Current Report Filing (8-k)

July 20 2021 - 6:09AM

Edgar (US Regulatory)

0000790051

false

0000790051

2021-07-18

2021-07-18

0000790051

us-gaap:CommonStockMember

2021-07-18

2021-07-18

0000790051

us-gaap:PreferredStockMember

2021-07-18

2021-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 18, 2021

CARLISLE COMPANIES INCORPORATED

(Exact Name of Registrant as Specified in its

Charter)

|

Delaware

|

|

1-9278

|

|

31-1168055

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

16430 North Scottsdale Road, Suite 400

|

|

|

|

Scottsdale,

|

|

85254

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number,

including area code: (480) 781-5000

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencements communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, $1 par value

|

|

CSL

|

|

New York Stock Exchange

|

|

Preferred Stock Purchase Rights, $1 par value

|

|

n/a

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b–2 of the Securities Exchange

Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On July 18, 2021,

Carlisle Companies Incorporated, a Delaware corporation (the “Company”),

ASP Henry Holdings, Inc., a Delaware corporation and a portfolio company of American Securities LLC (“Henry”),

ASP Henry Investco LP, a Delaware limited partnership, solely in its capacity as the representative of all of the equityholders of

Henry, and Aaron Merger Sub, Inc., a Delaware corporation and wholly-owned indirect subsidiary of the Company (“Merger

Sub”), entered into an Agreement and Plan of Merger (the “Merger

Agreement”), pursuant to which the Company agreed to acquire Henry through a merger of Merger Sub with and into Henry

(the “Merger”), with Henry surviving the Merger as a wholly-owned

indirect subsidiary of the Company. Pursuant to the Merger Agreement, the Company will pay Henry’s equityholders an aggregate

of $1.575 billion in cash, subject to certain customary adjustments (the “Merger

Consideration”), upon the closing of the Merger (the “Closing”).

The adjustments to the Merger Consideration include, among others, (i) a working capital adjustment, (ii) an upward adjustment for

any cash and cash equivalents held by Henry at the Closing, and (iii) a downward adjustment for the aggregate amount of

Henry’s indebtedness, certain expenses related to the transaction and other related fees and expenses.

The Merger Agreement

contains customary representations, warranties, covenants and agreements of the parties. The Closing is subject to conditions that

include, among others, receipt of regulatory approvals, correctness of the representations and warranties of the parties (subject to

certain materiality standards set forth in the Merger Agreement) and material compliance by the parties with their respective

obligations under the Merger Agreement that must be complied with by such party at or prior to the Closing. Subject to regulatory

approvals, the Closing is expected to occur within the third quarter of 2021. The Agreement provides that, upon the termination of

the Agreement under certain conditions, the Company will be required to pay to Henry or its designees a customary termination

fee as set forth in the Merger Agreement.

The representations, warranties, covenants and

agreements set forth in the Merger Agreement have been made only for the purposes of the Merger Agreement and solely for the benefit of

the parties to the Merger Agreement, may be subject to limitations agreed upon by the parties thereto, including being qualified by

confidential disclosures, may have been made for the purposes of allocating contractual risk between the parties to the Merger Agreement

instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that

differ from those applicable to investors. Accordingly, the Merger Agreement is included with this filing only to provide investors with

information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding the

parties or their respective businesses, and should be read in conjunction with the disclosures in the Company’s periodic reports

and other filings with the Securities and Exchange Commission.

A copy of the Merger Agreement has been filed as

Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing description of the Merger Agreement

is qualified in its entirety by reference to the full text of the Merger Agreement.

This Form 8-K contains forward-looking statements,

including those with respect to the acquisition of Henry and the anticipated timing of the closing of the transaction. These statements

are not historical facts, but instead represent only the Company’s current belief regarding future events, many of which, by their

nature, are inherently uncertain and outside of the Company’s control. Actual results could differ materially from those reflected

in the Form 8-K for various reasons, including the failure of the parties to meet or waive closing conditions and failure to receive required

regulatory approvals. The Company disclaims any obligation to update forward-looking statements except as required by law.

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

On July 19, 2021, the Company issued a press release

announcing the execution of the Agreement. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by

reference.

The information in this Item 7.01 of this Current

Report on Form 8-K, including Exhibit 99.1, is being furnished herewith and shall not be deemed “filed” for the purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the

Exchange Act, except as expressly set forth by specific reference in such filing.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

*Schedules have been omitted pursuant to Item 601(b)(2) of Regulation

S-K. A copy of any omitted schedule will be furnished supplementally to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: July 20, 2021

|

|

|

|

|

|

|

CARLISLE COMPANIES INCORPORATED

|

|

|

|

|

|

By:

|

/s/ Robert M. Roche

|

|

|

|

Robert M. Roche

|

|

|

|

Vice President and Chief Financial Officer

|

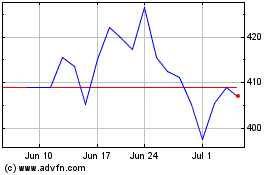

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

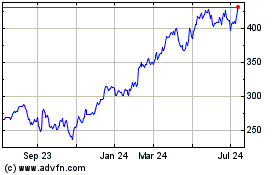

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Apr 2023 to Apr 2024