Anadarko: Occidental Offer 'Superior' to Chevron's

May 07 2019 - 3:47AM

Dow Jones News

By WSJ City

Anadarko Petroleum said a $38bn bid by Occidental Petroleum was

superior to an offer it accepted from Chevron, raising the stakes

in the battle for the company.

KEY FACTS

-- Anadarko has told Chevron it will terminate their $33bn deal in favour of

Occidental's offer.

-- It came a day after Occidental sweetened its bid by raising the cash

portion.

-- Chevron has four business days to make another offer, Anadarko said,

though that period could be extended.

-- If Chevron doesn't counter and the deal is terminated, Anadarko will owe

it a $1bn breakup fee.

What They Said

A Chevron spokesman said it had received Anadarko's notification

and had no further comment at this time. Occidental said it is

pleased that Anadarko determined that its offer was superior and

looks forward to the next steps.

Occidental's Thinking

During a call with investors Monday, Occidental CEO Vicki Hollub

(pictured) explained the company's decision to raise the cash

portion of its offer. She said it sought to bolster its bid because

Anadarko still hadn't declared it superior to the agreement

Anadarko struck with Chevron. The strategy appears to have

worked.

A fuller story is available on WSJ.com

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

May 07, 2019 03:32 ET (07:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

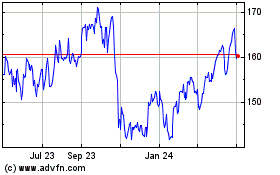

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

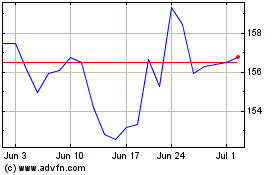

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024