Current Report Filing (8-k)

February 18 2022 - 7:52AM

Edgar (US Regulatory)

0001306830

false

0001306830

2022-02-18

2022-02-18

0001306830

us-gaap:CommonStockMember

2022-02-18

2022-02-18

0001306830

CE:SeniorUnsecuredNotesDue2023Member

2022-02-18

2022-02-18

0001306830

CE:SeniorUnsecuredNotesDue2025Member

2022-02-18

2022-02-18

0001306830

CE:SeniorUnsecuredNotesDue2027Member

2022-02-18

2022-02-18

0001306830

CE:SeniorUnsecuredNotesDue2028Member

2022-02-18

2022-02-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 18, 2022

CELANESE CORPORATION

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-32410 |

|

98-0420726 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

222 West Las Colinas Blvd. Suite 900N, Irving,

TX 75039

(Address of Principal Executive Offices)

(Zip Code)

Registrant's telephone number, including

area code: (972) 443-4000

(Former name or former address, if changed since last

report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.0001 per share |

CE |

The New York Stock Exchange |

| 1.125% Senior Notes due 2023 |

CE /23 |

The New York Stock Exchange |

| 1.250% Senior Notes due 2025 |

CE /25 |

The New York Stock Exchange |

| 2.125% Senior Notes due 2027 |

CE /27 |

The New York Stock Exchange |

| 0.625% Senior Notes due 2028 |

CE /28 |

The New York Stock Exchange |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the

Securities Exchange Act of 1934.

Emerging growth

company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry

into a Material Definitive Agreement

Transaction Agreement

On February 17, 2022, Celanese Corporation (“Celanese”

or the “Company”) entered into a transaction agreement (the “Transaction Agreement”) with DuPont de Nemours, Inc.

and one of its affiliates (“DuPont”), pursuant to which Celanese will acquire from DuPont (the “Acquisition”)

a majority of the Mobility and Materials business of DuPont (the “Business”) for an aggregate purchase price of approximately

$11 billion in cash, subject to certain adjustments. The Transaction Agreement provides that, upon the terms and conditions set forth

therein, Celanese will purchase the Business through the acquisition of the equity of certain subsidiaries of DuPont related to the Business.

The Business excludes Delrin® POM, Tedlar® PVF, Multibase, and Auto Adhesives & Fluids businesses.

The consummation of the Acquisition is subject to certain conditions,

including the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the receipt

of other antitrust approvals in certain foreign jurisdictions.

The Transaction Agreement contains various representations and warranties

and covenants by the parties to such agreement. DuPont and Celanese have agreed to enter into related agreements ancillary to the Acquisition

that will become effective upon the consummation of the Acquisition, including certain documents related to intellectual property matters

and transition services.

The foregoing description of the Transaction Agreement set forth herein

is subject to, and qualified in its entirety by reference to, the full text of the Transaction Agreement, a copy of which is attached

as Exhibit 2.1 hereto and is incorporated by reference herein. The Transaction Agreement has been attached to provide investors with information

regarding its terms. It is not intended to provide any other factual information about DuPont, Celanese or the Business. In particular,

the assertions embodied in the representations and warranties in the Transaction Agreement were made as of a specified date, are modified

or qualified by information in a confidential disclosure letter prepared in connection with the execution and delivery of the Transaction

Agreement, may be subject to a contractual standard of materiality different from what might be viewed as material to shareholders, or

may have been used for the purpose of allocating risk between the parties. Accordingly, the representations and warranties in the Transaction

Agreement are not necessarily characterizations of the actual state of facts about DuPont, Celanese, or the Business at the time they

were made or otherwise and should only be read in conjunction with the other information that Celanese and DuPont make publicly available

in reports, statements and other documents filed with the U.S. Securities and Exchange Commission.

Bridge Facility Commitment Letter

In connection with the Transaction Agreement, on February 17, 2022,

the Company entered into a commitment letter (the “Commitment Letter”) with Bank of America, N.A. (the “Commitment Party”)

pursuant to which the Commitment Party has committed to provide, subject to the terms and conditions set forth in the Commitment Letter,

a 364-day $11 billion senior unsecured bridge term loan facility (the “Bridge Facility,” and the provision of such funds as

set forth in the Commitment Letter, the “Bridge Financing”). The Bridge Facility is available to finance the transactions

contemplated by the Transaction Agreement and to pay fees and expenses related thereto to the extent that the Company does not finance

such consideration and fees and expenses through permanent financing obtained in the form of term loans and/or the issuance of notes in

a public offering or private placement as described below. The funding of the Bridge Facility provided for in the Commitment Letter is

contingent on the satisfaction of customary conditions, including (i) the execution and delivery of definitive documentation with respect

to the Bridge Facility in accordance with the terms set forth in the Commitment Letter, and (ii) the consummation of the Acquisition in

accordance with the Transaction Agreement. Bridge Facility availability is subject to reduction in equivalent amounts upon any incurrence

by the Company of term loans and/or the issuance of notes in a public offering or private placement prior to the consummation of the Acquisition

and upon other specified events, subject to certain exceptions set forth in the Commitment Letter. The Bridge Facility will contain certain

representations and warranties, certain affirmative covenants, certain negative covenants, and certain conditions and events of default

that are customarily required for similar financings. The foregoing description of the Commitment Letter set forth herein is subject to,

and qualified in its entirety by reference to, the full text of the Commitment Letter, a copy of which is attached as Exhibit 10.1 hereto

and is incorporated by reference herein.

| |

Item 7.01 |

Regulation FD Disclosure. |

Press Release

A copy of the press release announcing the above-referenced transaction

is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”).

Investor Call

Celanese management will host a conference call on Friday, February

18, 2022, at 8:30 a.m. Eastern time. The presentation, press release and management’s prepared comments may be accessed on our website

at investors.celanese.com under News & Events — Events Calendar. This call will be available by webcast at

https://investors.celanese.com or by phone as set forth in the press release furnished as Exhibit 99.1 to this Current Report.

Copies of the presentation and management’s prepared remarks

for the webcast are also furnished as Exhibit 99.2 and 99.3 to this Current Report.

Forward-Looking Statements

The information set forth in this Current Report contains certain

“forward-looking statements,” which include information concerning the Company’s plans, objectives, goals, strategies,

future revenues, cash flow, synergies, performance, capital expenditures and other information that is not historical information. Forward-looking

statements can be identified by words such as “outlook,” “forecast,” “estimates,” “expects,”

“anticipates,” “projects,” “plans,” “intends,” “believes,” “will,”

and variations of such words or similar expressions. All forward-looking statements are based upon current expectations and beliefs and

various assumptions. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct.

There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied

by the forward-looking statements contained herein. These include the Company’s ability to obtain regulatory approval for, and satisfy

closing conditions to, the transactions described herein, the timing of closing thereof, and the Company’s ability to realize the

anticipated benefits of the transactions described herein. Numerous other factors, many of which are beyond the Company’s control

could cause actual results to differ materially from those expressed as forward-looking statements. Other risk factors include those that

are discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31,

2021 and other filings made with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which

it is made, and the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after

the date the on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) The following exhibits are being furnished herewith:

Exhibit

Number |

|

|

| 2.1 |

|

Transaction Agreement,

dated as of February 17, 2022, by and among DuPont De Nemours, Inc., DuPont E&I Holding, Inc. and Celanese Corporation. |

| |

|

|

| 10.1 |

|

Commitment Letter,

dated as of February 17, 2022, by and among Celanese Corporation, Bank of America, N.A. and BofA Securities, Inc. |

| |

|

|

| 99.1 |

|

Press Release

dated February 18, 2022* |

| |

|

|

| 99.2 |

|

Investor Presentation

dated February 18, 2022* |

| |

|

|

| 99.3 |

|

Prepared Remarks

from Management dated February 18, 2022* |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded

within the inline XBRL document). |

* The information in Item 7.01 of this Current Report, including Exhibits

99.1, 99.2 and 99.3 furnished thereunder, is being furnished and shall not be deemed "filed" for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of such section.

The information in Item 7.01 this Current Report, including the exhibits furnished thereunder, shall not be incorporated by reference

into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language

in any such filing. The disclosure in Item 7.01 of this Current Report will not be deemed an admission as to the materiality of any information

in such item in this Current Report that is required to be disclosed solely by Regulation FD.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CELANESE CORPORATION |

| |

|

| |

By: |

/s/ Michael R. Sullivan |

| |

Name: |

Michael R. Sullivan |

| |

Title: |

Vice President, Deputy General Counsel and Assistant Secretary |

| |

|

|

| |

Date: |

February 18, 2022 |

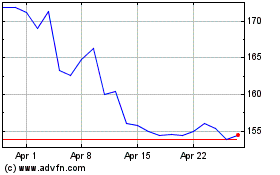

Celanese (NYSE:CE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Celanese (NYSE:CE)

Historical Stock Chart

From Apr 2023 to Apr 2024