McLendon-Founded Chesapeake Energy Returns to Deal Making in Oil Patch -- WSJ

October 31 2018 - 3:02AM

Dow Jones News

By Rebecca Elliott

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 31, 2018).

After years of selling assets to pay down debt, Chesapeake

Energy Corp. is growing again.

The Oklahoma-based driller said Tuesday that it would buy

WildHorse Resource Development Corp. in a deal valued at nearly $4

billion, including debt.

Under the deal, Chesapeake would add about 420,000 acres in the

Eagle Ford and Austin Chalk formations, nearly tripling the

company's footprint in Texas, and boosting its oil production.

"It's a pivot today for us," Chesapeake Chief Executive Doug

Lawler said in an interview, explaining that he thinks the industry

is at an "inflection point" when it comes to consolidation. "We've

gone through a period with these difficult prices and we've seen a

lot of smaller players emerge. And in order to capture greater

value, it really requires that you have some of the larger scale,

the technology and the efficiencies."

Chesapeake, a company co-founded by the late shale pioneer

Aubrey McClendon, was once the country's second-largest natural gas

producer. But it has struggled with debt and has sold billions in

oil and gas holdings since Mr. Lawler took over in 2013, including

a $2 billion deal announced in July to shed its last remaining

acreage in Ohio's Utica Shale.

The company's net debt as of the end of the second quarter was

$9.2 billion, down from nearly $16 billion in 2012.

Under terms of the deal, WildHorse owners can trade each of

their shares in the company for either 5.989 shares of Chesapeake

stock or a combination of 5.336 shares of Chesapeake stock and $3

in cash, the companies said in a statement Tuesday. Under deal

terms, Chesapeake will assume the value of WildHorse's net debt of

$930 million. The companies project $200 million to $280 million in

average annual cost savings.

The deal is the latest move toward consolidation in the shale

patch as investors push companies to rein in spending. Diamondback

Energy Inc. announced a deal in August to acquire Energen Corp. for

more than $9 billion, including debt. Concho Resources Inc. agreed

in March to buy RSP Permian Inc. for about $9.5 billion.

Chesapeake's acquisition is expected to close in the first half

of 2019 and is subject to shareholder approval.

--Micah Maidenberg contributed to this article.

Write to Rebecca Elliott at rebecca.elliott@wsj.com

(END) Dow Jones Newswires

October 31, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

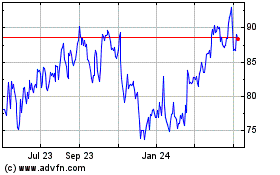

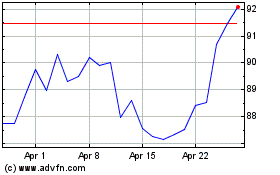

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024