UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

(Check One)

|

|

|

|

¨

|

Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

|

or

|

|

|

|

þ

|

Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

|

For fiscal year ended: March 31, 2019 Commission File number: 1-31402

CAE INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Canada

(Province or Other Jurisdiction of Incorporation or Organization)

|

3699

(Primary Standard Industrial Classification Code Number, if applicable)

|

Not Applicable

(I.R.S. Employer Identification Number, if applicable)

|

8585 Côte-de-Liesse, Saint-Laurent, Québec, H4T 1G6

514-341-6780

(

Address and Telephone Number of Registrant’s principal executive office)

CT Corporation System, 111 Eighth Avenue, 13

th

Floor, New York, NY 10011 (212) 894-8700

(

Name, Address and Telephone Number of Agent for Service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class

Trading Name of Each Exchange

Symbol

On Which Registered

Common Shares, CAE New York Stock Exchange

including associated Common Share

purchase rights pursuant to the Registrant’s

Shareholder Rights Plan, which purchase rights

will trade together with the Common Shares

Securities registered or to be registered pursuant to Section 12(g) of the Act: none

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: none

For annual reports, indicate by check mark the information filed with this form:

þ

Annual Information Form

þ

Audited Annual Financial Statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

265,447,603 common shares

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes

þ

No

¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

Yes

þ

No

¨

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company

¨

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

DISCLOSURE CONTROLS AND PROCEDURES

A. Evaluation of disclosure controls and procedures.

Disclosure controls and procedures are designed to ensure that information required to be disclosed by CAE Inc. (“CAE” or the “Company”) in reports filed with securities regulatory agencies is recorded, processed, summarized and reported on a timely basis and is accumulated and communicated to CAE’s management, including our President and Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding disclosure.

Under the supervision of the President and Chief Executive Officer and Chief Financial Officer, management evaluated the effectiveness of CAE’s disclosure controls and procedures, as defined in Rule 13a-15(e) and 15d-15(e) under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), as of March 31, 2019, the end of the period covered by this Annual Report on Form 40-F. The President and Chief Executive Officer and the Chief Financial Officer concluded from the evaluation that the design and operation of CAE’s disclosure controls and procedures were effective as at March 31, 2019.

B. Management’s report on internal control over financial reporting.

CAE’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act.

CAE’s internal control over financial reporting includes those policies and procedures that: (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of CAE’s assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that CAE’s receipts and expenditures are being made only in

accordance with authorizations of its management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of CAE’s assets that could have a material effect on the financial statements.

Management evaluated the effectiveness of CAE’s internal controls over financial reporting as of March 31, 2019, based on the framework and criteria set forth in

Internal Control – Integrated Framework (2013)

issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and has concluded that CAE’s internal control over financial reporting is effective as of the end of the period covered by this Annual Report on Form 40-F.

C. Attestation report of the Independent Auditors.

PricewaterhouseCoopers LLP, independent auditors who audited and reported on CAE’s financial statements included in this annual report, has issued an attestation report on the effectiveness of CAE’s internal control over financial reporting as of the end of the period covered by this Annual Report on Form 40-F. This attestation report is included in Exhibit 99.2 to this Annual Report on Form 40-F.

D. Changes in internal control over financial reporting.

There were no changes to CAE’s internal control over financial reporting during the year ended March 31, 2019 that have materially affected, or are reasonably likely to materially affect, CAE’s internal control over financial reporting.

E. Limitations on the effectiveness of controls.

A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance with respect to the reliability of financial reporting and financial statement preparation. Accordingly, CAE’s management, including our President and Chief Executive Officer and our Chief Financial Officer, does not expect that CAE’s internal control over financial reporting will prevent or detect all errors and all fraud.

CAE will continue to periodically review its disclosure controls and procedures and internal control over financial reporting and may make modifications from time to time as considered necessary or desirable.

AUDIT COMMITTEE FINANCIAL EXPERT

CAE’s board of directors has determined that it has two audit committee financial experts serving on its audit committee. The board of directors has determined that Ms. Kate Stevenson and Mr. Alan MacGibbon are audit committee financial experts within the meaning of General Instruction B(8)(b) of Form 40-F and are independent as that term is defined by the New York Stock Exchange’s corporate governance standards applicable to CAE.

The Securities and Exchange Commission (the “Commission”) has indicated that the designation of a person as an audit committee financial expert does not make such person an “expert” for any purpose, does not impose on such person any duties, obligations or liability that are greater than those imposed on such person as a member of the audit committee and the board of directors in the absence of such designation and does not affect the duties, obligations or liability of any other member of the audit committee or board of directors.

CODE OF ETHICS

CAE has a code of ethics entitled “Code of Business Conduct”. The Code of Business Conduct is included in Exhibit 99.10 to this Annual Report on Form 40-F. It applies to all directors, officers, and employees of CAE, including CAE’s principal executive officer, principal financial officer, principal accounting officer, agents, representatives, contractors, suppliers and consultants. The Code of Business Conduct is available at CAE’s website

http://www.cae.

com/investors/governance/

. Amendments to the Code of Business Conduct and waivers, if any, for executive officers will be disclosed on CAE’s website. Unless specifically referred to herein, the information on CAE’s website shall not be deemed to be incorporated by reference in this annual report.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The disclosure provided under section 11 “Approval Of Services” on page 56 of Exhibit 99.1, Annual Information Form, providing details on the fees billed by PricewaterhouseCoopers LLP, the Company’s principal accountant, to CAE in each of the years ended March 31, 2019 and March 31, 2018 for professional services rendered to CAE, is incorporated by reference herein.

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

The disclosure provided under section 11 “Approval of Services” on page 56 of Exhibit 99.1, Annual Information Form, is incorporated by reference herein.

None of the services described above under the captions “Audit-Related Fees” or “Tax Fees” were approved by the Audit Committee pursuant to the de minimis exemption to the pre-approval requirements provided by paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

OFF-BALANCE SHEET ARRANGEMENTS

The disclosure provided under section 7.2 “Off balance sheet arrangements” on page 30 of Exhibit 99.3, Management’s Discussion and Analysis, is incorporated by reference herein.

CONTRACTUAL OBLIGATIONS

The disclosure provided under section 6.4 “Contractual Obligations” on page 27 of Exhibit 99.3, Management’s Discussion and Analysis, is incorporated by reference herein.

IDENTIFICATION OF THE AUDIT COMMITTEE

CAE has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. CAE’s Audit Committee is, as of the date hereof, comprised of the following directors: Alan MacGibbon, François Olivier, Michael E. Roach, Norton B. Schwartz and Katharine B. Stevenson.

SIGNIFICANT DIFFERENCES

There are significant ways in CAE’s corporate governance practices differ from those required of domestic companies under NYSE listing standards. Disclosure concerning these differences is available at CAE’s website

http://www.cae.com/investors/governance/

.

UNDERTAKING AND CONSENT TO

SERVICE OF PROCESS

CAE Inc. (the “Registrant”) undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

|

|

|

|

B.

|

Consent to Service of Process

|

The Registrant has previously filed with the Commission a Form F-X in connection with the Common Shares, including the associated Common Share purchase rights pursuant to the Registrant’s Shareholder Rights Plan, which purchase rights trade together with the Common Shares.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: June 27, 2019

CAE INC.

By:

_/s/ Mark Hounsell____________________

Name: Mark Hounsell

|

|

|

|

Title:

|

General Counsel, Chief Compliance Officer and Corporate Secretary

|

EXHIBIT INDEX

|

|

|

|

|

|

|

99.1

|

|

Annual Information Form for the fiscal year ended March 31, 2019, dated June 13, 2019

|

|

99.2

|

|

Audited annual financial statements for the fiscal year ended March 31, 2019

|

|

99.3

|

|

Management’s Discussion and Analysis for the fiscal year ended March 31, 2019

|

|

99.4

|

|

Consent of PricewaterhouseCoopers LLP

|

|

99.5

|

|

Certification of Marc Parent required by Rule 13a-14(a) or Rule 15d-14(a)

|

|

99.6

|

|

Certification of Sonya Branco required by Rule 13a-14(a) or Rule 15d-14(a)

|

|

99.7

|

|

Certification of Marc Parent pursuant to 18 U.S.C. Section 1350, as enacted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

99.8

|

|

Certification of Sonya Branco pursuant to 18 U.S.C. Section 1350, as enacted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

99.9

|

|

Notice and Management Proxy Circular dated June 19, 2019 (incorporated by reference to CAE’s Form 6-K (commission file no. 1-31402) furnished to the Commission on June 27, 2019

|

|

99.10

|

|

Code of Business Conduct

|

|

101

|

XBRL Documents

|

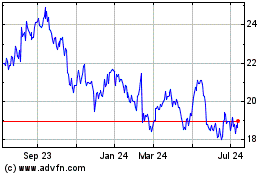

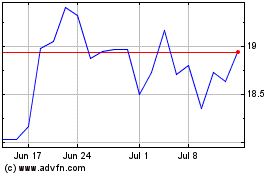

Cae (NYSE:CAE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cae (NYSE:CAE)

Historical Stock Chart

From Apr 2023 to Apr 2024