GameStop Saga Prompts SEC to Weigh Review of Payment for Order Flow

March 09 2021 - 2:35PM

Dow Jones News

By Dave Michaels

WASHINGTON -- The Securities and Exchange Commission's acting

chairwoman signaled support for a wholesale review of a practice

that funnels many small investors' stock orders to be filled by

high-speed trading firms.

The system, known as payment for order flow, is decades old but

has generated greater scrutiny as more individual investors trade

on brokerage apps operated by companies such as Robinhood Markets

Inc. Online brokers like Robinhood make money by selling customers'

orders to firms such as Citadel Securities and Susquehanna

International Group LLP, which trade with them.

In a letter made public Tuesday, SEC Acting Chairwoman Allison

Herren Lee said regulators should examine such arrangements to make

sure practices are fully disclosed and "consistent with best

execution obligations." That requirement considers whether

customers get a better price than what is currently quoted in the

market, the speed of execution and the probability their order will

be filled.

Ms. Lee's letter, which was sent in response to questions from

Sen. Elizabeth Warren (D., Mass.), didn't say how or when the SEC

might start a review of payment for order flow. An agency

spokeswoman didn't immediately return a message seeking

comment.

Ms. Warren sent questions to the SEC in January after frenetic

trading in shares of GameStop Corp. and other so-called meme stocks

created such volatility that some brokers had to curb trading to

meet margin calls from their clearinghouses.

In the past, the SEC has repeatedly blessed payment for order

flow, saying brokerages monitor for conflicts of interest and that

it often results in better prices for small investors.

Nonetheless, the practice has long generated controversy, and

the rise of commission-free trading has put more focus on it. Firms

like Robinhood and Charles Schwab Corp. don't charge trading

commissions and instead make money from other sources such as

payment for order flow.

Some critics say the practice breeds bad incentives, since

brokerages may be tempted to send customer orders to the market

center that pays them the biggest rebate. Supporters, including

many brokers and trading firms, say the practice is misunderstood

and helps investors enjoy seamless trading and good prices.

A surge in trading among small investors has contributed to a

bigger slice of trading happening outside of regulated exchanges. A

record 47.2% of U.S. equity trading volume in January was executed

away from public stock exchanges, up from 39.9% a year earlier,

according to data from Rosenblatt Securities, a brokerage firm.

Ms. Lee's letter also said the SEC should consider new

regulations, such as greater disclosure of short selling and steps

to ensure small investors understand how options work. The Wall

Street Journal reported last month that the agency had started to

consider whether to draft new rules relating to short-sale

disclosures.

One provision of the 2010 Dodd-Frank financial overhaul law

required the SEC to issue rules within two years that would enhance

public information about the lending or borrowing of securities.

Another told the agency to publicly report, at least once a month,

on how much of a company's shares have been shorted.

Ms. Lee also wrote that regulators should consider requiring

brokerage firms to disclose more about how options trading works

and examine whether retail customers understand the products, which

allow traders to speculate more cheaply on stocks without buying

the shares. Robinhood Chief Executive Vlad Tenev said last month in

testimony to the House Financial Services Committee that Robinhood

has enhanced its educational materials about options trading and

boosted the eligibility criteria for new customers seeking to trade

certain kinds of options strategies.

The SEC is conducting a broad review of the trading in GameStop

shares, including whether any of the trading was manipulative and

whether brokerages followed all applicable rules.

"We are continuing to analyze the recent market events, and the

outcome of that review may ultimately lead us toward different or

additional policy considerations," Ms. Lee wrote in the letter.

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

March 09, 2021 14:20 ET (19:20 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

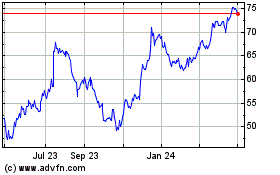

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

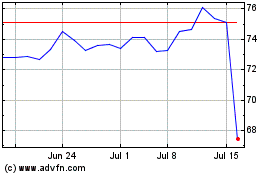

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024