NAME OF REGISTRANT: CHARLES SCHWAB

NAME OF PERSON RELYING ON EXEMPTION: FRIENDS FIDUCIARY CORPORATION

ADDRESS OF PERSON RELYING ON EXEMPTION: 1700 MARKET STREET, SUITE

1535, PHILADELPHIA, PA 19103

April 9, 2021

To Charles Schwab Corporation Stockholders:

Friends Fiduciary Corporation seeks your support for Proposal #4

at the stockholder meeting on May 13, 2021.

The proposal asks Schwab to prepare an annual report on its lobbying.

Resolved, the stockholders of Schwab request

the preparation of a report, updated annually, disclosing:

|

|

1.

|

Company policy and procedures governing lobbying, both direct and indirect, and grassroots lobbying communications.

|

|

|

2.

|

Payments by Schwab used for (a) direct or indirect lobbying or (b) grassroots lobbying communications, in each case including the

amount of the payment and the recipient.

|

|

|

3.

|

Description of management’s and the Board’s decision-making process and oversight for making payments described above.

|

For purposes of this proposal, a “grassroots

lobbying communication” is a communication directed to the general public that (a) refers to specific legislation or regulation,

(b) reflects a view on the legislation or regulation and (c) encourages the recipient of the communication to take action with respect

to the legislation or regulation. “Indirect lobbying” is lobbying engaged in by a trade association or other organization

of which Schwab is a member.

Both “direct and indirect lobbying”

and “grassroots lobbying communications” include efforts at the local, state and federal levels.

The report shall be presented to the Audit Committee

or other relevant oversight committees and posted on Schwab’s website.

Rationale to vote FOR the Proposal

and Rebuttal to Company’s Opposition Statement

As investors we believe transparency and accountability in corporate

spending to influence legislation and regulation are in the best interests of Schwab stockholders. Our aim is not to keep the Company

from spending, but to ensure sufficient transparency for shareholders to be able to evaluate these significant costs, as well as to ensure

sufficient internal accountability to safeguard the alignment of spending with Company mission, values, and ethics. Without a clear system

ensuring accountability, corporate assets can be used to promote public policy objectives which can pose risks to Schwab’s reputation

to the detriment of shareholder value.

SUMMARY OF RATIONALE

|

|

·

|

Company reputation is an important component of shareholder value;

|

|

|

·

|

Schwab’s current disclosures are inadequate;

|

|

|

·

|

Indirect lobbying through trade associations and social welfare groups presents potential risks and lacks accountability;

|

|

|

·

|

Schwab could easily provide shareholders the lobbying disclosures requested in this proposal; and

|

|

|

·

|

Investors are asking for lobbying transparency to better understand risks

|

|

|

I.

|

Company Reputation is an Important Component of Shareholder Value

|

Schwab’s failure to provide robust and complete disclosure of

its lobbying activities and expenditures exposes it to potential reputational damage and therefore potential negative impacts on shareholder

value. Heightened scrutiny of corporate spending on lobbying and other political expenditures potentially exposes companies to increased

reputational risk, particularly if sufficient oversight and controls are lacking.

According to a Conference Board study, companies with a high reputation

rank perform better financially than lower ranked companies. Executives also find it is much harder to recover from a reputational failure

than to build and maintain reputation.1 The 2018 Reputation Dividend Report estimates that “corporate reputation is

now directly responsible for an average of 38% of market capitalisation across the FTSE 100 & 250.”2 Furthermore,

the Ipsos Global Reputation Centre research across 31 countries shows conclusive proof of the relationship between a good reputation and

better business efficiency.3

A 2014 Deloitte survey found 87 percent of executives rated reputation

risk as more important or much more important than other strategic risks their companies are facing, and 88 percent said their companies

are explicitly focusing on managing reputation risk.4 Clearly, corporate reputation has significant impact on shareholder

value.

1

“Reputation Risk,” The Conference Board, 2007, p. 6, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1077894.

2

https://www.provokemedia.com/research/article/link-between-corporate-reputation-market-value-strengthens-study

3

https://www.ipsos.com/sites/default/files/ct/publication/documents/2018-05/unlocking_value_of_reputation-may_2018.pdf.

4 “2014 Global Survey on Reputation Risk,”

Deloitte, p. 4, https://www2.deloitte.com/content/dam/Deloitte/pl/Documents/Reports/pl_Reputation_Risk_survey_EN.pdf.

Schwab Needs to Commit to Lobbying and Dark Money Transparency in

the Wake of the Capitol Insurrection

In the wake of the Capital riots, transparency and accountability of

corporate lobbying activities and expenditures are especially important.

After January 6, Schwab announced it would halt all PAC contributions

through 2021, noting, “This pause will give the firm an opportunity to evaluate the best path forward to fulfill our long-standing

commitment to advocate on behalf of individual investors and those who serve them.”5

This pause in contributions indicates the Company recognizes potential

risk in its political activities. But the question remains whether the short-term change that Schwab, and other companies, made in response

was simply an emergency measure to attempt to repair reputational damage, or whether more lasting action is needed to mitigate risks to

the company.6 Further, in its PAC announcement, the Company states, “we believe a clear and apolitical position is

in the best interest of our clients, employees, stockholders and . . . communities,” which highlights the importance of transparency

and accountability by the company.7 Increasingly, investors are asking companies to commit to greater corporate political

responsibility by disclosing their lobbying, including all dark money payments to third-party groups that use that money to influence

policy.8

On advocacy and ethics, Schwab states, “the trust we earn from

our clients and communities rests on upholding our reputation for integrity and lawfulness. We are committed to the highest standards

of ethical conduct.”9 As investors we believe Schwab could show its commitment to integrity and lawfulness by disclosing

its lobbying to stockholder, including all its third-party spending to influence public policy.

Schwab’s failure to commit to disclosure of its third-party spending

to influence public policy subjects our Company to unknown reputational risks. We believe Schwab needs to commit to corporate political

responsibility by increasing its lobbying disclosure, including all its third-party spending to influence public policy. In this letter,

we will show support for this proposal is warranted because:

5 https://www.aboutschwab.com/schwab-to-halt-all-PAC-contributions-through-2021

6 https://www.newyorker.com/business/currency/corporate-america-reckons-with-its-role-enabling-trump

7 https://www.aboutschwab.com/schwab-to-discontinue-its-PAC

8 https://www.iccr.org/wake-jan-6-investors-call-companies-re-evaluate-whether-corporate-political-spending-companys-or

9 https://www.aboutschwab.com/advocacy-and-ethics.

|

|

II.

|

Schwab’s Current Disclosures are Inadequate;

|

Schwab has a broad lobbying footprint and the Company’s spending

information is difficult to obtain, limited, and is not consolidated. Yet, our Company does not provide investors a central and comprehensive

source where they can learn relevant corporate spending on direct or indirect lobbying activities/relationships, priorities, and how those

efforts are supportive of or align with the Company’s strategy and investor interests.

Based upon information from various disparate sources, our Company

spent $5,070,000 in 2019 and 2020 on federal lobbying activities and from 2010 – 2020, Schwab spent $29,453,000 on federal lobbying.

The extent of Schwab’s spending at the state level is even more opaque because state-level lobbying disclosure requirements are

often very cursory, investors have no idea how much companies are spending in 22 states and have only a murky picture in others. In one

state with reporting, California, Schwab spent over $800,000 on lobbying from 2010 – 2020.10 Obtaining comprehensive

state lobbying information is described by an expert as “nearly impossible” given “the ‘Byzantine’ manner

in which the data is captured and made available online effectively buries information at many states.”11

|

|

III.

|

Indirect Lobbying through Trade Associations and Social Welfare Groups Presents Potential Risks and

Lack Accountability

|

While corporate donations to politicians and traditional PACs have

strict limits, corporate payments to trade associations and 501(c)(4) social welfare nonprofits have no restrictions. This means that

companies can give unlimited amounts to third party groups that spend millions on lobbying and often undisclosed grassroots activity.

This is frequently referred to as dark money spending.

No Limits on Dark Money Trade Association Payments

Corporations make payments to trade associations that are then used

to lobby indirectly on the corporation’s behalf without specific disclosure or accountability. Trade associations spend hundreds

of millions to lobby. For example, the US Chamber of Commerce has spent more than $1.6 billion since 1998.12 Schwab shareholders

face a trade association blind spot, as Schwab fails to disclose its trade association memberships, and does not disclose its trade association

payments, nor the portions of these payments used for lobbying.

10

https://cal-access.sos.ca.gov/Lobbying/Employers/Detail.aspx?id=1144228&session=2019&view=activity.

11

“Wal-Mart Improves Lobbying Disclosure after Shareholder Push,” Reuters, May 13, 2015, https://www.reuters.com/article/us-wal-mart-stores-disclosure-lobbying-e/exclusive-wal-mart-improves-lobbying-disclosure-after-shareholder-push-idUSKBN0NY0AH20150513

12

https://www.opensecrets.org/federal-lobbying/top-spenders?cycle=a, accessed January 29, 2021.

Through research, we found that Schwab serves on the boards of the

Securities Industry and Financial Markets Association (SIFMA)13 and the Money Management Institute14 and also

belongs to the Investment Company Institute15 and the Risk Management Association.16And Schwab previously served

on the board of the Chamber of Commerce.17 SIFMA and the Chamber spent $83,885,000 on federal lobbying in 2020, alone. Shareholders

have no way of knowing Schwab’s payments to the Chamber and SIFMA and other trade associations, or what portion of these payments

are being used to lobby on its behalf. Schwab’s trade association disclosure lags many of its peer group members which disclose

their trade associations payments and the amounts used for lobbying, including PayPal, PNC Financial Services Group, Regions Financial

and US Bancorp.

Trade Association Lobbying Misalignments Create Reputational Risk

We believe Schwab’s trade association memberships and payments

used for lobbying pose potential reputational risks and risks to long-term sustainable growth when the lobbying of its trade associations

contradicts Schwab’s public positions. The Company’s federal lobbying efforts on the Retirement Enhancement and Savings Act

has drawn scrutiny.18 Another example is our Company’s public support protecting the interests of investors by holding

the financial industry to a high standard,19 yet Schwab, SIFMA and the Chamber reportedly lobbied “to quash various

aspects” of the Department of Labor fiduciary rule to require investment advisers to put their clients’ interests ahead of

their own.20

Schwab’s recent decision to leave the Chamber underscores the

need for Schwab to commit to lobbying disclosure as well as the need for companies to have oversight and disclose their spending, and

the materiality of this for investors. Disclosure will help ensure Schwab’s alignment with its public positions and the protection

of Schwab’s reputation.21

Schwab Doesn’t Disclose All Social Welfare Organization Spending

(AKA Dark Money), and It Should

In addition to failing to disclose any information about its trade

associations, Schwab also fails to provide any information on support for social welfare - 501(c)(4) - organizations which can also lobby.

The dark money scandal at FirstEnergy illustrates why investors need disclosure of social welfare group spending to prevent reputational,

regulatory and financial damage. FirstEnergy is under investigation for allegedly funneling $60 million through a dark money 501(c)(4)

group called Generation Now that was used for bribery in Ohio.22 In 2018, FirstEnergy had agreed

to disclose its trade association lobbying payments but failed to include its payments 501(c)(4)s, leaving a loophole and blind-spot

FirstEnergy used to make over $60 million in undisclosed dark money payments.

13

https://www.sifma.org/about/board-officers/.

14

https://www.mminst.org/board-governors.

15

https://www.ici.org/about_ici/membership/member_lists/open_end#C.

16https://www.rmahq.org/boardcouncilsandcommittees.aspx?TabID=1486&ComMastCustID=00271890&ComSubCustID=0

17 https://www.huffpost.com/entry/who-funds-the-chamber-of_n_334654.

18

https://www.marketwatch.com/story/as-industry-spends-millions-on-lobbying-and-campaign-donations-congress-acts-on-retirement-legislation-2019-04-22.

19

https://www.aboutschwab.com/schwab-statement-on-SEC-Reg-BI.

20

https://theintercept.com/2017/07/16/financial-advisers-want-to-rip-off-small-investors-trump-wants-to-help-them-do-it/.

21

https://www.cnbc.com/2021/03/23/charles-schwab-leaves-us-chamber-of-commerce.html

22

https://www.energyandpolicy.org/firstenergy-service-company/

Dark money connections to the Capitol riot also highlight social welfare

group risks to shareholders. The Rule of Law Defense Fund is a social welfare group that helped organize the protest before the riots.23

Yet Schwab stockholders currently have no way to learn if Schwab makes

any direct contributions to groups like the Rule of Law Defense Fund, because Schwab fails to provide disclosure of its contributions

to social welfare groups.

Americans for Job Security Dark Money Highlights Risks

Mr. Charles Schwab has drawn attention for giving $8.8 million in donations

to Americans for Job Security from 2010 – 2012, a now defunct trade association which spent $26.3 million in grants in 2011 and

2012 to other dark money groups, mostly the Center to Protect Patient Rights, a controversial 501(c)(4).24 The Center to

Protect Patient Rights (since renamed American Encore) funneled more than $182 million in grants to other organizations between 2009 and

2012, with $167 million of that going to nonprofits that reported political spending on the federal level.25 This significant

political activity by the Chairman and firm namesake, which could be conflated with Company activity by the Company’s customers

and potential customers, spotlights the firm’s potential reputational risk and therefore the burden on Schwab for strong accountability

and transparency in its political spending and lobbying.

Currently, investors have no way to know whether our Company has made

any direct contributions to groups like the Rule of Law Defense Fund, the Center to Protect Patient Rights or American Encore because

of the Company’s lack of disclosure of contributions to social welfare groups.

Schwab, the Chamber of Commerce, and the American Legislative Exchange

Council Connection

While we do not know whether Schwab directly supports ALEC, because

of lack of Company disclosures, the Company was, until recently, a member of the Chamber of Commerce which is one of ALEC’s major

trade associations and serves on its board. The Chamber also serves on ALEC’s Private Enterprise Advisory Council.26

ALEC has attracted negative attention for its role in promoting bills that undermine regulations to address issues like climate change,

workplace safety and workers’ rights. More recently it has drawn attention for “numerous ties to the Capitol insurrection

and ‘Big Lie’” challenging the validity of the election results.27

23

https://documented.net/2021/01/republican-attorneys-general-dark-money-group-organized-protest-preceding-capitol-mob-attack/

24

https://www.opensecrets.org/news/2019/10/donors-to-anti-obama-dark-money-grp/.

25

https://www.opensecrets.org/news/2014/03/an-encore-for-the-center-to-protect-patient-rightstect-patient-right/

26

https://www.alec.org/group/private-enterprise-advisory-council-2/

27 https://www.exposedbycmd.org/2021/01/27/alecs-numerous-ties-to-the-capitol-insurrection-and-big-lie/

Even before the riot, ALEC drew negative scrutiny for putting brand

reputations at risk when a lawyer associated with it was involved in a phone call President Trump made to Georgia Secretary of State Brad

Raffensperger in an attempt to overturn election results.28 Such activities seem to be at odds with Schwab’s stated

values and investors are unable to assess potential risks without adequate disclosures.

IV. Schwab Could Easily Provide Shareholders the Lobbying Disclosures

Requested in this Proposal

The Company’s Statement in Opposition to Stockholder Proposal

states that “in light of the company’s discontinuation of its PAC, its publicly available disclosures about its advocacy,

and the company’s oversight of lobbying activities, we believe this proposal is not appropriate for the company.”

However, as we have demonstrated, Schwab is failing to provide investors

what the proposal is asking for. Schwab’s existing practices fail to provide a unified disclosure report to shareholders capturing

its federal and state lobbying payments, including through its trade associations.

Schwab has this information readily available and could easily provide

it to shareholders in a single report at minimal expense.

|

|

V.

|

Investors Are Asking for Lobbying Transparency to Better Understand Risks

|

The International Corporate Governance Network (ICGN) representing more

than $18 trillion in assets, supports lobbying disclosure and political disclosure as best practice, and supports disclosure of any amounts

over $10,000.29 In 2018, the Principles for Responsible Investment (PRI) launched a guide on corporate climate lobbying to

help investors engage with companies on their direct and indirect lobbying practices related to climate policy. Specifically, companies

should be consistent in their policy engagement in all geographic regions and should ensure any engagement conducted by member trade associations

on their behalf or with their support is aligned with a company positions.30

28 https://www.triplepundit.com/story/2021/reputation-alec-trump-phone-call/709706

29

https://www.icgn.org/sites/default/files/ICGN%20Political%20Lobbying%20%26%20Donations%202017.pdf

30

https://www.unpri.org/Uploads/g/v/q/PRI_Converging_on_climate_lobbying.pdf

In October 2018, a $2 trillion coalition of investors led by the Church

of England pension board and Swedish pension fund AP7, sent letters to 55 large European companies, stating that lobbying on climate issues

should be evaluated, managed and reported on transparently, and noting it was unacceptable that companies counteract ambitious climate

policy, either directly or through their trade associations.31 The OECD’s Principles for Transparency and Integrity

in Lobbying find that a sound framework for transparency in lobbying is crucial to safeguard the integrity of the public decision-making

process.32

Lobbying Transparency: What Gets Disclosed

Gets Managed.

Clear policies and board oversight – coupled with disclosures

to shareholders, would help mitigate risks and provide greater transparency and accountability allowing investors to assess potential

risks and whether sufficient safeguards are in place to protect our Company’s interests as well as the interest of shareholders.

The well-documented reputational risks of Schwab’s lobbying and

its inadequate lobbying disclosure policies highlight the critical need for the Company to improve its lobbying disclosures and increase

transparency around its lobbying policies, procedures and spending details.

Based on the above Rationale, we believe that Schwab’s

current lobbying disclosures are inadequate to protect shareholder interests. We urge you to vote FOR Proposal #4, the stockholder

proposal requesting a report on the Company’s lobbying expenditures.

Sincerely,

Jeffery Perkins

Executive Director

Friends Fiduciary Corporation

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card; Friends Fiduciary Corporation is not able to vote your proxies, nor does this communication contemplate

such an event. Friends Fiduciary Corporation urges stockholders to vote for Proposal #4 following the instructions provided on

the Company’s proxy mailing.

31

“Pension Funds Challenge Major European Emitters on Climate Lobbying,” Church of England, October 29, 2018, https://www.churchofengland.org/more/media-centre/news/pension-funds-challenge-major-european-emitters-climate-lobbying.

32

http://www.oecd.org/gov/ethics/oecdprinciplesfortransparencyandintegrityinlobbying.htm

8

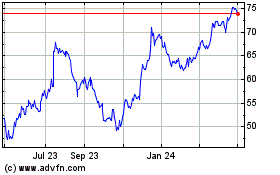

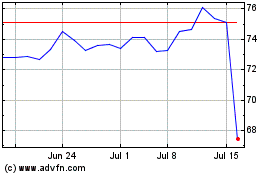

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024