SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________________________

FORM 40-F

☐ Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

☑ Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended September 30, 2022

Commission file number 001-14858

CGI INC.

(Exact name of Registrant as specified in its charter)

Quebec, Canada

(Province or other jurisdiction of incorporation or organization)

8742

(Primary Standard Industrial Classification Code Number)

98-0406227

(I.R.S. Employer Identification Number)

1350 René-Lévesque Boulevard West, 25th Floor

Montréal, Quebec

Canada H3G 1T4

(514) 841-3200

(Address and telephone number of Registrant’s principal executive offices)

CGI Technologies and Solutions Inc.

11325 Random Hills

Fairfax, VA 22030

(703) 267-8679

(Name, address and telephone number of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class: |

Trading symbol: |

Name of each exchange on which registered: |

| Class A subordinate voting shares |

GIB |

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

For annual reports, indicate by check mark the information filed with this form:

☑ Annual Information Form ☑ Audited Annual Financial Statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 211,302,549 Class A subordinate voting shares, 26,445,706 Class B shares.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days:

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit such files):

Yes ☑ No ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act:

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standards† provided pursuant to Section 13(a) of the Exchange Act: ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report: ☑

Undertaking

Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

Controls and Procedures

The Registrant’s assessment and conclusion on the effectiveness of disclosure controls and procedures and internal controls over financial reporting excludes the controls, policies and procedures of Umanis SA (“Umanis”), the control of which was acquired on May 31, 2022. Umanis’ results since the acquisition date represented 0.9% of revenue for the year ended September 30, 2022 and constituted 3.9% of total assets as at September 30, 2022.

The Registrant has established and maintains disclosure controls and procedures designed to provide reasonable assurance that the material information relating to the Registrant is made known to the Chief Executive Officer and Chief Financial Officer by others, particularly during the period in which annual and interim filings are prepared and that information required to be disclosed by the Registrant in its annual, interim filings or other reports filed or submitted by the Registrant under Canadian and U.S. securities laws is recorded, processed, summarized and reported within the time periods specified under those laws and the related rules. The effectiveness of these disclosure controls and procedures, as defined under National Instrument 52-109 adopted by Canadian securities regulators and in Rule 13a-15(e) under the U.S. Securities Exchange Act of 1934, as amended, was evaluated under the supervision of and with the participation of the Registrant’s Chief Executive Officer and Chief Financial Officer as of the end of the Registrant’s most recently completed fiscal year on September 30, 2022. Based on such evaluations, management, including the Chief Executive Officer and Chief Financial Officer concluded that the Registrant’s disclosure controls and procedures were effective as at September 30, 2022.

The Registrant has also established and maintains internal control over financial reporting, as defined under National Instrument 52-109 and in Rule 13a-15(f) under the U.S. Securities Exchange Act of 1934, as amended. Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Registrant. The Registrant’s internal control over financial reporting is a process designed under the supervision of the Chief Executive Officer and Chief Financial Officer, and effected by management and other key personnel of the Registrant, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board. However, because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements on a timely basis. The effectiveness of the Registrant’s internal control over financial reporting as at September 30, 2022 was evaluated under the supervision of and with the participation of the Registrant’s Chief Executive Officer and Chief Financial Officer as of the end of the Registrant’s most recently completed fiscal year on September 30, 2022 based on the criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO 2013). Based on that evaluation, management, including the Chief Executive Officer and Chief Financial Officer concluded that the Registrant’s internal control over financial reporting was effective as at September 30, 2022.

The effectiveness of the Registrant's internal control over financial reporting as of September 30, 2022 has been audited by PricewaterhouseCoopers LLP (PCAOB Firm ID 271), an independent registered public accounting firm, as stated in their report, filed as Exhibit 99.2 to this Annual Report.

There have been no changes in the Registrant’s internal control over financial reporting during the fiscal year ended September 30, 2022 that has materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

Audit Committee

The Audit and Risk Management Committee of the Board of Directors is composed entirely of unrelated directors who meet the independence and experience requirements of the New York Stock Exchange, the Toronto Stock Exchange, the Securities and Exchange Commission rules and National Instrument 52-110 adopted by Canadian securities regulators, as amended.

The Audit and Risk Management Committee is currently composed of Mr. Gilles Labbé, Chair of the Committee, Messrs. Stephen S. Poloz and Frank Witter, and Mses. Alison C. Reed and Kathy N. Waller.

The Registrant’s Board of Directors has determined that the following members of the Audit and Risk Management Committee of the Board of Directors are “audit committee financial experts” within the meaning of paragraph (8) of General Instruction B to Form 40-F:

•Gilles Labbé;

•Frank Witter;

•Alison C. Reed; and

•Kathy N. Waller.

Please refer to the Registrant’s Management Proxy Circular dated December 5, 2022 (and furnished to the Commission as Exhibit 99.2 to the Registrant's Form 6-K on December 16, 2022) under the heading Nominees for Election as Directors for a brief summary of Messrs. Labbé and Witter and Mses. Reed and Waller’s relevant experience.

Principal Accountant Fees and Services

In order to satisfy itself as to the independence of the external auditors, the Audit and Risk Management Committee has adopted an auditor independence policy which covers (a) the services that may and may not be performed by the external auditors, (b) the governance procedures to be followed prior to retaining services from the external auditors, and (c) the responsibilities of the key participants. The following is a summary of the material provisions of the policy.

Performance of Services

Services are either acceptable services or prohibited services.

The acceptable services are audit and review of financial statements, prospectus work, the audit of pension plans, special audits on control procedures, tax planning services on mergers and acquisitions activities, due diligence relating to mergers and acquisitions, tax services related to transfer pricing, sales tax planning and returns, research and interpretation related to taxation, research relating to accounting issues, tax planning services, preparation of tax returns, and all other services that are not prohibited services.

The prohibited services are bookkeeping services, the design and implementation of financial information systems, appraisal or valuation services or fairness opinions, actuarial services, internal audit services, management functions, human resources functions, broker-dealer services, legal services, services based on contingency fees, and expert services.

Governance Procedures

The following control procedures are applicable when considering whether to retain the external auditors’ services:

For all services falling within the permitted services category, whether they are audit or non-audit services, a request for approval must be submitted to the Audit and Risk Management Committee through the Executive Vice-President and Chief Financial Officer prior to engaging the auditors to perform the services.

In the interests of efficiency, certain permitted services are pre-approved quarterly by the Audit and Risk Management Committee and thereafter only require approval by the Executive Vice-President and Chief Financial Officer as follows:

•The Audit and Risk Management Committee can pre-approve envelopes for certain services to pre-determined dollar limits on a quarterly basis;

•Once pre-approved by the Audit and Risk Management Committee, the Executive Vice-President and Chief Financial Officer may approve the services prior to the engagement;

•For services not covered by the pre-approved envelopes and for costs in excess of the pre-approved amounts, separate requests for approval must be submitted to the Audit and Risk Management Committee; and

•At each quarterly meeting of the Audit and Risk Management Committee, a consolidated summary of all fees by service type is presented including a breakdown of fees incurred within each of the pre-approved envelopes.

Fees Billed by the External Auditors

During the fiscal years ended September 30, 2022 and September 30, 2021, the Registrant’s external auditors billed the following fees for their services:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees billed and percentage |

| Service retained |

2022 |

2021 |

| Audit fees |

$7,708,142 |

76.30% |

$6,990,722 |

67.32% |

Audit related fees(a) |

$942,671 |

9.33% |

$1,297,931 |

12.50% |

Tax fees(b) |

$1,394,072 |

13.80% |

$2,078,521 |

20.02% |

All other fees(c) |

$57,158 |

0.57% |

$17,145 |

0.16% |

| Total fees billed |

$10,102,043 |

100% |

$10,384,319 |

100% |

(a) The audit related fees billed by the external auditors for the fiscal years ended September 30, 2022 and 2021 were primarily in relation to service organization control procedures audits and assistance.

(b) The tax fees billed by the external auditors for the fiscal years ended September 30, 2022 and 2021 were in relation to tax compliance and advisory services.

(c) The other fees billed by the external auditor for the fiscal year ended September 30, 2022 were mainly in relation to corporate social responsibility advisory services. The other fees billed by the external auditor for the fiscal year ended September 30, 2021 were not significant.

Codes of Ethics

In addition to its Code of Ethics and Business Conduct, (which incorporates the CGI Anti-Corruption Policy) that applies to all the Registrant’s employees, officers and directors, the Registrant has adopted an Executive Code of Conduct that applies specifically to the Registrant’s principal executive and financial officers, including the Founder and Executive Chairman of the Board, the President and Chief Executive Officer, and the Executive Vice-President and Chief Financial Officer, the principal accounting officer or controller, or other persons performing similar functions (collectively, the “Officers”). The Executive Code of Conduct is designed to deter wrongdoing and to promote:

•Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

•Full, fair, accurate, timely, and understandable disclosure in reports and documents that the Registrant files with, or submits to, the Securities and Exchange Commission and in other public communications made by the Registrant;

•Compliance with applicable governmental laws, rules and regulations;

•The prompt internal reporting of violations of the Executive Code of Conduct to an appropriate person or persons identified in the Executive Code of Conduct; and

•Accountability for adherence to the Executive Code of Conduct.

The Registrant’s Executive Code of Conduct and its Code of Ethics and Business Conduct (which incorporates the CGI Anti-Corruption Policy) are available on the Registrant’s website at www.cgi.com.

The Board of Directors monitors compliance with the Executive Code of Conduct and the Code of Ethics and Business Conduct (which incorporates the CGI Anti-Corruption Policy) and is, under its charter, responsible for any waivers of their provisions granted to directors or Officers. No such waivers have been granted to date.

Corporate Governance Practices

As a Canadian reporting issuer with a listing on the New York Stock Exchange, the Registrant is considered a foreign private issuer. As such, many of the corporate governance rules applicable to U.S. domestic companies are not applicable to the Registrant. However, the Registrant’s corporate governance practices generally conform to those followed by U.S. domestic companies under the New York Stock Exchange listing standards, other than with respect to certain specific rules, including that the Registrant requires shareholder approval of share compensation arrangements involving the issuances of new shares, but does not require such approval if the compensation arrangement involves only shares purchased in the open market, consistent with the laws applicable to the Registrant.

Off-balance Sheet Arrangements

The Registrant does not enter into off-balance sheet financing as a matter of practice except for the use of operating leases for office space, computer equipment and vehicles, none of which are off-balance sheet arrangements within the meaning of paragraph (11) of General Instruction B to Form 40-F.

As disclosed in note 30 to the Registrant’s Audited Annual Consolidated Financial Statements, in the normal course of business, the Registrant enters into agreements that may provide for indemnification and guarantees to counterparties in transactions such as consulting and outsourcing services, business divestitures, lease agreements and financial obligations. These indemnification undertakings and guarantees may require the Registrant to compensate counterparties for costs and losses incurred as a result of various events, including breaches of representations and warranties, intellectual property right infringement, claims that may arise while providing services or as a result of litigation that may be suffered by counterparties. The nature of most indemnification undertakings prevent the Registrant from making a reasonable estimate of the maximum potential amount the Registrant could be required to pay counterparties, as the agreements do not specify a maximum amount and the amounts are dependent upon the outcome of future contingent events, the nature and likelihood of which cannot be determined at this time. The Registrant does not expect that any sum it may have to pay in connection with these guarantees will have a material adverse effect on its Audited Annual Consolidated Financial Statements.

Tabular Presentation of Contractual Obligations

As of September 30, 2022, the Registrant’s commitments under the terms of contractual obligations with various expiration dates, primarily related to long-term debt and for the rental of premises, computer equipment used in outsourcing contracts and long-term service agreements, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitment type In thousands of CAD |

Total |

Less than 1 year |

1 - 3 years |

3 - 5 years |

More than 5 years |

| Long-term debt |

3,267,034 |

93,447 |

1,178,103 |

863,125 |

1,132,359 |

| Estimated interest on long-term debt |

313,496 |

87,287 |

100,508 |

62,479 |

63,222 |

| Lease liabilities |

709,201 |

157,944 |

254,219 |

146,694 |

150,344 |

| Estimated interest on lease liabilities |

99,244 |

24,871 |

40,798 |

20,154 |

13,421 |

| Long-term service agreements and other |

250,049 |

146,662 |

83,065 |

20,322 |

— |

| Total |

4,639,024 |

510,211 |

1,656,693 |

1,112,774 |

1,359,346 |

The Registrant’s required benefit plan contributions have not been included in this table as such contributions depend on periodic actuarial valuations for funding purposes. The Registrant’s contributions to defined benefit plans are estimated at $7.3 million for fiscal 2023 as described in note 17 of the Registrant's Audited Annual Consolidated Financial Statements.

Interactive Data File

The Registrant is submitting as Exhibit 101.0 to this Annual Report its Interactive Data File.

Information to be Filed on This Form

The following documents are filed as exhibits to this Annual Report:

|

|

|

|

|

|

|

|

|

|

|

|

| 99.1 |

|

|

Annual Information Form for the fiscal year ended September 30, 2022 |

|

|

|

| 99.2 |

|

|

Audited Annual Consolidated Financial Statements for the fiscal years ended September 30, 2022 and September 30, 2021 |

|

|

|

| 99.3 |

|

|

Management’s Discussion and Analysis of Financial Position and Results of Operations for the fiscal years ended September 30, 2022 and September 30, 2021 |

|

|

|

| 99.4 |

|

|

Certification of the Registrant’s Chief Executive Officer required pursuant to Rule 13a-14(a) |

|

|

|

| 99.5 |

|

|

Certification of the Registrant’s Chief Financial Officer required pursuant to Rule 13a-14(a) |

|

|

|

| 99.6 |

|

|

Certification of the Registrant’s Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

|

|

| 99.7 |

|

|

Certification of the Registrant’s Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

|

|

| 99.8 |

|

|

Consent of PricewaterhouseCoopers LLP |

|

|

|

| 101.0 |

|

|

Interactive Data File (formatted as Inline XBRL) |

|

|

|

|

| 104.0 |

|

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101.0) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CGI Inc. |

|

|

|

|

| Date: December 16, 2022 |

|

|

|

|

|

|

|

|

By: |

/s/ Benoit Dubé |

|

|

Name: |

Benoit Dubé |

|

|

Title: |

Executive Vice-President, Legal and Economic Affairs, and Corporate Secretary |

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

|

| 99.1 |

|

|

Annual Information Form for the fiscal year ended September 30, 2022 |

|

|

|

| 99.2 |

|

|

Audited Annual Consolidated Financial Statements for the fiscal years ended September 30, 2022 and September 30, 2021 |

|

|

|

| 99.3 |

|

|

Management’s Discussion and Analysis of Financial Position and Results of Operations for the fiscal years ended September 30, 2022 and September 30, 2021 |

|

|

|

| 99.4 |

|

|

Certification of the Registrant’s Chief Executive Officer required pursuant to Rule 13a-14(a) |

|

|

|

| 99.5 |

|

|

Certification of the Registrant’s Chief Financial Officer required pursuant to Rule 13a-14(a) |

|

|

|

| 99.6 |

|

|

Certification of the Registrant’s Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

|

|

| 99.7 |

|

|

Certification of the Registrant’s Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

|

|

| 99.8 |

|

|

Consent of PricewaterhouseCoopers LLP |

|

|

|

| 101.0 |

|

|

Interactive Data File (formatted as Inline XBRL) |

|

|

|

|

| 104.0 |

|

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit

101.0) |

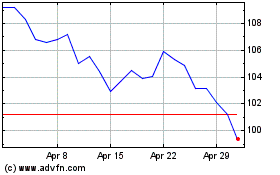

CGI (NYSE:GIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

CGI (NYSE:GIB)

Historical Stock Chart

From Apr 2023 to Apr 2024