Chevron Lowers Outlook for Capital Spending by Another $2 Billion

May 01 2020 - 8:07AM

Dow Jones News

By Allison Prang

Chevron Corp. said it was lowering its capital spending outlook

by another $2 billion and said it expects a $1 billion drop in

operating expenses this year.

Chevron, which recently cut its capital spending by 20%, is now

guiding for $14 billion in capital expenditures for 2020.

The oil company, like the rest of the energy business, has had

to grapple with a dive in the price of crude in the first quarter,

which fell to around $20 a barrel at quarter's end, down more than

$40 from three months earlier, according to Dow Jones Market

Data.

Oil companies have been sandwiched between two major headwinds:

The industry has been producing too much oil and is doing so during

a time when consumers aren't needing as much gas to travel by car

or plane because of the Covid-19 pandemic.

Chevron said Friday that "financial results in future periods

are expected to be depressed as long as current market conditions

persist."

The oil company's net income was $3.6 billion, rising 36% from a

year earlier. Chevron's earnings broke out to $1.93 a share, up

from $1.39 a share a year ago and more than analysts' consensus

from FactSet of 63 cents a share.

Revenue was $31.5 billion, topping the analyst consensus of

$29.14 billion, but slipping 11% from a year ago.

Production was 3.24 million barrels of oil-equivalent a day, the

company said. That rose from 3.04 million a day a year earlier.

Analysts expected 2.77 million.

(END) Dow Jones Newswires

May 01, 2020 07:52 ET (11:52 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

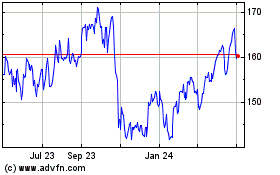

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

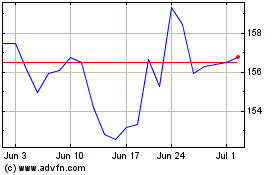

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024