Statement of Changes in Beneficial Ownership (4)

January 13 2021 - 6:26PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

GARCIA ERNEST C. II |

2. Issuer Name and Ticker or Trading Symbol

CARVANA CO.

[

CVNA

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

1720 W. RIO SALADO PARKWAY, SUITE A |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/11/2021 |

|

(Street)

TEMPE, AZ 85281

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 1/11/2021 | | C | | 400 | A | $0.00 (1) | 400 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 400 | D | $266.8575 (3) | 0 | D | |

| Class A Common Stock | 1/11/2021 | | C | | 700 | A | $0.00 (1) | 700 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 700 | D | $268.1471 (3) | 0 | D | |

| Class A Common Stock | 1/11/2021 | | C | | 1200 | A | $0.00 (1) | 1200 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 1200 | D | $269.5608 (3) | 0 | D | |

| Class A Common Stock | 1/11/2021 | | C | | 300 | A | $0.00 (1) | 300 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 300 | D | $270.7767 (3) | 0 | D | |

| Class A Common Stock | 1/11/2021 | | C | | 5963 | A | $0.00 (1) | 5963 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 5963 | D | $272.5448 (3) | 0 | D | |

| Class A Common Stock | 1/11/2021 | | C | | 6561 | A | $0.00 (1) | 6561 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 6561 | D | $273.4699 (3) | 0 | D | |

| Class A Common Stock | 1/11/2021 | | C | | 15185 | A | $0.00 (1) | 15185 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 15185 | D | $274.6179 (3) | 0 | D | |

| Class A Common Stock | 1/11/2021 | | C | | 8740 | A | $0.00 (1) | 8740 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 8740 | D | $275.2567 (3) | 0 | D | |

| Class A Common Stock | 1/11/2021 | | C | | 3614 | A | $0.00 (1) | 3614 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 3614 | D | $276.6807 (3) | 0 | D | |

| Class A Common Stock | 1/11/2021 | | C | | 3437 | A | $0.00 (1) | 3437 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 3437 | D | $277.5156 (3) | 0 | D | |

| Class A Common Stock | 1/11/2021 | | C | | 3900 | A | $0.00 (1) | 3900 | D | |

| Class A Common Stock | 1/11/2021 | | S(2) | | 3900 | D | $278.5976 (3) | 0 | D | |

| Class A Common Stock | | | | | | | | 555556 | I | Verde Investments, Inc. (4) |

| Class A Common Stock | | | | | | | | 100000 | I | Ernest C. Garcia III Multi-Generational Trust III (5) |

| Class B Common Stock | 1/11/2021 | | J | | 50000 | D | $0.00 (6) | 47059482 | D | |

| Class B Common Stock | | | | | | | | 11834021 | I | Ernest Irrevocable 2004 Trust III (7) |

| Class B Common Stock | | | | | | | | 11952000 | I | Ernest C. Garcia III Multi-Generational Trust III (8) |

| Class B Common Stock | | | | | | | | 8000000 | I | ECG II SPE, LLC (9) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Class A Units | (1) | 1/11/2021 | | C | | | 62500 | (1) | (1) | Class A Common Stock | 50000 | $0.00 | 58824352 | D | |

| Class A Units | (10) | | | | | | | (10) | (10) | Class A Common Stock | (10) | | 14792526 | I | Ernest Irrevocable 2004 Trust III |

| Class A Units | (11) | | | | | | | (11) | (11) | Class A Common Stock | (11) | | 14940000 | I | Ernest C. Garcia III Multi-Generational Trust III |

| Class A Units | (12) | | | | | | | (12) | (12) | Class A Common Stock | (12) | | 10000000 | I | ECG II SPE, LLC |

| Explanation of Responses: |

| (1) | Reflects the conversion of Class A Common Units ("Class A Units") of Carvana Group, LLC ("Carvana Group") owned directly by Ernest C. Garcia II into shares of Class A Common Stock ("Class A Shares") of the Issuer pursuant to the Exchange Agreement, dated April 27, 2017, by and among the Issuer, Carvana Co. Sub LLC, Carvana Group and the members of Carvana Group (the "Exchange Agreement"). |

| (2) | The sales reported on this Form 4 were effected pursuant to a Rule 10b5-1 trading plan adopted by Ernest C. Garcia II and Elizabeth Joanne Garcia on June 15, 2020, as modified. |

| (3) | Column 4 reflects weighted average prices. Shares were sold in multiple transactions at prices ranging from $266.61-$267.29 inclusive (weighted average of $266.8575); $267.95-$268.57 inclusive (weighted average of $268.1471); $269.16-$270.14 inclusive (weighted average of $269.5608); $270.16-$271.09 inclusive (weighted average of $270.7767); $271.96-$272.955 inclusive (weighted average of $272.5448); $272.99-$273.98 inclusive (weighted average of $273.4699); $274.01-$275.00 inclusive (weighted average of $274.6179); $275.01-$275.99 inclusive (weighted average of $275.2567); $276.12-$277.08 inclusive (weighted average of $276.6807); $277.14-$278.02 inclusive (weighted average of $277.5156); and $278.20-$279.13 inclusive (weighted average of $278.5976), respectively. Reporting person undertakes to provide issuer, a securityholder of the issuer or to SEC staff, upon request, full information regarding the number of shares sold at each separate price within the ranges set forth herein. |

| (4) | These Class A Shares are owned directly by Verde Investments, Inc., an entity which Mr. Garcia wholly owns and controls. |

| (5) | These Class A Shares are owned directly by the Ernest C. Garcia III Multi-Generational Trust III (the "Multi-Generational Trust"). Mr. Garcia has sole investment and dispository power over the Multi-Generational Trust assets and Mr. Garcia's son, Ernie Garcia, III, together with Ernie Garcia, III's children, are the sole beneficiaries of the Multi-Generational Trust. |

| (6) | Reflects the cancellation for no consideration of Class B Common Stock of the Issuer ("Class B Shares") in connection with the conversion of Class A Units into Class A Shares. Following the reported transaction, the remaining Class B Shares are owned directly by Ernest C. Garcia II. |

| (7) | These Class B Shares are owned directly by the Ernest Irrevocable 2004 Trust III (the "2004 Trust"). Mr. Garcia has shared investment and dispository power over the 2004 Trust assets and Mr. Garcia's son, Ernie Garcia, III, is the sole beneficiary of the 2004 Trust. |

| (8) | These Class B Shares are owned directly by the Multi-Generational Trust. |

| (9) | These Class B Shares are owned directly by ECG II SPE, LLC ("E-SPE"), an entity which Mr. Garcia wholly owns and controls. |

| (10) | These Class A Units are owned directly by the 2004 Trust and are exchangeable for 0.8 Class A Shares pursuant to the Exchange Agreement. |

| (11) | These Class A Units are owned directly by the Multi-Generational Trust and are exchangeable for 0.8 Class A Shares pursuant to the Exchange Agreement. |

| (12) | These Class A Units are owned directly by E-SPE and are exchangeable for 0.8 Class A Shares pursuant to the Exchange Agreement. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

GARCIA ERNEST C. II

1720 W. RIO SALADO PARKWAY, SUITE A

TEMPE, AZ 85281 |

| X |

|

|

VERDE INVESTMENTS, INC.

1720 W. RIO SALADO PARKWAY, SUITE A

TEMPE, AZ 85281 |

| X |

|

|

Signatures

|

| /s/ Ernest C. Garcia II | | 1/13/2021 |

| **Signature of Reporting Person | Date |

| /s/ Ernest C. Garcia II, Verde Investments, Inc. | | 1/13/2021 |

| **Signature of Reporting Person | Date |

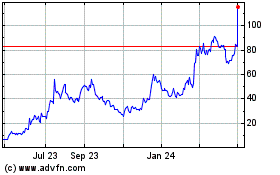

Carvana (NYSE:CVNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

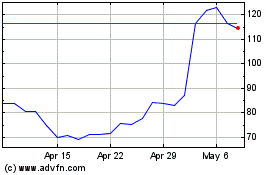

Carvana (NYSE:CVNA)

Historical Stock Chart

From Apr 2023 to Apr 2024