Schwab Report: Self-Directed 401(k) Investor Balances Rebound in Q1 Following Strong Market Performance

May 16 2019 - 9:00AM

Business Wire

According to Charles Schwab’s SDBA Indicators Report™, an

industry-leading benchmark on retirement plan participant

investment activity within self-directed brokerage accounts

(SDBAs), the average SDBA balance jumped to $267,609 at the end of

Q1 2019, an increase of 8.7 percent from Q4 2018, as the markets

bounced back from the sharp losses experienced at the end of

2018.

SDBAs are brokerage accounts within retirement plans, including

401(k)s and other types of retirement plans, which participants can

use to invest in stocks, bonds, exchange-traded funds, mutual funds

and other securities that are not part of their retirement plan's

core investment offerings.

According to the Schwab data, mutual funds continued to hold the

highest percentage of participant assets at approximately 37

percent, the same as Q4 2018. Equities remained the second-largest

holding at 29 percent, followed by exchange-traded funds (17%),

cash (13%) and fixed income (3%).

Allocation Trends

The data also reveals specific sector holdings within each

investment category:

- With regard to mutual funds, large-cap

funds represented approximately 29 percent of all allocations,

followed by taxable bond (20%), international (16%), hybrid (12%)

and small-cap (12%) funds.

- Apple (AAPL) remained the top overall

equity holding, representing 9.1 percent of the equity allocation

of all portfolios. Amazon (AMZN) was the second-largest allocation,

representing 6.4 percent of portfolios, and Berkshire Hathaway

(BRKA) (2.5%), Microsoft (MSFT) (2.1%) and Facebook (FB) (1.8%)

rounded out the top five equity holdings.

- Among exchange-traded funds, investors

allocated the most dollars to U.S. equity (48%), international

equity (16%), U.S. fixed income (15%), and sector ETFs (11%).

Report Highlights

Additional findings include:

- On average, participants made just 6.5

trades during the quarter and held approximately 10 positions in

their SDBA.

- Baby Boomers ended the quarter with the

largest balance of all generations: $374,622, up from $342,810 in

Q4 18. They were followed by Gen X ($202,481) and Millennials

($65,928).

- The average age of an SDBA participant

was 51. Gen X made up 41 percent of participants, followed by Baby

Boomers (40%) and Millennials (12%).

About the SDBA Indicators Report™

The SDBA Indicators Report includes data collected from

approximately 137,000 retirement plan participants who currently

have balances between $5,000 and $10 million in their Schwab

Personal Choice Retirement Account®. Data is extracted quarterly on

all accounts that are open as of quarter-end and meet the balance

criteria.

The SDBA Indicators Report tracks a wide variety of investment

activity and profile information on participants with a Schwab

Personal Choice Retirement Account (PCRA), ranging from asset

allocation trends and asset flow in various equity, exchange-traded

fund and mutual fund categories, to age trends and trading

activity. The SDBA Indicators Report™ provides insight into PCRA

users’ perceptions of the markets and the investment decisions they

make.

Data contained in this quarterly report is from the first

quarter of 2019, and can be found at www.schwab.com/sdbaindicators,

along with prior reports.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube, and LinkedIn.

Disclosures

Through its operating subsidiaries, The Charles Schwab

Corporation (NYSE: SCHW) provides a full range of securities

brokerage, banking, money management and financial advisory

services to individual investors and independent investment

advisors. Its broker-dealer subsidiary, Charles Schwab & Co.,

Inc. (member SIPC, www.sipc.org), and affiliates offer a complete

range of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

compliance and trade monitoring solutions; referrals to independent

fee-based investment advisors; and custodial, operational and

trading support for independent, fee-based investment advisors

through Schwab Advisor Services. Its banking subsidiary, Charles

Schwab Bank (member FDIC and an Equal Housing Lender), provides

banking and lending services and products. More information is

available at www.schwab.com and www.aboutschwab.com.

This report is for informational purposes only and is not a

solicitation, or a recommendation that any particular investor

should purchase or sell any particular security.

Schwab Personal Choice Retirement Account® (PCRA) is offered

through Charles Schwab & Co., Inc. (member SIPC), the

registered broker/dealer, which also provides other brokerage and

custody services to its customers.

Brokerage Products: Not FDIC Insured • No Bank Guarantee

• May Lose Value

© 2019 Charles Schwab & Co., Inc. Member SIPC.

(0519-9T8S)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190516005139/en/

Mike PetersonCharles

Schwab330-908-4334mike.peterson@schwab.com

Mike GelorminoIntermarket

Communications212-754-5479mgelormino@intermarket.com

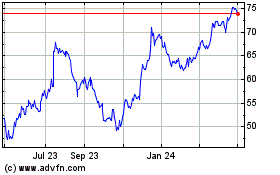

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

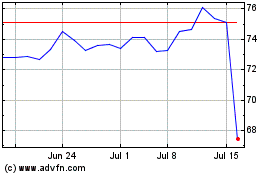

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024