Amended Current Report Filing (8-k/a)

December 16 2019 - 4:31PM

Edgar (US Regulatory)

Form 8-K/A date of report 10-01-19

true

0001632127

0001632127

2019-10-01

2019-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 1, 2019

Cable One, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

001-36863

|

13-3060083

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

210 E. Earll Drive, Phoenix, Arizona

|

85012

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (602) 364-6000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.01

|

|

CABO

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

On October 1, 2019, Cable One, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original Form 8-K”) with the Securities and Exchange Commission (the “SEC”) reporting that on such date the Company completed its acquisition (the “Transaction”) of all the outstanding equity interests in the entities comprising Fidelity Communications Co.’s data, video and voice business and certain related assets (collectively, the “Fidelity Entities”) pursuant to a Stock Purchase Agreement, dated as of March 31, 2019.

As previously disclosed in the Original Form 8-K, in a letter dated May 2, 2019 from the SEC’s Division of Corporation Finance (the “Division”), the Division stated that it would permit the Company to substitute an audited statement of assets acquired and liabilities assumed at fair value at the closing date of the Transaction (the “Fidelity Abbreviated Financial Statement”) for the full financial statements of the Fidelity Entities required by Rule 3-05 of Regulation S-X (“Rule 3-05”). This Amendment No. 1 is being filed to provide, and amends the Original Form 8-K to include, the Fidelity Abbreviated Financial Statement set forth below under Item 9.01 and should be read in conjunction with the Original Form 8-K.

An application of the investment test under Rule 3-05 resulted in the Transaction qualifying as a “significant acquisition” at a significance level of 22.8%, but the investment test calculation used the Company’s total assets as of December 31, 2018 and did not include assets acquired by the Company on January 8, 2019, the closing date of the Company’s acquisition of Delta Communications, L.L.C. (the “Clearwave Acquisition”). If the Clearwave Acquisition had been consummated eight days earlier, on December 31, 2018, the Transaction would no longer have qualified as a “significant acquisition” under the investment test. The Transaction was not significant under either the income test or the asset test of Rule 3-05. In addition, the Transaction represents an expansion of the geographic scope of the Company’s pre-existing core business to new communities in the United States, rather than an expansion into new businesses with financial characteristics that differ materially from those applicable to the Company’s historical operations. For these reasons, the Company believes that the Fidelity Abbreviated Financial Statement, which includes the disclosure of certain operating statistics of the Fidelity Entities, provides investors with the information needed to evaluate the Company and its business following the Transaction.

Cautionary Statement Regarding Forward-Looking Statements

This document contains “forward-looking statements” that involve risks and uncertainties. These statements can be identified by the fact that they do not relate strictly to historical or current facts, but rather are based on current expectations, estimates, assumptions and projections about the Company’s industry, business, financial results and financial condition. Forward-looking statements often include words such as “will,” “should,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” “plans,” “believes” and words and terms of similar substance in connection with discussions of future operating or financial performance. As with any projection or forecast, forward-looking statements are inherently susceptible to uncertainty and changes in circumstances. The Company’s actual results may vary materially from those expressed or implied in its forward-looking statements. Accordingly, undue reliance should not be placed on any forward-looking statement made by the Company or on its behalf. Important factors that could cause the Company’s actual results to differ materially from those in its forward-looking statements include government regulation, economic, strategic, political and social conditions and the following factors, which are discussed in the Company’s latest Annual Report on Form 10-K and Quarterly Report on Form 10-Q:

|

|

●

|

the effect of the Transaction on the Company’s and the Fidelity Entities’ ability to retain and hire key personnel and to maintain relationships with customers, suppliers and other business partners;

|

|

|

●

|

risks related to management’s attention being diverted from the Company’s ongoing business operations;

|

|

|

●

|

uncertainties as to the Company’s ability and the amount of time necessary to realize the expected synergies and other benefits of the Transaction;

|

|

|

●

|

the Company’s ability to integrate the Fidelity Entities’ operations into its own;

|

|

|

●

|

rising levels of competition from historical and new entrants in the Company’s markets;

|

|

|

●

|

recent and future changes in technology;

|

|

|

●

|

the Company’s ability to continue to grow its business services products;

|

|

|

●

|

increases in programming costs and retransmission fees;

|

|

|

●

|

the Company’s ability to obtain hardware, software and operational support from vendors;

|

|

|

●

|

the effects of any new significant acquisitions by the Company;

|

|

|

●

|

risks that the Company’s rebranding may not produce the benefits expected;

|

|

|

●

|

adverse economic conditions;

|

|

|

●

|

the integrity and security of the Company’s network and information systems;

|

|

|

●

|

the impact of possible security breaches and other disruptions, including cyber-attacks;

|

|

|

●

|

the Company’s failure to obtain necessary intellectual and proprietary rights to operate its business and the risk of intellectual property claims and litigation against the Company;

|

|

|

●

|

the Company’s ability to retain key employees;

|

|

|

●

|

legislative or regulatory efforts to impose network neutrality and other new requirements on the Company’s data services;

|

|

|

●

|

additional regulation of the Company’s video and voice services;

|

|

|

●

|

the Company’s ability to renew cable system franchises;

|

|

|

●

|

increases in pole attachment costs;

|

|

|

●

|

changes in local governmental franchising authority and broadcast carriage regulations;

|

|

|

●

|

the potential adverse effect of the Company’s level of indebtedness on its business, financial condition or results of operations and cash flows;

|

|

|

●

|

the possibility that interest rates will rise, causing the Company’s obligations to service its variable rate indebtedness to increase significantly;

|

|

|

●

|

the Company’s ability to incur future indebtedness;

|

|

|

●

|

fluctuations in the Company’s stock price;

|

|

|

●

|

the Company’s ability to continue to pay dividends;

|

|

|

●

|

dilution from equity awards and potential stock issuances in connection with acquisitions;

|

|

|

●

|

provisions in the Company’s charter, by-laws and Delaware law that could discourage takeovers; and

|

|

|

●

|

the other risks and uncertainties detailed from time to time in the Company’s filings with the SEC, including but not limited to its latest Annual Report on Form 10-K and Quarterly Report on Form 10-Q.

|

Any forward-looking statements made by the Company in this document speak only as of the date on which they are made. The Company is under no obligation, and expressly disclaims any obligation, except as required by law, to update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise.

|

Item 9.01

|

Financial Statements and Exhibits.

|

Financial Statements of Businesses Acquired. The audited Fidelity Abbreviated Financial Statement is filed herewith as Exhibit 99.1 and is incorporated by reference herein.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Cable One, Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Peter N. Witty

|

|

|

|

|

Name:

|

Peter N. Witty

|

|

|

|

|

Title:

|

Senior Vice President, General Counsel and Secretary

|

|

|

|

|

|

|

Date: December 16, 2019

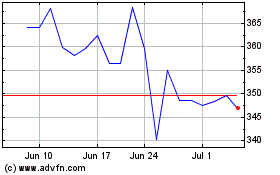

Cable One (NYSE:CABO)

Historical Stock Chart

From Mar 2024 to Apr 2024

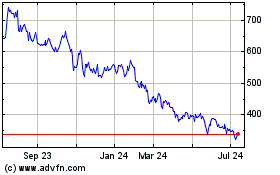

Cable One (NYSE:CABO)

Historical Stock Chart

From Apr 2023 to Apr 2024