Current Report Filing (8-k)

March 01 2021 - 4:04PM

Edgar (US Regulatory)

0001364954false00013649542021-03-012021-03-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report: March 1, 2021

(Date of earliest event reported)

Chegg, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

|

|

|

|

001-36180

|

|

20-3237489

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3990 Freedom Circle

|

|

|

|

Santa Clara,

|

California

|

|

95054

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(408) 855-5700

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.001 par value per share

|

CHGG

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

Chegg, Inc. (“Chegg”) issued a notice of redemption to the holders of its outstanding 0.25% Convertible Senior Notes due 2023 (the “Convertible Notes”) on March 1, 2021, pursuant to which it will redeem the outstanding Convertible Notes for cash at a price of 100% of the principal amount of the Convertible Notes, plus accrued and unpaid interest, if any, on May 20, 2021 (the “Redemption Date”), unless earlier converted. Prior to the Redemption Date, the holders of the Convertible Notes are entitled to convert to shares of Chegg common stock at a rate of 37.1051 shares per $1,000 principal amount of Convertible Notes. In the event any holder delivers a conversion notice as provided in that certain Indenture dated as of April 3, 2018 (the “Indenture”) related to the Convertible Notes, Chegg intends to satisfy its conversion obligation with respect to each $1,000 principal amount of Convertible Notes tendered by Combination Settlement (as defined in the Indenture), where Chegg intends to settle outstanding principal with cash and the remainder by delivery of shares of Common Stock. A copy of the notice of redemption is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and other federal securities laws. Any statements contained herein that do not describe historical facts, including, but not limited to, settlement of Convertible Notes prior to the Redemption Date, are forward-looking statements. The words “intends” and “will” and similar expressions are intended to identify these forward-looking statements. These forward-looking statements are subject to a number of risk, uncertainties and assumptions, including Chegg’s ability to settle the Convertible Notes prior to the Redemption Date in cash and shares of Common Stock. In addition, new risks may emerge from time to time and it is not possible for the Company to predict all risks, nor can it assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward‑looking statements made. In light of these risks, uncertainties and assumptions, the future events discussed in this Current Report on Form 8‑K may not occur and actual results could differ from those anticipated or implied in the forward‑looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

CHEGG, INC.

|

|

|

|

|

|

By: /s/ Andrew Brown

|

|

|

Andrew Brown

|

|

|

Chief Financial Officer

|

Date: March 1, 2021

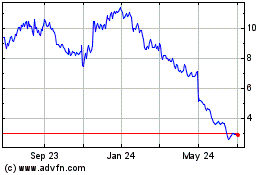

Chegg (NYSE:CHGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

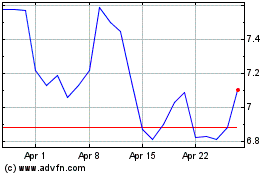

Chegg (NYSE:CHGG)

Historical Stock Chart

From Apr 2023 to Apr 2024