Chevron Says Could Return $75 Billion-$80 Billion to Shareholders Through 2024

March 03 2020 - 7:56AM

Dow Jones News

By Colin Kellaher

Chevron Corp. Tuesday said it has the potential to distribute

$75 billion to $80 billion in cash to shareholders over the next

five years.

The San Ramon, Calif., energy giant, which in January raised its

dividend by 8%, said it expects to buy back $5 billion worth of

stock a year through 2024.

Chevron said disciplined capital spending, improved cost

efficiency and continued cash flow growth over the next five years

will help drive the shareholder returns.

The company said it expects 9% compound annual growth in

adjusted per-share operating cash flow through 2024, adding that it

will hold annual capital spending to a range of $19 billion to $22

billion over the same term.

The company also said it expects compound annual production

growth topping 3% from 2019 to 2024, excluding any future

unannounced asset sales.

"We believe our advantaged portfolio and capital efficiency

enable us to grow cash flows and increase returns without relying

on rising oil prices," Chevron said.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

March 03, 2020 07:41 ET (12:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

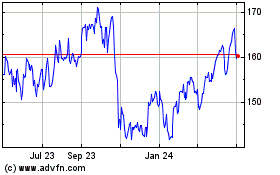

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

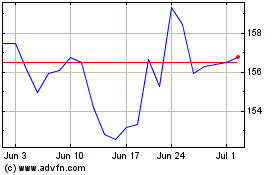

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024