By Bradley Olson and Cara Lombardo

Vicki Hollub, Occidental Petroleum Corp.'s chief executive, took

a corporate jet to Omaha, Neb., this weekend with a singular

mission in mind: getting Warren Buffett's backing for her $38

billion bid for Anadarko Petroleum Corp.

On Tuesday, Mr. Buffett's Berkshire Hathaway Inc. said it was

throwing its weight behind the effort by buying $10 billion of

Occidental preferred stock. The move positions Ms. Hollub to

potentially win one of the most heated takeover battles in years, a

contest with Chevron Corp. Chief Executive Mike Wirth, who earlier

struck a deal to buy Anadarko for $33 billion. Occidental's backing

from Berkshire leaves Chevron and Mr. Wirth with a tough decision:

significantly raise their offer or walk away.

Chevron is still weighing whether to come back with a new offer,

according to a person familiar with the company's plans. Chevron

believes its agreement offers Anadarko shareholders the most value

and certainty of closing, a spokesman said Tuesday. Chevron is

entitled to a $1 billion breakup fee if Anadarko agrees to a deal

with Occidental instead.

Even as some investors applaud Ms. Hollub's bold push for

Anadarko and its prized assets at the heart of the U.S. oil boom in

West Texas and New Mexico, others are expressing concern that the

company has been too aggressive in its pursuit and that the deal

carries significant risks.

Indeed, Berkshire is exacting a heavy toll for its backing: The

sprawling conglomerate would receive shares of preferred stock in

Occidental with a coupon of 8% a year should the company succeed in

its pursuit of Anadarko.

T. Rowe Price Group Inc., Occidental's sixth-largest shareholder

with a roughly 3% stake, said Tuesday it has concerns about

Occidental's "bet-the-company" bid to buy Anadarko, which is

roughly equal to its size.

John Linehan, a T. Rowe portfolio manager, said in an interview

the deal would complicate Occidental's business by adding

geographies and expanding business lines, increase the company's

exposure to a downturn and weaken its balance sheet.

Mr. Linehan also criticized Occidental for striking a

"sweetheart deal" with Berkshire that could be used to avoid giving

shareholders a chance to vote on the agreement.

Occidental is currently planning to pay with cash and stock; if

it issues less than 19.9% of its existing shares, no vote is

required. If Occidental looks likely to avoid a shareholder vote,

T. Rowe would vote against the company's directors at the annual

meeting next week, Mr. Linehan said.

Occidental's push to take over Anadarko began with overtures

from Ms. Hollub almost two years ago, she said in an interview last

week.

Eager to scale up in a region where Occidental was already a

dominant player, Ms. Hollub approached Anadarko CEO Al Walker, who

like a number of other energy executives began coming under

pressure in late 2017 from shareholders who wanted the company to

focus more on profitability than growth.

The discussions on a potential deal picked up in earnest in

recent months as it became clear that an Anadarko project on the

other side of the world was running into trouble: A discovery of

huge quantities of natural gas off the coast of Mozambique would

cost billions more to develop than some investors expected.

The company had yet to make a final decision whether to build

the infrastructure that would be needed to bring the gas to market,

but angst surrounding the project was enough to shave about 25% off

Anadarko's stock in the year ending April 11, the day before its

deal with Chevron was announced. That decline came along with an

unexpected plunge in oil prices and despite Anadarko's

multibillion-dollar share-repurchase program.

Mr. Walker, a former banker, had long been seen as the man who

would sell Anadarko, a company oil giants such as Exxon Mobil Corp.

and Chevron had been stalking for years. Mr. Walker had helped

Anadarko expand with several big deals more than a decade

before.

A resident of San Diego who travels back and forth to Anadarko's

Houston-area headquarters in a Gulfstream jet, Mr. Walker had a

preference for any deal with a company like Exxon or Chevron that

has the wherewithal to operate a diverse array of assets from

deep-water projects in the Gulf of Mexico and Africa to lucrative

shale opportunities in Colorado and the Permian Basin, according to

people familiar with his views.

Meanwhile at Chevron, Mr. Wirth sensed an opportunity in

Anadarko. After taking the reins about a year earlier, he was

looking for a transformative deal that would allow the company to

improve its vast pool of assets, according to people close to Mr.

Wirth.

He saw a deal as a catalyst to allow Chevron to sell off

billions of dollars of older properties and create steady growth

opportunities that throw off a lot of cash, these people said.

The discussions between Chevron and Anadarko proceeded quickly,

people close to the deal said. Even as Occidental's Ms. Hollub

continued to communicate with Anadarko's Mr. Walker through calls

and text messages, the talks with Chevron reached a serious stage,

the people said.

On April 8, Occidental revised an earlier offer of about $76 a

share to about $72 a share and changed terms that would have

protected the value of the proposal in the event the company's

share price declined, according to a person familiar with the

negotiations.

On April 11, Occidental revised its offer upward, but Anadarko

viewed Chevron's bid as superior and feared that entertaining

Occidental's new proposal would lead the larger company to walk

away, which it had threatened to do before, the person said.

Write to Bradley Olson at Bradley.Olson@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

April 30, 2019 19:50 ET (23:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

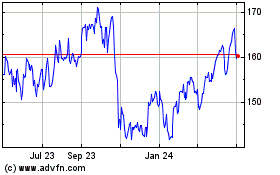

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

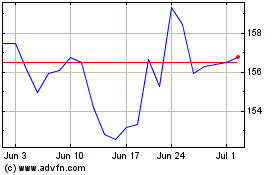

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024