CarMax, Inc. (NYSE:KMX) today reported results for the third

quarter ended November 30, 2022.

Highlights:

- Net revenues of $6.5 billion, down 23.7% compared with the

prior year third quarter.

- Total retail used units sold decreased 20.8%, while used unit

sales in comparable stores were down 22.4%; strength in margin

management delivered solid gross profit per retail used unit of

$2,237, in line with the prior year third quarter.

- Total wholesale units sold decreased 36.7%; despite a decrease

of $165 per unit from the record prior year third quarter,

wholesale gross profit per unit remained strong at $966. Both

volume and margins were impacted by steep market depreciation as

well as retail selectivity.

- Bought 238,000 vehicles from consumers and dealers, down 39.8%

versus last year’s record third quarter, due to steep market

depreciation and our response to deliberately slow buys.

- CarMax Auto Finance (CAF) income of $152.2 million, down 8.3%

from the prior year third quarter due to compression in the net

interest margin percentage and a higher provision for loan losses,

primarily driven by the expansion of Tier 2 and Tier 3 originations

within CAF’s portfolio, partially offset by an increase in average

managed receivables.

- Completed the nationwide rollout of our industry-leading,

multi-lender pre-qualification finance experience.

- SG&A of $591.7 million increased 2.7% or $15.8 million from

last year’s third quarter. In the prior year’s third quarter, we

received a $22.6 million settlement from a class action lawsuit.

Adjusting for that settlement, SG&A expenses would have

declined 1.1% year-over-year.

- Took deliberate actions in response to the current market

conditions by reducing SG&A, increasing the mix of older retail

vehicles sold, increasing CAF rates, reducing planned capital

expenditures, and prudently managing our capital structure,

including pausing share buybacks.

- Net earnings per diluted share of $0.24, down from $1.63 a year

ago.

CEO Commentary: “In response

to the ongoing pressures across the used car industry, we have

taken deliberate steps to support our business for both the

near-term and the long-term. We are managing our business

prudently, and prioritizing initiatives that reduce costs, unlock

operating efficiencies, profitably grow market share and create

better experiences for our associates and customers,” said Bill

Nash, president and chief executive officer. “As the market leader,

we have spent almost thirty years building a diversified business

that can profitably navigate the ups and downs of the used car

industry. We believe we are well positioned to effectively manage

through this cycle.”

Third Quarter Business Performance

Review:

Sales. Combined retail and

wholesale used vehicle unit sales were 298,807, a decrease of 28%

from the prior year’s third quarter. Online retail sales(1)

accounted for 12% of retail unit sales, compared with 9% in the

third quarter of last year. Revenue from online transactions(2),

including retail and wholesale unit sales, was $1.8 billion, or

approximately 28% of net revenues, a decline from 30% of net

revenues in last year’s third quarter.

Total retail used vehicle unit sales declined 20.8% to 180,050

and comparable store used unit sales declined 22.4% from the prior

year’s third quarter. We believe vehicle affordability challenges

continued to impact our third quarter unit sales performance, as

headwinds remain due to widespread inflationary pressures, climbing

interest rates, and low consumer confidence. External title data

indicates that we gained market share on a year-to-date basis

through October, though we’ve seen some recent loss of share. We

are focused on profitable market share gains that can be sustained

for the long-term. Total retail used vehicle revenues decreased

19.1% compared with the prior year’s third quarter, driven by the

decrease in retail used units sold as the average retail selling

price was up $535 per unit or 1.9% compared to the prior year.

Total wholesale vehicle unit sales decreased 36.7% to 118,757

versus the prior year’s third quarter. Wholesale volume was

negatively impacted by the rapidly changing market conditions and

retail selectivity, our decision to shift some units from wholesale

to retail to meet consumer demand for lower priced vehicles. Total

wholesale revenues decreased 40.1% compared with the prior year’s

third quarter due to the decrease in wholesale units sold and a

decrease in the average wholesale selling price by almost $600 per

unit, or 6.0%.

We bought 238,000 vehicles from consumers and dealers, down

39.8% versus last year’s record third quarter due to steep market

depreciation and our response to deliberately slow buys. 224,000 of

these vehicles were bought from consumers, down 41.6% over last

year’s record results. The remaining 14,000 of these vehicles were

bought through MaxOffer, our digital appraisal product for dealers,

up 15.8% over last year’s third quarter.

Other sales and revenues declined by 12.2% compared with the

third quarter of fiscal 2022, representing a decrease of $20.7

million. The decrease was primarily driven by a $14.8 million

decline in extended protection plan (EPP) revenues reflecting the

combined effects of the decline in retail unit sales, stronger

margins, favorable year-over-year return reserve adjustment and

stable penetration.

Gross Profit. Total gross

profit was $576.7 million, down 31.1% versus last year’s third

quarter. Retail used vehicle gross profit declined 20.8%,

reflecting the decline in retail unit sales. Retail gross profit

per used unit was $2,237, in line with the prior year.

Wholesale vehicle gross profit decreased 46.0% versus the prior

year’s quarter, reflecting lower wholesale unit volume and gross

profit per unit, which declined $165 to $966. Gross profit per unit

was impacted by steep market depreciation as well as retail

selectivity.

Other gross profit declined 49.0% largely reflecting a reduction

in service department margins and EPP revenues. Service margins

declined primarily due to continued deleverage resulting from the

reduction in retail unit sales and by our decision to maintain

technician staffing through the current cycle.

SG&A. Compared with the

third quarter of fiscal 2022, SG&A expenses increased 2.7% to

$591.7 million. In the prior year’s third quarter, we received a

$22.6 million settlement from a class action lawsuit. Adjusting for

that settlement, SG&A expenses would have declined 1.1%

year-over-year. This reduction reflects deliberate steps to further

reduce costs by managing staff levels through attrition in our

stores and CECs, limiting hiring and contractor utilization in our

corporate offices, and aligning marketing spend to sales.

Compensation and benefits also included a decrease in share-based

compensation, which largely reflected changes in the company’s

share price. Total SG&A expenses included increases in

investments to advance our technology platforms and strategic

initiatives as well as growth related costs. SG&A as a percent

of gross profit was 102.6%, versus 68.8% in the prior year’s third

quarter, which was primarily driven by the 31.1% decrease in gross

margin dollars, and does not reflect the run-rate of the actions we

took to reduce costs during the quarter.

CarMax Auto

Finance.(3) CAF income decreased 8.3% to $152.2

million, driven by the decline in CAF’s net interest margin

percentage and a $9.5 million year-over-year increase in the

provision for loan losses, which outweighed the growth in CAF’s

average managed receivables. This quarter’s provision was $85.7

million compared to $76.2 million last year.

As of November 30, 2022, the allowance for loan losses was 2.95%

of ending managed receivables, up from 2.92% as of August 30, 2022.

The increase in the allowance percentage primarily reflected the

effect of the previously disclosed expansion of Tier 2 and Tier 3

originations within CAF’s portfolio.

CAF’s total interest margin percentage, which represents the

spread between interest and fees charged to consumers and our

funding costs, was 6.7% of average managed receivables, down from

7.2% in the prior year’s third quarter as increases in our customer

rates were offset by the rising cost of funds. After the effect of

3-day payoffs, CAF financed 44.4% of units sold in the current

quarter up from 41.2% in the second quarter and from 42.2% in the

prior year’s third quarter. CAF’s weighted average contract rate

increased to 9.8% in the quarter up from 8.3% in the third quarter

last year.

Share Repurchase Activity.

Given third quarter performance and continued market uncertainties,

we are taking a conservative approach to our capital structure.

Accordingly, we have paused our share repurchases. During the third

quarter of fiscal 2023, we repurchased 30,000 shares of common

stock for $2.6 million pursuant to our share repurchase program

before pausing additional purchases. As of November 30, 2022, we

had $2.45 billion remaining available for repurchase under the

outstanding authorization. We remain committed to returning capital

back to shareholders over time and may resume share repurchases in

the future at any time depending upon market conditions and our

capital needs, among other factors.

Store Openings. During the

third quarter of fiscal 2023, we opened one new retail location in

Oceanside, California. In fiscal 2023, we plan to open a total of

ten new locations across the country. For fiscal 2024, we are

planning new store growth of five locations; however, we can expand

our plans if market conditions change.

Fiscal 2023 Capital Spending

Outlook. We expect capital expenditures will end the

fiscal year at approximately $450 million versus our previous

estimate of $500 million.

(1)

An online retail unit sale is defined as a

sale where the customer completes all four of these major

transactional activities remotely: reserving the vehicle; financing

the vehicle, if needed; trading-in or opting out of a trade in; and

creating a remote sales order.

(2)

Revenue from online transactions is

defined as revenue from retail sales that qualify for an online

retail sale, as well as any EPP and third-party finance

contribution, wholesale sales where the winning bid was an online

bid, and all revenue earned by Edmunds.

(3)

Although CAF benefits from certain

indirect overhead expenditures, we have not allocated indirect

costs to CAF to avoid making subjective allocation decisions.

Supplemental Financial

Information Amounts and percentage calculations may not

total due to rounding.

Sales

Components

Three Months Ended November

30

Nine Months Ended November

30

(In millions)

2022

2021

Change

2022

2021

Change

Used vehicle sales

$

5,204.6

$

6,435.6

(19.1

) %

$

18,503.2

$

18,697.3

(1.0

) %

Wholesale vehicle sales

1,152.2

1,922.3

(40.1

) %

4,959.1

4,998.2

(0.8

) %

Other sales and revenues:

Extended protection plan revenues

91.8

106.6

(13.9

) %

318.1

353.8

(10.1

) %

Third-party finance income/(fees), net

1.0

1.6

(38.2

) %

7.1

(0.3

)

2,825.4

%

Advertising & subscription revenues

(1)

33.3

33.3

(0.2

) %

101.9

67.9

50.2

%

Other

23.1

28.4

(18.6

) %

73.1

96.8

(24.4

) %

Total other sales and revenues

149.2

169.9

(12.2

) %

500.2

518.2

(3.5

) %

Total net sales and operating revenues

$

6,506.0

$

8,527.8

(23.7

) %

$

23,962.4

$

24,213.7

(1.0

) %

(1) Excludes intersegment revenues that

have been eliminated in consolidation.

Unit

Sales

Three Months Ended November

30

Nine Months Ended November

30

2022

2021

Change

2022

2021

Change

Used vehicles

180,050

227,424

(20.8

) %

637,939

730,020

(12.6

) %

Wholesale vehicles

118,757

187,630

(36.7

) %

464,741

557,117

(16.6

) %

Average Selling

Prices

Three Months Ended November

30

Nine Months Ended November

30

2022

2021

Change

2022

2021

Change

Used vehicles

$

28,530

$

27,995

1.9

%

$

28,692

$

25,380

13.0

%

Wholesale vehicles

$

9,294

$

9,890

(6.0

) %

$

10,280

$

8,634

19.1

%

Vehicle Sales

Changes

Three Months Ended November

30

Nine Months Ended November

30

2022

2021

2022

2021

Used vehicle units

(20.8

) %

16.9

%

(12.6

) %

33.5

%

Used vehicle revenues

(19.1

) %

52.9

%

(1.0

) %

64.2

%

Wholesale vehicle units

(36.7

) %

48.5

%

(16.6

) %

72.7

%

Wholesale vehicle revenues

(40.1

) %

132.1

%

(0.8

) %

151.1

%

Comparable Store

Used Vehicle Sales Changes (1)

Three Months Ended November

30

Nine Months Ended November

30

2022

2021

2022

2021

Used vehicle units

(22.4

) %

15.8

%

(14.3

) %

32.5

%

Used vehicle revenues

(21.0

) %

51.4

%

(3.2

) %

63.4

%

(1)

Stores are added to the comparable store

base beginning in their fourteenth full month of operation.

Comparable store calculations include results for a set of stores

that were included in our comparable store base in both the current

and corresponding prior year periods.

Used Vehicle

Financing Penetration by Channel (Before the Impact of 3-day

Payoffs)(1)

Three Months Ended November

30

Nine Months Ended November

30

2022

2021

2022

2021

CAF (2)

47.3

%

46.1

%

44.9

%

46.6

%

Tier 2 (3)

20.5

%

22.2

%

22.6

%

22.2

%

Tier 3 (4)

6.1

%

6.5

%

6.4

%

8.0

%

Other (5)

26.1

%

25.2

%

26.1

%

23.2

%

Total

100.0

%

100.0

%

100.0

%

100.0

%

(1)

Calculated as used vehicle units financed

for respective channel as a percentage of total used units

sold.

(2)

Includes CAF's Tier 2 and Tier 3 loan

originations, which represent approximately 1% of total used units

sold.

(3)

Third-party finance providers who

generally pay us a fee or to whom no fee is paid.

(4)

Third-party finance providers to whom we pay a fee.

(5)

Represents customers arranging their own financing and customers

that do not require financing.

Selected

Operating Ratios

Three Months Ended November

30

Nine Months Ended November

30

(In millions)

2022 % (1)

2021 % (1)

2022 % (1)

2021 % (1)

Net sales and operating revenues

$

6,506.0

100.0

$

8,527.8

100.0

$

23,962.4

100.0

$

24,213.7

100.0

Gross profit

$

576.7

8.9

$

836.6

9.8

$

2,189.2

9.1

$

2,576.6

10.6

CarMax Auto Finance income

$

152.2

2.3

$

166.0

1.9

$

539.5

2.3

$

607.7

2.5

Selling, general, and administrative

expenses

$

591.7

9.1

$

575.9

6.8

$

1,914.5

8.0

$

1,704.3

7.0

Interest expense

$

30.2

0.5

$

24.3

0.3

$

91.7

0.4

$

67.2

0.3

Earnings before income taxes

$

50.0

0.8

$

356.0

4.2

$

554.2

2.3

$

1,291.1

5.3

Net earnings

$

37.6

0.6

$

269.4

3.2

$

415.8

1.7

$

991.5

4.1

(1) Calculated as a percentage of net

sales and operating revenues.

Gross Profit (1)

Three Months Ended November

30

Nine Months Ended November

30

(In millions)

2022

2021

Change

2022

2021

Change

Used vehicle gross profit

$

402.8

$

508.4

(20.8

) %

$

1,461.3

$1,611.9

(9.3

) %

Wholesale vehicle gross profit

114.7

212.2

(46.0

) %

447.0

587.0

(23.9

) %

Other gross profit

59.2

116.0

(49.0

) %

280.9

377.7

(25.6

) %

Total

$

576.7

$

836.6

(31.1

) %

$

2,189.2

$2,576.6

(15.0

) %

(1) Amounts are net of intercompany

eliminations.

Gross Profit per

Unit (1)

Three Months Ended November

30

Nine Months Ended November

30

2022

2021

2022

2021

$ per unit(2)

%(3)

$ per unit(2)

%(3)

$ per unit(2)

%(3)

$ per unit(2)

%(3)

Used vehicle gross profit

$

2,237

7.7

$

2,235

7.9

$

2,291

7.9

$

2,208

8.6

Wholesale vehicle gross profit

$

966

10.0

$

1,131

11.0

$

962

9.0

$

1,054

11.7

Other gross profit

$

329

39.7

$

510

68.3

$

440

56.2

$

517

72.9

(1)

Amounts are net of intercompany

eliminations. Those eliminations had the effect of increasing used

vehicle gross profit per unit and wholesale vehicle gross profit

per unit and decreasing other gross profit per unit by immaterial

amounts.

(2)

Calculated as category gross profit

divided by its respective units sold, except the other category,

which is divided by total used units sold.

(3)

Calculated as a percentage of its

respective sales or revenue.

SG&A

Expenses (1)

Three Months Ended November

30

Nine Months Ended November

30

(In millions)

2022

2021

Change

2022

2021

Change

Compensation and benefits:

Compensation and benefits, excluding

share-based compensation expense

$

306.2

$

308.3

(0.7

) %

$

985.2

$

891.8

10.5

%

Share-based compensation expense

17.2

33.3

(48.4

) %

64.0

100.5

(36.3

) %

Total compensation and benefits (2)

$

323.4

$

341.6

(5.3

) %

$

1,049.2

$

992.3

5.7

%

Occupancy costs

70.1

59.3

18.2

%

204.8

165.0

24.2

%

Advertising expense

58.7

76.1

(22.9

) %

230.5

233.6

(1.3

) %

Other overhead costs (3)

139.5

98.9

41.0

%

430.0

313.4

37.2

%

Total SG&A expenses

$

591.7

$

575.9

2.7

%

$

1,914.5

$

1,704.3

12.3

%

SG&A as % of gross profit

102.6

%

68.8

%

33.8

%

87.5

%

66.1

%

21.4

%

(1)

Amounts are net of intercompany

eliminations.

(2)

Excludes compensation and benefits related

to reconditioning and vehicle repair service, which are included in

cost of sales.

(3)

Includes IT expenses, non-CAF bad debt,

insurance, preopening and relocation costs, charitable

contributions, travel and other administrative expenses.

Components of CAF

Income and Other CAF Information

Three Months Ended November

30

Nine Months Ended November

30

(In millions)

2022

% (1)

2021

% (1)

2022

% (1)

2021

% (1)

Interest margin:

Interest and fee income

$

365.4

8.8

$

330.0

8.6

$

1,069.3

8.8

$

964.4

8.7

Interest expense

(88.8

)

(2.1

)

(53.6

)

(1.4

)

(200.1

)

(1.6

)

(180.0

)

(1.6

)

Total interest margin

276.6

6.7

276.4

7.2

869.2

7.2

784.4

7.1

Provision for loan losses

(85.7

)

(2.1

)

(76.2

)

(2.0

)

(219.0

)

(1.8

)

(87.3

)

(0.8

)

Total interest margin after provision for

loan losses

190.9

4.6

200.2

5.2

650.2

5.4

697.1

6.3

Total direct expenses

(38.8

)

(0.9

)

(34.3

)

(0.9

)

(110.7

)

(0.9

)

(89.4

)

(0.8

)

CarMax Auto Finance income

$

152.2

3.7

$

166.0

4.3

$

539.5

4.4

$

607.7

5.5

Total average managed receivables

$

16,540.2

$

15,288.8

$

16,177.8

$

14,706.9

Net loans originated

$

2,147.2

$

2,420.3

$

6,928.0

$

7,276.1

Net penetration rate

44.4

%

42.2

%

41.4

%

43.0

%

Weighted average contract rate

9.8

%

8.3

%

9.4

%

8.6

%

Ending allowance for loan losses

$

491.0

$

426.5

$

491.0

$

426.5

Warehouse facility information:

Ending funded receivables

$

3,420.9

$

3,155.9

$

3,420.9

$

3,155.9

Ending unused capacity

$

1,979.1

$

1,669.1

$

1,979.1

$

1,669.1

(1) Annualized percentage of total average

managed receivables.

Earnings

Highlights

Three Months Ended November

30

Nine Months Ended November

30

(In millions except per share data)

2022

2021

Change

2022

2021

Change

Net earnings

$

37.6

$

269.4

(86.1

) %

$

415.8

$

991.5

(58.1

) %

Diluted weighted average shares

outstanding

158.5

164.9

(3.8

) %

160.2

165.6

(3.3

) %

Net earnings per diluted share

$

0.24

$

1.63

(85.3

) %

$

2.60

$

5.99

(56.6

) %

Conference Call

Information

We will host a conference call for investors at 9:00 a.m. ET

today, December 22, 2022. Domestic investors may access the call at

1-800-274-8461 (international callers dial 1-203-518-9814). The

conference I.D. for both domestic and international callers is

3170513. A live webcast of the call will be available on our

investor information home page at investors.carmax.com.

A replay of the webcast will be available on the company’s

website at investors.carmax.com through April 10, 2023, or via

telephone (for approximately one week) by dialing 1-800-723-0532

(or 1-402-220-2655 for international access) and entering the

conference ID 3170513.

Fourth Quarter Fiscal 2023 Earnings

Release Date

We currently plan to release results for the fourth quarter

ending February 28, 2023, on Tuesday, April 11, 2023, before the

opening of trading on the New York Stock Exchange. We plan to host

a conference call for investors at 9:00 a.m. ET on that date.

Information on this conference call will be available on our

investor information home page at investors.carmax.com in March

2023.

About CarMax

CarMax, the nation’s largest retailer of used autos,

revolutionized the automotive retail industry by driving integrity,

honesty and transparency in every interaction. The company offers a

truly personalized experience with the option for customers to do

as much, or as little, online and in-store as they want. CarMax

also provides a variety of vehicle delivery methods, including home

delivery, express pickup and appointments in its stores. During the

fiscal year ended February 28, 2022, CarMax sold approximately

924,000 used vehicles and 706,000 wholesale vehicles at its

auctions. In addition, CarMax Auto Finance originated more than $9

billion in receivables during fiscal 2022, adding to its nearly $16

billion portfolio. CarMax has more than 230 stores, more than

30,000 associates, and is proud to have been recognized for 18

consecutive years as one of the Fortune 100 Best Companies to Work

For®. CarMax is committed to making a positive impact on people,

communities and the environment. Learn more in the 2022

Responsibility Report. For more information, visit

www.carmax.com.

Forward-Looking

Statements

We caution readers that the statements contained in this release

that are not statements of historical fact, including statements

about our future business plans, operations, challenges,

opportunities or prospects, including without limitation any

statements or factors regarding expected operating capacity, sales,

inventory, market share, financial targets, revenue, margins,

expenses, liquidity, loan originations, capital expenditures, debt

obligations or earnings, are forward-looking statements made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. You can identify these

forward-looking statements by the use of words such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “outlook,” “plan,” “positioned,” “predict,” “should,”

“target,” “will” and other similar expressions, whether in the

negative or affirmative. Such forward-looking statements are based

upon management’s current knowledge, expectations and assumptions

and involve risks and uncertainties that could cause actual results

to differ materially from anticipated results. Among the factors

that could cause actual results and outcomes to differ materially

from those contained in the forward-looking statements are the

following:

- The effect and consequences of the Coronavirus public health

crisis on matters including U.S. and local economies; our business

operations and continuity; the availability of corporate and

consumer financing; the health and productivity of our associates;

the ability of third-party providers to continue uninterrupted

service; and the regulatory environment in which we operate.

- Changes in general or regional U.S. economic conditions,

including inflationary pressures, climbing interest rates and the

potential impact of Russia’s invasion of Ukraine.

- Changes in the availability or cost of capital and working

capital financing, including changes related to the asset-backed

securitization market.

- Changes in the competitive landscape and/or our failure to

successfully adjust to such changes.

- Events that damage our reputation or harm the perception of the

quality of our brand.

- Our inability to realize the benefits associated with our

omni-channel initiatives and strategic investments.

- Our inability to recruit, develop and retain associates and

maintain positive associate relations.

- The loss of key associates from our store, regional or

corporate management teams or a significant increase in labor

costs.

- Security breaches or other events that result in the

misappropriation, loss or other unauthorized disclosure of

confidential customer, associate or corporate information.

- Significant changes in prices of new and used vehicles.

- Changes in economic conditions or other factors that result in

greater credit losses for CAF’s portfolio of auto loans receivable

than anticipated.

- A reduction in the availability of or access to sources of

inventory or a failure to expeditiously liquidate inventory.

- Changes in consumer credit availability provided by our

third-party finance providers.

- Changes in the availability of extended protection plan

products from third-party providers.

- Factors related to the regulatory and legislative environment

in which we operate.

- Factors related to geographic and sales growth, including the

inability to effectively manage our growth.

- The failure of or inability to sufficiently enhance key

information systems.

- The performance of the third-party vendors we rely on for key

components of our business.

- The effect of various litigation matters.

- Adverse conditions affecting one or more automotive

manufacturers, and manufacturer recalls.

- The failure or inability to realize the benefits associated

with our strategic transactions.

- The inaccuracy of estimates and assumptions used in the

preparation of our financial statements, or the effect of new

accounting requirements or changes to U.S. generally accepted

accounting principles.

- The volatility in the market price for our common stock.

- The failure or inability to adequately protect our intellectual

property.

- The occurrence of severe weather events.

- Factors related to the geographic concentration of our

stores.

For more details on factors that could affect expectations, see

our Annual Report on Form 10-K for the fiscal year ended February

28, 2022, and our quarterly or current reports as filed with or

furnished to the U.S. Securities and Exchange Commission. Our

filings are publicly available on our investor information home

page at investors.carmax.com. Requests for information may also be

made to the Investor Relations Department by email to

investor_relations@carmax.com or by calling (804) 747-0422 x7865.

We undertake no obligation to update or revise any forward-looking

statements after the date they are made, whether as a result of new

information, future events or otherwise.

CARMAX,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EARNINGS

(UNAUDITED)

Three Months Ended November

30

Nine Months Ended November

30

(In thousands except per share data)

2022

%(1)

2021

%(1)

2022

%(1)

2021

%(1)

SALES AND OPERATING REVENUES:

Used vehicle sales

$

5,204,584

80.0

$

6,435,590

75.5

$

18,503,159

77.2

$

18,697,300

77.2

Wholesale vehicle sales

1,152,207

17.7

1,922,283

22.5

4,959,050

20.7

4,998,212

20.6

Other sales and revenues

149,165

2.3

169,886

2.0

500,171

2.1

518,205

2.1

NET SALES AND OPERATING

REVENUES

6,505,956

100.0

8,527,759

100.0

23,962,380

100.0

24,213,717

100.0

COST OF SALES:

Used vehicle cost of sales

4,801,790

73.8

5,927,237

69.5

17,041,898

71.1

17,085,416

70.6

Wholesale vehicle cost of sales

1,037,534

15.9

1,710,103

20.1

4,512,053

18.8

4,411,175

18.2

Other cost of sales

89,944

1.4

53,859

0.6

219,205

0.9

140,573

0.6

TOTAL COST OF SALES

5,929,268

91.1

7,691,199

90.2

21,773,156

90.9

21,637,164

89.4

GROSS PROFIT

576,688

8.9

836,560

9.8

2,189,224

9.1

2,576,553

10.6

CARMAX AUTO FINANCE INCOME

152,196

2.3

165,968

1.9

539,538

2.3

607,732

2.5

Selling, general, and administrative

expenses

591,727

9.1

575,930

6.8

1,914,508

8.0

1,704,285

7.0

Depreciation and amortization

57,377

0.9

54,428

0.6

170,717

0.7

157,107

0.6

Interest expense

30,150

0.5

24,303

0.3

91,670

0.4

67,247

0.3

Other income

(363

)

—

(8,094

)

(0.1

)

(2,303

)

—

(35,453

)

(0.1

)

Earnings before income taxes

49,993

0.8

355,961

4.2

554,170

2.3

1,291,099

5.3

Income tax provision

12,413

0.2

86,523

1.0

138,420

0.6

299,638

1.2

NET EARNINGS

$

37,580

0.6

$

269,438

3.2

$

415,750

1.7

$

991,461

4.1

WEIGHTED AVERAGE COMMON SHARES:

Basic

158,003

162,006

159,044

162,710

Diluted

158,536

164,873

160,195

165,606

NET EARNINGS PER SHARE:

Basic

$

0.24

$

1.66

$

2.61

$

6.09

Diluted

$

0.24

$

1.63

$

2.60

$

5.99

(1) Percents are calculated as a

percentage of net sales and operating revenues and may not total

due to rounding.

CARMAX,

INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

As of

November 30

February 28

November 30

(In thousands except share data)

2022

2022

2021

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

688,618

$

102,716

$

62,598

Restricted cash from collections on auto

loans receivable

466,525

548,099

552,487

Accounts receivable, net

246,794

560,984

563,135

Inventory

3,414,937

5,124,569

4,659,460

Other current assets

167,143

212,922

117,390

TOTAL CURRENT ASSETS

4,984,017

6,549,290

5,955,070

Auto loans receivable, net

16,240,832

15,289,701

15,167,170

Property and equipment, net

3,375,001

3,209,068

3,175,577

Deferred income taxes

87,262

120,931

134,382

Operating lease assets

529,781

537,357

543,645

Goodwill

141,258

141,258

141,258

Other assets

580,790

490,659

458,117

TOTAL ASSETS

$

25,938,941

$

26,338,264

$

25,575,219

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

802,780

$

937,717

$

936,556

Accrued expenses and other current

liabilities

496,202

533,271

530,592

Accrued income taxes

—

—

518

Current portion of operating lease

liabilities

51,215

44,197

43,151

Current portion of long-term debt

112,708

11,203

10,889

Current portion of non-recourse notes

payable

474,147

521,069

535,146

TOTAL CURRENT LIABILITIES

1,937,052

2,047,457

2,056,852

Long-term debt, excluding current

portion

1,903,223

3,255,304

2,602,598

Non-recourse notes payable, excluding

current portion

15,737,459

14,919,715

14,856,266

Operating lease liabilities, excluding

current portion

509,106

523,269

529,821

Other liabilities

364,528

357,080

419,886

TOTAL LIABILITIES

20,451,368

21,102,825

20,465,423

Commitments and contingent liabilities

SHAREHOLDERS’ EQUITY:

Common stock, $0.50 par value; 350,000,000

shares authorized; 158,019,398 and 161,053,983 shares issued and

outstanding as of November 30, 2022 and February 28, 2022,

respectively

79,010

80,527

80,936

Capital in excess of par value

1,697,062

1,677,268

1,672,728

Accumulated other comprehensive income

(loss)

57,420

(46,422

)

(100,301

)

Retained earnings

3,654,081

3,524,066

3,456,433

TOTAL SHAREHOLDERS’ EQUITY

5,487,573

5,235,439

5,109,796

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

25,938,941

$

26,338,264

$

25,575,219

CARMAX,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

Nine Months Ended November

30

(In thousands)

2022

2021

OPERATING ACTIVITIES:

Net earnings

$

415,750

$

991,461

Adjustments to reconcile net earnings to

net cash provided by (used in) operating activities:

Depreciation and amortization

202,655

200,819

Share-based compensation expense

64,974

108,962

Provision for loan losses

218,967

87,342

Provision for cancellation reserves

79,924

91,607

Deferred income tax (benefit)

provision

(2,178

)

19,564

Other

8,879

(26,808

)

Net decrease (increase) in:

Accounts receivable, net

314,190

(290,346

)

Inventory

1,709,632

(1,502,323

)

Other current assets

149,777

(13,615

)

Auto loans receivable, net

(1,170,098

)

(1,764,693

)

Other assets

(43,502

)

(18,309

)

Net (decrease) increase in:

Accounts payable, accrued expenses and

other

current liabilities and accrued

income taxes

(195,154

)

170,474

Other liabilities

(91,739

)

(136,780

)

NET CASH PROVIDED BY (USED IN)

OPERATING ACTIVITIES

1,662,077

(2,082,645

)

INVESTING ACTIVITIES:

Capital expenditures

(319,486

)

(226,903

)

Proceeds from disposal of property and

equipment

3,806

260

Proceeds from sale of business

—

12,284

Purchases of investments

(6,460

)

(13,676

)

Sales and returns of investments

3,486

36,915

Business acquisition, net of cash

acquired

—

(241,563

)

NET CASH USED IN INVESTING

ACTIVITIES

(318,654

)

(432,683

)

FINANCING ACTIVITIES:

Proceeds from issuances of long-term

debt

2,863,500

5,804,200

Payments on long-term debt

(4,116,775

)

(4,524,973

)

Cash paid for debt issuance costs

(13,987

)

(14,473

)

Payments on finance lease obligations

(10,056

)

(8,822

)

Issuances of non-recourse notes

payable

11,351,696

11,217,298

Payments on non-recourse notes payable

(10,581,076

)

(9,565,649

)

Repurchase and retirement of common

stock

(333,814

)

(475,950

)

Equity issuances

13,504

76,310

NET CASH (USED IN) PROVIDED BY

FINANCING ACTIVITIES

(827,008

)

2,507,941

Increase (decrease) in cash, cash

equivalents, and restricted cash

516,415

(7,387

)

Cash, cash equivalents, and restricted

cash at beginning of year

803,618

771,947

CASH, CASH EQUIVALENTS, AND RESTRICTED

CASH AT END OF PERIOD

$

1,320,033

$

764,560

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221222005091/en/

Investors: David Lowenstein, Assistant Vice President, Investor

Relations investor_relations@carmax.com, (804) 747-0422 x7865

Media: pr@carmax.com, (855) 887-2915

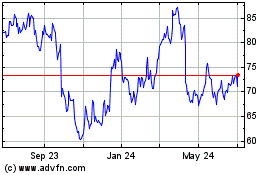

CarMax (NYSE:KMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CarMax (NYSE:KMX)

Historical Stock Chart

From Apr 2023 to Apr 2024