Carpenter Technology Corporation (NYSE: CRS) (the “Company”) today

announced financial results for the fiscal second quarter ended

December 31, 2022. For the quarter, the Company reported net

income of $6.2 million, or $0.13 earnings per diluted share.

“The second quarter of fiscal year 2023 was a

meaningful step on our path back to pre-pandemic levels and further

long-term growth,” said Tony R. Thene, President and CEO of

Carpenter Technology. “Our return to profitability was driven by

ongoing strong demand in each of our end-use markets, as evidenced

by the continued growth of our backlog, and increased throughput

across our manufacturing facilities.”

“The Specialty Alloys Operations (‘SAO’) segment

demonstrated continued improvement with operating income of $30.3

million for the second quarter of fiscal year 2023. The results for

SAO were driven by the ongoing aerospace ramp and our focus on

increasing our productivity and throughput. The Performance

Engineered Products (‘PEP’) segment had another strong quarter with

operating income of $9.3 million, led by our Dynamet Titanium and

Additive businesses.”

“Looking ahead, we remain confident in our growth

trajectory. We continue to see strong demand across each of our

end-use markets and are focused on driving operational

improvements. As a result, we expect to realize accelerating sales

momentum and improved margins.”

Financial Highlights

| |

|

Q2 |

|

Q2 |

|

Q1 |

|

($ in millions except per share amounts) |

|

FY2023 |

|

FY2022 |

|

FY2023 |

|

Net sales |

|

$ |

579.1 |

|

|

$ |

396.0 |

|

|

$ |

522.9 |

|

| Net sales

excluding surcharge (a) |

|

$ |

420.8 |

|

|

$ |

314.9 |

|

|

$ |

375.7 |

|

| Operating

income (loss) |

|

$ |

22.6 |

|

|

$ |

(31.5 |

) |

|

$ |

8.3 |

|

| Adjusted

operating income (loss) excluding special item (a) |

|

$ |

22.6 |

|

|

$ |

(29.8 |

) |

|

$ |

8.3 |

|

| Net income

(loss) |

|

$ |

6.2 |

|

|

$ |

(29.4 |

) |

|

$ |

(6.9 |

) |

| Earnings

(loss) per share |

|

$ |

0.13 |

|

|

$ |

(0.61 |

) |

|

$ |

(0.14 |

) |

| Adjusted

earnings (loss) per share (a) |

|

$ |

0.13 |

|

|

$ |

(0.58 |

) |

|

$ |

(0.14 |

) |

| Net cash

used for operating activities |

|

$ |

(86.4 |

) |

|

$ |

(89.2 |

) |

|

$ |

(78.0 |

) |

| Free cash

flow (a) |

|

$ |

(113.7 |

) |

|

$ |

(116.3 |

) |

|

$ |

(101.3 |

) |

| |

|

|

|

|

|

|

| (a) Non-GAAP financial

measures explained in the attached tables |

| |

Net sales for the second quarter of fiscal year

2023 were $579.1 million, compared with $396.0 million in the

second quarter of fiscal year 2022, an increase of $183.1 million

(or 46 percent), on a 17 percent increase in shipment volume. Net

sales excluding surcharge were $420.8 million, an increase of

$105.9 million (or 34 percent) from the same period a year ago.

Operating income was $22.6 million compared to

operating loss of $31.5 million in the prior year period. Earnings

per share in the second quarter of fiscal year 2023 was $0.13

compared to loss of $0.61 per share in the prior year quarter.

Excluding the special item, adjusted earnings per share in the

second quarter of fiscal year 2022 was loss of $0.58. The

improvement in operating income and earnings per share is primarily

the result of increased shipments as activity levels continued to

ramp to meet improving market conditions in key end-use markets

compared to the prior year period.

Cash used for operating activities in the second

quarter of fiscal year 2023 was $86.4 million compared to $89.2

million in the same quarter last year. Free cash flow in the second

quarter of fiscal year 2023 was negative $113.7 million, compared

to negative $116.3 million in the same quarter last year. The

operating cash flow and free cash flow performance in the second

quarter of fiscal year 2023 reflects improved earnings offset by

higher cash used for inventory to meet growing demand. Capital

expenditures in the second quarter of fiscal year 2023 were $17.5

million, compared to $19.1 million in the same quarter last

year.

Total liquidity, including cash and available

revolver balance, was $237.0 million at the end of the second

quarter of fiscal year 2023. This consisted of $20.0 million of

cash and $217.0 million of available borrowing under the Company’s

credit facility.

Conference Call and Webcast

Presentation

Carpenter Technology will host a conference call

and webcast presentation today, January 26, 2023, at 10:00 a.m. ET,

to discuss the financial results of operations for the second

quarter of fiscal year 2023. Please dial +1 412-317-9259 for access

to the live conference call. Access to the live webcast will be

available at Carpenter Technology’s website

(http://www.carpentertechnology.com), and a replay will soon be

made available at http://www.carpentertechnology.com. Presentation

materials used during this conference call will be available for

viewing and download at http://www.carpentertechnology.com.

Non-GAAP Financial Measures

This press release includes discussions of

financial measures that have not been determined in accordance with

U.S. Generally Accepted Accounting Principles (GAAP). A

reconciliation of the non-GAAP financial measures to their most

directly comparable financial measures prepared in accordance with

GAAP, accompanied by reasons why the Company believes the non-GAAP

measures are important, are included in the attached schedules.

About Carpenter Technology

Carpenter Technology Corporation is a recognized

leader in high-performance specialty alloy-based materials and

process solutions for critical applications in the aerospace,

defense, medical, transportation, energy, industrial and consumer

electronics markets. Founded in 1889, Carpenter Technology has

evolved to become a pioneer in premium specialty alloys, including

titanium, nickel, and cobalt, as well as alloys specifically

engineered for additive manufacturing (AM) processes and soft

magnetics applications. Carpenter Technology has expanded its AM

capabilities to provide a complete “end-to-end” solution to

accelerate materials innovation and streamline parts production.

More information about Carpenter Technology can be found at

www.carpentertechnology.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Act of 1995. These forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ from

those projected, anticipated or implied. The most significant of

these uncertainties are described in Carpenter Technology’s filings

with the Securities and Exchange Commission, including its report

on Form 10-K for the fiscal year ended June 30, 2022, Form 10-Q for

the quarter ended September 30, 2022, and the exhibits attached to

those filings. They include but are not limited to: (1) the

cyclical nature of the specialty materials business and certain

end-use markets, including aerospace, defense, medical,

transportation, energy, industrial and consumer, or other

influences on Carpenter Technology’s business such as new

competitors, the consolidation of competitors, customers, and

suppliers or the transfer of manufacturing capacity from the United

States to foreign countries; (2) the ability of Carpenter

Technology to achieve cash generation, growth, earnings,

profitability, operating income, cost savings and reductions,

qualifications, productivity improvements or process changes; (3)

the ability to recoup increases in the cost of energy, raw

materials, freight or other factors; (4) domestic and foreign

excess manufacturing capacity for certain metals; (5) fluctuations

in currency exchange rates; (6) the effect of government trade

actions; (7) the valuation of the assets and liabilities in

Carpenter Technology’s pension trusts and the accounting for

pension plans; (8) possible labor disputes or work stoppages; (9)

the potential that our customers may substitute alternate materials

or adopt different manufacturing practices that replace or limit

the suitability of our products; (10) the ability to successfully

acquire and integrate acquisitions; (11) the availability of credit

facilities to Carpenter Technology, its customers or other members

of the supply chain; (12) the ability to obtain energy or raw

materials, especially from suppliers located in countries that may

be subject to unstable political or economic conditions; (13)

Carpenter Technology’s manufacturing processes are dependent upon

highly specialized equipment located primarily in facilities in

Reading and Latrobe, Pennsylvania and Athens, Alabama for which

there may be limited alternatives if there are significant

equipment failures or a catastrophic event; (14) the ability to

hire and retain key personnel, including members of the executive

management team, management, metallurgists and other skilled

personnel; (15) fluctuations in oil and gas prices and production;

(16) uncertainty regarding the return to service of the Boeing 737

MAX aircraft and the related supply chain disruption; (17)

potential impacts of the COVID-19 pandemic on our operations,

financial results and financial position; (18) our efforts and

efforts by governmental authorities to mitigate the COVID-19

pandemic, such as travel bans, shelter in place orders and business

closures, and the related impact on resource allocations and

manufacturing and supply chains; (19) our ability to execute our

business continuity, operational, budget and fiscal plans in light

of the COVID-19 pandemic; and (20) our ability to successfully

carry out restructuring and business exit activities on the

expected terms and timelines. Any of these factors could have an

adverse and/or fluctuating effect on Carpenter Technology’s results

of operations. The forward-looking statements in this document are

intended to be subject to the safe harbor protection provided by

Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act

of 1934, as amended. We caution you not to place undue reliance on

forward-looking statements, which speak only as of the date of this

Form 10-K or as of the dates otherwise indicated in such

forward-looking statements. Carpenter Technology undertakes no

obligation to update or revise any forward-looking statements.

PRELIMINARY CONSOLIDATED

STATEMENTS OF OPERATIONS (in millions, except per share

data) (Unaudited)

| |

|

Three Months

Ended |

|

Six Months

Ended |

| |

|

December 31, |

|

December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

NET SALES |

|

$ |

579.1 |

|

$ |

396.0 |

|

|

$ |

1,102.0 |

|

|

$ |

783.6 |

|

| Cost of

sales |

|

|

509.1 |

|

|

382.9 |

|

|

|

977.2 |

|

|

|

745.3 |

|

| Gross

profit |

|

|

70.0 |

|

|

13.1 |

|

|

|

124.8 |

|

|

|

38.3 |

|

| |

|

|

|

|

|

|

|

|

| Selling,

general and administrative expenses |

|

|

47.4 |

|

|

44.6 |

|

|

|

93.9 |

|

|

|

88.9 |

|

| Operating

income (loss) |

|

|

22.6 |

|

|

(31.5 |

) |

|

|

30.9 |

|

|

|

(50.6 |

) |

| |

|

|

|

|

|

|

|

|

| Interest

expense, net |

|

|

13.0 |

|

|

10.1 |

|

|

|

25.6 |

|

|

|

20.3 |

|

| Other

expense (income), net |

|

|

1.9 |

|

|

(6.6 |

) |

|

|

5.4 |

|

|

|

(10.7 |

) |

| |

|

|

|

|

|

|

|

|

| Income

(loss) before income taxes |

|

|

7.7 |

|

|

(35.0 |

) |

|

|

(0.1 |

) |

|

|

(60.2 |

) |

| Income tax

expense (benefit) |

|

|

1.5 |

|

|

(5.6 |

) |

|

|

0.5 |

|

|

|

(16.1 |

) |

| |

|

|

|

|

|

|

|

|

| NET INCOME

(LOSS) |

|

$ |

6.2 |

|

$ |

(29.4 |

) |

|

$ |

(0.6 |

) |

|

$ |

(44.1 |

) |

| |

|

|

|

|

|

|

|

|

| EARNINGS

(LOSS) PER COMMON SHARE: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.13 |

|

$ |

(0.61 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.91 |

) |

| Diluted |

|

$ |

0.13 |

|

$ |

(0.61 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.91 |

) |

| |

|

|

|

|

|

|

|

|

| WEIGHTED

AVERAGE COMMON SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

| Basic |

|

|

48.8 |

|

|

48.6 |

|

|

|

48.7 |

|

|

|

48.5 |

|

| Diluted |

|

|

49.0 |

|

|

48.6 |

|

|

|

48.7 |

|

|

|

48.5 |

|

PRELIMINARY CONSOLIDATED

STATEMENTS OF CASH FLOWS (in millions) (Unaudited)

| |

|

Six Months

Ended |

| |

|

December 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

| OPERATING

ACTIVITIES |

|

|

|

|

|

Net loss |

|

$ |

(0.6 |

) |

|

$ |

(44.1 |

) |

|

Adjustments to reconcile net loss to net cash used for operating

activities: |

|

|

|

|

|

Depreciation and amortization |

|

|

64.8 |

|

|

|

65.3 |

|

|

Deferred income taxes |

|

|

(0.9 |

) |

|

|

(17.6 |

) |

|

Net pension expense (income) |

|

|

9.9 |

|

|

|

(3.6 |

) |

|

Share-based compensation expense |

|

|

7.1 |

|

|

|

5.6 |

|

|

Net loss on disposals of property, plant and equipment |

|

|

0.6 |

|

|

|

0.2 |

|

|

Changes in working capital and other: |

|

|

|

|

|

Accounts receivable |

|

|

(58.5 |

) |

|

|

— |

|

|

Inventories |

|

|

(226.7 |

) |

|

|

(109.8 |

) |

|

Other current assets |

|

|

(4.1 |

) |

|

|

(7.4 |

) |

|

Accounts payable |

|

|

62.1 |

|

|

|

26.9 |

|

|

Accrued liabilities |

|

|

(12.1 |

) |

|

|

(42.9 |

) |

|

Pension plan contributions |

|

|

— |

|

|

|

(0.2 |

) |

|

Other postretirement plan contributions |

|

|

(1.5 |

) |

|

|

(1.9 |

) |

|

Other, net |

|

|

(4.6 |

) |

|

|

(6.8 |

) |

|

Net cash used for operating activities |

|

|

(164.5 |

) |

|

|

(136.3 |

) |

| INVESTING

ACTIVITIES |

|

|

|

|

|

Purchases of property, plant, equipment and software |

|

|

(31.0 |

) |

|

|

(33.4 |

) |

|

Proceeds from disposals of property, plant and equipment and assets

held for sale |

|

|

— |

|

|

|

1.8 |

|

|

Net cash used for investing activities |

|

|

(31.0 |

) |

|

|

(31.6 |

) |

| FINANCING

ACTIVITIES |

|

|

|

|

|

Short-term credit agreement borrowings, net change |

|

|

41.2 |

|

|

|

— |

|

|

Credit agreement borrowings |

|

|

60.1 |

|

|

|

— |

|

|

Credit agreement repayments |

|

|

(20.1 |

) |

|

|

— |

|

|

Dividends paid |

|

|

(19.7 |

) |

|

|

(19.7 |

) |

|

Withholding tax payments on share-based compensation awards |

|

|

(3.4 |

) |

|

|

(3.1 |

) |

|

Net cash provided from (used for) financing activities |

|

|

58.1 |

|

|

|

(22.8 |

) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

3.2 |

|

|

|

0.2 |

|

| DECREASE IN

CASH AND CASH EQUIVALENTS |

|

|

(134.2 |

) |

|

|

(190.5 |

) |

| Cash and

cash equivalents at beginning of year |

|

|

154.2 |

|

|

|

287.4 |

|

| Cash and

cash equivalents at end of period |

|

$ |

20.0 |

|

|

$ |

96.9 |

|

PRELIMINARY CONSOLIDATED

BALANCE SHEETS (in millions) (Unaudited)

| |

|

December 31, |

|

June 30, |

|

|

|

|

2022 |

|

|

|

2022 |

|

| ASSETS |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

20.0 |

|

|

$ |

154.2 |

|

|

Accounts receivable, net |

|

|

441.6 |

|

|

|

382.3 |

|

|

Inventories |

|

|

722.7 |

|

|

|

496.1 |

|

|

Other current assets |

|

|

99.1 |

|

|

|

86.8 |

|

|

Total current assets |

|

|

1,283.4 |

|

|

|

1,119.4 |

|

| Property,

plant and equipment, net |

|

|

1,390.5 |

|

|

|

1,420.8 |

|

|

Goodwill |

|

|

241.4 |

|

|

|

241.4 |

|

| Other

intangibles, net |

|

|

31.7 |

|

|

|

35.2 |

|

| Deferred

income taxes |

|

|

5.2 |

|

|

|

5.7 |

|

| Other

assets |

|

|

104.3 |

|

|

|

109.8 |

|

|

Total assets |

|

$ |

3,056.5 |

|

|

$ |

2,932.3 |

|

| |

|

|

|

|

|

LIABILITIES |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Short-term credit agreement borrowings |

|

$ |

81.2 |

|

|

$ |

— |

|

|

Accounts payable |

|

|

304.7 |

|

|

|

242.1 |

|

|

Accrued liabilities |

|

|

124.4 |

|

|

|

133.5 |

|

|

Total current liabilities |

|

|

510.3 |

|

|

|

375.6 |

|

| Long-term

debt |

|

|

692.4 |

|

|

|

691.8 |

|

| Accrued

pension liabilities |

|

|

199.4 |

|

|

|

196.6 |

|

| Accrued

postretirement benefits |

|

|

78.3 |

|

|

|

77.4 |

|

| Deferred

income taxes |

|

|

162.0 |

|

|

|

162.4 |

|

| Other

liabilities |

|

|

93.0 |

|

|

|

98.0 |

|

|

Total liabilities |

|

|

1,735.4 |

|

|

|

1,601.8 |

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

| Common

stock |

|

|

280.1 |

|

|

|

280.1 |

|

| Capital in

excess of par value |

|

|

315.3 |

|

|

|

320.3 |

|

| Reinvested

earnings |

|

|

1,190.7 |

|

|

|

1,211.0 |

|

| Common stock

in treasury, at cost |

|

|

(298.4 |

) |

|

|

(307.4 |

) |

| Accumulated

other comprehensive loss |

|

|

(166.6 |

) |

|

|

(173.5 |

) |

|

Total stockholders’ equity |

|

|

1,321.1 |

|

|

|

1,330.5 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

3,056.5 |

|

|

$ |

2,932.3 |

|

PRELIMINARY SEGMENT

FINANCIAL DATA (in millions, except pounds sold)

(Unaudited)

| |

Three Months

Ended |

|

Six Months

Ended |

| |

December 31, |

|

December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Pounds sold

(000): |

|

|

|

|

|

|

|

|

Specialty Alloys Operations |

|

49,442 |

|

|

|

43,248 |

|

|

|

94,006 |

|

|

|

86,256 |

|

|

Performance Engineered Products |

|

2,978 |

|

|

|

2,776 |

|

|

|

5,304 |

|

|

|

5,148 |

|

|

Intersegment |

|

(1,920 |

) |

|

|

(2,942 |

) |

|

|

(3,920 |

) |

|

|

(4,792 |

) |

|

Consolidated pounds sold |

|

50,500 |

|

|

|

43,082 |

|

|

|

95,390 |

|

|

|

86,612 |

|

| |

|

|

|

|

|

|

|

| Net

sales: |

|

|

|

|

|

|

|

|

Specialty Alloys Operations |

|

|

|

|

|

|

|

|

Net sales excluding surcharge |

$ |

346.2 |

|

|

$ |

251.6 |

|

|

$ |

651.9 |

|

|

$ |

509.8 |

|

|

Surcharge |

|

149.6 |

|

|

|

79.2 |

|

|

|

291.3 |

|

|

|

153.0 |

|

|

Specialty Alloys Operations net sales |

|

495.8 |

|

|

|

330.8 |

|

|

|

943.2 |

|

|

|

662.8 |

|

| |

|

|

|

|

|

|

|

|

Performance Engineered Products |

|

|

|

|

|

|

|

|

Net sales excluding surcharge |

|

98.0 |

|

|

|

83.8 |

|

|

|

185.6 |

|

|

|

157.4 |

|

|

Surcharge |

|

8.7 |

|

|

|

1.9 |

|

|

|

14.4 |

|

|

|

2.9 |

|

|

Performance Engineered Products net sales |

|

106.7 |

|

|

|

85.7 |

|

|

|

200.0 |

|

|

|

160.3 |

|

| |

|

|

|

|

|

|

|

|

Intersegment |

|

|

|

|

|

|

|

|

Net sales excluding surcharge |

|

(23.4 |

) |

|

|

(20.5 |

) |

|

|

(41.0 |

) |

|

|

(39.4 |

) |

|

Surcharge |

|

— |

|

|

|

— |

|

|

|

(0.2 |

) |

|

|

(0.1 |

) |

|

Intersegment net sales |

|

(23.4 |

) |

|

|

(20.5 |

) |

|

|

(41.2 |

) |

|

|

(39.5 |

) |

| |

|

|

|

|

|

|

|

|

Consolidated net sales |

$ |

579.1 |

|

|

$ |

396.0 |

|

|

$ |

1,102.0 |

|

|

$ |

783.6 |

|

| |

|

|

|

|

|

|

|

| Operating

income (loss): |

|

|

|

|

|

|

|

|

Specialty Alloys Operations |

$ |

30.3 |

|

|

$ |

(20.3 |

) |

|

$ |

50.2 |

|

|

$ |

(26.2 |

) |

|

Performance Engineered Products |

|

9.3 |

|

|

|

3.0 |

|

|

|

15.6 |

|

|

|

3.6 |

|

|

Corporate |

|

(16.4 |

) |

|

|

(14.5 |

) |

|

|

(33.5 |

) |

|

|

(28.6 |

) |

|

Intersegment |

|

(0.6 |

) |

|

|

0.3 |

|

|

|

(1.4 |

) |

|

|

0.6 |

|

|

Consolidated operating income (loss) |

$ |

22.6 |

|

|

$ |

(31.5 |

) |

|

$ |

30.9 |

|

|

$ |

(50.6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Company has two reportable segments, Specialty

Alloys Operations (“SAO”) and Performance Engineered Products

(“PEP”).

The SAO segment is comprised of Carpenter’s major

premium alloy and stainless steel manufacturing operations. This

includes operations performed at mills primarily in Reading and

Latrobe, Pennsylvania and surrounding areas as well as South

Carolina and Alabama.

The PEP segment is comprised of the Company’s

differentiated operations. This segment includes the Dynamet

titanium business, the Carpenter Additive business and the Latrobe

and Mexico distribution businesses. The businesses in the PEP

segment are managed with an entrepreneurial structure to promote

flexibility and agility to quickly respond to market dynamics. It

is our belief this model will ultimately drive overall revenue and

profit growth. The pounds sold data above for the PEP segment

includes only the Dynamet and Additive businesses.

Corporate costs are comprised of executive and

director compensation, and other corporate facilities and

administrative expenses not allocated to the segments. Also

included are items that management considers not representative of

ongoing operations and other specifically-identified income or

expense items.

The service cost component of net pension expense,

which represents the estimated cost of future pension liabilities

earned associated with active employees, is included in the

operating results of the business segments. The residual net

pension expense is comprised of the expected return on plan assets,

interest costs on the projected benefit obligations of the plans,

and amortization of actuarial gains and losses and prior service

costs and is included in other expense (income), net.

PRELIMINARY NON-GAAP

FINANCIAL MEASURES (in millions, except per share data)

(Unaudited)

| |

|

Three Months

Ended |

|

Six Months

Ended |

| |

|

December 31, |

|

December 31, |

|

ADJUSTED OPERATING MARGIN EXCLUDING SURCHARGE REVENUE AND SPECIAL

ITEM |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

| Net

sales |

|

$ |

579.1 |

|

|

$ |

396.0 |

|

|

$ |

1,102.0 |

|

|

$ |

783.6 |

|

| Less:

surcharge revenue |

|

|

158.3 |

|

|

|

81.1 |

|

|

|

305.5 |

|

|

|

155.8 |

|

| Net sales

excluding surcharge revenue |

|

$ |

420.8 |

|

|

$ |

314.9 |

|

|

$ |

796.5 |

|

|

$ |

627.8 |

|

| |

|

|

|

|

|

|

|

|

| Operating

income (loss) |

|

$ |

22.6 |

|

|

$ |

(31.5 |

) |

|

$ |

30.9 |

|

|

$ |

(50.6 |

) |

| Special

item: |

|

|

|

|

|

|

|

|

|

COVID-19 costs |

|

|

— |

|

|

|

1.7 |

|

|

|

— |

|

|

|

3.3 |

|

| Adjusted

operating income (loss) |

|

$ |

22.6 |

|

|

$ |

(29.8 |

) |

|

$ |

30.9 |

|

|

$ |

(47.3 |

) |

| |

|

|

|

|

|

|

|

|

| Operating

margin |

|

|

3.9 |

% |

|

(8.0 |

)% |

|

|

2.8 |

% |

|

(6.5 |

)% |

| |

|

|

|

|

|

|

|

|

| Adjusted

operating margin excluding surcharge revenue and special item |

|

|

5.4 |

% |

|

(9.5 |

)% |

|

|

3.9 |

% |

|

(7.5 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Management believes that removing the impact of

raw material surcharge from operating margin provides a more

consistent basis for comparing results of operations from period to

period, thereby permitting management to evaluate performance and

investors to make decisions based on the ongoing operations of the

Company. In addition, management believes that excluding the impact

of special items from operating margin is helpful in analyzing the

operating performance of the Company, as these items are not

indicative of ongoing operating performance. Management uses its

results excluding these amounts to evaluate its operating

performance and to discuss its business with investment

institutions, the Company’s board of directors and others.

|

ADJUSTED EARNINGS PER SHARE EXCLUDING SPECIAL ITEM |

|

Income Before Income Taxes |

|

Income Tax Expense |

|

Net Income |

|

Earnings Per Diluted Share* |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, 2022, as reported |

|

$ |

7.7 |

|

$ |

(1.5 |

) |

|

$ |

6.2 |

|

$ |

0.13 |

| |

|

|

|

|

|

|

|

|

| Special

item: |

|

|

|

|

|

|

|

|

|

None reported |

|

|

— |

|

|

— |

|

|

|

— |

|

|

— |

| |

|

|

|

|

|

|

|

|

| Three Months

Ended December 31, 2022, as adjusted |

|

$ |

7.7 |

|

$ |

(1.5 |

) |

|

$ |

6.2 |

|

$ |

0.13 |

| |

|

|

|

|

|

|

|

|

| * Impact per diluted

share calculated using weighted average common shares outstanding

of 49.0 million for the three months ended December 31,

2022. |

|

ADJUSTED LOSS PER SHARE EXCLUDING SPECIAL ITEM |

|

Loss Before Income Taxes |

|

Income Tax Benefit |

|

Net Loss |

|

Loss Per Diluted Share* |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, 2021, as reported |

|

$ |

(35.0 |

) |

|

$ |

5.6 |

|

|

$ |

(29.4 |

) |

|

$ |

(0.61 |

) |

| |

|

|

|

|

|

|

|

|

| Special

item: |

|

|

|

|

|

|

|

|

|

COVID-19 costs |

|

|

1.7 |

|

|

|

(0.3 |

) |

|

|

1.4 |

|

|

|

0.03 |

|

| |

|

|

|

|

|

|

|

|

| Three Months

Ended December 31, 2021, as adjusted |

|

$ |

(33.3 |

) |

|

$ |

5.3 |

|

|

$ |

(28.0 |

) |

|

$ |

(0.58 |

) |

| |

|

|

|

|

|

|

|

|

| * Impact per diluted

share calculated using weighted average common shares outstanding

of 48.6 million for the three months ended December 31,

2021. |

|

ADJUSTED LOSS PER SHARE EXCLUDING SPECIAL ITEM |

|

Loss Before Income Taxes |

|

Income Tax Expense |

|

Net Loss |

|

Loss Per Diluted Share* |

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended December 31, 2022, as reported |

|

$ |

(0.1 |

) |

|

$ |

(0.5 |

) |

|

$ |

(0.6 |

) |

|

$ |

(0.02 |

) |

| |

|

|

|

|

|

|

|

|

| Special

item: |

|

|

|

|

|

|

|

|

|

None reported |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Six Months

Ended December 31, 2022, as adjusted |

|

$ |

(0.1 |

) |

|

$ |

(0.5 |

) |

|

$ |

(0.6 |

) |

|

$ |

(0.02 |

) |

| |

|

|

|

|

|

|

|

|

| * Impact per diluted

share calculated using weighted average common shares outstanding

of 48.7 million for the six months ended December 31,

2022. |

|

ADJUSTED LOSS PER SHARE EXCLUDING SPECIAL ITEM |

|

Loss Before Income Taxes |

|

Income Tax Benefit |

|

Net Loss |

|

Loss Per Diluted Share* |

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended December 31, 2021, as reported |

|

$ |

(60.2 |

) |

|

$ |

16.1 |

|

|

$ |

(44.1 |

) |

|

$ |

(0.91 |

) |

| |

|

|

|

|

|

|

|

|

| Special

item: |

|

|

|

|

|

|

|

|

|

COVID-19 costs |

|

|

3.3 |

|

|

|

(0.8 |

) |

|

|

2.5 |

|

|

|

0.05 |

|

| |

|

|

|

|

|

|

|

|

| Six Months

Ended December 31, 2021, as adjusted |

|

$ |

(56.9 |

) |

|

$ |

15.3 |

|

|

$ |

(41.6 |

) |

|

$ |

(0.86 |

) |

| |

|

|

|

|

|

|

|

|

| * Impact per diluted

share calculated using weighted average common shares outstanding

of 48.5 million for the six months ended December 31,

2021. |

| |

Management believes that earnings (loss) per share

adjusted to exclude the impact of the special items is helpful in

analyzing the operating performance of the Company, as these items

are not indicative of ongoing operating performance. Management

uses its results excluding these amounts to evaluate its operating

performance and to discuss its business with investment

institutions, the Company’s board of directors and others.

| |

|

Three Months

Ended |

|

Six Months

Ended |

| |

|

December 31, |

|

December 31, |

|

FREE CASH FLOW |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Net cash used for operating activities |

|

$ |

(86.4 |

) |

|

$ |

(89.2 |

) |

|

$ |

(164.5 |

) |

|

$ |

(136.3 |

) |

|

Purchases of property, plant, equipment and software |

|

|

(17.5 |

) |

|

|

(19.1 |

) |

|

|

(31.0 |

) |

|

|

(33.4 |

) |

|

Proceeds from disposals of property, plant and equipment and assets

held for sale |

|

|

— |

|

|

|

1.8 |

|

|

|

— |

|

|

|

1.8 |

|

|

Dividends paid |

|

|

(9.8 |

) |

|

|

(9.8 |

) |

|

|

(19.7 |

) |

|

|

(19.7 |

) |

| |

|

|

|

|

|

|

|

|

|

Free cash flow |

|

$ |

(113.7 |

) |

|

$ |

(116.3 |

) |

|

$ |

(215.2 |

) |

|

$ |

(187.6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management believes that the free cash flow

measure provides useful information to investors regarding the

Company’s financial condition because it is a measure of cash

generated which management evaluates for alternative uses.

PRELIMINARY SUPPLEMENTAL

SCHEDULE (in millions) (Unaudited)

| |

|

Three Months

Ended |

|

Six Months

Ended |

| |

|

December 31, |

|

December 31, |

| NET SALES BY

END-USE MARKET |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

| End-Use

Market Excluding Surcharge Revenue: |

|

|

|

|

|

|

|

|

|

Aerospace and Defense |

|

$ |

200.4 |

|

$ |

134.0 |

|

$ |

383.8 |

|

$ |

268.8 |

|

Medical |

|

|

62.7 |

|

|

40.4 |

|

|

112.5 |

|

|

77.4 |

|

Transportation |

|

|

27.3 |

|

|

28.5 |

|

|

51.0 |

|

|

60.0 |

|

Energy |

|

|

22.6 |

|

|

16.0 |

|

|

40.9 |

|

|

32.2 |

|

Industrial and Consumer |

|

|

78.6 |

|

|

66.4 |

|

|

147.0 |

|

|

132.7 |

|

Distribution |

|

|

29.2 |

|

|

29.6 |

|

|

61.3 |

|

|

56.7 |

| |

|

|

|

|

|

|

|

|

| Total net

sales excluding surcharge revenue |

|

|

420.8 |

|

|

314.9 |

|

|

796.5 |

|

|

627.8 |

| |

|

|

|

|

|

|

|

|

| Surcharge

revenue |

|

|

158.3 |

|

|

81.1 |

|

|

305.5 |

|

|

155.8 |

| |

|

|

|

|

|

|

|

|

| Total net

sales |

|

$ |

579.1 |

|

$ |

396.0 |

|

$ |

1,102.0 |

|

$ |

783.6 |

| Media

Inquiries: |

Investor

Inquiries: |

| Heather Beardsley |

The Plunkett Group |

| +1 610-208-2278 |

Brad Edwards |

| hbeardsley@cartech.com |

+1 914-582-4187 |

| |

brad@theplunkettgroup.com |

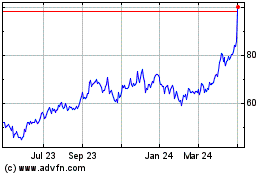

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

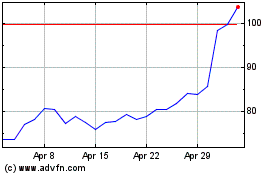

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024