UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filed by the Registrant

|

☒

|

Filed by a party other than the registrant

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☒

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

CARVANA CO.

(Name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

|

☒

|

No fee required.

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computer pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it is determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

Dear Fellow Stockholders,

We are pleased to invite you to attend the 2021 Annual Meeting of Stockholders of Carvana Co. on Monday, May 3, 2021, beginning at 9:00 a.m., PDT. The annual meeting will be conducted virtually via live webcast. To participate in this year's annual meeting of stockholders, you must register beforehand by visiting www.proxydocs.com/CVNA by 5:00 p.m. EST on April 29, 2021 or the Registration Deadline. After completion of your registration by the Registration Deadline, further instructions, including a unique link to access the annual meeting, will be emailed to you. You will not be able to attend the annual meeting physically. Once registered you will be able to listen to the annual meeting live, submit questions, and vote online.

Details regarding how to attend the meeting online and the business to be conducted at the annual meeting are more fully described in the accompanying Notice of 2021 Virtual Annual Meeting Stockholders and Proxy Statement. We will mail a notice containing instructions on how to access this proxy statement and our annual report on or about Wednesday, March 24, 2021, to all stockholders entitled to vote at the annual meeting. Stockholders who prefer a paper copy of the proxy materials may request one on or before April 23, 2021, by following the instructions provided in the notice we will send.

Your vote is important. Whether or not you plan to attend the annual meeting, we urge you to vote. You may vote by proxy over the Internet, by telephone, or by mail following instructions on the proxy card. Voting by proxy will ensure your representation at the annual meeting regardless of whether you attend.

Ernest Garcia III

President, Chief Executive Officer and Chairman

NOTICE OF 2021 VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

The 2021 virtual Annual Meeting of Stockholders of CARVANA CO. (“Carvana” or the “Company”) will be held on Monday, May 3, 2021 at 9:00 AM (PDT) and will be conducted virtually via live webcast (the "Annual Meeting"). To participate at this year’s Annual Meeting, you must register beforehand by visiting http://www.proxydocs.com/CVNA by 5:00 p.m. EST on April 29, 2021 (the "Registration Deadline"). You will be asked to provide the control number located inside the shaded gray box on your notice or the proxy card, or the Control Number, as described in the notice or proxy card. After completion of your registration by the Registration Deadline, further instructions, including a unique link to access the Annual Meeting, will be emailed to you. Once registered you will be able to listen to the Annual Meeting live, submit questions, and vote online. We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement:

1.to elect two nominees identified in the accompanying proxy statement to serve as directors, as recommended by the Compensation and Nominating Committee of the Board of Directors of Carvana;

2.to approve the Carvana Co. Employee Stock Purchase Plan;

3.to ratify the appointment of Grant Thornton LLP as Carvana’s independent registered public accounting firm for the year ending December 31, 2021;

4.to consider the approval, by an advisory vote, of Carvana’s executive compensation (i.e., “say-on-pay” proposal); and

5.to transact other business as may properly come before the meeting or any adjournment of the meeting.

Our board of directors has set March 4, 2021, as our record date for this year’s meeting. Only stockholders that owned Carvana Co.’s Class A common stock or Class B common stock at the close of business on that day are entitled to notice of our Annual Meeting and may vote at it or any adjournment of the meeting. On or about March 24, 2021, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials, or the Notice, containing instructions on how to access our proxy statement and our 2020 annual report. This Notice provides instructions on how to vote via the Internet or by telephone and includes instructions on how to receive a paper copy of our proxy materials by mail. The proxy statement and our 2020 annual report can be accessed directly at the following Internet address: http://www.proxydocs.com/CVNA.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By Order of the Board of Directors

|

|

|

|

Paul Breaux

General Counsel and Secretary

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

Commonly Asked Questions and Answers About the Annual Meeting

|

|

|

Board of Directors and Corporate Governance

|

|

|

ITEM 1 - ELECTION OF DIRECTORS

|

|

|

Director Nominees

|

|

|

Continuing Directors

|

|

|

Independence Status

|

|

|

Controlled Company Status

|

|

|

Board Meetings and Committees

|

|

|

Board Leadership Structure

|

|

|

Delinquent Section 16(A) Reports

|

|

|

Risk Oversight

|

|

|

Compensation Committee Interlocks and Insider Participation

|

|

|

Communications by Stockholders and Other Interested Parties with the Board of Directors

|

|

|

Director Compensation

|

|

|

Executive Officers

|

|

|

Compensation Discussion and Analysis

|

|

|

Executive Summary

|

|

|

Compensation Objectives and Principles

|

|

|

Compensation Setting Process

|

|

|

Competitiveness of Our Compensation Program

|

|

|

Compensation Components

|

|

|

Compensation-Related Policies

|

|

|

Compensation and Risk

|

|

|

Tax and Accounting Implications

|

|

|

Compensation and Nominating Committee Report

|

|

|

Compensation Tables

|

|

|

Summary Compensation Table

|

|

|

Grants of Plan-Based Awards

|

|

|

Outstanding Equity Awards at 2019 Fiscal Year End

|

|

|

Option Exercises and Stock Vested

|

|

|

Potential Payments upon a Change in Control

|

|

|

CEO Pay Ratio

|

|

|

Certain Relationships and Related Party Transactions

|

|

|

Policies for Approval of Related Party Transactions

|

|

|

Amended and Restated Operating Agreement

|

|

|

Exchange Agreement

|

|

|

Registration Rights Agreement

|

|

|

Tax Receivable Agreement

|

|

|

|

|

|

|

|

|

|

Indemnification of Officers and Directors

|

|

|

Registered Direct Offering

|

|

|

Relationship with DriveTime

|

|

|

Security Ownership of Certain Beneficial Owners and Management

|

|

|

ITEM 2 - APPROVAL OF EMPLOYEE STOCK PURCHASE PLAN

|

|

|

ITEM 3 - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

|

Fees and Services

|

|

|

Audit Committee Report

|

|

|

ITEM 4 - SAY ON PAY

|

|

|

Other Matters

|

|

|

Incorporation by Reference

|

|

|

Availability of SEC Filings, Code of Conduct, and Committee Charters

|

|

|

Where to Find Additional Information

|

|

|

Cost of Proxy Solicitation

|

|

|

Annex

|

|

|

Non-GAAP Financial Measures

|

|

|

Employee Stock Purchase Plan

|

|

Commonly Asked Questions and Answers About the Annual Meeting

Q: Why did I receive these materials?

The Board of Directors of Carvana Co. (the “Board”) is soliciting your proxy to vote at our 2021 Annual Meeting of Stockholders (or at any postponement or adjournment of the meeting). Stockholders who own shares of our common stock (Class A or Class B) as of the record date, March 4, 2021, are entitled to vote at the annual meeting. You should review these proxy materials carefully as they give important information about the items that will be voted on at the annual meeting, as well as other important information about Carvana.

Q: Who will be entitled to vote?

Stockholders who own shares of our common stock as of the record date, March 4, 2021, are entitled to vote at the annual meeting. As of the record date, Carvana had approximately 78,331,472 shares of Class A common stock outstanding and 93,929,471 shares of Class B common stock outstanding. Holders of shares of Class A common stock are entitled to one vote per share of Class A common stock. Ernest Garcia II, Ernest Garcia III, and entities controlled by one or both of them (collectively, the “Garcia Parties”) are entitled to ten votes per share of Class B common stock they beneficially own, for so long as the Garcia Parties maintain, in the aggregate, direct or indirect beneficial ownership of at least 25% of the outstanding shares of Class A common stock, determined on an as-exchanged basis assuming that all of the Class A common units (“Class A Units”) and Class B common units (“Class B Units,” and together with Class A Units, “LLC Units”) of Carvana Group, LLC (“Carvana Group”) were exchanged for Class A common stock. The Garcia Parties are currently entitled to ten votes per share of Class B common stock they beneficially own. All other holders of Class B common stock are entitled to one vote per share. All holders of Class A common stock and Class B common stock will vote together as a single class except as otherwise required by applicable law. Cumulative voting is not permitted with respect to the election of directors or any other matter to be considered at the annual meeting.

Q: What will I be voting on?

You will be voting on the following matters:

1.to elect two Class I directors to serve on the Board until the 2024 Annual Meeting and until their successors are duly elected and qualified;

2.to approve the Carvana Co. Employee Stock Purchase Plan;

3.to ratify the appointment of Grant Thornton LLP as Carvana’s independent registered public accounting firm for the year ending December 31, 2021;

4.to consider the approval, by an advisory vote, of Carvana’s executive compensation (i.e., “say-on-pay”); and

5.to transact other business as may properly come before the meeting or any adjournment of the meeting.

Q: How does the Board recommend I vote on these matters?

The Board recommends you vote for the following:

1.FOR the election of Ernest Garcia III and Ira Platt as Class I directors;

2.FOR the approval of the Carvana Co. Employee Stock Purchase Plan;

3.FOR the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2021; and

4.FOR the approval, by an advisory vote, of Carvana’s executive compensation.

Q: How do I cast my vote?

Registered Stockholders. If you hold shares in your own name, you are a registered stockholder and there are four ways to vote:

1.by Internet at http://www.proxypush.com/CVNA, 24 hours a day, seven days a week (have your proxy card in hand when you visit the website);

2.by toll-free telephone at 1-866-509-2149 (have your proxy card in hand when you call);

3.by completing and mailing your proxy card (if you received printed proxy materials); or

4.by voting during the virtual Annual Meeting through www.proxydocs.com/CVNA. To be admitted to the Annual Meeting and vote your shares, you must register by the Registration Deadline and provide the Control Number as described in the Notice or proxy card. After completion of your registration by the Registration Deadline, further instructions, including a unique link to access the Annual Meeting, will be emailed to you.

Even if you plan to attend the Annual Meeting, we recommend that you also vote by proxy so that your vote will be counted if you decide not to attend the Annual Meeting.

Beneficial Stockholders. If you hold your shares through a broker, trustee, or other nominee, you are a beneficial stockholder. If you are a beneficial stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Beneficial stockholders should generally be able to vote by returning the voting instruction card to their broker, bank or other nominee, or by telephone or via Internet. However, the availability of telephone or Internet voting will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a beneficial stockholder, you are invited to attend and vote your shares at the Annual Meeting live via webcast so long as you register to attend the Annual Meeting at www.proxydocs.com/CVNA by the Registration Deadline. To vote online at the Annual Meeting, you must obtain a legal proxy from your broker, bank or other nominee.

Q: Can I access the proxy materials electronically?

Yes. Your notice, proxy card, or voting instruction card will contain instructions on how to view our proxy materials for the annual meeting online and how to instruct us to send our future proxy materials to you electronically by email. Our proxy materials are also available at www.proxydocs.com/CVNA and will be available during the voting period starting on March 24, 2021.

Instead of receiving future copies of our proxy statement and annual reports by mail, stockholders of record and most beneficial owners can elect to receive an email that will provide an electronic link to these documents. Your election to receive future proxy materials by email will remain in effect until you revoke it.

Please note that only one notice will be sent to stockholders who are listed at the same address.

Q: How may I change or revoke my proxy?

Registered Stockholders. If you are a stockholder of record, you can change your vote or revoke your proxy any time before or at the Annual Meeting by:

1.entering a new vote by Internet or by telephone (until the applicable deadline for each method as set forth above);

2.returning a later-dated proxy card (which automatically revokes the earlier proxy card);

3.notifying our Secretary, in writing, at Carvana Co., Attn: Corporate Secretary, 1930 W. Rio Salado Pkwy, Tempe, AZ 85281; or

4.attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy) at www.proxydocs.com/CVNA.

Beneficial Stockholders. If you are a beneficial stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote.

Q: Who can attend the annual meeting?

All common stockholders as of the record date, or their duly appointed proxies, may pre-register and attend the Annual Meeting.

Q: What is the voting requirement to approve each of the items, and how are the votes counted?

ITEM 1 – ELECTION OF DIRECTORS. A plurality of the votes cast by the shares of common stock present in person or represented by proxy at the meeting and entitled to vote thereon is required to elect each nominee. This means that the two nominees receiving the highest number of votes at the annual meeting will be elected, even if those votes do not constitute a majority of the votes cast. Abstentions and broker non-votes will not impact the election of the nominees.

ALL OTHER ITEMS. The affirmative vote of a majority of the votes cast by the shares of common stock present in person or represented by proxy at the meeting and entitled to vote thereon is required to approve all other items. Abstentions will be counted as present and entitled to vote on the proposal and will therefore have the effect of a negative vote. We do not expect there to be any broker non-votes with respect to any of the proposals.

Q: When will the results of the vote be announced?

The preliminary voting results will be announced at the annual meeting. The final voting results will be published in a current report on Form 8-K filed with the SEC within four business days of the annual meeting.

Q: What is the deadline for submitting a stockholder proposal or director nomination for the 2022 Annual Meeting?

Stockholder proposals pursuant to SEC Rule 14a-8 for inclusion in Carvana’s proxy statement and form of proxy for Carvana’s 2022 Annual Meeting of Stockholders must be received by Carvana at our principal executive offices at 1930 W. Rio Salado Pkwy, Tempe, AZ, 85281, no later than the close of business on November 29, 2021. Stockholders wishing to make a director nomination or bring a proposal, but not include it in Carvana’s proxy materials, must provide written notice of their nomination or proposal to the general counsel and secretary at Carvana’s principal executive offices no later than the close of business on January 24, 2022, and not earlier than the close of business on December 25, 2021, assuming Carvana does not change the date of the 2022 Annual Meeting of Stockholders by more than 30 days before or after the anniversary of the 2021 Annual Meeting. If so, Carvana will release an updated time frame for stockholder proposals. Any stockholder proposal or director nomination must comply with the other provisions of Carvana’s amended and restated bylaws and be submitted in writing to the general counsel and secretary at Carvana’s principal executive offices.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business and affairs are managed under the direction of our Board, which is composed of six directors. Our certificate of incorporation provides that the authorized number of directors may be changed only by resolution of our Board. Our certificate also provides that our Board will be divided into three classes of directors, with the classes as nearly equal in number as possible. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class whose term is then expiring.

The following table sets forth the director class, name, age as of May 3, 2021, and other information for each member of our Board:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Class

|

Age

|

Position

|

Director Since

|

Current Term Expires

|

Expiration of Term For Which Nominated

|

|

Ernest Garcia III

|

I

|

38

|

President, CEO, and Chairman

|

2017

|

2021

|

2024

|

|

Ira Platt

|

I

|

57

|

Director

|

2017

|

2021

|

2024

|

|

Dan Quayle

|

II

|

74

|

Director

|

2017

|

2022

|

|

|

Gregory Sullivan

|

II

|

62

|

Director

|

2017

|

2022

|

|

|

Michael Maroone

|

III

|

67

|

Lead Director

|

2017

|

2023

|

|

|

Neha Parikh

|

III

|

42

|

Director

|

2019

|

2023

|

|

We believe that in order for our Board to effectively guide us to long-term sustainable, dependable performance, it should be composed of individuals with sophistication and experience in the many disciplines that impact our business. To best serve our stockholders, we seek to have a board of directors that, as a whole, is competent in key corporate disciplines, including accounting and financial acumen, business judgment, crisis management, governance, leadership, people management, risk management, social responsibility and reputational issues, and strategy and strategic planning. Additionally, the Board desires to have specific knowledge related to our industry, such as expertise in automotive retail, consumer finance, and eCommerce.

The Compensation and Nominating Committee believes that all directors must, at a minimum, meet the criteria set forth in the Board’s code of conduct and the corporate governance guidelines, which specify, among other things, that the Compensation and Nominating Committee will consider criteria such as independence, diversity, age, skills, and experience in the context of the needs of the Board. In addressing issues of diversity in particular, the Compensation and Nominating Committee considers a nominee’s differences in viewpoint, professional experience, background, education, skill, age, race, gender, and national origin. The Compensation and Nominating Committee believes that diversity of backgrounds and viewpoints is a key attribute for a director nominee. Accordingly, to improve director diversity and best serve our stockholders, the Compensation and Nominating Committee

formally adopted a policy in 2019 to request that any search firm that it engages include women and minority candidates in the initial list from which the committee selects director candidates. The Compensation and Nominating Committee also will consider a combination of factors for each director, including whether the nominee possesses:

a.the ability to represent all stockholders without a conflict of interest;

b.the ability to work in and promote a productive environment;

c.sufficient time and willingness to fulfill the substantial duties and responsibilities of a director;

d.the high level of character and integrity that we expect;

e.broad professional and leadership experience and skills necessary to effectively respond to the complex issues encountered by a national, publicly traded company; and

f.the ability to apply sound and independent business judgment.

The Compensation and Nominating Committee has determined that all of our directors meet the criteria and qualifications set forth in the code of conduct for the Board, the corporate governance guidelines and the criteria set forth above for director nominees. Moreover, each director possesses the following critical personal qualities and attributes that we believe are essential for the proper functioning of the Board to allow it to fulfill its duties for our stockholders: accountability, ethical leadership, governance, integrity, risk management, and sound business judgment. In addition, our directors have the mature confidence to assess and challenge the way things are done and recommend alternative solutions, a keen awareness of our business and the social realities of the environment in which we operate, the independence and high-performance standards necessary to fulfill the Board’s oversight function, and the humility, professional maturity, and style to interface openly and constructively with other directors. Finally, the director biographies below include a non-exclusive list of other key experiences and qualifications that further qualify the individual to serve on the Board. These collective qualities, skills, experiences, and attributes are essential to our Board’s ability to exercise its oversight function for Carvana and its stockholders and to guide the long-term sustainable, dependable performance of our business.

Subject to any earlier resignation or removal in accordance with the terms of our certificate and bylaws, our Class I directors will serve until this our fourth annual meeting of stockholders, our Class II directors will serve until the fifth annual meeting of stockholders, and our Class III directors will serve until our sixth annual meeting of stockholders. In addition, our certificate provides that our directors may be removed with or without cause by the affirmative vote of at least a majority of the voting power of our outstanding shares of stock entitled to vote thereon, voting together as a single class, for so long as the Garcia Parties are entitled to ten votes for each share of Class B common stock they hold. If the Garcia Parties are no longer entitled to ten votes for each share of Class B common stock they hold, then our directors may be removed only for cause upon the affirmative vote of at least 66⅔% of the voting power of our outstanding shares of stock entitled to vote thereon.

The Compensation and Nominating Committee will consider stockholder nominations for membership on the Board. For the 2022 Annual Meeting, nominations may be submitted to Carvana Co., 1930 W. Rio Salado Pkwy, Tempe, AZ 85281, Attn: Secretary, who will forward them to the Chairman of the Compensation and Nominating Committee. Recommendations must

be in writing and we must receive the recommendation no later than the close of business on January 24, 2022, and not earlier than the close of business on December 25, 2021. Recommendations must also include certain other requirements specified in our bylaws. The committee will apply the same criteria to the evaluation of those candidates as it applies to other director candidates.

When filling a vacancy on the Board, the Compensation and Nominating Committee identifies the desired skills and experience of a new director and nominates individuals who it believes can strengthen the Board’s capabilities and further diversify the collective experience represented by the then-current directors. The Compensation and Nominating Committee may engage third parties to assist in the search and provide recommendations. As discussed above, any search firm that the committee engages is requested to include women and minority candidates in the initial list from which the committee selects director candidates. Also, directors are generally asked to recommend candidates for the position. The candidates would be evaluated based on the process outlined in the Corporate Governance Guidelines and the Compensation and Nominating Committee charter, and the same process would be used for all candidates, including candidates recommended by stockholders.

ITEM 1—ELECTION OF DIRECTORS

Our Board recommends that the nominees below be elected as members of the Board at the annual meeting to serve for a three-year term expiring at the 2024 Annual Meeting.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME

|

AGE

|

DIRECTOR SINCE

|

POSITION

|

|

Ernest Garcia III

|

38

|

2017

|

President, CEO, and Chairman

|

|

Ira Platt

|

57

|

2017

|

Director

|

Each nominee was recommended for election by the Compensation and Nominating Committee for consideration by the Board and proposal to our stockholders. If, before the annual meeting, any nominee becomes unable to serve, or chooses not to serve, the Board may (i) nominate a substitute (ii) allow the vacancy to remain until the Board identifies an appropriate candidate or (iii) reduce the size of the board to eliminate the vacancy. If the Board chooses to nominate a substitute nominee, the persons named as proxies on the proxy card will vote for that substitute nominee.

The Board recommends that you vote “FOR” each of the director nominees.

DIRECTOR NOMINEES

Ernest Garcia III co-founded Carvana and has served as our president and Chief Executive Officer ("CEO") since our inception in 2012. Mr. Garcia is also Chairman of the Carvana Co. Board. Prior to founding Carvana, Mr. Garcia held various roles at DriveTime Automotive Group, Inc. (“DriveTime”) from January 2007 to January 2013. From January 2007 to December 2008, he served as a financial strategist. He was a managing director of corporate finance from December 2008 to November 2009. From November 2009 until January 2013, he served as a vice president and treasurer and director of quantitative analytics. As director of quantitative analytics, Mr. Garcia was responsible for the firm’s ongoing development of consumer credit scoring models, and its utilization of those tools in retail-vehicle-sales deal structuring and vehicle-price optimization. Prior to DriveTime, Mr. Garcia was an associate in the Principal Transactions Group at RBS Greenwich Capital from 2005 to 2006, where he focused on consumer-credit-based investments. Mr. Garcia holds a B.S. in management science and engineering from Stanford University. We believe that Mr. Garcia will continue to be a valuable member of our Board because of his extensive knowledge of our business and strategy, as well as his experience in the automotive retail industry and leadership role with us.

Ira Platt has served on our Board since the completion of our initial public offering (“IPO”) in 2017. Mr. Platt has been the president of Georgiana Ventures, LLC, a firm that provides equity and debt capital to specialty finance companies, acquires portfolios of consumer finance receivables and offers consulting services to the specialty finance industry, since its inception in 2009. From May 2009 to December 2013, Mr. Platt served as the president of 221 Capital Partners, LLC, a firm that provides advisory services. From 2009 to 2011, Mr. Platt was

the Portfolio Manager for the Rosemont TALF Opportunity Fund, a partnership investing in asset-backed securities. In addition, Mr. Platt was a managing director and Head of the Principal & Distressed Capital Business for RBS Greenwich Capital, the domestic fixed income banking unit of the Royal Bank of Scotland Group, from 1997 to 2009. Mr. Platt was an executive vice president of the Aegis Consumer Funding Group, a publicly traded non-prime automotive finance company, from 1991 to 1997. Mr. Platt earned a B.A. degree in 1985 from Emory University and an M.B.A. from The Fuqua School of Business at Duke University. Mr. Platt served on DriveTime’s board of directors from February 2014 until April 2017. We believe that Mr. Platt will continue to be a valuable member of our Board because of his service on DriveTime’s board and his extensive experience in consumer finance and the automotive retail industry.

CONTINUING DIRECTORS

Dan Quayle has served on our Board since the completion of our IPO. Mr. Quayle has served the United States Federal Government in various capacities: congressman, senator, and as the 44th Vice President of the United States of America from 1989 to 1993. Since 1999, Mr. Quayle has been with Cerberus Capital, a New York private investment firm. He has served as chairman of Cerberus Global Investments since 2001. Mr. Quayle earned a B.A. degree in political science from DePauw University and a J.D. from the Indiana University Robert H. McKinney School of Law. We believe Mr. Quayle will continue to be a valuable member of our Board because of his experience as the chairman of Cerberus Global Investments, LLC, as well as his extensive experience in the areas of government, foreign relations, and private investment.

Gregory Sullivan has served on our Board since the completion of our IPO. Mr. Sullivan is the co-founder and CEO of AFAR Media, a travel media company he co-founded in 2007. From 1995 to 2007, Mr. Sullivan served DriveTime in various capacities, including as president from 1995 to 2004, CEO from 1999 to 2004, and vice chairman from 2004 to 2007. Mr. Sullivan earned a B.B.A. degree in finance from the University of Notre Dame and a J.D. from the University of Virginia School of Law. We believe that Mr. Sullivan will continue to be a valuable member of our Board because of his senior management experience in the automotive and media industries.

Michael Maroone has served on our Board since the completion of our IPO. Mr. Maroone is currently the CEO of Maroone U.S.A. LLC. From July 2005 to April 2015, Mr. Maroone served on the board of AutoNation, Inc., an automotive retailer and provider of new and used vehicles and related services. From August 1999 until his retirement in February 2015, Mr. Maroone also served as president and chief operating officer of AutoNation, Inc. Prior to joining AutoNation, Inc., Mr. Maroone was president and chief executive officer of the Maroone Automotive Group, a privately-held automotive retail group, from 1977 to 1997. Mr. Maroone currently serves on four other boards: as chairman of the board of Cleveland Clinic Florida, a non-profit, multi-specialty academic hospital; as a member of the board of the Cleveland Clinic Enterprise Board; as a member of the board of Salty Dot, Inc.; and as a member of the board of MDH Acquisition Corp.. Mr. Maroone previously served as a member of the board of Cox Automotive, Inc., a privately held combination of global automotive wholesale and services businesses including automotive auctions, financial services, media, and software; on the Cleveland Clinic Board of Trustees; and was co-chairman of the Florida Leadership Board of the

Cleveland Clinic. He holds a B.S. degree in Small Business Management from the University of Colorado Boulder. Mr. Maroone was selected to serve on our Board because of his advisory experience and his extensive experience in the automotive retail industry and we believe that Mr. Maroone will continue to be a valuable member of our Board because of such experience.

Neha Parikh has served on our Board since April 2019. From August 2017 to November 2019, Ms. Parikh served as the President of Hotwire, a leading innovator in value creation and discount travel and a member of the Expedia Group. She first started with Expedia Group in 2008 with Hotels.com, where she amassed experience in roles across the business, including product development, customer relationship marketing, pricing, and strategy. Prior to her role with Hotwire, she was the Senior Vice President of Global Brands and Retail for Hotels.com, driving brand marketing activities, overseeing financial plans and operations, and leading merchandising, business development, and partner marketing globally. Before joining Hotels.com, Ms. Parikh worked in consumer insight and demand strategy consulting with The Cambridge Group (a Nielsen company), where she led projects across a variety of retailers, and at Dade Behring, Inc. (a Siemens healthcare company), where she held progressive levels of responsibility in marketing and product development. She also worked as a management consultant at Pricewaterhouse Coopers, LLP and gained multi-faceted expertise at an internet start-up in Chicago. Ms. Parikh holds a bachelors of business degree from The University of Texas at Austin and an MBA from the Kellogg School of Management at Northwestern University. We believe that Ms. Parikh will continue to be a valuable member of our Board because of her extensive senior management experience in the online retail vertical.

INDEPENDENCE STATUS

The listing standards of the New York Stock Exchange ("NYSE") require that, subject to specified exceptions, each member of a listed company’s audit committee, and compensation committee, and nominating committee be independent and that audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act.

Our Board has determined that each of our non-employee directors, including our director nominee Ira Platt, meets the requirements to be an independent director. In making this determination, our Board considered the relationships that each non-employee director has with Carvana and all other facts and circumstances that our Board deemed relevant in determining their independence, including beneficial ownership of our Class A common stock.

CONTROLLED COMPANY STATUS

For purposes of the corporate governance rules of the NYSE, we are a “controlled company.” Controlled companies under those rules are companies of which more than 50% of the voting power for the election of directors is held by an individual, a group, or another company. The Garcia Parties beneficially own more than 50% of the combined voting power of Carvana Co. Accordingly, we expect to be eligible for, but do not currently intend to take advantage of, certain exemptions from the corporate governance requirements of the NYSE. Specifically, as a “controlled company,” we would not be required to have:

a.a majority of independent directors,

b.a nominating and corporate governance committee composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities,

c.a compensation committee composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities, or

d.an annual performance evaluation of the nominating and governance and compensation committees.

In the event we choose to rely on some or all of these exemptions in the future, you would not have the same protections afforded to stockholders of companies that are subject to all of the applicable corporate governance rules of the NYSE.

BOARD MEETINGS AND COMMITTEES

During the year ended December 31, 2020, our Board held twenty-three meetings, our Audit Committee held eight meetings, and our Compensation and Nominating Committee held four meetings. Directors are expected to attend the annual meeting of stockholders and all or substantially all of the Board meetings and meetings of committees on which they serve, and to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. Each director attended last year’s annual meeting. Twenty of the twenty-three meetings of the Board in 2020 were attended by 100% of the directors, and the remaining three meetings of the Board with less than 100% attendance were attended by five of the six directors. Each director attended 100% of the meetings held by the committees of the Board on which the director served.

Our Board has an Audit Committee and a Compensation and Nominating Committee. The composition, duties and responsibilities of these committees are as set forth below. In the future, our board may establish other committees, as it deems appropriate, to assist it with its responsibilities.

|

|

|

|

|

|

|

|

|

|

|

Board Member

|

Audit Committee

|

Compensation and

Nominating Committee

|

|

Ira Platt

|

(Chairman)

|

•

|

|

Gregory Sullivan

|

•

|

(Chairman)

|

|

Dan Quayle

|

|

•

|

|

Michael Maroone

|

•

|

|

|

Neha Parikh

|

•

|

•

|

AUDIT COMMITTEE

The Audit Committee is responsible for, among other matters,

1.appointing, compensating, retaining, evaluating, terminating, and overseeing our independent registered public accounting firm;

2.discussing with our independent registered public accounting firm their independence from management;

3.reviewing with our independent registered public accounting firm the scope and results of their audit;

4.approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm;

5.overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC;

6.reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls, and compliance with legal and regulatory requirements;

7.establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls, or auditing matters;

8.reviewing and approving related party transactions; and

9.overseeing our enterprise risk management program.

Our Board has affirmatively determined that Mr. Platt, Mr. Maroone, Ms. Parikh, and Mr. Sullivan meet the definition of “independent director” for purposes of serving on an Audit Committee under Rule 10A-3 of the Exchange Act and the NYSE rules. In addition, our Board has determined that Mr. Platt and Mr. Sullivan each qualify as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K. The written charter for our Audit Committee is available at our corporate website at investors.carvana.com/corporate-governance/governance-documents.

COMPENSATION AND NOMINATING COMMITTEE

The Compensation and Nominating Committee is responsible for, among other matters,

1.reviewing key employee compensation goals, policies, plans, and programs;

2.reviewing and providing recommendations to the Board regarding the compensation of our directors, CEO, and other executive officers;

3.reviewing and approving employment agreements and other similar arrangements between us and our executive officers;

4.administering stock plans and other incentive compensation plans;

5.identifying individuals qualified to become members of our Board, consistent with criteria approved by our Board;

6.overseeing the organization of our Board to discharge the Board’s duties and responsibilities properly and efficiently;

7.assisting the Board in its oversight of human capital management, including corporate culture, diversity and inclusion, recruiting, retention, attrition, talent management, career development and progression, succession, and employee relations;

8.identifying best practices and recommending corporate governance principles; and

9.developing and recommending to our Board a set of corporate governance guidelines and principles applicable to us.

The Board has adopted a written charter for the Compensation and Nominating Committee, which is available on our corporate website at investors.carvana.com/corporate-

governance/governance-documents. Each member of our Compensation and Nominating Committee is an independent director as defined by NYSE rules.

BOARD LEADERSHIP STRUCTURE

The following section describes our board leadership structure, the reasons why the structure is in place at this time, the roles of various positions, and related key governance practices. The mix of experienced independent and management directors that make up our Board, along with the independent role of our lead director and our independent board-committee composition, benefits Carvana and its stockholders.

INDEPENDENCE; BOARD MIX

Our Board has an effective mix of independent and management directors. It is composed of five independent directors and our current chairman and CEO, Ernest Garcia III.

LEAD DIRECTOR

The Board believes that it is beneficial to Carvana and its stockholders to designate one of the directors as a lead director who is elected by a majority of the Board. The lead director serves a variety of roles, including reviewing and approving Board schedules to confirm the appropriate board and committee topics are reviewed and sufficient time is allocated to each; liaising between our chairman and CEO and non-management directors when necessary and appropriate (that said, each director has direct and regular access to the chairman and CEO) and calling an executive session of independent directors at any time consistent with the bylaws and certificate of incorporation. Michael Maroone, an independent director and member of our Audit Committee, is currently our lead director. Mr. Maroone is an effective lead director for Carvana due to, among other things, his independence, his board leadership experience with AutoNation, Inc., his strong strategic and financial acumen, his commitment to ethics, his extensive knowledge of the automotive retail environment, and his deep understanding of Carvana and its business.

CHAIRMAN / CEO

With respect to the roles of chairman and CEO, the corporate governance guidelines provide that the roles may be separated or combined, and the Board will exercise its discretion in combining or separating these positions as it deems appropriate in light of prevailing circumstances. Mr. Garcia has been our chairman and CEO since our IPO. The Board believes that combining the roles of chairman and CEO, together with the separate, independent role of our lead director, is currently the most effective leadership structure because Mr. Garcia has extensive knowledge and experience in a variety of relevant areas acquired through his professional and other experiences, including automotive retail, e-commerce, consumer finance and strategic planning. This knowledge and experience give Mr. Garcia the insight necessary to combine the responsibilities of strategic development and execution along with management of day-to-day operations.

SELF EVALUATION

Our Compensation and Nominating Committee conducts an annual performance evaluation to determine whether the Board, its committees, and the directors are functioning effectively. This includes survey materials as well as conversations between each director and the lead director. The evaluation focuses on the Board’s and the committees’ contributions to Carvana and has an enhanced focus on areas in which the Board or management believes that the Board could improve.

As part of the annual Board self-evaluation, the Board evaluates whether the current leadership structure continues to be appropriate for Carvana and its stockholders. Our corporate governance guidelines provide the flexibility for our Board to modify our leadership structure in the future as appropriate.

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Exchange Act requires our directors, executive officers and greater-than-ten-percent stockholders to file initial reports of ownership and reports of changes in ownership of any of our securities with the SEC and us. Other than the following instance, we believe that during the 2020 fiscal year all of our directors, executive officers, and greater-than-ten-percent stockholders complied with the requirements of Section 16(a): on January 13, 2021, a Form 4 for Ms. Parikh reflecting a change in ownership of our securities was filed after the deadline to file such Form 4.

RISK OVERSIGHT

The Board, as a whole and through the Audit Committee, oversees our risk management program, which is designed to identify, evaluate, and respond to our high priority risks and opportunities. The risk management program facilitates constructive dialog at the senior management and board level to proactively realize opportunities and manage risks. Our Audit Committee is primarily responsible for overseeing our risk management processes on behalf of the full board. Our management, including our executive officers, is primarily responsible for managing the risks associated with the operation and business of our Company and provides regular updates to the Audit Committee and the full board on identified high priority risks and opportunities within the risk management program, and regularly provides a more in depth report on select topics, such as cybersecurity, including response planning and the program’s major initiatives.

CODE OF ETHICS AND CONDUCT

We have adopted a code of business conduct and ethics that applies to all of our employees, officers, and directors, including those officers responsible for financial reporting. Our code of business conduct and ethics is available on our website at investors.carvana.com/

corporate-governance/governance-documents. We intend to disclose any amendments to the code or waivers of its requirements on our website.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No interlocking relationships exist between the members of our Board and the board or compensation committee of any other company.

COMMUNICATIONS BY STOCKHOLDERS AND OTHER INTERESTED PARTIES WITH THE BOARD OF DIRECTORS

Stockholders and other interested parties may contact an individual director, the lead director, the Board as a group, or a specified board committee or group, including the non-management directors as a group, by sending regular mail to

Carvana Co.

1930 W. Rio Salado Pkwy

Tempe, AZ 85281

ATTN: Board of Directors

or by email at leaddirector@carvana.com.

Each communication should specify which director or directors the communication is addressed to, as well as the general topic of the communication. Carvana will receive the communications and process them before forwarding them to the addressee. Carvana may also refer communications to other departments within Carvana. Carvana generally will not forward to the directors a communication that is primarily commercial in nature, relates to an improper or irrelevant topic, or requests general information regarding Carvana.

DIRECTOR COMPENSATION

Prior to our IPO, none of our directors received compensation as a director from us. We have designed our non-employee director compensation program to achieve the following objectives:

a.align directors’ interests with the long-term interests of our shareholders;

b.attract and retain outstanding director candidates with diverse backgrounds and experiences; and

c.recognize the substantial time commitment required to serve as a Carvana director.

The Compensation and Nominating Committee reviews the Company’s director compensation program periodically. Independent directors may not receive, directly or indirectly, any consulting, advisory or other compensatory fees from us. Members of the Board who are employees of Carvana do not receive compensation for their service on the Board. The following

table presents summary information regarding the total compensation awarded to, earned by, and paid to our non-employee directors for the year ended December 31, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Fees earned or paid in cash ($)(1)

|

Stock awards ($) (2)

|

Total ($)

|

|

Ira Platt

|

$

|

57,500

|

|

$

|

322,235

|

|

$

|

379,735

|

|

|

Gregory Sullivan

|

$

|

57,500

|

|

$

|

322,235

|

|

$

|

379,735

|

|

|

Dan Quayle

|

$

|

37,500

|

|

$

|

322,235

|

|

$

|

359,735

|

|

|

Michael Maroone

|

$

|

57,500

|

|

$

|

322,235

|

|

$

|

379,735

|

|

|

Neha Parikh

|

$

|

37,500

|

|

$

|

322,235

|

|

$

|

359,735

|

|

(1) As disclosed in our Shareholder Letter dated May 6, 2020, in response to the COVID-19 pandemic, management and the Board recommended and the Compensation and Nominating Committee agreed, to contribute a portion of executive officers' base salaries and each Board member's annual retainer to the Company’s disaster relief program under Section 139 of the IRS code—the “We’re All In This Together Fund” (the “Fund”). As a result, the amounts reported as "Fees earned or paid in cash ($)" for each non-employee director reflect the originally expected 2020 annual retainer plus fees for serving as the lead director or chair of a committee (for Mr. Platt, Mr. Sullivan, and Mr. Maroone, $95,000; and for Ms. Parikh and Mr. Quayle, $75,000) adjusted for the amount each non-employee director contributed to the Fund.

(2) The amounts reported in the Stock Awards column represent the grant date fair value on July 23, 2020, of the restricted stock units ("RSUs") granted to the non-employee directors during the year ended December 31, 2020 presented as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. As disclosed in the table below, the annual grant of RSUs for each non-employee director, similar to 2019, was calculated at a fair market value of $150,000 based on the 10-day trailing average closing stock price on April 20, 2020. In 2020, this amount came to 2,178 RSUs. However, due to the onset of the COVID-19 pandemic, in April 2020 the Compensation and Nominating Committee elected to postpone granting annual Board RSU awards in light of macro-environment and then-current circumstances. The annual grant was made to non-employee directors on July 23, 2020 and the grant date fair value of 2,178 RSUs on July 23, 2020 is reflected in this table.

NON-EMPLOYEE DIRECTOR COMPENSATION STRUCTURE

As of December 31, 2020, we compensated our non-employee directors according to the following structure:

|

|

|

|

|

|

|

|

Description

|

Amount

|

|

|

|

|

Annual retainer

|

$75,000

|

|

Annual grant

|

Grant of 2,178 restricted stock units having a fair market value of $150,000, based on the 10-day trailing average closing stock price on April 20, 2020, that vests 100% after approximately one (1) year.

|

|

Board meeting fees

|

$2,000 per each board meeting in excess of six board meetings in any calendar year that a non-employee director attends in person.

|

|

Additional retainer for chair of committee

|

$20,000 for Audit Committee; $20,000 for Compensation and Nominating Committee

|

|

Additional retainer for lead director

|

$20,000

|

Additionally, upon the completion of our IPO, each then current non-employee director received a one-time award of options to purchase an aggregate of approximately 30,927 shares of our Class A common stock, vesting over three years, with an exercise price of $15.00. When Ms. Parikh was appointed to the Board in April 2019, she received a one-time award of RSUs having a fair market value of $150,000 based on the stock closing price as of April 18, 2019 that vests annually over three (3) years. All non-employee directors are also reimbursed for their reasonable expenses to attend meetings of our Board and related committees and otherwise attend to our business.

DIRECTOR STOCK OWNERSHIP GUIDELINES

The minimum Company stock ownership guidelines for non-employee directors is five (5) times the amount of the annual retainer paid by the Company, not including retainers paid for serving as the lead director or chair of a committee, within five (5) years of being named a director. For the CEO, the minimum Company stock ownership guideline is six (6) times base salary within five (5) years of being named in the role. The guidelines serve to align the interests of our directors to those of our stockholders.

Under this formula, the current ownership requirement is $375,000 (5 x $75,000) of Company stock for non-employee directors, and $4,602,000 (6 x $767,000) of Company stock for our CEO. Under these guidelines, directors elected at our IPO would have until April 2022 to comply with this requirement and Ms. Parikh, who joined the Board in April 2019, would have until April 2024 to meet this requirement. Each director is expected to continue to meet the ownership requirement for as long as he or she serves as a director of the Board. All non-employee directors and our CEO are in compliance with these guidelines as of the date of this proxy statement.

EXECUTIVE OFFICERS

Below is a list of the names, ages, positions, and a brief account of the business experience of the individuals who serve as executive officers of Carvana Co. as of May 3, 2021:

|

|

|

|

|

|

|

|

|

|

|

Name

|

Age

|

Position

|

|

Ernest Garcia III

|

38

|

President, Chief Executive Officer and Chairman

|

|

Mark Jenkins

|

42

|

Chief Financial Officer

|

|

Benjamin Huston

|

38

|

Chief Operating Officer

|

|

Ryan Keeton

|

43

|

Chief Brand Officer

|

|

Daniel Gill

|

38

|

Chief Product Officer

|

|

Paul Breaux

|

37

|

Vice President, General Counsel, and Secretary

|

|

Tom Taira

|

50

|

President, Special Projects

|

Ernest Garcia III is the president and CEO of Carvana and the chairman of our Board. His biography can be found above under “Board of Directors and Corporate Governance – Continuing Directors.”

Mark Jenkins has served as our chief financial officer since July 2014. Prior to joining Carvana, Mr. Jenkins was a professor in the finance department at the Wharton School of the University of Pennsylvania from 2009 to 2014, where his teaching and research focused on consumer and corporate credit markets. While at Wharton, Mr. Jenkins was responsible for teaching courses in the undergraduate, MBA, and executive education programs on corporate restructuring, corporate credit, and leveraged finance. Prior to his time at Wharton, Mr. Jenkins worked at the Brattle Group from 2001 to 2004, an economic consulting firm, where he focused on corporate valuation and demand forecasting in technology markets. Mr. Jenkins received a Ph.D. in economics from Stanford University and a B.S.E. from Duke University in mathematics and civil engineering.

Benjamin Huston co-founded Carvana and has served as our chief operating officer since our inception in 2012. In 2011, prior to joining Carvana, Mr. Huston co-founded Looterang, a card-linking platform that enabled personalized deals to be automatically administered through consumer credit or debit cards. Mr. Huston was CEO of Looterang from 2011-2012. From 2008 to 2011, Mr. Huston served as an associate at Latham and Watkins, a full-service global law firm, where he focused on regulatory affairs. Mr. Huston holds a J.D. from Harvard Law School and a B.A. in American studies from Stanford University.

Ryan Keeton co-founded Carvana and has served as our chief brand officer since our inception in 2012. Prior to joining Carvana, Mr. Keeton was a principal at the Montero Group, a strategic consultancy firm, from 2010 to 2012, where he advised global public and private companies on strategic and business initiatives. From 2008 to 2010, Mr. Keeton served as

director of strategic marketing for George P. Johnson, a global marketing agency. Mr. Keeton holds a B.A. in English and American literature and language from Harvard University.

Daniel Gill has served as our chief product officer since March 2015, overseeing all technology functions, as well as strategic partnerships for the business. Prior to joining Carvana, Mr. Gill spent his career in both enterprise software and consumer internet businesses. He co-founded and served as CEO of Huddler from 2007 until the company’s acquisition by Wikia in May of 2014. Mr. Gill holds a degree in biology from Stanford University.

Paul Breaux has served as our general counsel since August 2015. Prior to joining Carvana, Mr. Breaux practiced law at the Houston, Texas office of the firm Andrews Kurth LLP (now Hunton Andrews Kurth LLP) from 2008 to 2015. While at Andrews Kurth, Mr. Breaux’s representative experience encompassed a broad range of general business transactions matters. Mr. Breaux holds a J.D. from Harvard Law School, a B.A. in Plan II Honors from The University of Texas at Austin, and a B.B.A. in finance from The University of Texas at Austin.

Tom Taira has served as President, Special Projects since October 2018. Prior to joining Carvana, Mr. Taira was the co-founder and CEO of Propel AI, which was acquired by Carvana in 2018. In 2005, Mr. Taira co-founded TrueCar, Inc. and from 2005 until 2018 he served in various roles at TrueCar, Inc. including Chief Product Officer, Chief Strategy Officer, and President. Between 2009 to 2010, Mr. Taira co-founded and served as CEO of Honk LLC, an automotive social media website, which was acquired by TrueCar. He has also been a Director and founding team member at various automotive startups, including Model E, a vehicle subscription service, and Build-to-Order, a new American automotive manufacturer. Mr. Taira began his automotive career at Toyota Motor Sales, U.S.A. where he served as eBusiness Strategy Manager. Mr. Taira holds a B.A. in Social Sciences from the University of California, Irvine and an M.B.A. from Georgetown University.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) describes our executive compensation objectives and design, our compensation-setting process, our executive compensation program components, and the decisions made in 2020 with respect to our CEO, chief financial officer, and our three other most highly compensated executive officers for the year ended December 31, 2020, who have been designated as our “named executive officers” under Item 402 of Regulation S-K (each, an "NEO" and collectively, the “NEOs”):

|

|

|

|

|

|

|

|

Named Executive Officer

|

Position

|

|

Ernest Garcia III

|

Chief Executive Officer

|

|

Mark Jenkins

|

Chief Financial Officer

|

|

Benjamin Huston

|

Chief Operating Officer

|

|

Daniel Gill

|

Chief Product Officer

|

|

Paul Breaux

|

Vice President, General Counsel, and Secretary

|

This CD&A may contain statements regarding future individual and Company performance targets and goals. These targets and goals should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply these statements to other contexts.

EXECUTIVE SUMMARY

COMPANY PERFORMANCE HIGHLIGHTS

2020 was both a challenging and successful year for Carvana. We had another year of impressive growth in revenue, retail units sold, and total customers served despite the health and economic consequences of COVID-19. We also achieved records in our gross profit per unit and EBITDA margin, notably reaching positive EBITDA during the third quarter. Our growth has few historical precedents and makes us one of the fastest-growing technology, consumer, or retail companies at our scale.

The highlights of our 2020 performance amidst the pandemic include:

•37% increase in retail units sold, from 177,549 to 244,111;

•42% revenue growth, from $3.9 billion to $5.6 billion;

•120 new markets, bringing our total from 146 to 266;

•4 additional car vending machines, bringing our total from 23 to 27;

•a $400 increase in gross profit per unit from $2,852 to $3,252

•improvement in net loss margin from (9.3%) to (8.3%);

•improvement in EBITDA margin from (6.2%) to (4.6%), including our first EBITDA positive quarter in Q3; and

Note that EBITDA and EBITDA margin are non-GAAP measures. A description of these measures and a reconciliation of these measures to the nearest comparable GAAP measure can be found in the annex of this proxy statement.

*GPU in 2018, 2019, and 2020 include a $43, $31, and $2 impact from the 100k Milestone Gift, respectively. EBITDA margin in 2018, 2019, and 2020 include a 0.6%, 0.4%, and 0.0% impact from the 100k Milestone Gift, respectively.

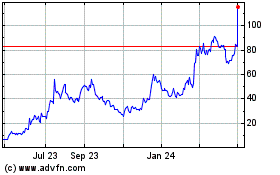

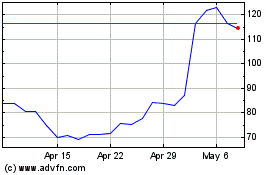

•a one-year total shareholder return of 160.2%, significantly outperforming our peer group companies (see “Competitiveness of our Compensation Program” below) as an index as well as the S&P 500 and S&P 500 Retailing Indices.

KEY COMPENSATION DESIGN AND DECISIONS TO LINK PAY AND PERFORMANCE

Underlying our executive compensation program is a strong belief in promoting a pay-for-performance culture. We accomplish this by linking a significant portion of the compensation of our executive officers, including our NEOs, to our performance. In addition, the Compensation and Nomination Committee seeks to set important target performance levels that reflect our business plans rather than goals based on prior years’ achievements. Our executives earn payouts under our performance-based compensation plans based upon the Company’s achievement of pre-established financial objectives.

CORPORATE GOVERNANCE HIGHLIGHTS REGARDING EXECUTIVE COMPENSATION

We endeavor to maintain sound executive compensation policies and practices, including compensation-related corporate governance standards, consistent with our executive compensation philosophy. The following summarizes our executive compensation and related governance policies and practices:

|

|

|

|

|

|

|

|

|

|

|

WHAT WE DO

|

|

WHAT WE DO NOT DO

|

|

A significant portion of compensation is "at risk" and tied to long-term Company performance

|

|

No discretionary or guaranteed incentive payments

|

|

Performance-measured incentive award metrics are solely based on Company performance; awards are determined based on pre-established targets

|

|

No new or legacy excise-tax gross-up provisions

|

|

Market-based executive compensation levels are reviewed by Compensation and Nominating Committee annually

|

|

No option repricing without stockholder consent

|

|

Performance-measured incentive awards are subject to a compensation recoupment policy

|

|

|

|

Executives are prohibited from hedging

|

|

|

|

An independent compensation consultant is retained to evaluate our executive compensation and make recommendations

|

|

|

We believe that we have designed executive compensation plans that effectively support our strategic and financial goals, create a culture of teamwork, and are directly tied to the performance of the Company and shareholder outcomes. We will continue to utilize rigorous governance processes to monitor and evaluate the compensation programs as well as implement best practices in compensation governance. We welcome shareholder feedback on our programs.

COMPENSATION OBJECTIVES AND PRINCIPLES

Carvana seeks to create and maintain a culture of teamwork and high performance. Our executive compensation programs are one of the tools we utilize to accomplish this objective. Philosophically, we aim to treat our executives fairly when considering:

a.the complexity of their jobs,

b.the market for their executive talent,

c.their individual performance,

d.the financial and strategic performance of the Company, and

e.the need to retain the executives.

Within that framework, it is critical that we meet our objectives to:

a.attract and retain the best executive talent to support our growth,

b.align the interests of our executives with those of our shareholders, and

c.provide incentives that are linked directly to our long- and short-term strategies.

We set important goals as our incentive compensation metrics and we expect that our executives will in aggregate be paid fairly compared to the compensation peer group approved by the Compensation and Nominating Committee considering Company performance, individual performance, tenure, and experience.

COMPENSATION SETTING PROCESS

ROLE OF COMPENSATION AND NOMINATING COMMITTEE AND CHIEF EXECUTIVE OFFICER IN SETTING EXECUTIVE COMPENSATION

The Compensation and Nominating Committee has responsibility for overseeing the design, development, and implementation of the compensation program for our CEO and other NEOs. The committee evaluates the performance of our CEO and the performance of the other executive officers. Our CEO assists the committee in evaluating the performance of our other executive officers, including the NEOs other than the CEO. Our CEO does not participate in certain portions of committee meetings or meetings of the Board when his compensation is discussed and determined, and has requested that his total compensation be set significantly below the market median due to his significant ownership interest in our Company.

Based on these assessments, the members of the Compensation and Nominating Committee, each of whom is an independent director, make the final compensation decisions for the NEOs other than the CEO, and make recommendations to the Board for the CEO’s compensation. The Board makes the final decision for the CEO’s compensation.

INDEPENDENT COMPENSATION ADVISOR

Our Compensation and Nominating Committee believes that independent advice is important in developing Carvana’s executive compensation programs. Since September 2017, the committee has engaged Korn Ferry as its independent compensation consultant to advise on executive compensation matters. All work performed by the independent compensation consultant regarding our executive compensation program is tasked and overseen directly by the committee. Our management provides information and analyses to the committee at the committee’s direction.

In addition to advising on our executive compensation program, Korn Ferry, at the request of and in service to the Compensation and Nominating Committee, provided certain other compensation advisory services for 2020 compensation, including assistance with establishing a compensation peer group, benchmarking executive compensation, aggregate broad based equity usage (including run rate and total dilution), outlining peer group short- and long-term incentive practices, and reviewing the narrative disclosure in this Compensation Discussion and Analysis.

Korn Ferry does not provide any other material services to Carvana Co. The Compensation and Nominating Committee has assessed the independence of Korn Ferry

pursuant to the NYSE rules and concluded that Korn Ferry’s work for the committee did not raise any conflicts of interest.

CONSIDERATION OF THE SAY-ON-PAY VOTE

We last held a non-binding, advisory vote to approve the compensation of our NEOs, commonly referred to as the “say-on-pay” vote, at our 2020 Annual Meeting of Shareholders, as required by Section 14A of the Securities Exchange Act of 1934. Our advisory resolution to approve the compensation of our NEOs received substantial majority support from shareholders with 99.99% “For” votes of votes cast. We take this result as support that our executive compensation program and practices are reasonable and well-aligned with shareholder expectations. Nevertheless, we review our overall approach to executive compensation periodically and we expect that the specific direction, emphasis, and components of our executive compensation program will continue to evolve, as will our process for establishing executive compensation.

COMPETITIVENESS OF OUR COMPENSATION PROGRAM

Our executive compensation program is designed so that the sum of base pay plus total long-term compensation is competitive with market practices. Market practices—or benchmarks—are based on peer-group data and compensation survey data.

The Compensation and Nominating Committee, with the assistance of its compensation consultant, Korn Ferry, reviewed and selected potential peer companies based on revenue size, industry focus, growth rates, complexity of operations, customer base, and market for talent. Many of our direct industry competitors are either privately held companies or are larger than us in revenue size, although very few have our growth trajectory. With the assistance of its compensation consultant, the committee approved the following compensation peer group in order to determine market pay levels and pay practices for fiscal year 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•

|

Advanced Auto Parts, Inc.

|

|

•

|

Aaron's, Inc.

|

|

•

|

Tractor Supply Company

|

|

•

|

Lululemon Athletica Inc.

|

|

•

|

Wayfair Inc.

|

|

•

|

GoDaddy Inc.

|

|

•

|

Ulta Beauty, Inc.

|

|

•

|

RH

|

|

•

|

Asbury Automotive Group, Inc.

|

|

•

|

Floor & Decor Holdings, Inc.

|

|

•

|

Williams-Sonoma, Inc.

|

|

•

|

Overstock.com, Inc.

|

|

•

|

IAC/INTERACTIVECORP

|

|

•

|

Stitch Fix, Inc.

|

The Compensation and Nominating Committee expects to continue to review our compensation peer group on an annual basis, considering changes in our size and business and the businesses of the companies in the peer group.

The Compensation and Nominating Committee also uses compensation survey data in its evaluation of executive pay for the NEOs. Survey data provides insight into positions that may not generally be reported in proxy statements and information about the compensation of

executives of non-public companies. To assist the committee in evaluating fiscal year 2020 compensation levels, the committee reviewed both peer-group proxy data and information from survey databases, utilizing appropriate subsets based on the size of the company.

COMPENSATION COMPONENTS