By Rebecca Elliott

Can new technology suck carbon dioxide, a prevalent greenhouse

gas, out of the air -- economically? More companies are betting

that it can, as governments adopt ambitious carbon-emissions

targets and investors grow increasingly concerned about the risks

of climate change.

Carbon-capture techniques have existed for decades. But it's

incredibly expensive -- not to mention energy intensive -- to

remove the carbon dioxide from the atmosphere on a large enough

scale to make a significant dent.

Now, Exxon Mobil Corp., Microsoft Corp. and others are focused

on reducing the cost and the amount of energy required to capture

carbon dioxide. Some companies are using giant fans to suck up air,

then separating the carbon dioxide chemically. One venture plans to

fill land in Arizona with dozens of accordionlike machines designed

to expand as they absorb the gas.

Carbon-capture technology works similarly to plant

photosynthesis in that it takes in carbon dioxide. But rather than

producing oxygen or carbohydrates, as plants do, the equipment

removes carbon dioxide from exhaust, ambient air or other gas

streams, and then concentrates the molecule so that it can be

stored underground, repurposed to make fuels or even used to

carbonate drinks.

Among those leading the charge are major oil companies such as

Occidental Petroleum Corp., Chevron Corp. and Exxon, whose fuels

contribute to global warming. Carbon dioxide traps heat, and most

domestic emissions of the gas come from burning fossil fuels,

according to the Environmental Protection Agency.

Many oil producers are investing in capture technology because

they have an economic purpose for the gas: They inject it deep

underground to help release trapped oil. Known as enhanced oil

recovery, this process is the top use for captured carbon dioxide

globally, according to an analysis of large-scale carbon capture

and storage facilities by the Global CCS Institute, a nonprofit

that advocates for the technology.

Many companies expect there will be more reasons to buy and sell

the molecule in the coming decades, though that likely will depend

on lawmakers taking additional steps to regulate emissions, such as

by putting a price on carbon.

"Part of this has to be economic," says Robert Peterson, a

senior vice president for Houston-based Occidental, a leader in

enhanced oil recovery.

Occidental gets nearly all of the carbon dioxide it injects

underground from naturally occurring carbon-dioxide reservoirs. But

in the future the company wants captured carbon to play a larger

role so that it can take advantage of federal tax incentives, help

meet corporate environmental targets and eventually market its

fuels as low-carbon.

To do so, Occidental has joined with Canadian firm Carbon

Engineering Ltd. to build a facility in the Permian Basin of Texas

and New Mexico that would take up to roughly 1 million metric tons

of carbon dioxide out of the atmosphere annually. That's equivalent

to the greenhouse-gas emissions from more than 200,000 cars a year,

according to EPA estimates.

Carbon Engineering plans to start construction next year and

open the plant in 2023. It would be the world's largest facility

designed to remove carbon dioxide from the ambient air, according

to the Global CCS Institute, relying on industrial fans to bring

air into contact with a liquid solution that binds to the

greenhouse gas. Existing large capture plants suck up the gas where

it's more concentrated, such as at natural-gas processing

plants.

Carbon Engineering declined to provide a cost estimate for the

facility.

Some find the practice of capturing carbon to augment oil

production troubling. "We see at least a strong danger of a moral

hazard here," says Jan Wurzbacher, chief executive of Swiss

carbon-capture firm Climeworks AG, which doesn't sell its carbon

dioxide to oil companies. "Will it just allow us to emit more

fossil fuels?"

Climeworks clients include a Swiss greenhouse that uses the gas

to help plants grow bigger; Coca-Cola HBC Switzerland, which uses

the carbon dioxide to make seltzer; and even individuals who want

to offset their carbon footprint by paying to bury the gas that

Climeworks captures. At its facility in Hinwil, a village in

Switzerland, fans suck air into containers roughly the size of

small cars, where filters remove the carbon dioxide.

Carbon capture isn't cheap. If current technology were

implemented at scale, it would cost between about $80 and $160 a

metric ton to capture and store the carbon dioxide produced by

natural-gas power plants, and between about $125 and $449 a metric

ton to take the gas out of the ambient air, where it's more

diffuse, according to Goldman Sachs estimates.

In the U.S. -- which generated roughly 5 billion metric tons of

carbon dioxide in 2017, EPA data show -- the tax credit for

capturing and storing carbon dioxide was less than $30 a metric ton

as of 2019, though that is set to increase to as much as $50 in the

coming years.

Globally, the highest price on carbon as of last year was about

$121 a metric ton, in Sweden, according to the World Bank.

"Ultimately this is a waste-management problem," says Arizona

State University engineering professor Klaus Lackner, who developed

the accordionlike machine. "Any carbon-based fuel that you combust

will produce CO2, and if you put that in the atmosphere, it becomes

your responsibility to take it out."

Mr. Lackner calls his machines "mechanical trees" for their

ability to filter carbon dioxide from the ambient air. One version

of the device is about 5 feet wide and can expand to about 30 feet

tall, exposing specialized disks that bind to carbon dioxide

molecules. When the disks get wet, the carbon is released and can

be collected.

Silicon Kingdom Holdings Ltd., an Irish company with ties to

ASU, plans to commercialize the technology, and sell the carbon

dioxide and potentially carbon credits or offsets, if those markets

take off. It plans to install a dozen of the devices in the Phoenix

area this year and eventually build a 360-unit farm in the

state.

Powering carbon-capture equipment also typically consumes a lot

of energy, potentially undercutting the climate benefits.

Generally, researchers have assumed that for every 100

kilowatt-hours of electricity a power plant produces, an additional

25 kilowatt-hours are needed to collect the associated carbon

dioxide emissions, according to Stanford University engineering

professor Mark Jacobson. However, Mr. Jacobson's research indicates

that figure can be as high as about 50 kilowatt-hours.

"There's really no case ever where carbon capture is better than

just taking renewable energy and replacing a coal or gas plant,"

says Mr. Jacobson, who has studied the health and climate effects

of carbon-dioxide removal.

Microsoft last month pledged to invest $1 billion over the next

four years in the development of carbon-removal and reduction

technology as part of a climate initiative that would have the

technology company become "carbon negative" by 2030.

Exxon also is working to address some of those issues by joining

with Connecticut-based FuelCell Energy Inc. to develop technology

that would remove carbon dioxide from industrial exhaust

electrochemically while also converting natural gas to

electricity.

Chevron has invested in companies that are fine-tuning how to

capture the greenhouse gas more efficiently. Among them are Carbon

Engineering and Svante Inc., a Canadian firm whose filters extract

the carbon dioxide produced from industrial processes such as

burning natural gas or making cement.

Chevron also operates one of the world's largest projects to

bury carbon dioxide, in Australia, which the government required

Chevron to build as part of a natural-gas development there. In

that case, however, Chevron isn't taking carbon dioxide out of the

air. Instead, it separates the molecule from natural gas as it

flows from underground.

"The demand for energy is growing, and the expectations to lower

the carbon footprint are increasing," says Barbara Burger,

president of Chevron's venture-capital arm.

More in The Future of Everything | Energy

Explore what's next for energy and climate.

Fusion Startups Step in to Realize Decades-Old Clean Power

Dream

Governments have spent billions of dollars studying the

emissions-free energy source. Now, private ventures are building

smaller, faster, cheaper reactors.

The Key to Keeping the Lights On: Artificial Intelligence

Power companies are turning to AI, drones and sensors to curtail

outages, save money and help operate an increasingly complex

electricity grid.

A Sci-fi Author's Boldest Vision of Climate Change: Surviving

It

Kim Stanley Robinson's novels imagine environmental collapse in

arresting precision -- and humanity finding a way forward

How a Utility's Counterintuitive Strategy Might Fuel a Greener

Future

Consumers Energy aims to slash carbon emissions and replace

traditional coal-fired plants with solar farms by betting on

smarter energy consumption

Read the full report.

Write to Rebecca Elliott at rebecca.elliott@wsj.com

(END) Dow Jones Newswires

February 12, 2020 09:23 ET (14:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

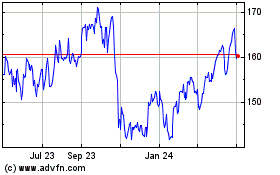

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

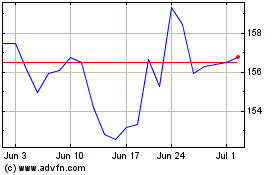

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024