, investigation, administrative hearing, appeal, or any other proceeding, whether civil, criminal, administrative, arbitrative or investigative, whether formal or informal, including a proceeding initiated by a director or officer to enforce such director’s or officer’s rights under the indemnification agreement, by reason of the fact that they are or were a director, officer, partner, trustee, employee or agent of the Company or any of its subsidiaries whether or not he or she is acting or serving in any such capacity at the time any liability or expense is incurred for which indemnification can be provided under the indemnification agreements. In the case of an action or proceeding by or in the right of the Company or any of its subsidiaries, no indemnification will be provided under the indemnification agreements where a court of competent jurisdiction has finally determined that the director or officer (i) failed to act in good faith and in a manner such director or officer believed to be in or not opposed to the best interests of the Company or (ii) is liable to the Company unless and to the extent that a court of competent jurisdiction shall determine that such indemnification may be made. The Company also maintains officers’ and directors’ liability insurance, which insures against liabilities that the Company’s officers and directors, in such capacities, may incur.

The Company’s certificate of incorporation provides that no director of the Company shall be personally liable to the Company or its stockholders for monetary damages for breach of fiduciary duty as a director, except (i) for any breach of the directors’ duty of loyalty to the Company or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL or (iv) for any transaction from which the director derived an improper personal benefit. The Company’s certificate of incorporation also provides that if Delaware law is amended to permit further elimination or limitation of personal liability of directors, then the liability of the Company’s directors will be eliminated or limited to the fullest extent permitted by Delaware law, as so amended.

The foregoing summary of the indemnification and limitation of liability of officers and directors pursuant to the Company’s certificate of incorporation, bylaws and the indemnification agreements entered into between the Company and its directors and officers does not purport to be complete and is qualified in its entirety by reference to the Company’s certificate of incorporation, bylaws and the form of such indemnification agreements (as applicable), which are filed as Exhibits (e)(2), (e)(3) and (e)(4), respectively, to this Statement and are incorporated herein by reference.

Item 4.

The Solicitation or Recommendation.

In Item 4 of the Schedule 14D-9, the subsection titled “

Solicitation/Recommendation

” is hereby amended and restated in its entirety to read as follows:

Solicitation/Recommendation

After careful consideration, including a thorough review of the terms and conditions of the Revised Offer in consultation with the Company’s independent financial and legal advisors, and consistent with its fiduciary duties under applicable law, the Board, by unanimous vote at a meeting on July 10, 2019, determined that the Revised Offer substantially undervalues the Company and is low-value, highly conditional and opportunistic and that the Revised Offer is not in the best interests of the Company or its stockholders. Accordingly, for the reasons described in more detail below, the Board unanimously recommends that the Company’s stockholders REJECT the Revised Offer and NOT tender their Shares pursuant to the Revised Offer.

8

If you have tendered your Shares, you can withdraw them. For assistance in withdrawing your Shares, you can contact your broker or the Company’s information agent, MacKenzie Partners, Inc. (“MacKenzie Partners”), at the address and phone number below.

MacKenzie Partners, Inc.

105 Madison Avenue

New York, NY 10016

Toll free: (800) 322-2885

Collect: (212) 929-5500

A copy of the press release and letter to the Company’s stockholders communicating the recommendation of the Board to reject the Revised Offer are filed as Exhibits (a)(9) and (a)(10) to this Statement, respectively, and are incorporated herein by reference.

In Item 4 of the Schedule 14D-9, all references to the “Offer” in the subsection titled “

Background of the Offer

” are deleted in their entirety and replaced with references to the “Original Offer.”

Item 4 of the Schedule 14D-9 is hereby amended and supplemented by adding the following paragraphs at the conclusion of the subsection titled “

Background of the Offer

”:

On July 8, 2019, Crane, by means of a press release, announced that it had increased the consideration payable pursuant to the Offer to $48.00 per Share, net to the seller in cash, without interest and less any required withholding taxes, and extended the expiration date of the Offer to 12:00 midnight, New York City time, on the night of Friday, July 19, 2019. That morning, Crane and the Purchaser filed with the SEC an amendment to the Schedule TO disclosing the Revised Offer. According to the Schedule TO, as of the close of business on July 5, 2019, approximately 2,050 Shares had been tendered in and not withdrawn from the Offer.

On July 8, 2019 at approximately 9:10 a.m. Eastern Time, the Company issued a “stop-look-and-listen” press release with respect to the Revised Offer.

On July 10, 2019, the Board held a special meeting for portions of which representatives from J.P. Morgan, Evercore and Ropes & Gray were present. The J.P. Morgan and Evercore representatives, independently, discussed with the Board their respective financial analyses in respect of the Revised Offer. Each of J.P. Morgan and Evercore rendered an oral opinion to the Board, which was subsequently confirmed in writing, that, as of the date of such opinion, and based upon and subject to the factors, assumptions, limitations and qualifications set forth in the written opinion, the consideration proposed to be paid to the stockholders (other than Crane and any of its affiliates) pursuant to the Revised Offer was inadequate from a financial point of view to such holders. The full text of the written opinions of J.P. Morgan and Evercore, each dated July 10, 2019, which set forth assumptions made, procedures followed, matters considered and limitations on the review undertaken in connection with the opinions, is attached hereto as Annexes G and H, respectively. The Board then discussed the Revised Offer and potential responses thereto. During this discussion, the Board considered potentially countervailing factors and risks, including the fact that the Revised Offer, if consummated, would provide stockholders with certainty of value and liquidity; the fact that the financial improvements discussed below may not be realized; and the fact that the consummation of the Revised Offer is not conditioned on Crane obtaining financing. Following discussion, the Board unanimously determined that the Revised Offer substantially undervalues the Company and is low-value, highly conditional and opportunistic and that the Revised Offer is not in the best interests of the Company or its stockholders.

9

In Item 4 of the Schedule 14D-9, the subsection titled “

Background of the Offer and Reasons for Recommendation—Reasons for Recommendation

” is hereby amended and restated in its entirety to read as follows:

Reasons for the Recommendation

After careful consideration, including a thorough review of the terms and conditions of the Revised Offer with the Company’s financial advisors and outside legal counsel, the Board has unanimously determined that the Revised Offer, like the Original Offer, is inadequate and not in the best interests of the Company or its stockholders.

In reaching its determination to reject the Revised Offer, the Board considered numerous reasons in consultation with the Company’s management and its financial advisors and outside legal counsel, including but not limited to, the following:

The Revised Offer is inadequate and substantially undervalues the Company.

·

The Board believes that execution of the Company’s strategic plan will deliver significantly greater value in the near-term and the long-term for the Company’s stockholders.

·

The Company is executing a detailed plan to deliver substantial earnings growth, while deleveraging the Company, over the next eighteen (18) months. The Company expects the strategic plan to generate significant stockholder value. The Company is confident in its outlook because it is based largely on actions in its control, as well as a higher visibility business mix as a result of the transformation. In addition, the outlook includes cost actions that have been executed or are in the process of being executed. The Company’s strategic plan includes:

·

delivering 2020 adjusted EBITDA of $165 million, up 37% over pro forma 2018;

·

expanding adjusted EBITDA margin to 14.9% in 2020, up from 10.8% in pro forma 2018; and

·

reducing the Company’s net leverage ratio from 5.5x in pro forma 2018 to approximately 3.5x in 2020.

·

In addition to the upside from the Company’s strategic plan, further upside opportunities could drive substantial additional stockholder value. Continued portfolio optimization and non-core divestitures may contribute to further debt reduction and potential multiple expansion. Also, although the Company has taken a conservative view of its prospects in cyclical markets (upstream oil & gas, commercial marine), a recovery in those markets could drive additional earnings growth and cash generation.

The Company’s 2020 adjusted EBITDA, adjusted EBITDA margin and net leverage forecasts reflect the Company’s current assumptions as to certain business and market conditions that are subject to change. In particular, the Company’s forecasts, as compared to the Company’s 2018 pro forma adjusted EBITDA, assume: price optimization resulting in an approximate $20 million increase in adjusted EBITDA; increased sales volume resulting in an approximate $18 million increase in adjusted EBITDA; savings from acquisition synergies and reduced corporate and group G&A costs resulting in an approximate $25 million increase in adjusted EBITDA; transition to low cost manufacturing resulting in an approximate $7 million increase in adjusted EBITDA; a net zero impact to adjusted EBITDA from the Company’s upstream oil & gas business as the result of the exit of one loss making business in 2019 and the incurrence of one time costs associated with the exit; an approximate $13 million decrease in adjusted EBITDA as a result of an increase in sales and engineering headcount; an approximate $9 million decrease in adjusted EBITDA as a result of inflation, tariffs and pension costs; and an approximate $3 million decrease in adjusted EBITDA resulting from contingency. In addition, the Company’s net leverage forecast assumes a reduction in net debt as compared to the Company’s 2018 pro forma net debt.

10

These assumptions reflect management’s analysis of existing trends and information and represent their judgment only as of the date of this Statement, and are further subject to the following limitations, among others: changes in the end markets in which the Company operates, particularly the energy market; significant changes or fluctuations in interest rates or currency exchange rates; the Company’s ability to respond to competitive developments and to grow its business, both domestically and internationally; changes in the cost, quality or supply of raw materials; the Company’s ability to comply with its debt obligations; the Company’s ability to successfully implement its acquisition, divestiture or restructuring strategies, including its integration of the Fluid Handling business; changes in industry standards, trade policies or government regulations, both in the United States and internationally; and the Company’s ability to operate its manufacturing facilities at current or higher levels and respond to increases in manufacturing costs.

The Company has strengthened and streamlined the business, positioning itself for increased revenue and profitability growth.

·

Eighty-three percent (83%) of the Company’s revenue in 2018 was from less cyclical, diversified end markets, up from forty-four percent (44%) in 2014.

·

Seventy-five percent (75%) of the Company’s revenue in 2018 was from differentiated products, up from forty-six percent (46%) in 2014.

·

Twenty-six percent (26%) of the Company’s revenue in 2018 was from higher-margin aftermarket, up from six percent (6%) in 2014.

·

The Company simplified and streamlined its business across multiple fronts (each of the following excludes the impact of acquired businesses):

·

reduced its manufacturing footprint with an approximately forty percent (40%) decrease in the number of factories since 2014 and significantly improved scale at remaining factories;

·

increased supplier efficiency, which has yielded material savings and improved both quality and delivery, as the Company has reduced its number of suppliers by approximately fifty-five percent (55%) since 2014, helping to drive annual savings of $9 million, net of inflation, over the last three (3) years;

·

decreased the number of business units by approximately forty-five percent (45%) since 2014, resulting in a significant reduction in overhead staff, market and customer aligned business units and increased business scale that attracts stronger talent; and

·

streamlined the number of enterprise resource planning systems, with an approximately forty-five percent (45%) decrease in the number of systems since 2014, which has enabled consistent best practices and lowered risk by eliminating unsupported systems.

The Company has taken significant actions to de-risk and transform the business into a diversified global flow control technology company.

·

The Company reduced exposure to upstream oil & gas by repositioning the Company during an unprecedented and protracted downturn in the upstream oil & gas market.

·

The Company has taken aggressive actions inside the energy group, including executing non-core divestitures, exiting unprofitable businesses, consolidating factories and significant simplification and restructuring.

·

The Company has made significant investments to grow and improve the aerospace & defense business. The Company has driven aerospace & defense adjusted EBITDA from $22 million in

11

2014 to $40 million in 2018, an increase of eighty-two percent (82%), and expanded adjusted EBITDA margin by over 630bps.

·

The Company also transformed its small industrial business into its largest group as part of the Fluid Handling integration. In 2018, the Company increased the industrial group’s adjusted EBITDA by approximately forty percent (40%) and adjusted EBITDA margins by 350bps versus 2017 combined results. The substantial increase in results was driven by synergies, G&A reduction, value pricing and the implementation of the CIRCOR Operating System. The Company also launched nine (9) new products in 2018, and expects to launch an additional nine (9) new products in 2019. The industrial group ended 2018 with a record backlog.

Recent investments are expected to drive additional future growth.

·

The Company has transformed its portfolio by deploying capital on accretive acquisitions. The recent acquisitions of Critical Flow Solutions, a high technology business serving the downstream oil & gas market, and Fluid Handling business, a severe-service pump technology business with diversified end markets and significant aftermarket exposure, greatly improved the quality of the Company’s revenues and profitability. Both acquisitions are performing well and are exceeding initial synergy targets. Both are delivering a strong return on invested capital, including:

·

10.7% in 2018 (year two) for Critical Flow Solutions, which is expected to be more than 12% by year three; and

·

8.8% in 2018 (year one) for the Fluid Handling business, which is expected to be more than 11% by year three.

·

The Company has invested in organic growth by expanding sales and engineering across the Company while establishing a Product Management function that did not exist five (5) years ago. In 2019, the Company anticipates launching at least thirty-five (35) new products, an approximately forty-five percent (45%) increase over 2018. Products launched within three (3) years of the current year are expected to generate approximately $70 million of revenue in 2019.

The Offer is opportunistically timed.

·

The Offer is opportunistically timed just as the Company is poised to deliver substantial value associated with its transformation, taking away value that rightfully belongs to the Company’s stockholders.

·

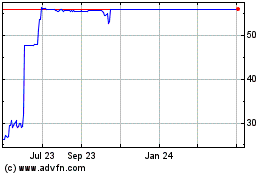

The Offer was made at a time when the Company’s stock price was in the process of a rapid upswing with significant momentum; prior to the Original Offer, the Company’s stock was up forty-four percent (44%) year-to-date.

·

Crane attempts to take advantage of the Company’s temporarily elevated leverage levels, although the Company has a clear line of sight into significant deleveraging. Net leverage is expected to be down 2x to approximately 3.5x by 2020.

·

Crane is attempting to justify its undervalued Offer by making inaccurate statements and focusing on the Company’s past product portfolio and the impact of headwinds in upstream oil & gas—failing to recognize our recent transformation and opportunities for near-term value creation.

The Board has received an inadequacy opinion from each of its financial advisors.

·

The Board considered the fact that its financial advisor, J.P. Morgan, rendered an oral opinion to the Board, which was subsequently confirmed in writing, that, as of the date of such opinion, and based upon and subject to the factors, assumptions, limitations and qualifications set forth in the

12

written opinion, that the consideration proposed to be paid to the Company’s stockholders pursuant to the Revised Offer is inadequate, from a financial point of view, to such holders. The full text of the written opinion of J.P. Morgan, dated July 10, 2019, which sets forth assumptions made, procedures followed, matters considered and limitations on the review undertaken in connection with the opinion, is attached hereto as Annex G. J.P. Morgan provided its opinion to the Board (in its capacity as such) in connection with and for purposes of its evaluation of the Revised Offer. The opinion of J.P. Morgan does not constitute a recommendation to any holder of Shares as to whether such holder should tender Shares in the Revised Offer.

·

The Board considered the fact that its financial advisor, Evercore, rendered an oral opinion to the Board, which was subsequently confirmed in writing, that, as of the date of such opinion, and based upon and subject to the factors and assumptions set forth in the written opinion, that the consideration proposed to be paid to the Company’s stockholders (other than Crane and any of its affiliates) pursuant to the Revised Offer is inadequate from a financial point of view to such holders. The full text of the written opinion of Evercore, dated July 10, 2019, which sets forth assumptions made, procedures followed, matters considered and limitations on the review undertaken in connection with the opinion, is attached hereto as Annex H. Evercore provided its opinion for the information and benefit of the Board (in its capacity as such) in connection with its evaluation of the Revised Offer and the Proposed Merger. The opinion of Evercore does not constitute a recommendation to the Board or to any other person in respect of the Revised Offer or the Proposed Merger, including as to whether any person should tender Shares in the Revised Offer or take any other action in respect of the Revised Offer or the Proposed Merger.

The conditions to the Offer create significant uncertainty and risk.

·

The Offer contains numerous conditions, including, among many others the Minimum Tender Condition, the Merger Agreement Condition, the Section 203 Condition, the Antitrust Condition and the Impairment Condition. See also “

Item 2—Identity and Background of Filing Person—Tender Offer

” above and Annex A to the Schedule 14D-9 filed on June 24, 2019. As a result, the Offer puts the Company and its stockholders at substantial risk that it will never be consummated.

·

The Offer includes conditions providing the Purchaser broad discretion to decide not to purchase the Shares. For example, the Offer provides that if at any time prior to the consummation of the Offer, there occurs any change in the general political, market, economic or financial conditions in the United States or elsewhere that, in Crane’s reasonable judgment, could have a material adverse effect on the business, assets, liabilities, financial condition, capitalization, operations, results of operations or prospects of the Company, Crane may terminate the Offer. In addition, the Offer provides that Crane may terminate the Offer if there is any decline in either the Dow Jones Industrial Average, the Standard and Poor’s Index of 500 Industrial Companies or the NASDAQ-100 Index by an amount in excess of fifteen percent (15%), measured from the close of business on June 14, 2019. The Offer also provides that Crane may terminate the Offer if the Company adopts a stockholder rights agreement.

·

There is no guarantee that the Offer can or will be completed as soon as Crane contemplates in its Offer materials. The Offer has already been extended once to expire on July 19, 2019, and this date may be further extended by Crane or the Purchaser, subject to compliance with applicable securities laws, in its sole discretion.

·

Crane and the Purchaser expressly reserves the right to further amend the terms of the Offer at any time before it expires, including by decreasing the Revised Offer price per Share or by changing the number of Shares being sought or the type of consideration.

ACCORDINGLY, BASED ON THE FOREGOING, THE BOARD UNANIMOUSLY RECOMMENDS THAT HOLDERS OF SHARES REJECT THE REVISED OFFER AND NOT TENDER ANY OF THEIR SHARES PURSUANT TO THE REVISED OFFER.

13

The foregoing discussion of the information and reasons identified by the Board is not intended to be exhaustive, but includes the material information, reasons and analyses considered by the Board in reaching its conclusions and recommendations. The members of the Board evaluated the various reasons listed above in light of their knowledge of the business, financial condition and prospects of the Company and considered the advice of the Board’s independent financial and legal advisors. In light of the number and variety of reasons that the Board considered, the Board did not find it practicable to, and did not, quantify or otherwise assign relative weights to the reasons summarized above in reaching its recommendation. In addition, individual members of the Board may have given different weight to different reasons. After considering the totality of the information and reasons, the Board unanimously rejected the terms of the Revised Offer and recommended that holders of the Shares not tender their Shares pursuant to the Revised Offer.

In Item 4 of the Schedule 14D-9, the subsection titled “

Intent to Tender

” is hereby amended and restated in its entirety to read as follows:

Neither the Company nor, to the knowledge of the Company after making reasonable inquiry, any of the Company’s directors, executive officers, affiliates or subsidiaries intends to tender any Shares he, she or it holds of record or beneficially owns for purchase pursuant to the Revised Offer.

Item 5. Persons/Assets, Retained, Employed, Compensated or Used.

In Item 5 of the Schedule 14D-9, the first and second full paragraphs are hereby amended and restated in their entirety to read as follows:

Pursuant to a letter agreement dated as of May 15, 2019, as amended on June 21, 2019, the Company has retained J.P. Morgan as its financial advisor in connection with, among other things, the Company’s analysis and consideration of, and response to, the Offer. The Board selected J.P. Morgan based on its qualifications, expertise, reputation and knowledge of the industry in which the Company operates and its familiarity with the business and affairs of the Company. The Company has agreed to pay J.P. Morgan customary fees consisting of (i) a nonrefundable, quarterly retainer payable for four (4) quarters and (ii) an advisory fee. In addition, the Company has agreed to offer J.P. Morgan the right to act as financial advisor for a sale transaction that it pursues within twelve (12) months from the date of the engagement letter, including a negotiated transaction with Crane. If J.P. Morgan agrees to such engagement, the parties intend to negotiate customary fee provisions based on fees paid to financial advisors in similar transactions. Such fee would not be lower than that payable by the Company to any other financial advisor. The quarterly retainer fee is credited against the advisory fee and the advisory fee will be credited against any future sale transaction fee. In addition, the Company has agreed to reimburse J.P. Morgan for its reasonable expenses in connection with its engagement, subject to a customary cap, and to indemnify J.P. Morgan against certain liabilities relating to or arising out of the engagement.

Pursuant to a letter agreement dated as of June 15, 2019, the Company has retained Evercore as its financial advisor in connection with, among other things, the Company’s analysis and consideration of, and response to, the Offer. The Board selected Evercore based on its qualifications, expertise, reputation and relevant experience. The Company has agreed to pay Evercore customary fees including a nonrefundable, quarterly advisory fee payable for six (6) quarters. In addition, the Company has agreed to offer Evercore the right to act as a financial advisor for a sale transaction that it determines to undertake within twelve (12) months of Evercore’s engagement under the letter agreement, including a negotiated transaction with Crane. If Evercore agrees to such engagement, the parties intend to negotiate customary fee provisions based on fees paid to financial advisors in similar transactions. Such fee would not be lower than that payable by the Company to any other financial advisor. The advisory fee payable under the letter agreement will be credited against any future sale transaction fee. In addition, the Company has agreed to reimburse Evercore for its reasonable expenses in connection with its engagement, subject to a customary cap, and to indemnify Evercore against certain liabilities relating to or arising out of the engagement.

Item 6.

Interest in Securities of the Subject Company.

Item 6 of the Schedule 14D-9 is hereby amended and supplemented by adding the transactions below to the table therein:

|

Name

|

|

Date of

Transaction

|

|

Nature of Transaction

|

|

Number of

Shares

|

|

Price Per

Share

|

|

|

Lane Walker

|

|

07/04/2019

|

|

Acquisition—Vesting of RSUs

|

|

3,074

|

|

$

|

48.81

|

|

|

Lane Walker

|

|

07/04/2019

|

|

Disposal—Sale to cover withholding tax

|

|

749

|

|

$

|

48.81

|

|

Item 8.

Additional information.

In Item 8 of the Schedule 14D-9, the subsection titled “

Golden Parachute Compensation

” is hereby amended and restated in its entirety to read as follows:

Golden Parachute Compensation

The following table sets forth the information required by Item 402(t) of Regulation S-K regarding certain compensation for each of the Company’s named executive officers that is based on or otherwise relates to the Offer and the Proposed Merger. For purposes of this table, the Company has assumed that the Offer, the Proposed Merger and any qualifying termination of employment occur on July 9, 2019 with respect to each named executive officer, the stock price is $48.00 per share, and no withholding taxes or reductions for potential golden parachute excise taxes are applicable to any payments set forth in the table. The Company has rounded all dollar amounts to the nearest whole dollar.

The table below describes the estimated potential payments to each of our named executive officers under the terms of their respective executive change of control agreements as amended from time to time, together with the value of the unvested Options, RSUs and PSUs that would be accelerated upon a change

14

of control. The amounts shown in the table do not include the value of payments or benefits that would have been earned, or any amounts associated with equity awards that would vest pursuant to their terms, on or prior to the effective date of the Offer or the value of payments or benefits that are not based on or otherwise related to the Offer.

The amounts shown in the table are estimates only and are based on assumptions and information available as of July 9, 2019. The actual amounts that may be paid upon an individual’s termination of employment can only be determined at the actual time of such termination, and are subject to reduction if doing so results in a larger net-after tax benefit for the named executive officer.

Golden Parachute Compensation

|

Name

|

|

Cash ($)(1)

|

|

Equity ($)(2)

|

|

Perquisites/

Benefits ($)(3)

|

|

Total ($)

|

|

|

Scott Buckhout

|

|

3,221,400

|

|

7,808,400

|

|

60,985

|

|

11,090,785

|

|

|

Chadi Chahine

|

|

1,344,000

|

|

860,375

|

|

48,992

|

|

2,253,367

|

|

|

Sumit Mehrotra

|

|

1,280,000

|

|

1,215,942

|

|

60,985

|

|

2,556,927

|

|

|

Lane Walker

|

|

1,334,646

|

|

758,875

|

|

60,985

|

|

2,154,506

|

|

|

Arjun Sharma

|

|

955,034

|

|

1,221,208

|

|

20,148

|

|

2,196,390

|

|

(1)

The termination benefits payable under these agreements are “double trigger” meaning that eligibility to receive the benefits requires a qualifying termination within twelve (12) months of the change of control. For this purpose, a “qualifying termination” is defined as a termination of the executive’s employment without cause or a resignation by the executive with good reason, as such terms are defined in the executive change of control agreement. The amount of cash severance benefits is equal to two (2) times the sum of the named executive officer’s current base salary and current target annual incentive compensation (for Mr. Sharma, this amount is equal to two (2) times his base salary at the time of termination plus his highest actual annual incentive compensation under the Company’s Executive Bonus Compensation Plan in the three (3) immediately preceding fiscal years). Cash severance payments are paid in a lump sum within thirty (30) days of the qualifying termination. The executive change of control agreements provide for non-competition and non-solicitation covenants that extend for twelve (12) months following a qualifying termination. For a description of the severance payments and benefits payable on a qualifying termination, see “

Item 3—Past Contacts, Transactions, Negotiations and Agreements—Potential Severance and Change of Control Benefits

” above.

The current base salary and current target annual incentive compensation for each named executive officer entitled to severance under an executive change of control severance agreement effective as of the date hereof is:

|

Name

|

|

Annual Base

Salary ($)

|

|

Target Annual Incentive

(% of Base Salary)

|

|

|

Scott Buckhout

|

|

$

|

767,000

|

|

110

|

%

|

|

Chadi Chahine

|

|

420,000

|

|

60

|

%

|

|

Sumit Mehrotra

|

|

400,000

|

|

60

|

%

|

|

Lane Walker

|

|

417,077

|

|

60

|

%

|

|

Arjun Sharma

|

|

310,000

|

|

50

|

%

|

|

|

|

|

|

|

|

|

(2)

The amounts listed in this column represent estimated payments in cancellation of (i) unvested Options held by each named executive officer, calculated based on (a) the number of Shares subject to the unvested Options that would be canceled multiplied by (b) the excess of $48.00 over the per Share exercise price applicable to the Options that would be canceled, (ii) RSUs held by each named executive officer, calculated as the product of (a) $48.00 per Share multiplied by (b) the number of RSUs being canceled and (iii) PSUs held by each named executive officer, calculated as the product of (a) $48.00 per Share multiplied by (b) the number of Shares underlying the PSUs being cancelled, with

15

performance deemed achieved at target. All of these awards granted prior to 2019 are “single trigger” (i.e., payable solely on account of a change of control) and amounts payable to the executive officers will be paid promptly after a purchase of Shares under the Offer that constitutes a change of control. With respect to all equity awards granted in 2019, it is intended that payments be made shortly after a qualifying termination that occurs during the one (1)-year period following a change of control. Further details are set forth under “

Item 3—Past Contacts, Transactions, Negotiations and Agreements—Consideration Payable Pursuant to the Offer and the Proposed Merger—Treatment of Stock Options and Treatment of Restricted Stock Units and Performance Share Units

” above.

|

Name

|

|

Value of

Options ($)

|

|

Value of

RSUs ($)

|

|

Value of

PSUs ($)

|

|

Total ($)

|

|

|

Scott Buckhout

|

|

2,023,104

|

|

1,621,248

|

|

4,164,048

|

|

7,808,400

|

|

|

Chadi Chahine

|

|

115,319

|

|

473,760

|

|

271,296

|

|

860,375

|

|

|

Sumit Mehrotra

|

|

109,350

|

|

706,896

|

|

399,696

|

|

1,215,942

|

|

|

Lane Walker

|

|

66,811

|

|

477,936

|

|

214,128

|

|

758,875

|

|

|

Arjun Sharma

|

|

91,048

|

|

769,968

|

|

360,192

|

|

1,221,208

|

|

As noted above, all of the outstanding equity awards granted prior to 2019 are “single trigger” (i.e., payable solely on account of a change of control), and amounts payable to the executive officers will be paid promptly after a purchase of shares under the Offer that constitutes a change of control. The value of such “single trigger” payments for each named executive officer based on a $48.00 per Share Offer price is as follows: $3,241,665 for Scott Buckhout, $0 for Chadi Chahine, $435,967 for Sumit Mehrotra, $0 for Lane Walker and $554,987 for Arjun Sharma.

(3)

Pursuant to their change of control severance agreements, the amounts in this column represent the estimated cost of providing health insurance coverage, for two (2) years, that is substantially similar to the coverage received prior to the date of termination of the named executive’s employment by the Company without cause or by the named executive officer for good reason within twelve (12) months following a change of control. For a description of the severance payments and benefits payable on a qualifying termination, see “

Item 3—Past Contacts, Transactions, Negotiations and Agreements—Potential Severance and Change of Control Benefits

” above.

Item 9.

Materials to Be Filed as Exhibits.

Item 9 of the Schedule 14D-9 is he

reby amended and supplemented by adding the following exhibits to the exhibit index:

|

Exhibit No.

|

|

Document

|

|

(a)(9)

|

|

CIRCOR Press Release, dated July 11, 2019

|

|

|

|

|

|

(a)(10)

|

|

Letter to CIRCOR Stockholders, dated July 11, 2019

|

|

|

|

|

|

(a)(11)

|

|

CIRCOR “Setting the Record Straight” Fact Sheet

|

|

|

|

|

|

(a)(12)

|

|

Opinion of J.P. Morgan, dated July 10, 2019 (included as Annex G to this Schedule 14D-9)

|

|

|

|

|

|

(a)(13)

|

|

Opinion of Evercore, dated July 10, 2019 (included as Annex H to this Schedule 14D-9)

|

16

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete and correct.

|

|

CIRCOR INTERNATIONAL, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Scott A. Buckhout

|

|

|

|

Scott A. Buckhout

|

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

|

|

Dated: July 11, 2019

|

|

17

Annex G

July 10, 2019

The Board of Directors

Circor International, Inc.

30 Corporate Drive, Suite 200

Burlington, MA 01803

Members of the Board of Directors:

You have requested our opinion as to the adequacy, from a financial point of view, to the holders (other than Crane (as defined below) and any of its affiliates) of the outstanding shares of common stock, par value $0.01 per share (the “Company Common Stock”), of CIRCOR International, Inc., a Delaware corporation (the “Company”) of the $48.00 in cash per share (the “Consideration”) proposed to be paid to such holders pursuant to the Offer (as defined below). Pursuant to the offer to purchase (the “Offer to Purchase”) and related letter of transmittal (collectively, as amended, the “Offer”) contained in the Tender Offer Statement on Schedule TO (together with all amendments, annexes and exhibits thereto, the “Offer Documents”) filed by Crane Co. (together with its subsidiaries, “Crane”) and CR Acquisition Company, a wholly owned subsidiary of Crane (“Offeror”), Crane, through Offeror, has made an offer for all of the outstanding Company Common Stock pursuant to a tender offer in which the holder of each outstanding share of Company Common Stock would be entitled to receive, in respect of such share, the Consideration. The Offer to Purchase further provides that, following completion of the Tender Offer and subject to the conditions set forth in the Offer to Purchase, Offeror expects that it would be merged with and into the Company (the “Merger” and, together with the Offer, the “Proposed Transaction”) and each remaining outstanding share of Company Common Stock will be converted in the merger into the right to receive an amount in cash equal to the highest price paid per share of Company Common Stock in the Offer, without interest.

In connection with preparing our opinion, we have (i) reviewed the terms and conditions of the Offer as set forth in the Offer Documents and the exhibits thereto; (ii) reviewed the Solicitation/Recommendation Statement of the Company filed on Schedule 14D-9 with the SEC on June 24, 2019 and the draft as of July 9, 2019 of the amendment to Schedule 14D-9 to be filed with the SEC on or about July 11, 2019, (iii) reviewed certain publicly available business and financial information concerning the Company and Crane and the industries in which they operate; (iv) compared the Consideration with the publicly available financial terms of certain transactions involving companies we deemed relevant and the consideration paid for such companies; (v) compared the financial and operating performance of the Company with publicly available information concerning certain other companies we deemed relevant and reviewed the current and historical market prices of the Company Common Stock and certain publicly traded securities of

such other companies; (vi) reviewed certain internal financial analyses and forecasts prepared by the management of the Company relating to its business; and (vii) performed such other financial studies and analyses and considered such other information as we deemed appropriate for the purposes of this opinion. In addition, we have held discussions with certain members of the management of the Company with respect to certain aspects of the Offer, their assessment of the strategic rationale of Crane, and the potential benefits for Crane, of the Proposed Transaction and the past and current business operations of the Company, the financial condition and future prospects and operations of the Company, and certain other matters we believed necessary or appropriate to our inquiry.

In giving our opinion, we have relied upon and assumed the accuracy and completeness of all information that was publicly available or was furnished to or discussed with us by the Company or otherwise reviewed by or for us. We have not independently verified any such information or its accuracy or completeness and, pursuant to our engagement letter with the Company, we did not assume any obligation to undertake any such independent verification. We have not conducted or been provided with any valuation or appraisal of any assets or liabilities, nor have we evaluated the solvency of the Company, Offeror or Crane under any state or federal laws relating to bankruptcy, insolvency or similar matters. In relying on financial analyses and forecasts provided to us or derived therefrom, we have assumed that they have been reasonably prepared based on assumptions reflecting the best currently available estimates and judgments by management as to the expected future results of operations and financial condition of the Company to which such analyses or forecasts relate. We express no view as to such analyses or forecasts or the assumptions on which they were based. We are not legal, regulatory or tax experts and have relied on the assessments made by advisors to the Company with respect to such issues.

Our opinion is necessarily based on economic, market and other conditions as in effect on, and the information made available to us as of, the date hereof. It should be understood that subsequent developments may affect this opinion and that we do not have any obligation to update, revise, or reaffirm this opinion. Our opinion is limited to the adequacy, from a financial point of view, of the Consideration proposed to be

paid to the holders of the Company Common Stock pursuant to the Offer and we express no opinion as to the adequacy of any consideration proposed to be paid in connection with the Offer to the holders of any other class of securities, creditors or other constituencies of the Company or as to the underlying decision by the Company whether or not to recommend that the holders of Company Common Stock tender their shares in the Offer. We do not express any view on, and our opinion does not address, the fairness, from a financial point of view, of the Consideration proposed to be paid pursuant to the Offer or the fairness or adequacy of any other term or aspect of the Offer or the Proposed Transaction. Our opinion does not address the relative merits of the Offer as compared to other strategies or transactions that might be available to the Company or in which the Company might engage; nor does it address any legal, regulatory, tax or accounting matters.

We note that we were not authorized to and did not solicit any expressions of interest from any other parties with respect to the sale of all or any part of the Company or any other alternative transaction.

We are acting as financial advisor to the Company with respect to the Offer and will receive a fee from the Company for our services. In addition, the Company has agreed to indemnify us for

certain liabilities arising out of our engagement. Please be advised that during the two years preceding the date of this letter, neither we nor our affiliates have had any other material financial advisory or other material commercial or investment banking relationships with the Company. During the two years preceding the date of this letter, we and our affiliates have had commercial or investment banking relationships with Crane, for which we and such affiliates have received customary compensation. Such services during such period have included acting as joint lead bookrunner on Crane’s offering of debt securities which closed in February 2018 and as joint lead arranger and joint bookrunner on Crane’s revolving credit facility which closed in December 2017. In addition, our commercial banking affiliate is an agent bank and a lender under outstanding credit facilities of Crane, for which it receives customary compensation or other financial benefits. In addition, we and our affiliates hold, on a proprietary basis, less than 1% of the outstanding common stock of each of the Company and Crane. In the ordinary course of our businesses, we and our affiliates may actively trade the debt and equity securities or financial instruments (including derivatives, bank loans or other obligations) of each of the Company and Crane for our own account or for the accounts of customers and, accordingly, we may at any time hold long or short positions in such securities or other financial instruments.

On the basis of and subject to the foregoing, it is our opinion as of the date hereof that the Consideration proposed to be paid to the holders of the Company Common Stock pursuant to the Offer is inadequate, from a financial point of view, to such holders.