By Julie Bykowicz and Ted Mann | Photographs by Octavio Jones for The Wall Street Journal

PORT CANAVERAL, Fla. -- Terminal Three, a cavernous $155 million

structure built for Carnival Cruises, is decked out with the

company's signature blue paint, hundreds of beechwood seats and a

posh VIP room with table lamps so new that sales tags still hang

from some.

It sits empty, near vast, vacant parking lots and fleets of idle

shuttle buses. Sparsely populated hotels and restaurants surround

what was once the world's second-busiest cruising port. Waylaid

port workers scrape by on a mix of low-paying odd jobs and

government help.

"I never thought I would be standing in a food line for hours,"

said James Cox, a 50-year-old porter, who used to earn $27 an hour

wrangling passengers and their luggage. "Just the degradation of

it. You say to yourself, 'Wow, I am really at this point.' "

Like the rest of the maritime tourism industry, Port Canaveral

was mothballed at the start of the coronavirus pandemic. One year

on, as other parts of the economy blink back to life, the U.S.

cruise industry is waiting anxiously for Washington's go-ahead to

sail again -- and worried that a second summer season is about to

be lost.

Other countries including Singapore, Italy and the U.K. have

authorized cruises or set a clear target date for them to set sail.

Almost 400,000 passengers have sailed since some countries first

began allowing cruises in July 2020, according to the industry's

trade group.

But to get started in the U.S., the cruise industry needs

direction from the Centers for Disease Control and Prevention.

The CDC lifted its no-sail order in October and replaced it with

a conditional set of rules; industry officials say the 40 pages of

rules are either indecipherable or impractical, such as a measure

requiring cruise lines to conduct "simulated voyages" with

volunteer passengers.

"I refer to it as the 'impossible-to-sail order' because no

business could operate profitably," Capt. John Murray, Port

Canaveral's chief executive officer, said.

The CDC said guidance is coming soon. "Future orders and

technical instructions will address additional activities to help

cruise lines prepare for and return to passenger operations in a

manner that mitigates Covid-19 risk among passengers, crew

members," spokesman Jason McDonald said in a statement, declining

to comment further.

A White House spokesman didn't respond to a request for

comment.

The order was written before vaccines were approved, and the CDC

hasn't said whether it will revise the guidance to incorporate

vaccinated crew and passengers.

Without CDC direction, cruise lines can't begin the monthslong

process of implementing safety measures and recalling thousands of

workers from around the world, industry officials said.

Washington's hesitancy may in part reflect the cruise industry's

troubles at the beginning of the pandemic.

Cruise lines continued sailing despite known risks from the

coronavirus, an investigation by The Wall Street Journal found.

Ports refused entry to ships with passengers sick with Covid-19,

and giant vessels were stuck at sea.

As the U.S. rollout of Covid-19 vaccines picks up, President

Biden is predicting a return to a sense of normalcy by July. Theme

parks, casinos, airlines and hotels all are operating with

restrictions and safety measures, and the cruise industry says it

can do the same.

"I hate to speculate, but I think CDC looks at it and feels

like, 'Is this a risk we really need to take?' " said Brian

Salerno, senior vice president of global maritime policy at Cruise

Lines International Association, the cruise industry's main trade

group. "To have an industry sidelined like this, based on a bad

perception, is a lot to ask."

Competitors are taking advantage of the vacuum. Hong Kong-based

Genting Cruise Lines said in a March 12 financial filing that

Crystal Serenity would begin sailing from the Bahamas in July,

disembarking in the Americas -- but bypassing U.S. and CDC

jurisdiction. One week later, Royal Caribbean Group said it would

send its own cruise out of Nassau in June, similarly avoiding U.S

ports.

Alaska-bound cruises face an extra hurdle. Most of those ships

are foreign-flagged, so they would have to make a stop in Canada,

because U.S. law forbids such ships from carrying passengers

between U.S. ports. The problem: Canada has banned cruises until

February 2022.

About 60% of all visitors to Alaska arrived by cruise ship in

2019, according to an October Federal Maritime Commission

report.

Alaska's Republican Sens. Dan Sullivan and Lisa Murkowski have

asked the Canadian government to reconsider its ban and introduced

legislation to allow Alaska-bound cruise ships to bypass Canada.

Either plan is predicated on the CDC allowing the resumption of

cruises.

"The CDC -- best scientists in the world. What they are not

designed for is to be a regulator of tourism in America. They're

not good at that," Mr. Sullivan said in an interview. Despite his

office's near-daily outreach to the agency, he said, "they don't

have answers."

The pandemic wiped out, at least temporarily, what was a growth

industry. In 2019, about 14 million cruise-goers departed from the

U.S., generating a record $55.5 billion for the U.S. economy and

supporting more than 436,000 U.S. jobs, according to the cruise

lines association.

The industry's "Big 3" -- global cruise line operators Carnival

Corp., Royal Caribbean and Norwegian Cruise Line Holdings Ltd. --

took major financial hits.

With revenue deeply depressed over the course of 2020, the

companies raised cash with huge bond and stock issues, according to

industry analysts and corporate filings. The big three have told

investors they have enough cash on hand to make it to the 2022

cruising season.

They also have aggressively pared expenses, furloughed workers

and in some cases sold off older, less-efficient ships, which

aren't as profitable to operate.

Even standing still is expensive. Carnival Corp. told investors

in February that it expected to burn through an average of $600

million in cash a month just to keep vessels maintained, sustain

corporate operations and invest in preparations to return to

sea.

"There's been an extraordinary amount of borrowing over the last

year that's happened in the industry," said Melissa Long, a

director at Standard & Poor's who covers the cruise

industry.

The trade group and cruise lines spent $4.4 million on federal

lobbyists last year, the industry's largest such investment since

2008, the start of the last recession, according to lobbying

records.

Carnival Corp. CEO Arnold Donald told investors in January that

the company and its rivals are in "constant communication" with

federal officials, including the CDC, about the reopening

process.

Cruise-related businesses, including ports, say they have been

trying to call Washington's attention to their plight over the past

year, pressing lawmakers and administration officials.

Unions representing port workers on both coasts say workers have

lost hundreds of thousands of hours since the pandemic hit.

In Port Canaveral, Phil Charlton, who has worked in the industry

since 1985, has taken a part-time flower delivery job along with

his wife, Olivia, also a port employee. Bob Baugher, who owns

hotels and transit buses in the area, said his businesses lost $16

million in revenue last year.

Almost 5 million passengers passed through Port Canaveral in

2019, making it second to only Miami for cruising activity. Many

U.S. ports are a mix of cruise and cargo, but here the cruise side

usually makes up about 80% of revenue.

Now, passenger-less vessels pull into the terminal a few times a

month for supplies and maintenance. None of the skeleton crew is

allowed ashore. On a recent March afternoon, the Disney Fantasy

blared a few melancholy strains of "When You Wish Upon a Star" as

it passed by Port Canaveral's Jetty Park.

Mike Horan is monitoring cruise-related Facebook pages for any

sign that his moribund shuttle business might soon be revived.

"That's our port," he wrote on his Facebook page recently,

sharing a photo of a docked ghost ship. "Cruise ships are now just

decorations."

Write to Julie Bykowicz at julie.bykowicz@wsj.com and Ted Mann

at ted.mann@wsj.com

(END) Dow Jones Newswires

March 22, 2021 05:44 ET (09:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

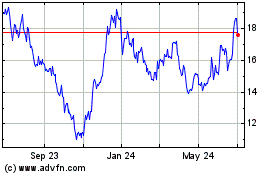

Carnival (NYSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

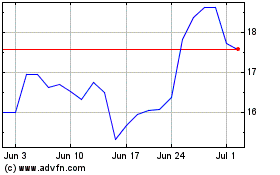

Carnival (NYSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024