Caleres (NYSE: CAL) (caleres.com), a diverse portfolio of global

footwear brands, today reported first quarter 2019 financial

results.

“Despite a soft marketplace, Brand Portfolio performed extremely

well and continued to grow – with sales up more than 20%

year-over-year – and to take share. Once again, we owned six of the

top 25 women's fashion footwear brands and grew sales ahead of

market rate while gaining share,” said Diane Sullivan, CEO,

president and chairman of Caleres. “At Famous Footwear, while the

quarter ended on an encouraging note – with positive

same-store-sales for both March and April – the slow start in

February was tough to overcome. Going forward, we expect to see

softness at Famous Footwear through at least the second quarter, as

we continue to prepare for back-to-school by aggressively clearing

underperforming inventory. While new additions to our elevated and

refreshed product assortment are gaining traction, we expect to see

more evidence of this during back-to-school, as we’ve previously

discussed.

“Rather than maintaining the mid-point of our adjusted EPS

guidance range at a 13% growth rate, we are prudently bringing the

mid-point for earnings growth down to 9%,” continued Sullivan.

“While we still expect to see year-over-year gains, we believe this

new rate more accurately reflects industry challenges to date and

gradual improvement over the balance of the year.”

First Quarter 2019 Results Versus 2018

- Consolidated sales of $677.8 million,

up 7.2%.

- Brand Portfolio sales of $341.1 million

were up 20.3%.

- Famous Footwear total sales were $352.2

million, while same-store-sales were down 1.0%.

- Gross profit was $279.8 million, up

1.8%, while gross margin was 41.3% and adjusted gross margin was

42.3% and excluded $7.2 million related to Vionic inventory

adjustment amortization and for Brand Portfolio business exit

expense.

- SG&A expense of $262.1 million

represented 38.7% of sales, an improvement of more than 90 basis

points.

- Operating earnings of $16.9 million and

adjusted operating earnings of $24.9 million.

- Net earnings were $9.1 million,

resulting in earnings per diluted share of $0.22.

- Adjusted net earnings were $15.0

million, while adjusted earnings per diluted share were $0.36.

Balance Sheet and Cash Flow

- Cash and equivalents of $35.8 million

and cash from operations of $49.9 million.

- There were $318.0 million of

outstanding borrowings under the revolving credit facility,

following the October 18, 2018, acquisition of Vionic.

- Inventory of $648.1 million was up

11.8% year-over-year and included $49.6 million of Vionic and

Blowfish Malibu inventory.

- Capital expenditures of $21.4 million

were up approximately $12 million year-over-year, due to the

investment in automation at the new Brand Portfolio fulfillment

center.

- Returned $2.9 million to

shareholders, via dividends.

Impact of New Lease Accounting Rules

- On February 3, 2019, Caleres adopted

the new accounting standard for leases (ASC 842), which resulted in

a significant increase in reported assets and liabilities

associated with leases. The company does not expect any material

differences in lease expense, lease payments, operating earnings or

cash flows, as compared to the previous accounting rules. However,

due to the incremental asset value required for operating leases

under the new standard, ongoing impairment charges for

underperforming retail stores are expected to be higher. The

adoption of ASC 842 will not impact the company’s credit facility

covenants.

2019 Outlook

Consolidated net sales ~$3.0 billion Brand Portfolio sales

Up low- to mid-teens, including acquisitions Famous Footwear

same-store-sales Flat to up low-single digits Adjusted earnings per

diluted share* $2.35 to $2.45

* Excludes ~$0.14 of expenses

related to brand acquisitions and exits

Investor Conference Call

Caleres will host an investor conference call at 4:30 p.m. ET

today, Monday, June 3. The webcast and slides will be available at

investor.caleres.com/news/events. A live conference call will be

available at (877) 217-9089 for analysts in North America or (706)

679-1723 for international analysts by using the conference ID

8758845. A replay will be available at

investor.caleres.com/news/events/archive for a limited period.

Investors may also access the replay by dialing (855) 859-2056 in

North America or (404) 537-3406 internationally and using the

conference ID 8758845 through Saturday, June 8.

Definitions

All references in this press release, outside of the condensed

consolidated financial statements that follow, unless otherwise

noted, related to net earnings attributable to Caleres, Inc. and

diluted earnings per common share attributable to Caleres, Inc.

shareholders, are presented as net earnings and earnings per

diluted share, respectively.

Non-GAAP Financial Measures

In this press release, the company’s financial results are

provided both in accordance with generally accepted accounting

principles (GAAP) and using certain non-GAAP financial measures. In

particular, the company provides historic and estimated future

gross profit, operating earnings, net earnings and earnings per

diluted share adjusted to exclude certain gains, charges and

recoveries, which are non-GAAP financial measures. These results

are included as a complement to results provided in accordance with

GAAP because management believes these non-GAAP financial measures

help identify underlying trends in the company’s business and

provide useful information to both management and investors by

excluding certain items that may not be indicative of the company’s

core operating results. These measures should not be considered a

substitute for or superior to GAAP results.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995

This press release contains certain forward-looking statements

and expectations regarding the company’s future performance and the

performance of its brands. Such statements are subject to various

risks and uncertainties that could cause actual results to differ

materially. These risks include (i) changing consumer demands,

which may be influenced by consumers' disposable income, which in

turn can be influenced by general economic conditions and other

factors; (ii) rapidly changing fashion trends and consumer

preferences and purchasing patterns; (iii) intense competition

within the footwear industry; (iv) political and economic

conditions or other threats to the continued and uninterrupted flow

of inventory from China and other countries, where the Company

relies heavily on third-party manufacturing facilities for a

significant amount of its inventory; (v) imposition of tariffs;

(vi) the ability to accurately forecast sales and manage inventory

levels; (vii) cybersecurity threats or other major disruption to

the Company’s information technology systems; (viii) customer

concentration and increased consolidation in the retail industry;

(ix) transitional challenges with acquisitions; (x) a

disruption in the Company’s distribution centers; (xi) foreign

currency fluctuations; (xii) changes to tax laws, policies and

treaties; (xiii) the ability to recruit and retain senior

management and other key associates; (xiv) compliance with

applicable laws and standards with respect to labor, trade and

product safety issues; (xv) the ability to secure/exit leases on

favorable terms; (xvi) the ability to maintain relationships with

current suppliers; and (xvii) the ability to attract, retain, and

maintain good relationships with licensors and protect our

intellectual property rights. The company's reports to the

Securities and Exchange Commission contain detailed information

relating to such factors, including, without limitation, the

information under the caption Risk Factors in Item 1A of the

company’s Annual Report on Form 10-K for the year ended February 2,

2019, which information is incorporated by reference herein and

updated by the company’s Quarterly Reports on Form 10-Q. The

company does not undertake any obligation or plan to update these

forward-looking statements, even though its situation may

change.

About Caleres

Caleres is a diverse portfolio of global footwear brands. Our

products are available virtually everywhere - in the over 1,200

retail stores we operate, in hundreds of major department and

specialty stores, on our branded e-commerce sites, and on many

additional third-party retail websites. Famous Footwear offers

great brands for the entire family with convenient, curated,

affordable collections. Sam Edelman keeps expressive women in step

with the latest trends in a playful, whimsical way. Naturalizer

shoes are beautiful from the inside out, with elegant simplicity

and legendary fit re-imagined for today’s consumer. Allen Edmonds

combines old world craft with new world technology to create luxe

footwear for the discerning man who wants sophisticated, modern

classics. Rounding out our family of brands are Vionic, Dr.

Scholl’s Shoes, Vince, Franco Sarto, LifeStride, Via Spiga,

Blowfish Malibu, Bzees, Circus by Sam Edelman, Fergie and Ryka.

Combined, these brands make Caleres a company with both a legacy

and a mission. Our legacy is our more than 140 years of

craftsmanship and our passion for fit, while our mission is to

continue to inspire people to feel great… feet first.

Visit caleres.com to learn more about us.

SCHEDULE 1 CALERES,

INC. CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

(Unaudited) Thirteen Weeks Ended (Thousands, except per

share data) May 4, 2019 May 5, 2018 Net sales $ 677,754 $ 632,142

Cost of goods sold 397,918 357,221 Gross profit

279,836 274,921 Selling and administrative expenses

262,111 250,197 Restructuring and other special charges, net 856

1,778 Operating earnings 16,869 22,946

Interest expense, net (7,340 ) (3,683 ) Other income, net 2,619

3,091 Earnings before income taxes 12,148

22,354 Income tax provision (3,063 ) (5,174 ) Net earnings

9,085 17,180 Net earnings (loss) attributable to

noncontrolling interests 2 (32 ) Net earnings attributable

to Caleres, Inc. $ 9,083 $ 17,212 Basic

earnings per common share attributable to Caleres, Inc.

shareholders $ 0.22 $ 0.40 Diluted earnings

per common share attributable to Caleres, Inc. shareholders $ 0.22

$ 0.40

SCHEDULE 2

CALERES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited) May 4, 2019 May 5, 2018 February 2, 2019

(Thousands)

ASSETS Cash and cash equivalents $ 35,778 $

96,481 $ 30,200 Receivables, net 148,487 125,559 191,722

Inventories, net 648,145 579,902 683,171 Prepaid expenses and other

current assets 54,902 62,385 71,354 Total current

assets 887,312 864,327 976,447 Lease

right-of-use assets 735,282 — — Property and equipment, net 236,257

208,898 230,784 Goodwill and intangible assets, net 548,508 339,900

549,897 Other assets 85,711 88,941 81,440 Total

assets $ 2,493,070 $ 1,502,066 $ 1,838,568

LIABILITIES AND EQUITY Borrowings under revolving credit

agreement $ 318,000 $ — $ 335,000 Trade accounts payable 289,071

268,917 316,298 Lease obligations 136,005 — — Other accrued

expenses 168,224 168,746 202,038 Total current

liabilities 911,300 437,663 853,336 Noncurrent

lease obligations 662,750 — — Long-term debt 198,046 197,587

197,932 Deferred rent — 53,027 54,850 Other liabilities 92,342

99,651 97,015 Total other liabilities 953,138

350,265 349,797 Total Caleres, Inc. shareholders’

equity 627,236 712,705 634,053 Noncontrolling interests 1,396

1,433 1,382 Total equity 628,632 714,138

635,435 Total liabilities and equity $ 2,493,070 $

1,502,066 $ 1,838,568

SCHEDULE 3

CALERES, INC. CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (Unaudited) Thirteen Weeks Ended

(Thousands) May 4, 2019 May 5, 2018 OPERATING ACTIVITIES:

Net cash provided by operating activities $ 49,910 $

51,347 INVESTING ACTIVITIES: Purchases of property

and equipment (18,443 ) (7,929 ) Capitalized software (2,917 )

(1,434 ) Net cash used for investing activities (21,360 ) (9,363 )

FINANCING ACTIVITIES: Borrowings under revolving credit

agreement 84,000 — Repayments under revolving credit agreement

(101,000 ) — Dividends paid (2,947 ) (3,023 ) Acquisition of

treasury stock — (3,288 ) Issuance of common stock under

share-based plans, net (2,559 ) (3,122 ) Other (394 ) —

Net cash used for financing activities (22,900 )

(9,433 ) Effect of exchange rate changes on cash and cash

equivalents (72 ) (117 ) Increase in cash and cash equivalents

5,578 32,434 Cash and cash equivalents at beginning of period

30,200 64,047 Cash and cash equivalents at end of

period $ 35,778 $ 96,481

SCHEDULE

4

CALERES, INC. RECONCILIATION OF NET EARNINGS AND

DILUTED EARNINGS PER SHARE (GAAP BASIS) TO ADJUSTED NET EARNINGS

AND ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP BASIS)

(Unaudited) Thirteen Weeks Ended May 4, 2019 May 5, 2018

(Thousands, except per share data)

Pre-Tax

Impact of

Charges/Other

Items

Net

Earnings

Attributable

to Caleres, Inc.

Diluted

Earnings

Per Share

Pre-Tax

Impact of

Charges/Other

Items

Net

Earnings

Attributable

to Caleres, Inc.

Diluted

Earnings

Per Share

GAAP earnings $ 9,083 $ 0.22 $ 17,212 $ 0.40

Charges/other

items:

Vionic acquisition and integration-related costs $ 6,118 4,544 0.11

$ — — — Brand Portfolio - business exits 1,905 1,415 0.03 — — —

Integration and reorganization of men's brands —

— — 1,778

1,315 0.03 Total charges/other items $ 8,023

$ 5,959 $ 0.14 $

1,778 $ 1,315 $ 0.03

Adjusted earnings $ 15,042 $ 0.36 $

18,527 $ 0.43

SCHEDULE 5

CALERES, INC. SUMMARY

FINANCIAL RESULTS BY SEGMENT SUMMARY FINANCIAL

RESULTS (Unaudited) Thirteen Weeks Ended Famous Footwear

Brand Portfolio Other

Consolidated (Thousands) May 4, 2019 May 5, 2018

May 4, 2019 May 5, 2018

May 4, 2019 May 5, 2018 May 4, 2019

May 5, 2018 Net sales $ 352,165 $ 363,411 $ 341,050 $

283,497 $ (15,461 ) $ (14,766 ) $ 677,754 $ 632,142 Gross profit $

152,693 $ 165,201 $ 126,860 $ 108,861 $ 283 $ 859 $ 279,836 $

274,921 Adjusted gross profit $ 152,693 $ 165,201 $ 134,027 $

108,861 $ 283 $ 859 $ 287,003 $ 274,921 Gross profit rate 43.4 %

45.5 % 37.2 % 38.4 % (1.8 )% (5.8 )% 41.3 % 43.5 % Adjusted gross

profit rate 43.4 % 45.5 % 39.3 % 38.4 % (1.8 )% (5.8 )% 42.3 % 43.5

% Operating earnings (loss) $ 10,813 $ 21,857 $ 12,929 $ 11,627 $

(6,873 ) $ (10,538 ) $ 16,869 $ 22,946 Adjusted operating earnings

(loss) $ 10,813 $ 21,857 $ 20,705 $ 13,211 $ (6,626 ) $ (10,344 ) $

24,892 $ 24,724 Operating earnings % 3.1 % 6.0 % 3.8 % 4.1 % 44.5 %

71.4 % 2.5 % 3.6 % Adjusted operating earnings % 3.1 % 6.0 % 6.1 %

4.7 % 42.9 % 70.1 % 3.7 % 3.9 % Same-store sales % (on a 13-week

basis) (1) (1.0 )% (0.8 )% (8.6 )% (1.0 )% — % — % — % — % Number

of stores 985 1,013

230 235 —

— 1,215

1,248

RECONCILIATION OF ADJUSTED RESULTS

(NON-GAAP) (Unaudited) Thirteen Weeks Ended Famous

Footwear Brand Portfolio Other

Consolidated (Thousands) May 4, 2019 May 5,

2018 May 4, 2019 May 5, 2018

May 4, 2019 May 5, 2018 May 4,

2019 May 5, 2018 Gross profit $ 152,693 $ 165,201 $

126,860 $ 108,861 $ 283 $ 859 $ 279,836 $ 274,921

Charges/Other

Items:

Vionic acquisition and integration-related costs — — 5,812 — — —

5,812 — Brand Portfolio - business exits — —

1,355 —

— — 1,355

— Total charges/other items —

— 7,167 —

— — 7,167

— Adjusted gross profit $ 152,693

$ 165,201 $ 134,027

$ 108,861 $ 283

$ 859 $ 287,003

$ 274,921 Operating earnings (loss) $ 10,813 $ 21,857

$ 12,929 $ 11,627 $ (6,873 ) $ (10,538 ) $ 16,869 $ 22,946

Charges/Other

Items:

Vionic acquisition and integration-related costs — — 5,871 — 247 —

6,118 — Brand Portfolio - business exits — — 1,905 — — — 1,905 —

Integration and reorganization of men's brands —

— — 1,584

— 194 —

1,778 Total charges/other items —

— 7,776

1,584 247 194

8,023 1,778

Adjusted operating earnings (loss) $ 10,813

$ 21,857 $ 20,705

$ 13,211 $ (6,626 ) $

(10,344 ) $ 24,892 $ 24,724

SCHEDULE 6

CALERES, INC. BASIC AND DILUTED EARNINGS PER SHARE

RECONCILIATION (Unaudited) Thirteen Weeks Ended

(Thousands, except per share data) May 4, 2019 May 5,

2018 Net earnings attributable to Caleres, Inc.: Net

earnings $ 9,085 $ 17,180 Net (earnings) loss attributable to

noncontrolling interests (2 ) 32 Net earnings

attributable to Caleres, Inc. 9,083 17,212 Net earnings allocated

to participating securities (283 ) (479 ) Net

earnings attributable to Caleres, Inc. after allocation of earnings

to participating securities $ 8,800 $ 16,733

Basic and diluted common shares attributable to

Caleres, Inc.: Basic common shares 40,741 41,910 Dilutive effect of

share-based awards 60 124 Diluted

common shares attributable to Caleres, Inc. 40,801

42,034 Basic earnings per common share

attributable to Caleres, Inc. shareholders $ 0.22

$ 0.40 Diluted earnings per common share

attributable to Caleres, Inc. shareholders $ 0.22

$ 0.40

SCHEDULE 7

CALERES, INC. BASIC AND DILUTED EARNINGS PER SHARE

RECONCILIATION (Unaudited) Thirteen Weeks Ended

(Thousands, except per share data) May 4, 2019 May 5,

2018 Adjusted net earnings attributable to Caleres, Inc.:

Adjusted net earnings $ 15,044 $ 18,495 Net (earnings) loss

attributable to noncontrolling interests (2 ) 32

Adjusted net earnings attributable to Caleres, Inc. 15,042

18,527 Net earnings allocated to participating securities (472 )

(516 ) Adjusted net earnings attributable to Caleres,

Inc. after allocation of earnings to participating securities $

14,570 $ 18,011 Basic and

diluted common shares attributable to Caleres, Inc.: Basic common

shares 40,741 41,910 Dilutive effect of share-based awards 60

124 Diluted common shares attributable

to Caleres, Inc. 40,801 42,034

Basic adjusted earnings per common share attributable to Caleres,

Inc. shareholders $ 0.36 $ 0.43

Diluted adjusted earnings per common share attributable to Caleres,

Inc. shareholders $ 0.36 $ 0.43

SCHEDULE 8 CALERES,

INC. RECONCILIATION OF INCOME TAX PROVISION AND EFFECTIVE

TAX RATE (GAAP BASIS) TO ADJUSTED INCOME TAX PROVISION AND ADJUSTED

EFFECTIVE TAX RATE (NON-GAAP BASIS) (Unaudited) Thirteen

Weeks Ended May 4, 2019 May 5, 2018 (Thousands)

Earnings

Before

Income

Taxes

Income

Tax

Provision

Effective

Tax Rate

Earnings

Before

Income

Taxes

Income

Tax

Provision

Effective

Tax Rate

GAAP basis $ 12,148 $ (3,063 ) 25.2 % $ 22,354 $ (5,174 )

23.1 %

Charges/other

items:

Vionic acquisition and integration - related costs 6,118 (1,574 ) —

— Brand Portfolio - business exits 1,905 (490 ) — — Integration and

reorganization of men's brands — — 1,778

(463 ) Adjusted basis $ 20,171 $ (5,127 ) 25.4

% $ 24,132 $ (5,637 ) 23.4 %

SCHEDULE 9

CALERES, INC. CALCULATION OF RETURN ON AVERAGE INVESTED

CAPITAL AND ADJUSTED RETURN ON AVERAGE INVESTED CAPITAL (NON-GAAP

METRICS) (Unaudited) May 4, 2019

May 5, 2018 (in 000's)

Return on Average Invested

Capital Net earnings (trailing twelve months) $ (13,569 ) $

89,510 Average invested capital (1) 453,430 564,459 Return on

average invested capital (3.0 )% 15.9 %

Adjusted Return

on Average Invested Capital Adjusted net earnings (trailing

twelve months) $ 91,569 $ 94,168 Average invested capital (1)

453,430 564,459 Adjusted return on average invested capital 20.2 %

16.7 % (1) Calculated as the 13-month average of each

month-end invested capital balance. Invested capital is defined as

current assets, excluding cash and cash equivalents, plus property

and equipment, net, less current liabilities, excluding borrowings

under revolving credit agreement and current lease obligations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190603005754/en/

Investor and Media ContactPeggy Reilly Tharp,

Caleresptharp@caleres.com

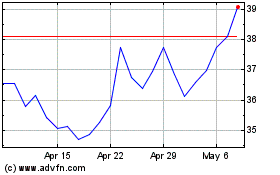

Caleres (NYSE:CAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Caleres (NYSE:CAL)

Historical Stock Chart

From Apr 2023 to Apr 2024