CF Industries Sees Nitrogen Fundamentals Improving -- Commodity Comment

October 30 2019 - 7:31PM

Dow Jones News

By Josh Beckerman

Fertilizer and chemical company CF Industries Holdings Inc. (CF)

said third-quarter sales were $1.038 billion, compared with $1.04

billion a year earlier, as earnings per share rose to 29 cents from

13 cents. The company expects nitrogen industry fundamentals will

continue to improve "as the global market continues to tighten over

the coming years."

On pricing in 2019:

"Average selling prices for the first nine months of 2019 were

higher year-over-year across all major products due to a tighter

global nitrogen supply and demand balance than the prior year

period and logistical issues in North America that limited supply

at some inland locations. Average selling prices for the third

quarter of 2019 were similarly higher for urea, urea ammonium

nitrate (UAN) and ammonium nitrate (AN), and were lower for ammonia

due to greater global supply availability."

On its market overview:

"In the near-term, demand from import-dependent regions should

support global pricing. In North America, corn crop futures

continue to support an increase in planted corn acres over the next

two seasons. Outside of North America, demand for urea from India

and Brazil remains positive. Through September 2019, India has

imported 5.9 million metric tons of urea, a 36 percent increase

over the same period in 2018. India is expected to issue 1-2 more

tenders through March 2020. Imports of urea to Brazil through

September 2019 were 3.5 million metric tons, up approximately three

percent year-over-year."

"The company expects that global demand growth for nitrogen over

the next four years will outpace net capacity additions given the

limited number of facilities currently under construction around

the world, none of which are in North America. The company also

expects Chinese coal-based nitrogen complexes to remain the global

marginal urea producer and thus set the global price floor. Net

Chinese-produced urea exports are likely to be in a range of 1-3

million metric tons annually, with higher nitrogen prices bidding

in additional Chinese export tons at times when urea supply is

needed worldwide."

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

October 30, 2019 19:16 ET (23:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

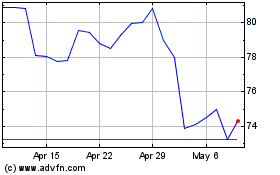

CF Industries (NYSE:CF)

Historical Stock Chart

From Mar 2024 to Apr 2024

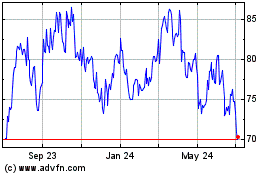

CF Industries (NYSE:CF)

Historical Stock Chart

From Apr 2023 to Apr 2024