Current Report Filing (8-k)

March 12 2021 - 8:10AM

Edgar (US Regulatory)

false

0000016058

0000016058

2021-03-12

2021-03-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 12, 2021

CACI International Inc

(Exact name of Registrant as Specified in Its Charter)

|

Delaware

|

001-31400

|

54-1345888

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1100 N. Glebe Road

Arlington, Virginia

|

|

22201

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (703) 841-7800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

CACI

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 1.01 Entry into a Material Definitive Agreement.

On March 12, 2021, CACI International Inc (the “Company”) entered into a master confirmation (the “Master Confirmation”) and a supplemental confirmation (together with the Master Confirmation, an “ASR Agreement”), with JPMorgan Chase Bank, National Association (the “ASR Counterparty”). Under the ASR Agreement, the Company will pay a total of $500 million to the ASR Counterparty and receive a total of approximately 1.7 million shares of the Company’s common stock (the “Common Stock”) from the ASR Counterparty on March 16, 2021. The total number of shares of Common Stock that the Company will repurchase under the ASR Agreement will be based on the average of the daily volume-weighted average prices of the Common Stock during the term of such ASR Agreement, less a discount and subject to adjustments pursuant to the terms of the ASR Agreement. At settlement, the ASR Counterparty may be required to deliver additional shares of Common Stock to the Company, or, under certain circumstances, the Company may be required to make a cash payment or deliver shares of Common Stock to the ASR Counterparty.

The ASR Agreement contains the principal terms and provisions governing the accelerated share repurchase, including, but not limited to, the mechanism used to determine the number of shares of Common Stock that will be delivered, the required timing of delivery of the shares, the circumstances under which the ASR Counterparty is permitted to make adjustments to valuation and calculation periods, and various acknowledgements, representations and warranties made by the Company and the ASR Counterparty to one another. The ASR Agreement also provides that the ASR Counterparty can terminate the transaction following the occurrence of certain specified events, including major corporate transactions involving the Company.

Item 7.01 Regulation FD Disclosure.

On March 12, 2021, the Company issued a press release announcing it had entered into an accelerated share repurchase agreement to repurchase $500 million of common stock. A copy of the Company’s press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended.

Item 9.01 Financial Statement and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

CACI International Inc

|

|

|

|

|

|

|

Date: March 12, 2021

|

|

By:

|

/s/ J. William Koegel, Jr.

|

|

|

|

|

J. William Koegel, Jr.

|

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

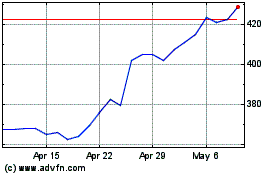

CACI (NYSE:CACI)

Historical Stock Chart

From Mar 2024 to Apr 2024

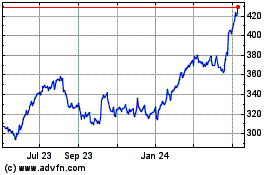

CACI (NYSE:CACI)

Historical Stock Chart

From Apr 2023 to Apr 2024