Caleres (NYSE: CAL) (caleres.com) today announced it plans to

release its first quarter 2019 financial results after market close

on Monday, June 3. Company executives will host a financial analyst

call at 4:30 p.m. ET that day, to discuss first quarter results and

to provide a general business update.

The dial-in number for financial analysts in North America is

(877) 217-9089, or (706) 679-1723 for international analysts, and

the conference ID is 8758845. To participate, please dial in a few

minutes before the scheduled time. Employees, the media and the

public are invited to listen to the call at

investor.caleres.com/news/events.

A replay of the call will be available through Saturday, June 8,

by dialing (855) 859-2056 in North America, or (404) 537-3406

internationally, and using the conference ID 8758845. A webcast

replay will also be archived for a limited period at

investor.caleres.com/news/events/archive.

Caleres also announced it is changing its segment presentation

to reflect growth in intersegment activity, driven by recent

acquisitions, and to better align reporting with its independent

business model. The company will continue to present two reportable

segments, Famous Footwear and Brand Portfolio, however, beginning

with the first quarter of 2019, Caleres will present Brand

Portfolio net sales inclusive of both external and intersegment

sales.

The elimination of intersegment sales and profit from Brand

Portfolio to Famous Footwear will be reflected within the

Eliminations and Other category. In conjunction with the change,

2017 and 2018 results have been recast and the related quarterly

historical segment results are included in the schedules to this

release.

About Caleres - Caleres is a diverse portfolio of global

footwear brands. Our products are available virtually everywhere -

in the over 1,200 retail stores we operate, in hundreds of major

department and specialty stores, on our branded e-commerce sites,

and on many additional third-party retail websites. Famous Footwear

offers great brands for the entire family with convenient, curated,

affordable collections. Sam Edelman keeps expressive women in step

with the latest trends in a playful, whimsical way. Naturalizer

shoes are beautiful from the inside out, with elegant simplicity

and legendary fit re-imagined for today’s consumer. Allen Edmonds

combines old world craft with new world technology to create luxe

footwear for the discerning man who wants sophisticated, modern

classics. Rounding out our family of brands are Vionic, Dr.

Scholl’s Shoes, Vince, Franco Sarto, LifeStride, Via Spiga,

Blowfish Malibu, Bzees, Circus by Sam Edelman, Fergie and Ryka.

Combined, these brands make Caleres a company with both a legacy

and a mission. Our legacy is our more than 140 years of

craftsmanship and our passion for fit, while our mission is to

continue to inspire people to feel great… feet first.

Visit caleres.com to learn more about us.

CALERES, INC. SUMMARY FINANCIAL RESULTS BY

SEGMENT SUMMARY FINANCIAL

RESULTS (Unaudited) Famous Footwear Brand

Portfolio Eliminations and Other Consolidated

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

(Thousands)

May 5,2018

April 29,2017

May 5,2018

April 29,2017

May 5,2018

April 29,2017

May 5,2018

April 29,2017

Net sales $ 363,411 $ 366,494 $ 283,497 $ 279,715 $

(14,766 ) $ (14,700 ) $ 632,142 $ 631,509 Gross profit $ 165,201 $

167,690 $ 108,861 $ 102,504 $ 859 $ 714 $ 274,921 $ 270,908

Adjusted gross profit $ 165,201 $ 167,690 $ 108,861 $ 105,533 $ 859

$ 714 $ 274,921 $ 273,937 Gross profit rate 45.5 % 45.8 % 38.4 %

36.7 % (5.8 )% (4.9 )% 43.5 % 42.9 % Adjusted gross profit rate

45.5 % 45.8 % 38.4 % 37.7 % (5.8 )% (4.9 )% 43.5 % 43.4 % Operating

earnings (loss) $ 21,857 $ 20,279 $ 11,627 $ 12,600 $ (10,538 ) $

(9,590 ) $ 22,946 $ 23,289 Adjusted operating earnings (loss) $

21,857 $ 20,279 $ 13,211 $ 16,475 $ (10,344 ) $ (9,328 ) $ 24,724 $

27,426 Operating earnings (loss) % 6.0 % 5.5 % 4.1 % 4.5 % 71.4 %

65.2 % 3.6 % 3.7 % Adjusted operating earnings % 6.0 % 5.5 % 4.7 %

5.9 % 70.1 % 63.5 % 3.9 % 4.3 % Same-store sales % (on a 13-week

basis) (1) (0.8 )% (0.6 )% (1.0 )% 2.3 %

—

%

—

%

—

%

—

%

Number of stores 1,013 1,052 235

233 — —

1,248 1,285

RECONCILIATION OF ADJUSTED RESULTS (NON-GAAP)

(Unaudited) Famous Footwear Brand Portfolio

Eliminations and Other Consolidated

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

(Thousands)

May 5,2018

April 29,2017

May 5,2018

April 29,2017

May 5,2018

April 29,2017

May 5,2018

April 29,2017

Gross profit $ 165,201 $ 167,690 $ 108,861 $ 102,504 $ 859 $ 714 $

274,921 $ 270,908

Charges/Other

Items:

Acquisition, integration and reorganization of men's brands —

— — 3,029 —

— — 3,029 Total

charges/other items — — —

3,029 — — —

3,029 Adjusted gross profit $ 165,201 $

167,690 $ 108,861 $ 105,533

$ 859 $ 714 $ 274,921

$ 273,937 Operating earnings (loss) $ 21,857 $ 20,279

$ 11,627 $ 12,600 $ (10,538 ) $ (9,590 ) $ 22,946 $ 23,289

Charges/Other

Items:

Acquisition, integration and reorganization of men's brands —

— 1,584 3,875

194 262 1,778

4,137 Total charges/other items — —

1,584 3,875 194

262 1,778 4,137 Adjusted

operating earnings (loss) $ 21,857 $ 20,279

$ 13,211 $ 16,475 $

(10,344 ) $ (9,328 ) $ 24,724 $ 27,426

(1) The thirteen-week period ended April 29, 2017 excludes

sales from Allen Edmonds.

CALERES, INC.

SUMMARY FINANCIAL RESULTS BY SEGMENT

SUMMARY

FINANCIAL RESULTS (Unaudited) Famous Footwear

Brand Portfolio Eliminations and Other Consolidated

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

(Thousands)

August 4,2018

July 29,2017

August 4,2018

July 29,2017

August 4,2018

July 29,2017

August 4,2018

July 29,2017

Net sales $ 429,472 $ 404,930 $ 305,021 $ 301,874 $

(27,881 ) $ (29,850 ) $ 706,612 $ 676,954 Gross profit $ 187,114 $

183,309 $ 108,288 $ 106,219 $ (2,301 ) $ (2,067 ) $ 293,101 $

287,461 Adjusted gross profit $ 187,114 $ 183,309 $ 108,828 $

108,129 $ (2,301 ) $ (2,067 ) $ 293,641 $ 289,371 Gross profit rate

43.6 % 45.3 % 35.5 % 35.2 % 8.3 % 6.9 % 41.5 % 42.5 % Adjusted

gross profit rate 43.6 % 45.3 % 35.6 % 35.8 % 8.3 % 6.9 % 41.6 %

42.7 % Operating earnings (loss) $ 33,240 $ 25,112 $ 15,909 $

17,983 $ (17,006 ) $ (14,669 ) $ 32,143 $ 28,426 Adjusted operating

earnings (loss) $ 33,240 $ 25,112 $ 18,248 $ 20,529 $ (16,682 ) $

(12,440 ) $ 34,806 $ 33,201 Operating earnings (loss) % 7.7 % 6.2 %

5.2 % 6.0 % 61.0 % 49.1 % 4.5 % 4.2 % Adjusted operating earnings %

7.7 % 6.2 % 6.0 % 6.8 % 59.8 % 41.7 % 4.9 % 4.9 % Same-store sales

% (on a 13-week basis) (1) 2.6 % 2.8 % (1.3 )% 15.8 %

—

%

—

%

—

%

—

%

Number of stores 1,008 1,055 233

238 — —

1,241 1,293

RECONCILIATION OF ADJUSTED RESULTS (NON-GAAP)

(Unaudited) Famous Footwear Brand Portfolio

Eliminations and Other Consolidated

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

(Thousands)

August 4,2018

July 29,2017

August 4,2018

July 29,2017

August 4,2018

July 29,2017

August 4,2018

July 29,2017

Gross profit $ 187,114 $ 183,309 $ 108,288 $ 106,219 $ (2,301 ) $

(2,067 ) $ 293,101 $ 287,461

Charges/Other

Items:

Blowfish Malibu acquisition-related costs — — 540 — — — 540 —

Acquisition, integration and reorganization of men's brands —

— — 1,910 —

— — 1,910 Total

charges/other items — — 540

1,910 — — 540

1,910 Adjusted gross profit $ 187,114

$ 183,309 $ 108,828 $ 108,129

$ (2,301 ) $ (2,067 ) $ 293,641

$ 289,371 Operating earnings (loss) $ 33,240 $ 25,112

$ 15,909 $ 17,983 $ (17,006 ) $ (14,669 ) $ 32,143 $ 28,426

Charges/Other

Items:

Blowfish Malibu acquisition-related costs — — 540 — 238 — 778 —

Acquisition, integration and reorganization of men's brands —

— 1,799 2,546

86 2,229 1,885

4,775 Total charges/other items — —

2,339 2,546 324

2,229 2,663 4,775 Adjusted

operating earnings (loss) $ 33,240 $ 25,112

$ 18,248 $ 20,529 $

(16,682 ) $ (12,440 ) $ 34,806 $ 33,201

(1) The thirteen-week period ended July 29, 2017 excludes

sales from Allen Edmonds.

CALERES, INC. SUMMARY FINANCIAL

RESULTS BY SEGMENT

SUMMARY FINANCIAL RESULTS (Unaudited) Famous Footwear

Brand Portfolio Eliminations and Other

Consolidated

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

(Thousands)

November 3,2018

October 28,2017

November 3,2018

October 28,2017

November 3,2018

October 28,2017

November 3,2018

October 28,2017

Net sales $ 448,765 $ 473,118 $ 343,032 $ 316,756 $ (15,968 ) $

(15,218 ) $ 775,829 $ 774,656 Gross profit $ 182,487 $ 198,073 $

126,558 $ 117,026 $ 1,565 $ 1,786 $ 310,610 $ 316,885 Adjusted

gross profit $ 182,487 $ 198,073 $ 128,404 $ 117,026 $ 1,565 $

1,786 $ 312,456 $ 316,885 Gross profit rate 40.7 % 41.9 % 36.9 %

37.0 % (9.8 )% (11.7 )% 40.0 % 40.9 % Adjusted gross profit rate

40.7 % 41.9 % 37.4 % 36.9 % (9.8 )% (11.7 )% 40.3 % 40.9 %

Operating earnings (loss) $ 24,414 $ 33,747 $ 25,114 $ 22,495 $

(9,780 ) $ (5,864 ) $ 39,748 $ 50,378 Adjusted operating earnings

(loss) $ 24,414 $ 33,747 $ 28,015 $ 22,495 $ (5,495 ) $ (5,864 ) $

46,934 $ 50,378 Operating earnings (loss) % 5.4 % 7.1 % 7.3 % 7.1 %

61.2 % 38.5 % 5.1 % 6.5 % Adjusted operating earnings % 5.4 % 7.1 %

8.2 % 7.1 % 34.4 % 38.5 % 6.0 % 6.5 % Same-store sales % (on a

13-week basis) (1) 2.8 % 0.9 % 1.7 % 2.4 %

—

%

—

%

—

%

—

%

Number of stores 1,007 1,042 232

235 — —

1,239 1,277

RECONCILIATION OF ADJUSTED RESULTS (NON-GAAP)

(Unaudited) Famous Footwear

Brand Portfolio Eliminations and Other

Consolidated

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

13 WeeksEnded

(Thousands)

November 3,2018

October 28,2017

November 3,2018

October 28,2017

November 3,2018

October 28,2017

November 3,2018

October 28,2017

Gross profit $ 182,487 $ 198,073 $ 126,558 $ 117,026 $ 1,565 $

1,786 $ 310,610 $ 316,885

Charges/Other

Items:

Blowfish Malibu acquisition-related costs — — 932 — — — 932 —

Vionic acquisition-related costs — —

914 — — —

914 — Total charges/other items —

— 1,846 — —

— 1,846 — Adjusted gross

profit $ 182,487 $ 198,073 $ 128,404

$ 117,026 $ 1,565 $ 1,786

$ 312,456 $ 316,885 Operating

earnings (loss) $ 24,414 $ 33,747 $ 25,114 $ 22,495 $ (9,780 ) $

(5,864 ) $ 39,748 $ 50,378

Charges/Other

Items:

Blowfish Malibu acquisition and integration-related costs — — 932 —

68 — 1,000 — Vionic acquisition-related costs — — 914 — 4,108 —

5,022 — Acquisition, integration and reorganization of men's brands

— — 1,055 —

109 — 1,164 —

Total charges/other items — — 2,901

— 4,285 —

7,186 — Adjusted operating earnings (loss)

$ 24,414 $ 33,747 $ 28,015

$ 22,495 $ (5,495 ) $ (5,864 )

$ 46,934 $ 50,378 (1) The thirteen-week

period ended October 28, 2017 excludes sales from Allen Edmonds.

CALERES, INC. SUMMARY FINANCIAL RESULTS BY

SEGMENT

SUMMARY FINANCIAL RESULTS (Unaudited)

Famous Footwear Brand Portfolio Eliminations and

Other Consolidated

13 WeeksEnded

14 WeeksEnded

13 WeeksEnded

14 WeeksEnded

13 WeeksEnded

14 WeeksEnded

13 WeeksEnded

14 WeeksEnded

(Thousands)

February 2,2019

February 3,2018

February 2,2019

February 3,2018

February 2,2019

February 3,2018

February 2,2019

February 3,2018

Net sales $ 365,160 $ 393,085 $ 382,001 $ 334,736 $

(26,898 ) $ (25,356 ) $ 720,263 $ 702,465 Gross profit $ 156,028 $

175,362 $ 123,212 $ 118,415 $ (1,528 ) $ (382 ) $ 277,712 $ 293,395

Adjusted gross profit $ 156,028 $ 175,362 $ 133,197 $ 118,415 $

(1,528 ) $ (382 ) $ 287,697 $ 293,395 Gross profit rate 42.7 % 44.6

% 32.3 % 35.4 % 5.7 % 1.5 % 38.6 % 41.8 % Adjusted gross profit

rate 42.7 % 44.6 % 34.9 % 35.4 % 5.7 % 1.5 % 39.9 % 41.8 %

Operating earnings (loss) $ 5,757 $ 13,093 $ (93,450 ) $ 27,082 $

(6,744 ) $ (14,584 ) $ (94,437 ) $ 25,591 Adjusted operating

earnings (loss) $ 6,149 $ 13,657 $ 20,678 $ 27,237 $ (6,341 ) $

(14,361 ) $ 20,486 $ 26,533 Operating earnings (loss) % 1.6 % 3.3 %

(24.5 )% 8.1 % 25.1 % 57.5 % (13.1 )% 3.6 % Adjusted operating

earnings % 1.7 % 3.5 % 5.4 % 8.1 % 23.6 % 56.6 % 2.8 % 3.8 %

Same-store sales % (on a 13-week basis) (1) 1.1 % 2.8 % 0.2 % 5.9 %

—

%

—

%

—

%

—

%

Number of stores 992 1,026 229

236 — —

1,221 1,262

RECONCILIATION OF

ADJUSTED RESULTS (NON-GAAP) (Unaudited) Famous Footwear

Brand Portfolio Eliminations and Other Consolidated

13 WeeksEnded

14 WeeksEnded

13 WeeksEnded

14 WeeksEnded

13 WeeksEnded

14 WeeksEnded

13 WeeksEnded

14 WeeksEnded

(Thousands)

February 2,2019

February 3,2018

February 2,2019

February 3,2018

February 2,2019

February 3,2018

February 2,2019

February 3,2018

Gross profit $ 156,028 $ 175,362 $ 123,212 $ 118,415 $ (1,528 ) $

(382 ) $ 277,712 $ 293,395

Charges/Other

Items:

Blowfish Malibu acquisition and integration-related costs — — 244 —

— — 244 — Vionic acquisition and integration-related costs — —

7,973 — — — 7,973 — Brand Portfolio - business exits —

— 1,768 — —

— 1,768 — Total

charges/other items — — 9,985

— — — 9,985

— Adjusted gross profit $ 156,028 $

175,362 $ 133,197 $ 118,415

$ (1,528 ) $ (382 ) $ 287,697 $

293,395 Operating earnings (loss) $ 5,757 $ 13,093 $ (93,450

) $ 27,082 $ (6,744 ) $ (14,584 ) $ (94,437 ) $ 25,591

Charges/Other

Items:

Impairment of goodwill and intangible assets — — 98,044 — — —

98,044 — Integration and reorganization of men's brands — — 984 —

30 — 1,014 — Logistics transition — — 4,488 — — — 4,488 — Blowfish

Malibu acquisition and integration-related costs — — 244 — — — 244

— Vionic acquisition and integration-related costs — — 7,973 — 373

— 8,346 — Brand Portfolio - business exits — — 2,395 — — — 2,395 —

Retail operations restructuring 392 564

— 155 — 223

392 942 Total charges/other items 392

564 114,128 155

403 223 114,923 942

Adjusted operating earnings (loss) $ 6,149

$ 13,657 $ 20,678 $ 27,237

$ (6,341 ) $ (14,361 ) $ 20,486

$ 26,533 (1) The fourteen-week period ended February

3, 2018 excludes sales from Allen Edmonds.

CALERES, INC. SUMMARY FINANCIAL RESULTS BY SEGMENT

SUMMARY FINANCIAL RESULTS (Unaudited) Famous Footwear

Brand Portfolio Eliminations and Other

Consolidated

52 WeeksEnded

53 WeeksEnded

52 WeeksEnded

53 WeeksEnded

52 WeeksEnded

53 WeeksEnded

52 WeeksEnded

53 WeeksEnded

(Thousands)

February 2,2019

February 3,2018

February 2,2019

February 3,2018

February 2,2019

February 3,2018

February 2,2019

February 3,2018

Net sales $ 1,606,808 $ 1,637,627 $ 1,313,551 $ 1,233,081 $ (85,513

) $ (85,124 ) $ 2,834,846 $ 2,785,584 Gross profit $ 690,830

$ 724,434 $ 466,919 $ 444,164 $ (1,405 ) $ 51 $ 1,156,344 $

1,168,649 Adjusted gross profit $ 690,830 $ 724,434 $ 479,291 $

449,103 $ (1,405 ) $ 51 $ 1,168,716 $ 1,173,588 Gross profit rate

43.0 % 44.2 % 35.5 % 36.0 % 1.6 % — % 40.8 % 42.0 % Adjusted gross

profit rate 43.0 % 44.2 % 36.5 % 36.4 % 1.6 % — % 41.2 % 42.1 %

Operating earnings (loss) $ 85,268 $ 92,230 $ (40,799 ) $ 80,160 $

(44,068 ) $ (44,707 ) $ 401 $ 127,683 Adjusted operating earnings

(loss) $ 85,660 $ 92,794 $ 80,152 $ 86,736 $ (38,861 ) $ (41,993 )

$ 126,951 $ 137,537 Operating earnings (loss) % 5.3 % 5.6 % (3.1 )%

6.5 % 51.5 % 52.5 % 0.0 % 4.6 % Adjusted operating earnings % 5.3 %

5.7 % 6.1 % 7.0 % 45.4 % 49.3 % 4.5 % 4.9 % Same-store sales % (on

a 52-week basis) (1) 1.5 % 1.4 % (0.1 )% 6.4 %

—

%

—

%

—

%

—

% Number of stores 992 1,026 229

236 — —

1,221 1,262 (1) The fifty-three week

period ended February 3, 2018 excludes sales from Allen Edmonds.

SCHEDULE 5

CALERES, INC. SUMMARY FINANCIAL RESULTS BY

SEGMENT

RECONCILIATION OF ADJUSTED RESULTS (NON-GAAP)

(Unaudited) Famous Footwear Brand Portfolio Other

Consolidated

52 WeeksEnded

53 WeeksEnded

52 WeeksEnded

53 WeeksEnded

52 WeeksEnded

53 WeeksEnded

52 WeeksEnded

53 WeeksEnded

(Thousands)

February 2,2019

February 3,2018

February 2,2019

February 3,2018

February 2,2019

February 3,2018

February 2,2019

February 3,2018

Gross profit $ 690,830 $ 724,434 $ 466,919 $ 444,164 $ (1,405 ) $

51 $ 1,156,344 $ 1,168,649

Charges/Other

Items:

Integration and reorganization of men's brands — — — 4,939 — — —

4,939 Blowfish Malibu acquisition and integration-related costs — —

1,717 — — — 1,717 — Vionic acquisition and integration-related

costs — — 8,886 — — — 8,886 — Brand Portfolio - business exits —

— 1,769 — —

— 1,769 — Total

charges/other items — — 12,372

4,939 — — 12,372

4,939 Adjusted gross profit $ 690,830 $

724,434 $ 479,291 $ 449,103

$ (1,405 ) $ 51 $ 1,168,716

$ 1,173,588 Operating earnings (loss) $ 85,268 $ 92,230 $

(40,799 ) $ 80,160 $ (44,068 ) $ (44,707 ) $ 401 $ 127,683

Charges/Other

Items:

Impairment of goodwill and intangible assets — — 98,044 — — —

98,044 — Integration and reorganization of men's brands — — 5,421

6,421 420 2,491 5,841 8,912 Logistics transition — — 4,488 — — —

4,488 — Blowfish Malibu acquisition and integration-related costs —

— 1,717 — 305 — 2,022 — Vionic acquisition and integration-related

costs — — 8,886 — 4,482 — 13,368 — Brand Portfolio - business exits

— — 2,395 — — — 2,395 — Retail operations restructuring 392

564 — 155 —

223 392 942 Total charges/other

items 392 564 120,951

6,576 5,207 2,714 126,550

9,854 Adjusted operating earnings (loss) 85,660

92,794 80,152 86,736

(38,861 ) (41,993 ) 126,951

137,537

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190522005755/en/

Investor and Media Contact:Peggy Reilly Tharp,

Caleres(314) 854-4134, ptharp@caleres.com

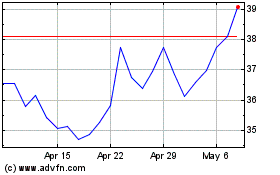

Caleres (NYSE:CAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Caleres (NYSE:CAL)

Historical Stock Chart

From Apr 2023 to Apr 2024