As filed with the Securities and Exchange

Commission on December 1, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Cigna Corporation

(Exact name of registrant as specified in its charter)

|

Delaware |

82-4991898 |

|

(State

or other jurisdiction of |

(I.R.S.

Employer |

|

incorporation

or organization) |

Identification

Number) |

900 Cottage Grove Road

Bloomfield, Connecticut 06002

(860) 226-6000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Nicole Jones

Executive Vice President and General Counsel

Cigna Corporation

900 Cottage Grove Road

Bloomfield, Connecticut 06002

(860) 226-6000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Joseph H. Kaufman

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017

(212) 455-2000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. o

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. o

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act

Large

accelerated filer ☒ |

|

Accelerated

filer |

o |

Non-accelerated

filer o (Do not check if a smaller reporting company) |

Smaller

reporting company |

o |

| |

|

Emerging

growth company |

o |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

PROSPECTUS

Cigna Corporation

Debt

Securities

Common Stock

Preferred Stock

Warrants

Purchase Contracts

Units

Cigna Corporation may offer and sell the

securities listed above from time to time in one or more classes or series and in amounts, at prices and on terms that we may determine

at the time of the offering. We will provide the specific terms of the securities in supplements to this prospectus. The debt securities,

preferred stock, warrants and purchase contracts may be convertible into or exercisable or exchangeable for common or preferred stock

or other securities of the Company or debt or equity securities of one or more other entities. These securities may also be sold by one

or more selling security holders to be named in a prospectus supplement. You should read this prospectus and any related prospectus supplement

carefully before you invest in our securities.

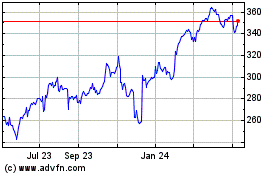

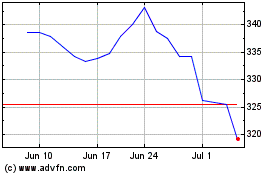

Our

common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “CI”. The last reported sale

price of our common stock on the NYSE on November 30, 2022 was $328.89 per share.

We or any selling security holders may

offer and sell these securities to or through one or more underwriters, dealers or agents, or directly to purchasers, on a continuous

or delayed basis. If underwriters, dealers or agents are used to sell the securities, we will name them and describe their compensation

in a prospectus supplement or free writing prospectus.

Investing in these securities involves

certain risks. You should carefully consider the risk factors included in our periodic reports filed with the Securities and Exchange

Commission under the Securities Exchange Act of 1934, as amended, before you invest in any of our securities. We may also include specific

risk factors in an applicable prospectus supplement under the heading “Risk Factors.”

Neither the Securities and Exchange Commission

nor any state securities regulator has approved or disapproved of these securities, or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is December

1, 2022.

We have not authorized anyone to provide

any information other than that contained or incorporated by reference in this prospectus, any prospectus supplement or in any free writing

prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance

as to the reliability of, any other information that others may give you. We are not making an offer of these securities or a solicitation

of your offer to buy these securities in any state where the offer or solicitation is not permitted or legal. You should not assume that

the information contained in or incorporated by reference in this prospectus is accurate or complete as of any date other than the date

on the front of this prospectus.

Unless otherwise mentioned or unless the

context requires otherwise, when used in this prospectus, the terms “Cigna,” “we,” “our” and “us”

refer to Cigna Corporation and its consolidated subsidiaries, and the term the “Company” refers to Cigna Corporation, not

including its consolidated subsidiaries. Unless the context otherwise requires, “including” means including without limitation.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic

“shelf” registration statement on Form S-3 that we filed with the Securities and Exchange Commission, which we refer to as

the “SEC,” as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended

(the “Securities Act”). This prospectus provides you with a general description of the securities we may offer. Each time

we use this prospectus to offer securities, we will provide a prospectus supplement and, if applicable, a pricing supplement. The prospectus

supplement and any applicable pricing supplement will describe the specific amounts, prices and other material terms of the securities

being offered at that time. The prospectus supplement and any applicable pricing supplement may also add, update or change the information

in this prospectus. You should read this prospectus, the applicable prospectus supplement and any applicable pricing supplement, together

with the information contained in the documents referred to under the heading “Where You Can Find More Information.” If there

is any inconsistency between information in this prospectus and any prospectus supplement or free writing prospectus, you should rely

on the information in the prospectus supplement or free writing prospectus.

We have not authorized anyone to provide

any information other than that contained or incorporated by reference in this prospectus or in any free writing prospectus prepared by

or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you. We are not making an offer of these securities in any state where the offer is not

permitted. You should not assume that the information contained in or incorporated by reference in this prospectus or any prospectus supplement

or in any such free writing prospectus is accurate as of any date other than their respective dates. Our business, financial condition,

liquidity, results of operations and prospects may have changed since those dates.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS AND RISK FACTORS

This prospectus and the documents incorporated

by reference herein contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements are based on Cigna’s current expectations and projections about future trends, events and uncertainties. These statements

are not historical facts. Forward-looking statements may include, among others, statements concerning future financial or operating performance,

including our ability to deliver affordable, predictable and simple solutions for our customers and clients, including in light of the

challenges presented by the COVID-19 pandemic; future growth, business strategy, and strategic or operational initiatives; economic, regulatory

or competitive environments, particularly with respect to the pace and extent of change in these areas and the impact of developing inflationary

pressures; the ongoing Russia-Ukraine conflict; financing or capital deployment plans and amounts available for future deployment; our

prospects for growth in the coming years; strategic transactions, including the sale of our international life, accident and supplemental

benefits businesses; and other statements regarding Cigna’s future beliefs, expectations, plans, intentions, liquidity, cash flows,

financial condition or performance. You may identify forward-looking statements by the use of words such as “believe,” “expect,”

“project,” “plan,” “intend,” “anticipate,” “estimate,” “predict,”

“potential,” “may,” “should,” “will” or other words or expressions of similar meaning,

although not all forward-looking statements contain such terms.

Forward-looking statements are

subject to risks and uncertainties, both known and unknown, that could cause actual results to differ materially from those

expressed or implied in forward-looking statements. Such risks and uncertainties include, but are not limited to: our ability to

achieve our strategic and operational initiatives; our ability to adapt to changes in an evolving and rapidly changing industry; our

ability to compete effectively, differentiate our products and services from those of our competitors and maintain or increase

market share; price competition, inflation and other pressures that could compress our margins or result in premiums that are

insufficient to cover the cost of services delivered to our customers; the potential for actual claims to exceed our estimates

related to expected medical claims; our ability to develop and maintain satisfactory relationships with physicians, hospitals, other

health service providers and with producers and consultants; our ability to maintain relationships with one or more key

pharmaceutical manufacturers or if payments made or discounts provided decline; changes in the pharmacy provider marketplace or

pharmacy networks; changes in drug pricing or industry pricing benchmarks; political, legal, operational, regulatory, economic and

other risks that could affect our multinational operations, including currency exchange rates; the scale, scope and duration of the

COVID-19 pandemic and its potential impact on our business, operating results, cash flows or financial condition; risks related to

strategic transactions and realization of the expected benefits of such transactions, as well as integration or separation difficulties or

underperformance relative to expectations; dependence on success of relationships with third parties; risk of significant disruption

within our operations or among key suppliers or third parties; our ability to invest in and properly maintain our information

technology and other business systems; our ability to prevent or contain effects of a potential cyberattack or other privacy or data

security incident; potential liability in connection with managing medical practices and operating pharmacies, onsite clinics and

other types of medical facilities; the substantial level of government regulation over our business and the potential effects of new

laws or regulations or changes in existing laws or regulations; uncertainties surrounding participation in government-sponsored

programs such as Medicare; the outcome of litigation, regulatory audits and investigations; compliance with applicable privacy,

security and data laws, regulations and standards; potential failure of our prevention, detection and control systems; unfavorable

economic and market conditions, including the risk of a recession or other economic downturn and resulting impact on employment

metrics, stock market or changes in interest rates and risks related to a downgrade in financial strength ratings of our insurance

subsidiaries; the impact of our significant indebtedness and the potential for further indebtedness in the future; unfavorable

industry, economic or political conditions; and credit risk related to our reinsurers.

This list of important factors is not

intended to be exhaustive. The discussions in our Annual Report on Form 10-K for the year ended December 31, 2021, including the

“Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” sections therein, as such discussions may be updated from time to time in our periodic filings with the SEC

incorporated by reference herein, include both expanded discussion of these factors and additional risk factors and uncertainties

that could affect the matters discussed in the forward-looking statements. Cigna does not assume any obligation to update any

forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You should not place undue reliance on

forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance or results and are

subject to risks, uncertainties and assumptions that are difficult to predict or quantify. Cigna undertakes no obligation to update or

revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by

law.

TRADEMARKS AND SERVICE

MARKS

We own or have rights to trademarks, service

marks or trade names that we use in connection with the operation of our business. In addition, our names, logos and website domain names

and addresses are our service marks or trademarks. We do not intend our use or display of other companies’ trademarks, service marks,

copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. The trademarks we

own or have the right to use include, among others, Cigna. We also own or have the rights to copyrights that protect the content of our

literature, be it in print or electronic form.

Solely for convenience, the trademarks,

service marks and trade names referred to or incorporated by reference in this prospectus are without the ® and ™ symbols,

but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our

rights or the rights of the applicable licensors to these trademarks, service marks and trade names. All trademarks, service marks and

trade names appearing in this prospectus are the property of their respective owners.

WHERE YOU CAN FIND MORE

INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The SEC maintains a website that contains reports, proxy statements and other information, including those filed by Cigna, at www.sec.gov.

You may also access the SEC filings and obtain other information about Cigna through the website www.cigna.com. Information on,

or accessible through, our website is expressly not incorporated by reference into, and does not constitute a part of, this prospectus

or any accompanying prospectus supplement, except for the SEC filings posted thereon that are referenced below.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

This prospectus is part of the registration

statement and does not contain all of the information included in the registration statement. Whenever a reference is made in this prospectus

to any contract or other document of Cigna, the reference may not be complete and you should refer to the exhibits that are a part of

the registration statement for a copy of the contract or document.

The SEC allows us to “incorporate

by reference” information we file with the SEC into this prospectus, which means that we can disclose important information to you

by referring you to another document filed separately with the SEC. The information incorporated by reference in this prospectus is an

important part of this prospectus, and information that we will file later with the SEC (including any prospectus supplement) will automatically

update and supersede this information.

This prospectus incorporates by reference

the documents set forth below that Cigna has previously filed with the SEC and that are not delivered with this prospectus. These documents

contain important information about Cigna and its financial condition. Since information that we file with the SEC in the future will

update and supersede previously incorporated information, you should look at all of the SEC filings that we incorporate by reference to

determine if any of the statements in this prospectus or any accompanying prospectus supplement or in any documents previously incorporated

by reference have been modified or superseded.

|

Cigna

SEC Filings (File No. 001-38769) |

Period |

|

Annual Report on Form

10-K |

For the year ended December

31, 2021 (the “Annual Report”) |

| |

|

|

Quarterly Report on

Form 10-Q |

For the quarters ended

March 31, 2022, June 30, 2022 and September 30, 2022 |

|

Proxy Statement on

Schedule 14A |

Filed on March 18, 2022

(solely those portions that were incorporated by reference into Part III of the Annual Report) |

|

Current Report on Form

8-K |

Filed on April 29, 2022,

May 2, 2022, June 16, 2022, and October 28, 2022 |

We also incorporate by reference into this

prospectus all documents filed by us under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus

until the offering of the particular securities covered by a prospectus supplement has been terminated or completed, other than any portion

of the respective filings that are furnished, rather than filed, under the applicable SEC rules. This additional information is a part

of this prospectus from the date of filing of those documents.

To obtain a copy of these filings at no

cost, you may write or telephone us at Cigna Corporation, Two Liberty Place, 5th Floor, 1601 Chestnut Street, Philadelphia, Pennsylvania

19192-1550, Attention: Shareholder Services. You may also request a copy at (212) 761-3516 or shareholderservices@cigna.com. Exhibits

to the filings will not be sent, however, unless those exhibits have been specifically incorporated by reference into such document.

CIGNA CORPORATION

Cigna Corporation, together with its subsidiaries,

is a global health services organization with a mission of helping those we serve improve their health, well-being and peace of mind by

making health care affordable, predictable and simple. Our subsidiaries offer a differentiated set of pharmacy, medical, behavioral, dental

and supplemental products and services.

Cigna’s principal executive offices

are located at 900 Cottage Grove Road, Bloomfield, CT 06002. Our telephone number is (860) 226-6000.

For additional information concerning Cigna,

please see our most recent Annual Report on Form 10-K and our other filings with the SEC. See “Where You Can Find More Information.”

USE OF PROCEEDS

Unless we inform you otherwise in a prospectus

supplement or free writing prospectus, the net proceeds from the sale of the securities will be added to Cigna’s general funds and

used for general corporate purposes, including the repayment of indebtedness.

We will not receive any proceeds from sales

of securities offered by any selling security holders under this prospectus and the applicable prospectus supplement.

DESCRIPTION OF DEBT SECURITIES

This prospectus describes certain general

terms and provisions of the debt securities. The debt securities will be our direct, unsecured obligations. When we offer to sell a particular

series of debt securities, we will describe the specific terms of the debt securities in a supplement to this prospectus. The prospectus

supplement will also indicate whether the general terms and provisions described in this prospectus apply to a particular series of debt

securities. The debt securities will be issued under one or more base indentures, together with related supplemental indentures or officers’

certificates, between us and U.S. Bank National Association, as trustee, or another trustee named in the prospectus supplement (the “Trustee”),

including under the indenture dated as of September 17, 2018, between Cigna and U.S. Bank National Association, as Trustee (together with

any related supplemental indentures or officers’ certificates, the “existing indenture”). We refer herein to each of

the existing indenture and any other indenture under which debt securities will be issued pursuant to this prospectus as the “indenture”.

The terms of the indenture and any debt securities issued thereunder will be set forth in the prospectus supplement relating to such debt

securities.

We have summarized some terms of the existing

indenture below. We expect that the terms of the indenture, if other than the existing indenture, will be substantially similar to the

existing indenture; however, we will describe the specific terms of the debt securities to be issued under the indenture in a supplement

to this prospectus. The below summary of the existing indenture is not complete. The existing indenture is incorporated by reference as

an exhibit to the registration statement of which this prospectus is a part. You should read the existing indenture for a complete statement

of the provisions summarized in this prospectus and for provisions that may be important to you. We sometimes refer below to specific

sections of the existing indenture. When we do so, we indicate where you can find the relevant section in the existing indenture by noting

the section number in parentheses. When we do refer to specific sections contained in the existing indenture or terms defined in the existing

indenture, including important terms, which we capitalize here, we use them in this prospectus in the same way we use them in the existing

indenture, and you should refer to the existing indenture itself for detailed, specific, legal descriptions. In this section, “Description

of Debt Securities,” when we refer to “Cigna,” “we,” “our” or “us,” we refer to

Cigna Corporation, not including its consolidated subsidiaries. The existing indenture is subject to and governed by the Trust Indenture

Act of 1939, as amended.

Summary of the existing indenture

Ranking

The debt securities will be our unsecured

and unsubordinated obligations and will rank equally with all of our existing and future senior unsecured and unsubordinated indebtedness,

and senior in right of payment to all of our future indebtedness that is subordinated in right of payment to the debt securities. The

debt securities will effectively rank junior to any of our existing and future secured obligations to the extent of the value of the collateral

securing such obligations.

Because a significant part of our operations

are conducted through subsidiaries, a significant portion of our cash flow, and consequently, our ability to service debt, including the

debt securities, is dependent upon the earnings of our subsidiaries and the transfer of funds by those subsidiaries to us in the form

of dividends or other transfers.

In addition, because the debt securities

will not be guaranteed by any of our subsidiaries, claims in respect of the debt securities will be structurally subordinated to claims

of creditors against our subsidiaries, including policy holders, trade creditors, debtholders, secured creditors, taxing authorities,

guarantee holders and any preferred shareholders, except to the extent that we are recognized as a creditor of our subsidiary. Any claims

of Cigna as the creditor of its subsidiary would be subordinate to any security interest in the assets of such subsidiary and any indebtedness

of such subsidiary senior to that held by us.

In addition to general state law restrictions

on payments of dividends and other distributions to shareholders applicable to all corporations, health maintenance organizations and

insurance companies, including some of Cigna’s direct and indirect subsidiaries, are subject to further state insurance regulations

that, among other things, may require those companies to maintain certain levels of equity and restrict the amount of dividends and other

distributions that may be paid to Cigna.

Terms of the Debt Securities to be Described in the Prospectus

Supplement

The existing indenture does not limit the

amount of debt securities that we may issue under them. We may issue debt securities under the existing indenture up to an aggregate principal

amount as we may authorize from time to time.

The prospectus

supplement will describe the terms of any debt securities being offered, including:

| |

• |

the title of the debt securities of the series; |

| |

• |

any limit on the aggregate principal amount of the debt securities; |

| |

• |

the person to whom the interest will be payable, if other than the person in whose name that debt security is registered at; |

| |

• |

the date or dates on which the principal will be payable; |

| |

• |

the interest rate, if any, and the method for calculating the interest rate; |

| |

• |

the interest payment dates and the record dates for interest payments; |

| |

• |

our right, if any, to defer payment of interest and the maximum length of this deferral period; |

| |

• |

any mandatory or optional redemption terms or prepayment or sinking fund provisions, including the period or periods, if any, within which, the price or prices at which, and the terms and conditions upon which the debt securities may be redeemed, in whole or in part, at our option or at your option; |

| |

• |

the terms and conditions, if any, upon which we may have to repay the debt securities early at your option; |

| |

• |

the place where we will pay principal, interest and any premium; |

| |

• |

the currency or currencies, if other than the currency of the United States, in which principal, interest and any premium will be paid; |

| |

• |

if other than denominations of $2,000 and any integral multiples of $1,000 thereof, the denominations in which the debt securities will be issued; |

| |

• |

whether the debt securities will be issued in the form of global securities; |

| |

• |

additional provisions, if any, relating to the discharge of our obligations under the debt securities; |

| |

• |

whether the amount of payment of principal (or premium, if any) or interest, if any, will be determined with reference to one or more indices; |

| |

• |

the portion of the principal amount of the debt securities to be paid upon acceleration of maturity thereof; |

| |

• |

the terms and conditions upon which conversion or exchange of the debt securities may be effected, if any, including the initial conversion or exchange price or rate and any adjustments thereto and the period or periods when a conversion or exchange may be effected; |

| |

• |

any authenticating or paying agents, registrars or other agents; |

| |

• |

the application, if any, of defeasance and covenant defeasance provisions to the debt securities; |

| |

• |

other specific terms, including any additional events of default, covenants or warranties; and |

| |

• |

any other terms, which may supplement, modify or delete any provision of the indenture as it applies to that series, including any terms that may be required or advisable under applicable law or regulations or advisable in connection with the marketing of the debt securities. (Section 3.01) |

We may from time to time, without notice

to or the consent of the holders of any series of debt securities, create and issue further debt securities of any such series ranking

equally with, and having the same terms and conditions as, the debt securities of such series in all respects (or in all respects other

than the payment of interest accruing prior to the issue date of such further debt securities); provided that if such additional debt

securities are not fungible with the initial debt securities of such series for U.S. federal income tax purposes, such additional debt

securities will have a separate CUSIP number.

Events of Default and Notice Thereof

When we use the

term “Event of Default” with respect to debt securities of any series we mean:

| |

• |

we fail to pay principal (including any sinking fund payment) of, or premium (if any) on, any debt security of that series when due; |

| |

• |

we fail to pay interest, if any, on any debt security of that series when due and the failure continues for a period of 30 days; |

| |

• |

we fail to perform in any material respect any covenant in the existing indenture not specified in the previous two bullet points (other than a covenant included in the existing indenture solely for the benefit of a different series of debt securities) and the failure to perform continues for a period of 90 days after receipt of a specified written notice to us from the Trustee or holders of at least 25% in aggregate principal amount of the outstanding debt securities of a particular series; and |

| |

• |

certain events of bankruptcy, insolvency, reorganization, receivership or liquidation of Cigna. (Section 5.01) |

An Event of Default with respect to debt

securities of a particular series may not constitute an Event of Default with respect to debt securities of any other series of debt securities.

If an Event of Default under the existing

indenture occurs with respect to the debt securities of any series and is continuing, then the Trustee or the holders of at least 25%

in principal amount of the outstanding debt securities of that series may require us to repay immediately the entire principal amount

(or, if the debt securities of that series are Original Issue Discount Securities (as defined in the existing indenture), such portion

of the principal amount as may be specified in the terms of that series) of all outstanding debt securities of that series; provided,

however, that under certain circumstances the holders of a majority in aggregate principal amount of outstanding debt securities of

that series may rescind or annul such acceleration and its consequences. (Section 5.02)

The existing indenture contains a provision

entitling the Trustee, subject to the duty of the Trustee during a default to act with the required standard of care (Section 6.01), to

be indemnified by the holders of debt securities before proceeding to exercise any right or power under that existing indenture at the

request of such holders. (Section 6.03) Subject to these provisions in the existing indenture for the indemnification of the Trustee and

certain other limitations, the holders of a majority in aggregate principal amount of the debt securities of each affected series then

Outstanding (as defined in the existing indenture) may direct the time, method and place of conducting any proceeding for any remedy available

to the Trustee or exercising any trust or power conferred on the Trustee. (Sections 5.12 and 5.13)

The existing indenture provides that the

Trustee may withhold notice to the holders of the debt securities of any default (except in payment of principal (or premium, if any)

or interest, if any) if the Trustee determines in good faith that it is in the interest of the holders of the debt securities to do so.

(Section 6.02)

The existing indenture provides that holders

of the outstanding debt securities of any series may seek to institute a proceeding with respect to the existing indenture or for any

remedy thereunder only after:

| |

• |

such holders previously gave notice to the Trustee of a continuing Event of Default; |

| |

• |

holders of at least 25% in aggregate principal amount of outstanding debt securities of any series have made a written request to the Trustee to institute a proceeding; |

| |

• |

such holders have offered an indemnity reasonably satisfactory to the Trustee to institute a proceeding; |

| |

• |

the Trustee for 60 days after its receipt of such notice, request and offer of indemnity has failed to institute any such proceeding; and |

| |

• |

the Trustee shall not have received from the holders of a majority in aggregate principal amount of the outstanding debt securities of that series a direction inconsistent with such request and shall have failed to institute such proceeding within 60 days. (Section 5.07) |

These limitations do not apply, however,

to a suit instituted by a holder of a debt security for enforcement of payment of the principal of (or premium, if any) or interest,

if any, on or after the respective due dates expressed in such debt security. (Section 5.08)

The existing indenture contains a covenant

under which we are required to furnish to the Trustee an officers’ certificate, within 120 days after the end of each fiscal year,

as to the compliance with all terms, provisions and conditions of the existing indenture, or if we are in default, specifying all such

defaults and the nature and status thereof of which we may have knowledge. (Section 10.07)

Modification and Waiver

The existing indenture (Section 9.01) provides

that we, together with the Trustee, may enter into supplemental indentures without the consent of the holders of debt securities to:

| |

• |

evidence the assumption by another person of our obligations; |

| |

• |

add covenants for the benefit of the holders of all or any series of debt securities or surrender any right or power of Cigna under the existing indenture or the debt securities; |

| |

• |

add any additional Events of Default; |

| |

• |

add or change the existing indenture to permit or facilitate the issuance of debt securities in bearer form or in uncertificated form; |

| |

• |

add to, change or eliminate a provision of the existing indenture or the debt securities if such addition, change or elimination does not apply to a debt security created prior to the execution of such supplemental indenture or modify the rights of a holder of any debt security with respect to such provision; |

| |

• |

secure any debt security or perfect the security interest securing Cigna’s obligations in respect of any debt security; |

| |

• |

establish the form or terms of debt securities of any series; |

| |

• |

evidence the acceptance of appointment by a successor Trustee; |

| |

• |

add to any provision of the existing indenture to the extent necessary to permit or facilitate defeasance and discharge of any series of debt securities if such action does not adversely affect the interests of the holders of debt securities in any material respect; |

| |

• |

cure any ambiguity or correct any inconsistency in the existing indenture or make other changes, provided that any such action does not adversely affect the interests of the holders of debt securities of any affected series in any material respect; |

| |

• |

provide for the guarantee by any person of any debt security; |

| |

• |

conform the existing indenture or any debt security to any provision of any relevant offering memorandum or prospectus; or |

| |

• |

conform the existing indenture to any mandatory provision of law. |

Other amendments and modifications of the

existing indenture may be made with the consent of the holders of not less than a majority of the aggregate principal amount of each series

of the outstanding debt securities affected by the amendment or modification; provided, however, no modification or amendment may,

without the consent of the holder of each outstanding debt security affected:

| |

• |

change the stated maturity of the principal of (or premium, if any) or any installment of principal or interest, if any, on any such debt security; |

| |

• |

reduce the principal amount of (or premium, if any) or the interest rate, if any, on any such debt security or the principal amount due upon acceleration of an Original Issue Discount Security; |

| |

• |

change the place or currency of payment of principal of (or premium, if any) or the interest, if any, on any such debt security; |

| |

• |

impair the right to institute suit for the enforcement of any such payment on or with respect to any such debt security; |

| |

• |

reduce the percentage of holders of debt securities necessary to modify or amend the existing indenture; or |

| |

• |

modify the foregoing requirements or reduce the percentage of outstanding debt securities necessary to waive compliance with certain provisions of the existing indenture or for waiver of certain defaults. (Section 9.02) |

The holders of at least a majority of the

aggregate principal amount of the outstanding debt securities of any series may, on behalf of all holders of that series, waive our required

compliance with certain restrictive provisions of the existing indenture and may waive any past default under the existing indenture,

except a default in the payment of principal, premium or interest or in the performance of certain covenants. (Section 5.13)

Limitations on Liens on Common Stock of Designated Subsidiaries

The existing indenture provides that so

long as any of the debt securities issued under the existing indenture remains outstanding, we will not, and we will not permit any of

our subsidiaries to, directly or indirectly, create, issue, assume, incur or guarantee any indebtedness for borrowed money secured by

a mortgage, pledge, lien, security interest or other encumbrance of any nature on any of the common stock of a Designated Subsidiary,

which common stock is directly or indirectly owned by us, unless our obligations under the debt securities and, if we so elect, any other

of our indebtedness ranking on a parity with, or prior to, the debt securities, shall be secured equally and ratably with, or prior to,

such secured indebtedness for borrowed money so long as it is outstanding and is so secured. (Section 10.05)

“Designated Subsidiary”

means each of Cigna Holding Company, Connecticut General Life Insurance Company, Life Insurance Company of North America, Evernorth

Health, Inc., Express Scripts, Inc. and Medco Health Solutions, Inc., so long as it remains a

subsidiary, or any subsidiary which is a successor of such Designated Subsidiary. (Section 1.01)

Consolidation, Merger and Sale of Assets

We may not consolidate with or merge with

or into any other person (other than in a merger or consolidation in which we are the surviving person) or sell our properties and assets

as, or substantially as, an entirety to any person unless:

| |

• |

the person formed by the consolidation or with or into which we are merged or the person that purchases our properties and assets as, or substantially as, an entirety is a corporation organized and validly existing under the laws of the United States of America, any State or the District of Columbia, and any such successor or purchaser expressly assumes Cigna’s obligations on the debt securities under a supplemental indenture reasonably satisfactory to the Trustee; |

| |

• |

immediately after giving effect to the transaction no Event of Default shall have occurred and be continuing; and |

| |

• |

an officers’ certificate and opinion of counsel are delivered to the Trustee. (Section 8.01) |

Upon compliance with the foregoing provisions,

the successor or purchaser will succeed to, and be substituted for, Cigna under the existing indenture with the same effect as if such

successor or purchaser had been the original obligor under the debt securities, and thereafter Cigna will be relieved of all obligations

and covenants under the existing indenture and the debt securities. (Section 8.02)

No Protection in the Event of a Change of Control

Unless otherwise indicated in a prospectus

supplement with respect to a particular series of debt securities, the debt securities will not contain an option for the holders of such

debt to require us to purchase all or a portion of such debt securities or any other protection in the event we have a change in control

or in the event of a highly leveraged transaction (whether or not such transaction results in a change in control).

Defeasance and Covenant Defeasance

If we irrevocably deposit, in trust, with

the Trustee (or other qualifying trustee), sufficient cash and/or specified government obligations (in the opinion of a nationally recognized

firm of independent public accountants) to pay the principal of (and premium, if any) and interest and any other sums due on the scheduled

due date for the debt securities of a particular series, then at our option and subject to certain conditions (including the absence of

an Event of Default):

| |

• |

we will be discharged from our obligations with respect to the debt securities of such series (which we refer to in this prospectus as a “legal defeasance”), or |

| |

• |

we will no longer be under any obligation to comply with the covenants described above under “Limitations on Liens on Common Stock of Designated Subsidiaries” and “Consolidation, Merger and Sale of Assets,” and an Event of Default relating to any failure to comply with such covenants will no longer apply to us (which we refer to in this prospectus as a “covenant defeasance”). |

If we exercise our legal defeasance option,

payment of such debt securities may not be accelerated because of an Event of Default. If we exercise our covenant defeasance option,

payment of such debt securities may not be accelerated by reference to the covenants from which we have been released or pursuant to Events

of Default referred to above which are no longer applicable. If we fail to comply with our remaining obligations with respect to such

debt securities under the existing indenture after we exercise the covenant defeasance option and such debt securities are declared due

and payable because of the occurrence of any Event of Default, the amount of money and government obligations on deposit with the Trustee

may be insufficient to pay amounts due on the debt securities of such series at the time of the acceleration resulting from such Event

of Default. However, we will remain liable for such payments. (Section 10.06)

Under current United States federal income

tax laws, a legal defeasance would be treated as an exchange of the relevant debt securities in which holders of those debt securities

might recognize gain or loss. Unless accompanied by other changes in the terms of the debt securities, a covenant defeasance generally

should not be treated as a taxable exchange. In order to exercise our defeasance options, we must deliver to the Trustee an opinion of

counsel to the effect that the deposit and related defeasance would not cause the holders of the debt securities to recognize income,

gain or loss for Federal income tax purposes. In the case of legal defeasance, such opinion of counsel must be based on (i) an Internal

Revenue Service ruling or (ii) a change in the applicable United States federal income tax law occurring since the date of the existing

indenture.

No Personal Liability of Incorporators, Stockholders, Officers,

Directors, Employees or Agents

The existing indenture provides that no

recourse shall be had for the payment of principal, premium, if any, or interest, if any, or any debt security, or for any claim based

on or in respect of any debt security or the existing indenture or any supplemental indenture, against any incorporator, or against any

past, present or future stockholder, officer, director, employee or agent of ours or of any successor person thereof under any law, statute

or constitutional provision or by the enforcement of any assessment or by any legal or equitable proceeding or otherwise. Each holder,

by accepting the debt securities, waives and releases all such liability.

Concerning our Relationship with the Trustee

U.S. Bank National Association, is the

Trustee under our existing indenture. We maintain customary banking relationships in the ordinary course of business with the Trustee

and its affiliates.

Governing Law

The existing indenture is governed by and

shall be construed in accordance with the internal laws of the State of New York, without regard to conflicts of laws principles thereof.

FORM OF DEBT SECURITIES

Each debt security will be represented

either by a certificate issued in definitive form to a particular investor or by one or more global securities representing the entire

issuance of securities. Certificated securities in definitive form and global securities will be issued in registered form. Definitive

securities name you or your nominee as the owner of the security, and in order to transfer or exchange these securities or to receive

payments other than interest or other interim payments, you or your nominee must physically deliver the securities to the Trustee. Global

securities name a depositary or its nominee as the owner of the debt securities represented by the global securities.

We may issue the debt securities in the

form of one or more fully registered global securities that will be deposited with a depositary or its nominee identified in the applicable

prospectus supplement and registered in the name of that depositary or nominee. In those cases, one or more global securities will be

issued in a denomination or aggregate denominations equal to the portion of the aggregate principal or face amount of the securities to

be represented by global securities. Unless and until it is exchanged in whole for securities in definitive registered form, a global

security may not be transferred except as a whole by and among the depositary for the global security, the nominees of the depositary

or any successors of the depositary or those nominees.

If not described below, any specific terms

of the depositary arrangement with respect to any securities to be represented by a global security will be described in the prospectus

supplement relating to those securities. (Sections 2.04 and 3.05) We anticipate that the following provisions will apply to all depositary

arrangements.

Ownership of beneficial interests in a global

security will be limited to persons, called participants, that have accounts with the depositary. Upon the issuance of a global security,

the depositary will credit, on its book-entry registration and transfer system, the participants’ accounts with the respective principal

or face amounts of the securities beneficially owned by the participants. Any dealers, underwriters or agents participating in the distribution

of the securities will designate the accounts to be credited. Ownership of beneficial interests in a global security will be shown on,

and the transfer of ownership interests will be effected only through, records maintained by the depositary, with respect to interests

of participants, and on the records of participants, with respect to interests of persons holding through participants. The laws of some

states may require that some purchasers of securities take physical delivery of these securities in definitive form. These laws may impair

your ability to own, transfer or pledge beneficial interests in global securities.

So long as the depositary, or its nominee,

is the registered owner of a global security, that depositary or its nominee, as the case may be, will be considered the sole owner or

holder of the securities represented by the global security for all purposes under the existing indenture. Except as described below,

owners of beneficial interests in a global security will not be entitled to have the securities represented by the global security registered

in their names, will not receive or be entitled to receive physical delivery of the securities in definitive form and will not be considered

the owners or holders of the securities under the existing indenture. Accordingly, each person owning a beneficial interest in a global

security must rely on the procedures of the depositary for that global security and, if that person is not a participant, on the procedures

of the participant through which the person owns its interest, to exercise any rights of a holder under the existing indenture. We understand

that under existing industry practices, if we request any action of holders or if an owner of a beneficial interest in a global security

desires to give or take any action that a holder is entitled to give or take under the existing indenture, the depositary for the global

security would authorize the participants holding the relevant beneficial interests to give or take that action, and the participants

would authorize beneficial owners owning through them to give or take that action or would otherwise act upon the instructions of beneficial

owners holding through them.

Principal (or premium, if any) and interest

payments on debt securities represented by a global security registered in the name of a depositary or its nominee will be made to the

depositary or its nominee, as the case may be, as the registered owner of the global security. Neither Cigna nor the Trustee nor any agent

of Cigna or the Trustee will have any responsibility or liability for any aspect of the records relating to payments made on account of

beneficial ownership interests in the global security or for maintaining, supervising or reviewing any records relating to those beneficial

ownership interests.

We expect that the depositary for any

of the securities represented by a global security, upon receipt of any payment of principal, premium, interest or other

distribution of underlying securities or other property to holders of that global security, will immediately credit

participants’ accounts in amounts proportionate to their respective beneficial interests in that global security as shown on

the records of the depositary. We also expect that payments by participants to owners of beneficial interests in a global security

held through participants will be governed by standing customer instructions and customary practices, and will be the responsibility

of those participants.

If the depositary for any of these securities

represented by a global security is at any time unwilling or unable to continue as depositary or ceases to be a clearing agency registered

under the Exchange Act, and a successor depositary registered as a clearing agency under the Exchange Act is not appointed by us within

90 days, we will issue securities in definitive form in exchange for the global security that had been held by the depositary. In addition,

we may at any time and in our sole discretion decide not to have any of the securities represented by one or more global securities.

If we make that decision, we will issue securities in definitive form in exchange for the global security or securities representing

those securities. Any securities issued in definitive form in exchange for a global security will be registered in the name or names

that the depositary gives to the Trustee or relevant agent of ours or theirs. It is expected that the depositary’s instructions

will be based upon directions received by the depositary from participants with respect to ownership of beneficial interests in the global

security that had been held by the depositary.

DESCRIPTION OF CAPITAL STOCK

Description of Common Stock

The following description of our common stock

is based upon our Amended and Restated Certificate of Incorporation (“Certificate of Incorporation”), our Amended and Restated

By-Laws (“By-Laws”) and applicable provisions of law as currently in effect. We have summarized certain portions of the Certificate

of Incorporation and By-Laws below. This summary is not complete and is qualified by the Certificate of Incorporation and the By-Laws,

which are incorporated by reference in the registration statement of which this prospectus forms a part.

Certain provisions of the Delaware General

Corporation Law, the Certificate of Incorporation and the By-Laws summarized in the following paragraphs may have an anti-takeover effect.

This may delay, defer or prevent a tender offer or takeover attempt that a stockholder might consider in its best interests, including

those attempts that might result in a premium over the market price for its shares.

The Company is authorized to issue 600,000,000

shares of common stock, par value $0.01 per share, of which 305,739,004 shares were outstanding at October 31, 2022.

Holders of common stock are entitled to receive

such dividends as the board of directors of the Company may from time to time declare. Payment of dividends on the common stock will at

all times be subject to, among other things, prior satisfaction of dividend and sinking fund requirements, if any, of any series of preferred

stock that may then be outstanding, and the availability of funds to the Company, which in turn may be subject to fixed payment obligations

which the Company may incur in the future, and the ability of the Company’s insurance subsidiaries to declare and pay dividends

under applicable insurance regulatory requirements. No shares of preferred stock are outstanding as of the date of this prospectus.

All directors of the Company currently hold

one-year terms. Any director may be removed, with or without cause, at any time, by a majority of the voting power of the issued and outstanding

capital stock of the Company entitled to vote at an election for directors. Holders of common stock have one vote per share and have no

cumulative voting rights, which means that the holders of more than 50% of the shares voting for the election of directors can elect 100%

of the directors and the holders of the remaining shares are not able to elect any directors. The Company has adopted a majority voting

standard for the election of directors in uncontested elections. Under this standard, each director must receive a majority of the votes

cast with respect to that director. This means that the number of votes cast “for” a director nominee must exceed the number

of votes cast “against” that nominee for the director to be elected. In general, each director agrees to tender, and not withdraw,

his or her resignation if he or she does not receive a majority of the votes cast at an annual meeting of shareholders at which such director

is a nominee for election. The Company’s Corporate Governance Committee will make a recommendation to the Company’s board

of directors on whether to accept the resignation. The Company’s board of directors has discretion to accept or reject the resignation.

In contested elections, the voting standard is a plurality of votes cast.

Subject to the rights of creditors and the

liquidation preferences of holders of preferred stock, the holders of common stock are entitled to share ratably in the remaining assets

of the Company in the event of its voluntary or involuntary liquidation or dissolution. Holders of common stock have no preemptive rights.

All shares of common stock presently outstanding are, and all such shares to be issued pursuant to this prospectus will be, fully paid

and nonassessable. Shares of the Company’s common stock are not convertible into shares of any other class of capital stock.

The Certificate of Incorporation grants the

Company the right to amend, alter, change or repeal any provision in the Certificate of Incorporation in the manner prescribed by statute.

Under Section 242 of the Delaware General Corporation Law, unless the Certificate of Incorporation requires a greater vote, a proposed

amendment to the Certificate of Incorporation must be approved by the affirmative vote of a majority of the voting power of the outstanding

stock entitled to vote thereon and a majority of the outstanding stock of each class entitled to vote as a class. The Company’s

By-Laws may be adopted, amended or repealed by majority vote of the capital stock of the Company outstanding and entitled to vote thereon,

or by the Company’s board of directors without any vote of the stockholders. Such provisions could inhibit a change in control in

situations that the board of directors determines are not adequate or in the best interests of shareholders, or that do not meet specified

fair price criteria and procedural conditions. In some circumstances, some or all shareholders could be denied the opportunity to realize

a premium over the then-prevailing market price for the shares.

Description of Preferred Stock

The Company’s Certificate of Incorporation

authorizes the issuance of 25,000,000 shares of preferred stock, par value $1.00 per share. No shares of preferred stock are outstanding

as of the date of this prospectus. The Company’s preferred stock may be issued from time to time in one or more series, without

shareholder approval, when authorized by the board of directors. Subject to limitations prescribed by law, the board of directors is authorized

to determine the voting powers (if any), designation, preferences and relative, participating, optional or other special rights, and qualifications,

limitations or restrictions thereof, for each series of preferred stock that may be issued, and to fix the number of shares of each such

series.

We will include the specific terms of each

series of the preferred stock being offered in a supplement to this prospectus.

Section 203 of the Delaware General Corporation Law

Section 203 of the Delaware General Corporation

Law prohibits a defined set of transactions between a Delaware corporation, such as us, and an interested stockholder. An interested stockholder

is defined as a person who, together with any affiliates or associates of such person, beneficially owns, directly or indirectly, 15%

or more of the outstanding voting shares of a Delaware corporation. This provision may prohibit business combinations between an interested

stockholder and a corporation for a period of three years after the date the interested stockholder becomes an interested stockholder.

The term business combination is broadly defined to include mergers, consolidations, sales or other dispositions of assets having a total

value in excess of 10% of the consolidated assets of the corporation, and some other transactions that would increase the interested stockholder’s

proportionate share ownership in the corporation.

This prohibition

is effective unless:

| |

• |

the business combination is approved by the corporation’s board of directors prior to the time the interested stockholder becomes an interested stockholder; |

| |

• |

the interested stockholder acquired at least 85% of the voting stock of the corporation, other than stock held by directors who are also officers or by qualified employee stock plans, in the transaction in which it becomes an interested stockholder; or |

| |

• |

the business combination is approved by a majority of the board of directors and by the affirmative vote of two-thirds of the outstanding voting stock that is not owned by the interested stockholder. |

In general, the prohibitions do not apply

to business combinations with persons who were shareholders before we became subject to Section 203.

Special By-Laws Provisions

Under our By-Laws, vacancies and newly-created

directorships resulting from any increase in the size of our board may be filled by our board, even if the directors then on the board

do not constitute a quorum or only one director is left in office. These provisions, together with the provisions of Section 203 of the

Delaware General Corporation Law, could have the effect of delaying, deferring or preventing a change in control or the removal of existing

management, of deterring potential acquirors from making an offer to our shareholders and of limiting any opportunity to realize premiums

over the then-prevailing market prices for our common stock in connection therewith. This could be the case notwithstanding that a majority

of our shareholders might benefit from such a change in control or offer.

Transfer Agent and Registrar

Computershare Inc.

serves as the registrar and transfer agent for the common stock.

Stock Exchange Listing

Our common stock

is listed on the New York Stock Exchange under the trading symbol “CI”.

DESCRIPTION OF WARRANTS

We may issue warrants to purchase our debt

or equity securities or securities of third parties or other rights, including rights to receive payment in cash or securities based

on the value, rate or price of one or more specified commodities, currencies, securities or indices, or any combination of the foregoing.

Warrants may be issued independently or together with any other securities and may be attached to, or separate from, such securities.

Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a warrant agent. The terms

of any warrants to be issued and a description of the material provisions of the applicable warrant agreement will be set forth in the

applicable prospectus supplement.

DESCRIPTION OF PURCHASE CONTRACTS

We may issue purchase

contracts for the purchase or sale of:

| |

• |

debt or equity securities issued by us or securities of third parties, a basket of such securities, an index or indices of such securities or any combination of the above; |

Each purchase contract will entitle or obligate

the holder thereof to purchase or sell, and obligate us to sell or purchase, on specified dates, such securities, currencies or commodities

at a specified purchase price, which may be based on a formula, all as set forth in the applicable prospectus supplement. We may, however,

satisfy our obligations, if any, with respect to any purchase contract by delivering the cash value of such purchase contract or the cash

value of the property otherwise deliverable or, in the case of purchase contracts on underlying currencies, by delivering the underlying

currencies, as set forth in the applicable prospectus supplement. The applicable prospectus supplement will also specify the methods by

which the holders may purchase or sell such securities, currencies or commodities and any acceleration, cancellation or termination provisions

or other provisions relating to the settlement of a purchase contract.

The purchase contracts may require us to

make periodic payments to the holders thereof or vice versa, which payments may be deferred to the extent set forth in the applicable

prospectus supplement, and those payments may be unsecured or prefunded on some basis. The purchase contracts may require the holders

thereof to secure their obligations in a specified manner to be described in the applicable prospectus supplement. The purchase contracts

may require holders to satisfy their obligations thereunder when the purchase contracts are issued or at settlement. Our obligation to

settle any pre-paid purchase contracts on the relevant settlement date may constitute indebtedness.

DESCRIPTION OF UNITS

We may issue units consisting of one or

more purchase contracts, warrants, debt securities, shares of preferred stock, shares of common stock or any combination of such securities.

The terms of any units to be issued and a description of the material provisions of the applicable unit agreement will be set forth in

the applicable prospectus supplement.

SELLING SECURITY HOLDERS

Selling security holders to be named in a

prospectus supplement may, from time to time, offer and sell some or all of our securities held by them pursuant to this prospectus and

the applicable prospectus supplement. Such selling security holders may sell our securities held by them to or through underwriters, dealers

or agents or directly to purchasers or as otherwise set forth in the applicable prospectus supplement. See “Plan of Distribution.”

Such selling security holders may also sell, transfer or otherwise dispose of some or all of our securities held by them in transactions

exempt from the registration requirements of the Securities Act.

We will provide you with a prospectus supplement,

which will, among other things, set forth the name of each selling security holder and the number of our securities beneficially owned

by such selling security holders that are covered by such prospectus supplement.

PLAN OF DISTRIBUTION

General

Any of the securities being offered pursuant

to this prospectus and any accompanying prospectus supplement may be sold in any one or more of the following ways from time to time:

| |

• |

directly to purchasers; |

| |

• |

to or through underwriters; |

| |

• |

directly to our shareholders; or |

| |

• |

through a combination of any such methods of sale. |

We may also issue

any of the securities as a dividend or distribution to our shareholders.

In addition, we may enter into derivative

transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions.

If the applicable prospectus supplement indicates, in connection with such a transaction the third parties may, pursuant to this prospectus

and the applicable prospectus supplement, sell securities covered by this prospectus and the applicable prospectus supplement. If so,

the third parties may use securities borrowed from us or others to settle such sales and may use securities received from us to close

out any related short positions. We may also loan or pledge securities covered by this prospectus and the applicable prospectus supplement

to third parties, who may sell the loaned securities or, in an event of default in the case of a pledge, sell the pledged securities pursuant

to this prospectus and the applicable prospectus supplement.

The distribution of the securities may be

effected from time to time in one or more transactions at a fixed price or prices, which may be changed, at market prices prevailing at

the time of sale, at prices related to such prevailing market prices or at negotiated prices.

We may solicit offers to purchase directly.

Offers to purchase securities also may be solicited by agents designated by us from time to time. Any such agent involved in the offer

or sale of the securities in respect of which this prospectus is delivered will be named, and any commissions payable by us to such agent

will be set forth, in the applicable prospectus supplement. Unless otherwise indicated in such prospectus supplement, any such agent will

be acting on a reasonable best efforts basis for the period of its appointment. Any such agent may be deemed to be an underwriter, as

that term is defined in the Securities Act, of the securities so offered and sold.

If securities are sold by means of an underwritten

offering, we will execute an underwriting agreement with an underwriter or underwriters at the time an agreement for such sale is reached,

and the names of the specific managing underwriter or underwriters, as well as any other underwriters, the respective amounts underwritten

and the terms of the transaction, including commissions, discounts and any other compensation of the underwriters and dealers, if any,

will be set forth in the applicable prospectus supplement which will be used by the underwriters to make resales of the securities in

respect of which this prospectus is being delivered to the public. If underwriters are utilized in the sale of any securities in respect

of which this prospectus is being delivered, such securities will be acquired by the underwriters for their own account and may be resold

from time to time in one or more transactions, including negotiated transactions, at fixed public offering prices or at varying prices

determined by the underwriters at the time of sale. Securities may be offered to the public either through underwriting syndicates represented

by managing underwriters or directly by one or more underwriters. If any underwriter or underwriters are utilized in the sale of securities,

unless otherwise indicated in the applicable prospectus supplement, the underwriting agreement will provide that the obligations of the

underwriters are subject to certain conditions precedent and that the underwriters with respect to a sale of such securities will be obligated

to purchase all such securities if any are purchased.

We may grant to the underwriters options

to purchase additional securities, to cover over-allotments, if any, at the initial public offering price (with additional underwriting

commissions or discounts), as may be set forth in the prospectus supplement relating thereto. If we grant any over-allotment option,

the terms of such over-allotment option will be set forth in the prospectus supplement for such securities.

If a dealer is used in the sale of the

securities in respect of which this prospectus is delivered, we will sell such securities to the dealer, as principal. The dealer may

then resell such securities to the public at varying prices to be determined by such dealer at the time of resale. Any such dealer may

be deemed to be an underwriter, as such term is defined in the Securities Act, of the securities so offered and sold. The name of the

dealer and their terms of the transaction will be set forth in the prospectus supplement relating thereto.

Offers to purchase securities may be solicited

directly by us and the sale thereof may be made by us directly to institutional investors or others, who may be deemed to be underwriters

within the meaning of the Securities Act with respect to any resale thereof. We may also offer securities through agents in connection

with a distribution to our shareholders of rights to purchase such securities. The terms of any such sales will be described in the prospectus

supplement relating thereto.

We may offer our equity securities into an

existing trading market on the terms described in the applicable prospectus supplement. Underwriters and dealers who may participate in

any at-the-market offerings will be described in the prospectus supplement relating thereto.

Pursuant to any standby underwriting agreement

entered into in connection with a subscription rights offering to our shareholders, persons acting as standby underwriters may receive

a commitment fee for all securities underlying the subscription rights that the underwriter commits to purchase on a standby basis. Additionally,

prior to the expiration date with respect to any subscription rights, any standby underwriters in a subscription rights offering to our

shareholders may offer such securities on a when-issued basis, including securities to be acquired through the purchase and exercise of

subscription rights, at prices set from time to time by the standby underwriters. After the expiration date with respect to such subscription

rights, the underwriters may offer securities of the type underlying the subscription rights, whether acquired pursuant to a standby underwriting

agreement, the exercise of the subscription rights or the purchase of such securities in the market, to the public at a price or prices

to be determined by the underwriters. The standby underwriters may thus realize profits or losses independent of the underwriting discounts

or commissions paid by us. If we do not enter into a standby underwriting arrangement in connection with a subscription rights offering

to our shareholders, we may elect to retain a dealer-manager to manage such a subscription rights offering for us. Any such dealer-manager

may offer securities of the type underlying the subscription rights acquired or to be acquired pursuant to the purchase and exercise of

subscription rights and may thus realize profits or losses independent of any dealer-manager fee paid by us.

Securities may also be offered and sold,

if so indicated in the applicable prospectus supplement, in connection with a remarketing upon their purchase, in accordance with a redemption

or repayment pursuant to their terms, or otherwise, by one or more firms (“remarketing firms”) acting as principals for their

own accounts or as agents for us. Any remarketing firm will be identified and the terms of its agreement, if any, with us and its compensation

will be described in the applicable prospectus supplement. Remarketing firms may be deemed to be underwriters, as that term is defined

in the Securities Act, in connection with the securities remarketed thereby.

If so indicated in the applicable prospectus

supplement, we may authorize agents, dealers or underwriters to solicit offers by certain institutions to purchase securities from us

at the public offering price set forth in the applicable prospectus supplement pursuant to delayed delivery contracts providing for payment

and delivery on the date or dates stated in the applicable prospectus supplement. Such delayed delivery contracts will be subject to only

those conditions set forth in the applicable prospectus supplement. A commission indicated in the applicable prospectus supplement will

be paid to underwriters and agents soliciting purchases of securities pursuant to delayed delivery contracts accepted by us.

Agents, underwriters, dealers and remarketing

firms may be entitled under relevant agreements with us to indemnification by us against certain liabilities, including liabilities under