Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

January 09 2019 - 5:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 9, 2019

BYLINE BANCORP, INC.

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

|

|

|

|

|

001-38139

|

|

36-3012593

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

180 North LaSalle Street, Suite 300

|

|

|

|

Chicago, Illinois

|

|

60601

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(773) 244-7000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Byline Bancorp, Inc., a Delaware corporation (“

Byline

”), is filing this Current Report on Form 8-K because it intends to incorporate by reference the exhibits listed below into one or more registration statements that Byline may file with the Securities and Exchange Commission (“

SEC

”) in the future. Byline previously included the historical audited consolidated financial statements of Ridgestone Financial Services, Inc. and related Independent Auditor’s Report that are included in Exhibit 99.1 hereto in its registration statement on Form S-1 (File No. 333-218362) and its registration statement on Form S-4 (File No. 333-218362).

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(a)

Financial Statements of Business Acquired.

The audited consolidated balance sheets as of October 14, 2016 and December 31, 2015, and the audited consolidated statements of income, comprehensive income, shareholders’ equity and cash flows for the period from January 1, 2016 to October 14, 2016 and the year ended December 31, 2015, and the accompanying notes thereto, of Ridgestone Financial Services, Inc. and related Independent Auditor’s Report, are filed as Exhibit 99.1 hereto and incorporated herein by reference. As previously reported, Byline completed the acquisition of Ridgestone Financial Services, Inc. on October 14, 2016.

(d)

Exhibits.

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

23.1

99.1

|

|

Consent of Crowe LLP

Audited consolidated balance sheets as of October 14, 2016 and December 31, 2015, and the audited consolidated statements of income, comprehensive income, shareholders’ equity and cash flows for the period from January 1, 2016 to October 14, 2016 and the year ended December 31, 2015, and the accompanying notes thereto, of Ridgestone Financial Services, Inc. and related Independent Auditor’s Report.

|

|

|

|

|

|

|

|

|

Additional Information and Where to Find It

This communication is being made in respect of the proposed merger transaction involving Byline and Oak Park River Forest Bankshares, Inc. (“

Oak Park

”). Byline intends to file a registration statement on Form S‑4 with the SEC, which will include a proxy statement of Oak Park and a prospectus of Byline, and Byline will file other documents regarding the proposed transaction with the SEC. A definitive proxy statement/prospectus will also be sent to Oak Park stockholders seeking the required stockholder approval of the proposed transaction. Before making any voting or investment decision, investors and security holders of Oak Park are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by Byline with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Byline may be obtained free of charge at its website at http://www.bylinebancorp.com. Alternatively, these documents, when available, can be obtained free of charge from Byline upon written request to Byline Bancorp, Inc., Attn: Corporate Secretary, 180 North LaSalle Street, 3

rd

Floor, Chicago, Illinois 60601.

Information regarding the interests of certain of Oak Park’s directors and executive officers and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the registration statement on Form S-4 regarding the proposed transaction when it becomes available.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

BYLINE BANCORP, INC.

|

|

|

|

|

|

|

Date: January 9, 2019

|

|

|

|

By:

|

/s/ Alberto J. Paracchini

|

|

|

|

|

|

Name:

|

Alberto J. Paracchini

|

|

|

|

|

|

Title:

|

President and Chief Executive Officer

|

3

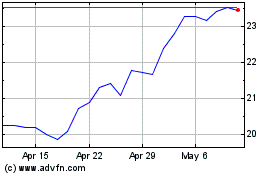

Byline Bancorp (NYSE:BY)

Historical Stock Chart

From Mar 2024 to Apr 2024

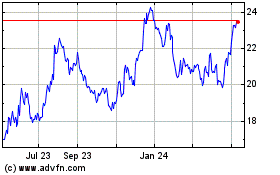

Byline Bancorp (NYSE:BY)

Historical Stock Chart

From Apr 2023 to Apr 2024