Current Report Filing (8-k)

December 11 2019 - 4:16PM

Edgar (US Regulatory)

0001739940

false

0001739940

2019-12-04

2019-12-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

December 4, 2019

Cigna Corporation

(Exact name of registrant as specified in its

charter)

|

Delaware

(State or other jurisdiction of incorporation)

|

001-38769

(Commission File Number)

|

82-4991898

(IRS Employer

Identification No.)

|

900 Cottage Grove Road

Bloomfield, Connecticut 06002

(Address of principal executive offices) (Zip

Code)

Registrant’s telephone number, including

area code:

(860) 226-6000

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[_] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[_] Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the

Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, Par Value $0.01

|

CI

|

New York Stock Exchange, Inc.

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company [_]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. [_]

|

|

Item 5.05

|

Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics.

|

On December 5, 2019, the Board of Directors of Cigna Corporation

(the “Company”), upon the recommendation of the Compliance Committee, approved an amended and restated Code of Ethics

and Principles of Conduct (the “Code of Ethics”). The Code of Ethics reflects the Company’s updated mission and

values, incorporates language for Express Scripts’ business lines, including expanded language related to government business

and reporting fraud, waste and abuse, and makes technical, administrative, and non-substantive changes. The Code of Ethics applies

to all directors, officers, and employees of the Company and its subsidiaries, and will be effective during the first quarter of

2020. The Code of Ethics does not materially change the responsibilities and obligations that applied previously, and did not relate

to or result in any waiver, explicit or implicit, of any provision of the previous Code of Ethics.

A copy of the Code of Ethics is available on the Corporate Governance

section of the Company’s website at www.cigna.com. The contents of the Company’s website are not incorporated by reference

in this report.

On December 4, 2019, Timothy C. Wentworth, President, Express Scripts

and Cigna Services, adopted a stock trading plan designed to comply with Rule 10b5-1 of the Securities Exchange Act of 1934, as

amended. Under Rule 10b5-1, officers, directors and other individuals who are not in possession of material non-public information

may adopt a pre-arranged plan or contract for transactions in company securities under specified conditions and at specified times.

Using these 10b5-1 plans, individuals can diversify their investment portfolios for financial planning purposes, plan for charitable

giving, spread stock trades over an extended period of time to reduce market impact and avoid concerns about transactions occurring

at a time when they might possess material non-public information. In accordance with Rule 10b5-1, Mr. Wentworth will not have

subsequent discretion over the transactions under his plan.

Mr. Wentworth’s plan provides for sales of up to 21,708 shares

of Cigna stock between February 2020 and July 2020, subject to a minimum price threshold as specified in the plan. Mr. Wentworth

continues to be subject to the Company's executive stock ownership guidelines, under which he is required to hold Cigna stock and

stock equivalents with a value of at least six times his base salary. Mr. Wentworth does not expect the plan to materially change

his ownership position.

Transactions under Mr. Wentworth’s plan will be reported to

the Securities and Exchange Commission in accordance with applicable securities laws, rules and regulations. The Company does not

undertake to report 10b5-1 plans that may be adopted by any officers or directors in the future, or to report any modification

or termination of any trading plan, whether or not the plan was publicly announced, except to the extent required by law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Cigna Corporation

|

|

|

|

|

|

|

|

|

|

Date: December 11, 2019

|

By:

|

/s/ Nicole S. Jones

|

|

|

|

Nicole S. Jones

|

|

|

|

Executive Vice President and

|

|

|

|

General Counsel

|

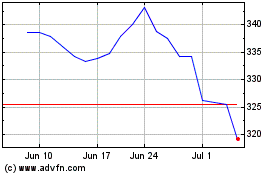

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

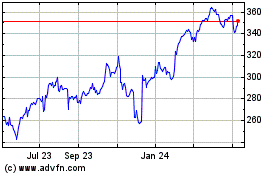

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024