Other Matters

We are not aware of any other matters that may be presented or acted on at the Annual Meeting. If you vote by signing and returning the enclosed proxy card or using the Internet or telephone voting procedures, the individuals named as proxies on the card may vote your shares, in their discretion, on any other matter requiring a stockholder vote that comes before the Annual Meeting.

CONFIDENTIAL VOTING

All voted proxies and ballots will be handled to protect your voting privacy as a stockholder. Your vote will not be disclosed except:

•to meet any legal requirements;

•in limited circumstances such as a proxy contest in opposition to our Board;

•to permit independent inspectors of election to tabulate and certify your vote; or

•to adequately respond to your written comments on your proxy card.

4  2023 PROXY STATEMENT

2023 PROXY STATEMENT

SOLICITATION OF PROXIES

We have sent or provided access to the materials to you because our Board is soliciting your proxy to vote your shares at our Annual Meeting. We will bear all expenses incurred in connection with this proxy solicitation. We have engaged Alliance Advisors to assist in the solicitation for a fee of $26,800. In addition, our officers and employees may solicit your proxy by telephone, facsimile transmission, electronic mail or in person, and they will not be separately compensated for such services. We solicit proxies to give all stockholders an opportunity to vote on matters that will be presented at the Annual Meeting. In this proxy statement, you will find information on these matters, which is provided to assist you in voting your shares. If your shares are held through a broker or other nominee (i.e., in "street name") and you have requested printed versions of these materials, we have requested that your broker or nominee forward this proxy statement to you and obtain your voting instructions, for which we will reimburse them for reasonable out-of-pocket expenses. If your shares are held through our Thrift Plan and you have requested printed versions of these materials, the trustee of that plan has sent you this proxy statement and you should instruct the trustee on how to vote your Thrift Plan shares.

2023 PROXY STATEMENT 5

2023 PROXY STATEMENT 5

| | | | | | | | |

| PROPOSAL 1: ELECTION OF DIRECTORS | |

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors is currently comprised of the nine members identified in the table below, all of whom are standing for election. All director nominees stand for election to one-year terms at the Annual Meeting and each annual meeting of stockholders thereafter.

| | |

10-Year Director Tenure Limit |

In 2015, our Board adopted a 10-year director tenure policy that provides that (1) no person may be nominated to serve on the Board if they have more than 10 years of service prior to the date of such election and (2) a director is deemed to resign and retire at the next annual meeting of stockholders following the term in which 10 years of service is attained. See "10-Year Director Tenure Limit" under Corporate Governance — Board Function, Leadership and Executive Sessions below. |

| | | | | |

| Director Nominee | Director Since |

| Jan A. Bertsch | 2013 |

| Gerhard F. Burbach | 2018 |

| Rex D. Geveden | 2017 |

| James M. Jaska | 2016 |

| Kenneth J. Krieg | 2016 |

| Leland D. Melvin | 2019 |

| Robert L. Nardelli | 2014 |

| Barbara A. Niland | 2016 |

| John M. Richardson | 2020 |

Director Qualifications

The table below highlights the qualifications, competency and experience of each director, including each nominee for election to our Board, that contributed to the Board’s determination that each individual is uniquely qualified to serve on the Board. This high-level summary is not intended to be an exhaustive list of each director’s skills or contributions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expertise / Experience | Bertsch | Burbach | Geveden | Jaska | Krieg | Melvin | Nardelli | Niland | Richardson |

| Executive / Operating | ● | ● | ● | ● | ● | | ● | ● | ● |

| Government, Nuclear or Manufacturing Industry | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Financial / Strategic / M&A | ● | ● | ● | ● | ● | | ● | ● | |

| Technology / Scientific | ● | ● | ● | ● | ● | ● | | ○ | ● |

| Risk Management | ● | ● | ● | ● | ○ | ● | ● | ● | ● |

| Healthcare / FDA Regulatory | | ● | | ○ | | | | | |

| Aerospace Industry | | | ● | | ● | ● | | | ● |

| Safety and Environmental | | | ● | ● | | ● | ○ | | ● |

| Public Company CEO Experience | | ● | ● | | | | ● | | |

| Security and Information Technology | ● | ● | ● | ● | ○ | ● | ○ | ○ | ● |

| Governance | ● | ● | ● | ● | ● | | ● | ● | ● |

| International | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Other Current Public Company Boards | 2 | 1 | 1 | 0 | 1 | 0 | 1 | 0 | 2 |

● Expertise ○ Experience |

6  2023 PROXY STATEMENT

2023 PROXY STATEMENT

| | | | | | | | |

| PROPOSAL 1: ELECTION OF DIRECTORS | |

Director Nominees

On the nomination of our Board following the recommendation of the Governance Committee, the following nominees will each stand for election as a director for a one-year term expiring at the 2024 Annual Meeting of Stockholders and until their successors are duly elected and qualified:

| | | | | |

•Jan A. Bertsch | •Leland D. Melvin |

•Gerhard F. Burbach | •Robert L. Nardelli |

•Rex D. Geveden | •Barbara A. Niland |

•James M. Jaska | •John M. Richardson |

•Kenneth J. Krieg | |

Each nominee has consented to serve as a director if elected.

Unless otherwise directed, the persons named as proxies on the enclosed proxy card intend to vote “FOR” the election of each of the director nominees. If any nominee should become unavailable for election, the shares will be voted for such substitute nominee as may be proposed by our Board. We are not aware of any circumstances that would prevent any of the nominees from serving.

Set forth below is certain information for each director nominee up for election at the Annual Meeting and each continuing director of our Company who is not up for election. (Ages are as of the Annual Meeting.)

NOMINEES FOR ELECTION AT THE ANNUAL MEETING

| | | | | | | | | | | | | | |

| Professional Experience |

•Ms. Bertsch, age 66, served as Chief Financial Officer of Owens-Illinois, Inc., a Fortune 500 manufacturer of glass and packaging products, from November 2015 to April 2019. •Previously, Ms. Bertsch served as the Executive Vice President and Chief Financial Officer of Sigma-Aldrich Corporation, a leading life science and high technology company, from March 2012 to November 2015. •Before joining Sigma-Aldrich, Ms. Bertsch served as Vice President, Controller and Principal Accounting Officer of Borg Warner, Inc., from August 2011 to February 2012 and as Vice President and Treasurer from December 2009 to July 2011. •Prior to that, Ms. Bertsch spent several years as Senior Vice President, Treasurer and Chief Information Officer for Chrysler Group, LLC, and Chrysler LLC, where she worked proactively with a number of constituents to determine a solution to Chrysler’s long-term viability. •Ms. Bertsch served on the Board of Directors of Meritor, Inc. from 2016 to 2022, and serves on the Boards of Regal Rexnord Corporation since 2019 and Axalta Coating Systems, Inc. since September 2022. |

|

|

|

|

|

Jan A. Bertsch Independent Board Chair Director since 2013

|

|

| Skills and Qualifications |

•Ms. Bertsch has held numerous advisory roles in the academic, technological, and major manufacturing industries. With 40 years of experience, Ms. Bertsch brings extensive corporate finance, strategic planning, restructuring and international experience to our Board. The depth and breadth of her professional career in the life science, automotive and manufacturing industries, with a keen focus on operational enhancements, cost reduction strategies and revenue generation for Fortune 500 and Fortune 1000 companies, make her a valuable member of the Board. |

|

|

|

| | | | | | | | | | | | | | |

| Professional Experience |

•Mr. Burbach, age 61, was President, Chief Executive Officer and director of Thoratec Corporation, a company that develops, manufactures and markets proprietary medical devices used for circulatory support, from 2006 to 2014. •Prior to that, he held executive leadership positions at Digirad Corporation, Philips Medical Systems, ADAC Laboratories, McKinsey & Company and CitiCorp. •Mr. Burbach received a bachelor’s degree in industrial engineering from Stanford University and a master’s of business administration from Harvard Business School. •Mr. Burbach serves on the board of directors of Fluidigm Corporation, a public company manufacturing and marketing innovative technologies for life sciences research, and is chairman of the board of directors of Procyrion Inc., a private medical device company focused on the treatment of chronic heart failure. He also serves on the boards of Artelon, a private biomaterial developer used for tendon and ligament reconstruction, and Vascular Dynamics, Inc., a private medical device company developing innovative solutions for heart failure and hypertension. |

|

|

|

|

|

Gerhard F. Burbach Independent Director Director since 2018 Committee: – Compensation (Chair) |

|

| Skills and Qualifications |

•Mr. Burbach's leadership background with medical device companies provides our Board with a key external perspective and insight into our medical isotope business, including strategy, development, operations, customers and other stakeholders. |

|

2023 PROXY STATEMENT 7

2023 PROXY STATEMENT 7

| | | | | | | | |

| PROPOSAL 1: ELECTION OF DIRECTORS | |

| | | | | | | | | | | | | | |

| Professional Experience |

•Mr. Geveden, age 62, has served as President and Chief Executive Officer since January 2017, and served as our Chief Operating Officer from October 2015 until December 2016. •Previously, Mr. Geveden was Executive Vice President at Teledyne Technologies Incorporated ("Teledyne"), a provider of electronic subsystems and instrumentation for aerospace, defense and other uses. There he led two of Teledyne's four operating segments since 2013, and concurrently served as President of Teledyne DALSA, Inc., a Teledyne subsidiary, since 2014. Mr. Geveden also served as President and Chief Executive Officer of Teledyne Scientific and Imaging, LLC (2011 to 2013) and President of both Teledyne Brown Engineering, Inc. and Teledyne's Engineered Systems Segment (2007 to 2011). •Mr. Geveden is a former Associate Administrator of the National Aeronautics and Space Administration ("NASA"), where he was responsible for all technical operations within the agency's $16 billion portfolio and served in various other positions with NASA in a career spanning 17 years. •Mr. Geveden has served as chairman of the board of directors of TTM Technologies, Inc. since 2021 and has been a director since 2018. |

|

|

|

|

|

Rex D. Geveden President, Chief Executive Officer and Director Director since 2017 |

|

| Skills and Qualifications |

•Mr. Geveden has broad leadership and technical experience overseeing commercial manufacturing operations for publicly traded companies and high-consequence technology programs for the U.S. government. This experience, combined with his strategic vision, make him a valuable contributor to our Board of Directors. |

|

|

| | | | | | | | | | | | | | |

| Professional Experience |

•Mr. Jaska, age 72, has served as Chief Executive Officer, Versar, Inc. since October 2021. He previously served as President and Chief Executive Officer of both GC Valiant LLC and Valiant Integrated Services LLC from 2016 to 2021. From July 2015 to January 2016, he served as Division President of Supreme Group LLC (now known as Valiant Integrated Services LLC). •Previously, Mr. Jaska served in a variety of roles of increasing responsibility with AECOM (formerly AECOM Technology Corporation) over a 10-year period, including President, Government (2013-2014), President of Americas & Government (2011-2013), Division Executive Vice President (2009-2011), Group Chief Executive, Government Group (2005-2009) and Consultant (2004-2005). •Mr. Jaska also held several positions with Tetra Tech, Inc., a global provider of professional technical services in engineering, applied sciences, resource management and infrastructure, including President and Director (2003-2004), President, Chief Financial Officer and Treasurer (2001-2003), Executive Vice President, Chief Financial Officer and Treasurer (2000-2001) and as Vice President, Chief Financial Officer and Treasurer (1994-2000). •Mr. Jaska has also held leadership roles with Alliant Techsystems, Inc., Honeywell, Inc. and Ecolab. •He holds a master's degree and a bachelor's degree from Western Illinois University. |

|

|

|

|

|

James M. Jaska Independent Director Director since 2016 Committees: – Audit and Finance – Governance (Chair) |

|

|

| Skills and Qualifications |

•Mr. Jaska's leadership background with large technology and government services operations provides our Board with a key external perspective on our operations, customers and other stakeholders relevant to our businesses. |

|

| | | | | | | | | | | | | | |

| Professional Experience |

•Mr. Krieg, age 62, has served as the founder and Principal of Samford Global Strategies, a consulting practice focused on helping clients lead and manage through periods of strategic change, since 2007. •Previously, Mr. Krieg served as the Under Secretary of Defense for Acquisition, Technology and Logistics from June 2005 to July 2007, in which role he was responsible for advising the Secretary of Defense on all matters relating to the Department of Defense acquisition system, research and development, advanced technology, developmental test and evaluation, production, logistics, installation management, military construction, procurement, environmental security, nuclear, chemical and biological matters. •Mr. Krieg has also served in a variety of Department of Defense roles, including as Special Assistant to the Secretary and Director for Program Analysis & Evaluation and Executive Secretary of the Senior Executive Council, and served as Vice President and General Manager of International Paper Realty Inc. •Mr. Krieg also worked in a number of defense and foreign policy assignments in Washington, DC, including positions at the White House, on the National Security Council Staff, and in the Office of the Secretary of Defense. •He serves on the board of directors on Leonardo DRS, Inc. since November 2022 and served on the boards of Tempus Applied Solutions Holdings, Inc. from 2014 to 2016, and API Technologies, Inc. from 2011 to 2016. |

|

|

|

|

|

Kenneth J. Krieg Independent Director Director since 2016 Committee: – Compensation |

|

|

| Skills and Qualifications |

•Mr. Krieg has significant experience overseeing major research, development and procurement programs for the Department of Defense. His background provides our Board of Directors with valuable insight into acquisition priorities and considerations of the U.S. Government, our single largest customer. |

|

|

8  2023 PROXY STATEMENT

2023 PROXY STATEMENT

| | | | | | | | |

| PROPOSAL 1: ELECTION OF DIRECTORS | |

| | | | | | | | | | | | | | |

| Professional Experience |

•Mr. Melvin, age 59, had a 24-year career with NASA as an astronaut and research scientist, including serving as mission specialist on two Space Shuttle Atlantis missions to the International Space Station. •In addition, he served as a NASA Associate Administrator for Education for over four years and served as co-chair of the White House's Federal Coordination in STEM Education Task Force to develop education plans for STEM. •Mr. Melvin served as a U.S. representative to the International Space Education Board, a global collaboration on space education among a number of government space agencies. •He is a director of Star Harbor Space Training Academy, an immersive space training academy, and Trustee Emeritus of the University of Richmond Board of Trustees. •Mr. Melvin received a B.S. in chemistry from the University of Richmond and an M.S. in materials science engineering from the University of Virginia. |

|

|

|

|

|

Leland D. Melvin Independent Director Director since 2019 Committee: – Compensation |

| Skills and Qualifications |

•Mr. Melvin has 24 years of experience with NASA with extensive technical expertise in space exploration as both an astronaut and research scientist. This experience provides an external perspective and insight into the strategy, development, operations and stakeholders for our space propulsion and related programs. |

|

|

| | | | | | | | | | | | | | |

| Professional Experience |

•Mr. Nardelli, age 74, is the Founder and Chief Executive Officer of XLR-8, LLC, an investment and consulting company, which he formed in 2012. •He has also served as a Senior Advisor at Emigrant Savings Bank since August 2015, and formerly served as Senior Advisor to the founder of Cerberus Capital Management, L.P. (“Cerberus”), a private equity firm, and held several senior positions with Cerberus and Cerberus Operations and Advisory Company, LLC from 2007 to August 2015. •Mr. Nardelli served as Chairman and CEO of Chrysler LLC from 2007 until 2009 and served as Chairman, President and CEO of The Home Depot, Inc. from 2000 to 2007. •Previously, Mr. Nardelli held several senior executive positions with General Electric Company. •Mr. Nardelli serves on the board of directors of Fathom Digital Manufacturing Corporation. He has served on the boards of directors of Accelerate Acquisition Corp. (2021-2023), The Home Depot (2000-2007), The Coca-Cola Company (2002-2005), Chrysler LLC (2007-2009) and Pep Boys – Manny, Moe and Jack (2015-2016). |

|

|

|

|

|

Robert L. Nardelli Independent Director Director since 2014 Committees: – Audit and Finance – Governance |

|

| Skills and Qualifications |

•Mr. Nardelli has over 40 years of global operating and financial experience, including with large publicly traded manufacturing companies. This experience combined with his past service on the boards of directors of several other publicly traded companies provides a meaningful perspective to our Board. |

|

| | | | | | | | | | | | | | |

| Professional Experience |

•Ms. Niland, age 64, most recently served as Corporate Vice President and Chief Financial Officer of Huntington Ingalls Industries, Inc. (March 2011 to March 2016), a Fortune 500 shipbuilding company for the U.S. Navy and Coast Guard that was spun off from Northrop Grumman Corporation in 2011. •Previously at Northrop Grumman, Ms. Niland served in a variety of roles of increasing responsibility over a career spanning over 37 years, including as Vice President and Chief Financial Officer, Shipbuilding; Vice President and Chief Financial Officer and Division Vice President - Finance. •Ms. Niland holds a master's degree from the University of Maryland University College and a bachelor's degree from Towson University. |

|

|

|

|

|

Barbara A. Niland Independent Director Director since 2016 Committees: – Audit and Finance (Chair) – Governance | Skills and Qualifications |

•Ms. Niland has over 30 years of financial and operations experience with shipbuilding and manufacturing operations for the U.S. Navy. Her tenure in senior financial leadership roles with one of our publicly traded peer companies provides our Board with valuable perspectives on our industry. |

|

|

2023 PROXY STATEMENT 9

2023 PROXY STATEMENT 9

| | | | | | | | |

| PROPOSAL 1: ELECTION OF DIRECTORS | |

| | | | | | | | | | | | | | |

| Professional Experience |

•Admiral Richardson, age 63, served as the 31st Chief of Naval Operations for the U.S. Navy from 2015 to 2019 and as its Director of the Naval Nuclear Propulsion Program from 2012 to 2015. As Chief of Naval Operations, he was responsible for the management of a $160 billion budget covering 600,000 sailors and civilians, over 70 installations, 290 warships and over 2,000 aircraft worldwide. •During his 37 years of service in the U.S. Navy, Admiral Richardson gained valuable operational and national security experience safely managing the Naval Nuclear Propulsion Program. He also served on four nuclear submarines, including commanding the submarine USS Honolulu, and served as naval aide to the President of the United States. •Admiral Richardson earned a bachelor of science degree in physics from the U.S. Naval Academy, a master's degree in electrical engineering from the Massachusetts Institute of Technology and Woods Hole Oceanographic Institution and a master's degree in National Security Strategy from the National War College. •Admiral Richardson serves on the Board of Directors of The Boeing Company and Constellation Energy Corporation, a spin-off of Exelon Corporation, where he served as a director from 2019 to 2022. |

|

|

|

|

|

John M. Richardson Independent Director Director since 2020 Committees: – Audit and Finance – Compensation |

|

| Skills and Qualifications |

•Admiral Richardson brings extensive expertise in nuclear, safety, regulation, operations management and oversight of complex, high-risk systems, as well as extensive national security experience. His unique understanding of the U.S. government, our single largest customer, and his service on other public company boards of directors provide valuable perspectives on our business and industry. |

|

|

| | |

RECOMMENDATION AND VOTE REQUIRED Our Board recommends that stockholders vote “FOR” each of the director nominees. The proxy holders will vote all proxies received "FOR" each of the director nominees unless instructed otherwise. Approval of this proposal requires that the number of votes cast "FOR" exceeds the number of votes cast "AGAINST" at the Annual Meeting. Abstentions and broker non-votes with respect to the election of directors will have no effect on the outcome and do not count as votes cast. Under our Bylaws, in the event of a contested election, the director nominees will be elected by the affirmative vote of a plurality of the votes cast by the shares of our common stock entitled to vote in the election of directors at the Annual Meeting. |

10  2023 PROXY STATEMENT

2023 PROXY STATEMENT

CORPORATE GOVERNANCE

We maintain a corporate governance section on our website, which contains copies of our principal governance documents. The corporate governance section may be found at www.bwxt.com under “Investors — Corporate Governance.” The corporate governance section includes the following documents:

•Amended and Restated Bylaws

•Corporate Governance Principles

•Code of Business Conduct

•Code of Ethics for Chief Executive Officer and Senior Financial Officers

•Director Conflict of Interest Policy

•Audit and Finance Committee Charter

•Compensation Committee Charter

•Governance Committee Charter

DIRECTOR INDEPENDENCE

The Board has established categorical standards, which conform to the independence requirements in the New York Stock Exchange (“NYSE”) listing standards, to assist it in determining director independence. These standards are contained in the Corporate Governance Principles found on our website at www.bwxt.com under “Investor Relations — Corporate Governance.”

Based on these independence standards, our Board has determined that the following eight directors are independent and meet our categorical standards:

| | | | | | | | | | | | | | |

•Jan A. Bertsch | | •Kenneth J. Krieg | | •Barbara A. Niland |

•Gerhard F. Burbach | | •Leland D. Melvin | | •John M. Richardson |

•James M. Jaska | | •Robert L. Nardelli | | |

In determining the independence of the directors, our Board considered ordinary course transactions between us and other entities with which the directors are associated. None were determined to constitute a material relationship with us.

The Board also determined that Mr. Geveden, who serves as an executive officer of the Company, is not an independent director. Accordingly, we currently have a supermajority of independent directors (eight of nine, or 89%) in compliance with our Corporate Governance Principles which require a majority of independent directors.

BOARD FUNCTION, LEADERSHIP STRUCTURE, DIRECTOR TENURE LIMIT AND MAJORITY VOTING

The mission of our Board is to promote the best interests of the Company’s stockholders through oversight of the management of the Company’s business and affairs. The Board believes that its corporate governance policies and practices provide independent oversight and accountability of management. The Company’s Corporate Governance Principles and Committee Charters provide for a number of processes and practices, including the 10-year director tenure limit; appointment of a Lead Independent Director in appropriate circumstances; executive sessions of the independent directors without management at each regular Board meeting; a majority of independent directors; and an Audit and Finance Committee, Compensation Committee and Governance Committee, each comprised exclusively of independent directors.

Chair and Chief Executive Officer Roles

BWXT does not have a policy requiring that the positions of Chair and Chief Executive Officer be separate or be occupied by the same individual. Our Board believes that this question is properly addressed as part of succession planning and that it is appropriate to make a determination on these matters when it elects a new Chief Executive Officer, appoints a new Chair or at other times. In anticipation of the retirement of Mr. Fees as our Non-Executive Chairman at the 2022 Annual Meeting, the Board undertook its regular succession planning process and elected Jan Bertsch as the Independent Board Chair and eliminated the lead independent director role at that time.

2023 PROXY STATEMENT 11

2023 PROXY STATEMENT 11

10-Year Director Tenure Limit

Our Bylaws provide that (1) a person shall not be nominated for election or reelection to our Board if such person will have served as a director for 10 years prior to the date of election or re-election (as measured from the date of the Bylaw amendment, July 1, 2015) and (2) any director who attains 10 years of service during his or her term shall be deemed to have resigned and retired at the first annual meeting following his or her attainment of 10 years of service as a director.

Majority Voting with Director Resignation Policy

Our Bylaws provide that, in an election of directors where the number of director nominees does not exceed the number of directors to be elected (an "Uncontested Election"), each director nominee must receive the majority of the votes cast with respect to that director. Each director nominee has submitted an irrevocable resignation contingent on (i) the receipt of a majority of the votes cast in an Uncontested Election and (ii) acceptance of such resignation by the Board. If a director nominee were not receive a majority vote, the Governance Committee would make a recommendation to the Board on whether to accept or reject the resignation or take other action. Any action taken by the Board would be publicly disclosed within 90 days of certification of the election results.

THE ROLE OF THE BOARD IN SUCCESSION PLANNING

The Board believes effective succession planning, particularly for the Chief Executive Officer, is important to the continued success of the Company. As a result, the Board regularly reviews and discusses succession planning for the Chief Executive Officer, other Named Executives (as defined in "Named Executive Profiles" below) and certain other executive officers during executive sessions of Board meetings. The Governance Committee assists the Board in the area of succession planning, in particular, with respect to succession planning for the Chief Executive Officer. From time to time, the Board also retains an executive search firm as part of its normal succession planning function.

THE ROLE OF THE BOARD IN ESG OVERSIGHT

The BWXT Board of Directors believes that a commitment to environmental, social and governance ("ESG") enhances shareholder value. To ensure effective governance, our policies include tenure limits, gender diversity, a no hedging/pledging policy for company securities and maintaining a lead independent director, among other things. In addition, we seek opportunities to engage with stockholders for input on current and emerging areas of focus.

The Board believes that the effective oversight of the Company's ESG objectives and metrics is best accomplished by the Board and each of its Committees. The Board oversees and monitors execution upon the Company's strategy and corporate purpose, safety and security performance, succession planning and overall sustainability efforts. The Audit and Finance Committee oversees and receives regular updates on litigation and environmental matters, regulatory compliance, training, and concerns and violations relating to the Code of Business Conduct. The Compensation Committee oversees and receives regular reports on compensation and benefits, and has maintained ESG performance (safety goals) for all participants in the Company's annual incentive plans since 2015.

The Governance Committee has primary responsibility for ESG matters and oversees and receives regular reports on the Company's corporate governance, human capital management, diversity and inclusion, cybersecurity and other ESG matters. The executive officers have responsibility for execution and implementation of the Company's ESG program and have established a Diversity and Inclusion Committee of employees who review and report to senior management on these matters and potential actions to encourage diversity and inclusion throughout the Company.

THE ROLE OF THE BOARD IN RISK OVERSIGHT

As part of its oversight function, the Board monitors the risks that we face. The diagram below provides a summary of the risk oversight allocation among the Board and its Committees.

We maintain an enterprise risk management ("ERM") program administered by our Risk Management group. The program facilitates the process of reviewing key external, strategic, operational, safety, security and financial risks as well as monitoring the effectiveness of risk mitigation. Information on the ERM program is presented to senior management and the Board on a quarterly basis. The Board is updated quarterly on safety.

The Audit and Finance Committee assists the Board in fulfilling its oversight responsibility in the areas of financial reporting, ethics and compliance, litigation and environmental risks and by meeting quarterly with management to review these risk exposures and discuss BWXT’s policies and guidelines concerning risk assessment and management.

12  2023 PROXY STATEMENT

2023 PROXY STATEMENT

The Compensation Committee also assists the Board with this function by assessing risks associated with our compensation programs in consultation with management and the Committee's outside compensation consultant. The Compensation Committee has included an ESG performance metric (safety) in our annual incentive plans since 2015 to emphasize continuous focus on our safety performance.

The Governance Committee assists the Board by assessing risks associated with ESG (including diversity and inclusion and human capital management), corporate governance and cybersecurity and receives quarterly briefings on these topics. The Chief Information Officer provides semiannual updates to the Governance Committee regarding cybersecurity and data security risks, enhancements and training.

CODE OF BUSINESS CONDUCT

Our Code of Business Conduct ("Code") applies to all directors, officers and employees, including our chief executive officer, chief financial officer, chief accounting officer, executive officers and other Named Executives, and provides the ethical guidelines and expectations for conducting our business. In addition, we expect our suppliers, vendors, contractors, agents, representatives, consultants and joint venture partners (our "Partners") to behave in the ethical manner described in our Code when doing work for the Company. The Code encourages our employees and Partners to speak up to clarify a policy, identify questionable conduct and report any violations through their supervisor, manager, Human Resources, Legal or Ethics and Compliance representative. Employees, Partners and third parties may also use the BWXT Help Line, which is managed by a third party and available 24 hours a day, seven days a week, to report any questions or concerns in a secure, confidential and (if desired) anonymous format. The Code prohibits retaliation against anyone who makes a good faith report of an alleged violation of our Code or policies. The Audit and Finance Committee receives quarterly reports on training, concerns and violations related to the Code. Our Code satisfies the requirements for a "code of ethics" within the meaning of SEC rules. A copy of the Code is posted on our website, www.bwxt.com under "About Us – Corporate Citizenship – Ethics and Compliance." In the event we amend or waive any of the provisions of the Code applicable to our principal executive officer, principal financial officer, principal accounting officer or controller that relates to any element of the definition of "code of ethics" enumerated in Item 406(b) of Regulation S-K under the Securities Exchange Action of 1934, as amended (the "Exchange Act"), we intend to disclose these actions on our website. A copy of the Code is also available to stockholders upon request, addressed to the Corporate Secretary at 800 Main Street, 4th Floor, Lynchburg, Virginia 24504.

Training

All employees are provided with a copy of the Code and required to certify their understanding and compliance with the Code annually. In addition, mandatory Code training is provided to all employees and directors at least annually. This training is part of the Company's broader training program administered by the Ethics and Compliance Department, including online and in-person training. Topics covered have included, among other things, diversity and inclusion, sexual harassment, cybersecurity, anti-corruption and anti-bribery, and export controls.

2023 PROXY STATEMENT 13

2023 PROXY STATEMENT 13

STOCKHOLDER ENGAGEMENT

We make it a priority to engage with our stockholders and have continued our stockholder engagement activities in 2022. Since the 2022 Annual Meeting of Stockholders, we conducted a stockholder engagement program and solicited stockholders holding approximately 75% of our outstanding shares to discuss, among other topics, environmental, social, governance and compensation matters. As a result of this outreach, stockholders representing approximately 16.6% of our outstanding shares requested meetings and provided feedback to management. The feedback received from our stockholder outreach program is reported to the Audit and Finance Committee, Compensation Committee and Governance Committee, as appropriate, and informs Board and Committee discussions and decisions on ESG matters, among other things.

| | |

Stockholder Feedback and Actions Taken Since the 2022 Annual Meeting, we received stockholder feedback regarding our sustainability report and have enhanced our disclosure regarding GHG emissions and added an index reflecting disclosures aligned with the Task Force on Climate-related Financial Disclosures (TCFD) in our 2023 sustainability report, which is available on our website. |

COMMUNICATION WITH THE BOARD

Stockholders or other interested persons may send written communications to the independent members of our Board, addressed to Board of Directors (independent members), c/o BWX Technologies, Inc., Corporate Secretary’s Office, 800 Main Street, 4th Floor, Lynchburg, Virginia 24504. All such communications shall be forwarded to the independent directors for their review, except for communications that (1) are unrelated to the Company’s business, (2) contain improper commercial solicitations, (3) contain material that is not appropriate for review by the Board based upon the Company’s Bylaws and the established practice and procedure of the Board, or (4) contain other improper or immaterial information. Information regarding this process is posted on our website at www.bwxt.com under “Investors — Corporate Governance.”

14  2023 PROXY STATEMENT

2023 PROXY STATEMENT

BOARD MEETINGS AND COMMITTEES

Director Attendance at Board and Annual Meetings of Stockholders

Our Board met four times during 2022. Each director attended 100% of the meetings of the Board and of the committees on which they served during the time they served on the Board in 2022. In addition, as reflected in our Corporate Governance Principles, we have adopted a policy that each member of our Board must make reasonable efforts to attend our Annual Meeting. All of our current directors who were directors at the time of the meeting attended the 2022 Annual Meeting of Stockholders.

Committees of the Board

The Board has established an Audit and Finance Committee, Compensation Committee and Governance Committee in accordance with the applicable NYSE and SEC requirements. Each Committee is comprised exclusively of independent directors as determined by the Board in accordance with the NYSE listing standards. Each of these committees has a written charter approved by the Board and available on our website at www.bwxt.com under “Investors — Corporate Governance.” The current members of the committees are identified below.

| | | | | | | | | | | | | | |

| Audit and Finance Committee | 2022 Meetings: 4 |

| Barbara Niland (Chair), James Jaska, Robert Nardelli and John Richardson | 100% Independent |

Our Audit and Finance Committee’s role is financial and risk oversight. Management is responsible for preparing financial statements, and our independent registered public accounting firm is responsible for auditing those financial statements. The Audit and Finance Committee is not providing any expert or special assurance as to our financial statements or any professional certification as to the independent registered public accounting firm’s work. The Audit and Finance Committee is responsible for the following: •Appoint, retain and oversee our independent registered public accounting firm and its audit process; •Monitor the effectiveness of our financial reporting processes and disclosure and internal controls; •Review our audited financial statements with management and our independent registered public accounting firm; •Review and evaluate the scope and performance of the internal audit function; •Review our policies and procedures regarding ethics and compliance, as well as training, concerns and violations related to our Code of Business Conduct; and •Review of our exposure to various risks, including financial, litigation, environmental and regulatory risks. Our Board has determined that (i) Ms. Niland and Messrs. Jaska and Nardelli are each "financially literate" as defined by the NYSE and each qualify as an “audit committee financial expert” within the definition established by the SEC and (ii) each member of the Audit and Finance Committee is independent for purposes of Rule 10A-3 of the Exchange Act. For more information on the backgrounds of these directors, see their biographical information under “Proposal 1: Election of Directors” above. For more information on the Audit and Finance Committee, see "Audit and Finance Committee Report" and "Proposal 4: Ratification of Auditors" below. |

2023 PROXY STATEMENT 15

2023 PROXY STATEMENT 15

| | | | | | | | | | | | | | |

| Compensation Committee | 2022 Meetings: 5 |

| Gerhard Burbach (Chair), Kenneth Krieg, Leland Melvin and John Richardson | 100% Independent |

The Compensation Committee has overall responsibility for our executive and non-employee director compensation plans, policies and programs. The Compensation Committee also oversees the annual evaluation of our Chief Executive Officer, in conjunction with the Governance Committee, and makes compensation recommendations to the independent directors of the Board. The Compensation Committee regularly reviews the design of our significant compensation programs with the assistance of its compensation consultant. The Compensation Committee administers our Executive Incentive Compensation Plan (the “EICP”), under which it awards annual cash-based incentive compensation to our officers based on the attainment of annual performance goals. Our Compensation Committee approves, among other things, the target EICP compensation, as well as the financial and safety goals for each officer. The Committee recommends to the independent members of the Board individual goals for EICP compensation for our Chief Executive Officer. Our Chief Executive Officer establishes EICP individual goals for the Presidents of principal operating groups and other executive officers. The Compensation Committee also administers our 2010 Long-Term Incentive Plan (as amended, the “2010 LTIP”) and 2020 Omnibus Incentive Plan (the "2020 Plan," and together with the 2010 LTIP, the "Incentive Plans"), and may delegate some of its duties (other than awards to directors and executive officers under the Incentive Plans) to our Chief Executive Officer or other senior officers. The Compensation Committee evaluates the Chief Executive Officer's performance under the EICP and the Incentive Plans and recommends payouts under such plans and other compensation changes to the independent members of the Board.

The Board has determined that each member of the Compensation Committee is (i) independent, as independence for compensation committee members is defined by the NYSE, (ii) a "non-employee director" for purposes of Section 16b-3 of the Exchange Act, and (iii) an "outside director" for purposes of 162(m) of the Internal Revenue Code. |

Executive Compensation Consultant The Compensation Committee has the authority to retain, terminate, compensate and oversee any compensation consultant ("Compensation Consultant") or other advisors to assist the committee in the discharge of its responsibilities. The Compensation Committee has engaged Exequity LLP (“Exequity”) as its outside Compensation Consultant. For 2022, Exequity assisted the Compensation Committee with: •advice and analysis on the design, structure and level of executive and director compensation and incentive plans; •review of market survey and proxy compensation data for benchmarking; •advice on external market factors and evolving compensation trends; and •assistance with regulatory compliance and changes regarding compensation matters. Exequity attends the Compensation Committee meetings, including executive sessions. Although Exequity works with our management on various matters for which the Compensation Committee is responsible, our management does not direct or oversee the retention or activities of Exequity.

See the “Compensation Discussion and Analysis” and “Compensation of Executive Officers” sections of this proxy statement for information about our 2022 executive officer compensation, including a discussion of the role of the Compensation Consultant. |

Compensation Committee Interlocks and Insider Participation No director who served as a member of the Compensation Committee during the year ended December 31, 2022 (i) was during such year, or had previously been, an officer or employee of BWXT or any of our subsidiaries, or (ii) had any material interest in a transaction of BWXT or a business relationship with, or any indebtedness to, BWXT. None of our executive officers have served as members of a compensation committee (or if no committee performs that function, the board of directors) of any other entity that has an executive officer serving as a member of our Board.

|

16  2023 PROXY STATEMENT

2023 PROXY STATEMENT

| | | | | | | | | | | | | | |

| Governance Committee | 2022 Meetings: 4 |

| James Jaska (Chair), Barbara Niland and Robert Nardelli | 100% Independent |

The Governance Committee has overall responsibility to: •establish and assess director qualifications; •review the composition of the Board and recommend director nominees for election; •lead the Board's oversight of ESG issues within the Company, including diversity and inclusion; •oversee the annual self-evaluation process for our Board and Committees, as well as the Chief Executive Officer in conjunction with our Compensation Committee; •evaluate director orientation and director education programs; and •monitor governance and cybersecurity risks. This committee will consider individuals recommended by stockholders for nomination as directors in accordance with the procedures described under “Stockholders’ Proposals.” |

Director Evaluation and Nomination Process Our Governance Committee is responsible for assessing the qualifications, skills and characteristics of candidates for election to the Board. In making this assessment, the Governance Committee generally considers a number of factors, including each candidate’s: •professional and personal experiences and expertise in relation to (i) our businesses and industries and (ii) the experiences and expertise of other Board members; •integrity and ethics in his/her personal and professional life; •professional accomplishments in his/her field; •personal, financial or professional interests in any competitor, customer or supplier of ours; •preparedness to participate fully in Board activities, including active membership on at least one Board committee and attendance at, and active participation in, meetings of the Board and the committee(s) of which he or she is a member, and any other personal or professional commitments that would, in the Governance Committee’s sole judgment, interfere with or limit his or her ability to do so; •willingness to apply for and ability to obtain and retain an appropriate U.S. Department of Defense or U.S. Department of Energy security clearance; and •ability to contribute positively to the Board and any of its committees. The Board recognizes the benefits of a diverse board and requires any search for potential director candidates to consider diversity as to gender, ethnic background, education, viewpoint and personal and professional experiences. Our Board includes three directors (33% of the Board) who are diverse by gender, race or ethnicity. The Governance Committee solicits ideas for possible candidates from a number of sources — including members of the Board, our Chief Executive Officer and other senior level executive officers, individuals personally known to the members of the Board and independent director candidate search firms. In addition, any stockholder may nominate one or more persons for election as one of our directors at an annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our Bylaws. See “Stockholders’ Proposals” in this proxy statement and our Bylaws, which may be found on our website at www.bwxt.com at “Investors — Corporate Governance.” The Governance Committee will evaluate properly identified candidates, including nominees recommended by stockholders. The Governance Committee also takes into account the contributions of incumbent directors as Board members and the benefits to us arising from the experience of incumbent directors on the Board. Although the Governance Committee will consider candidates identified by stockholders, the Governance Committee has sole discretion whether to recommend those candidates to the Board.

|

2023 PROXY STATEMENT 17

2023 PROXY STATEMENT 17

| | | | | | | | |

| COMPENSATION OF DIRECTORS | |

COMPENSATION OF DIRECTORS

The table below summarizes the compensation earned by or paid to our non-employee directors only for services as a member of our Board for the year ending December 31, 2022. The Compensation Committee of our Board, in coordination with its Compensation Consultant, conducts an annual benchmarking analysis of our Board's non-employee director compensation in comparison to two comparator groups — our custom peer group used for executive compensation benchmarking and a general industry reference group of 100 companies, for which the Company is the median based on revenue. Directors who are also our employees do not receive any compensation for their service as directors. For information regarding the compensation of our Chief Executive Officer, our only employee director, see “Compensation of Executive Officers” on the following pages.

DIRECTOR COMPENSATION TABLE FOR 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name of Non-Employee Director | Fees Earned or Paid in Cash (1) | Stock Awards (2) | All Other Compensation (3) | Total |

| Jan A. Bertsch | | $ | 171,250 | | | | $ | 129,971 | | | | $ | — | | | | $ | 301,221 | | |

| Gerhard F. Burbach | | 105,000 | | | | 129,971 | | | | — | | | | 234,971 | | |

| James A. Jaska | | 105,000 | | | | 129,971 | | | | — | | | | 234,971 | | |

| Kenneth J. Krieg | | 96,250 | | | | 129,971 | | | | — | | | | 226,221 | | |

| Leland D. Melvin | | 90,000 | | | | 129,971 | | | | — | | | | 219,971 | | |

| Robert L. Nardelli | | 90,000 | | | | 129,971 | | | | — | | | | 219,971 | | |

| Barbara A. Niland | | 113,750 | | | | 129,971 | | | | — | | | | 243,721 | | |

| John M. Richardson | | 90,000 | | | | 129,971 | | | | — | | | | 219,971 | | |

(1)See “Fees Earned or Paid in Cash” below for a discussion of the amounts reported in this column.

(2)See “Stock Awards” below for a discussion of the amounts reported in this column.

(3)See “All Other Compensation” below for a discussion of the amounts that may be reported in this column.

During 2022, non-employee director compensation generally consisted of cash and equity. The compensation of our non-employee directors under our current non-employee director compensation program is described in more detail below. | | | | | | | | | | | | | | |

| Annual Director Compensation (All amounts in cash, except stock award) | Amount |

| Retainer for Non-Employee Directors | $ | 90,000 | |

| Stock Award for Non-Employee Directors | 130,000 | |

| Independent Board Chair | 100,000 | |

| Lead Independent Director (if appointed) | 25,000 | |

| Chair of the Audit and Finance Committee | 25,000 | |

| Chair of the Compensation Committee | 20,000 | |

| Chair of the Governance Committee | 15,000 | |

Fees Earned or Paid in Cash. Under our current director compensation program, non-employee directors are eligible to receive the above annual retainer amounts, paid in quarterly installments (pro-rated for partial terms). Under our Supplemental Executive Retirement Plan (as amended and restated, “SERP”), directors may elect to defer the payment of up to 100% of their annual retainer and fees. Amounts elected to be deferred are credited as a bookkeeping entry into a notional account, which we refer to as a deferral account. The balance of a director’s deferral account consists of deferral contributions made by the director and hypothetical credited gains or losses attributable to investments elected by the director, or by our Compensation Committee if the director fails to make investment elections. Directors are 100% vested in their deferral accounts at all times. Ms. Bertsch and Messrs. Jaska, Krieg, Melvin and Nardelli elected to defer 100% of their cash retainer in 2022. No other directors made a deferral election with respect to their cash retainer in 2022. Amounts reported in the Director Compensation Table include amounts deferred in 2022.

18  2023 PROXY STATEMENT

2023 PROXY STATEMENT

| | | | | | | | |

| COMPENSATION OF DIRECTORS | |

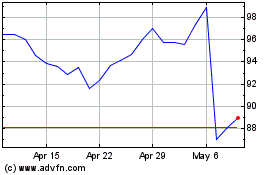

Stock Awards. In addition to the cash payments provided to our directors, each non-employee director was entitled to receive a number of restricted stock units equal to $130,000 (prorated by quarter for partial terms) divided by the closing price of our common stock on the grant date, rounded down to the nearest whole share. The awards of restricted stock units were granted under our 2020 Plan and vested immediately on the date of grant. Directors are required to retain shares equivalent to five times (5x) the annual cash retainer pursuant to our stock ownership requirements. As a result, all of our non-employee directors own equity in the Company.

The amounts reported in the “Stock Awards” column represent the grant date fair value computed in accordance with FASB ASC Topic 718. Grant date fair values are determined using the closing price of our common stock on the date of grant. Each non-employee director received an annual equity grant of 2,561 restricted stock units on May 3, 2022 with a grant date fair value of $129,971 based on the closing price of our common stock of $50.75 per share. There were no unvested stock awards or unexercised option awards (whether or not exercisable) held by the non-employee directors as of December 31, 2022. No option awards were granted to directors in 2022.

Under our Incentive Plan, directors may elect to defer payment of all or a portion of their stock awards. Ms. Bertsch and Messrs. Burbach, Jaska, Krieg, Nardelli, Melvin and Richardson each elected to defer 100% of their 2022 stock awards. No other directors made a deferral election with respect to their stock awards in 2022. Amounts reported in the Director Compensation Table include amounts deferred in 2022.

All Other Compensation. We have a travel and reimbursement policy pursuant to which we reimburse directors for travel and other expenses incurred in connection with business of the Board. The presence of a director’s spouse may be appropriate or necessary at certain meetings, conferences or other business-related functions. In those cases, pursuant to our policy, we pay the travel, meals and other expenses of the director’s spouse incurred while attending such functions. Pursuant to our reimbursement policy, to the extent the expenses of a spouse are imputed to the director as income, we will also reimburse the director for the taxes resulting from any such imputed income. In 2022, there were no incremental costs to the Company to provide reimbursement for spousal travel, meals, activities and other expenses under our policy.

2023 PROXY STATEMENT 19

2023 PROXY STATEMENT 19

| | | | | | | | |

| PROPOSAL 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION | |

NAMED EXECUTIVE PROFILES

The following profiles provide summary information regarding the experience of our named executive officers (our “Named Executives”), including our Chief Executive Officer, Chief Financial Officer and three other most highly compensated executive officers who were employed by BWXT as of December 31, 2022. The Named Executive profiles provide professional experience, tenure with the Company and age as of the Annual Meeting.

| | | | | | | | | | | | | | |

| Professional Experience | Tenure with BWXT: 8 years |

•Mr. Geveden, age 62, has served as President and Chief Executive Officer since January 2017, and served as our Chief Operating Officer from October 2015 until December 2016. •Previously, Mr. Geveden was Executive Vice President at Teledyne Technologies Incorporated ("Teledyne"), a provider of electronic subsystems and instrumentation for aerospace, defense and other uses. There he led two of Teledyne's four operating segments since 2013, and concurrently served as President of Teledyne DALSA, Inc., a Teledyne subsidiary, since 2014. Mr. Geveden also served as President and Chief Executive Officer of Teledyne Scientific and Imaging, LLC (2011 to 2013) and President of both Teledyne Brown Engineering, Inc. and Teledyne's Engineered Systems Segment (2007 to 2011). •Mr. Geveden is a former Associate Administrator of NASA, where he was responsible for all technical operations within the agency's $16 billion portfolio and served in various other positions with NASA in a career spanning 17 years. •He received his bachelor and masters degrees in physics from Murray State University. •Mr. Geveden chairs the board of directors of TTM Technologies, Inc. |

|

|

|

|

|

Rex D. Geveden President, Chief Executive Officer and Director

|

|

| | | | | | | | | | | | | | |

| Professional Experience | Tenure with BWXT: 3 years |

•Mr. LeMasters, age 45, has served as our Senior Vice President and Chief Financial Officer since November 2021. Prior to that, he served as is our Senior Vice President and Chief Strategy Officer since July 2020. Mr. LeMasters served on the Company’s Board of Directors from July 2015 to April 2020. •Prior to joining BWXT, Mr. LeMasters was a Managing Director at Blue Harbour, L.P., a multi-billion dollar investment firm, a position he held since 2011. Prior to joining Blue Harbour Group, he was a Founding Partner of Theleme Partners from 2009 to September 2011. He also served as a Partner at The Children’s Investment Fund (TCI) from 2008 to 2009 and a Vice President in the Relative Value/Event-Driven Group at Highbridge Capital Management from 2005 to 2008. Mr. LeMasters began his career as an analyst at Morgan Stanley & Co. in the Mergers and Acquisitions Group and subsequently joined Forstmann Little & Co. as an analyst. •Mr. LeMasters earned a bachelor of science from the University of Pennsylvania and a masters of business administration from the Harvard Business School.

|

|

|

|

|

|

Robb A. LeMasters

Senior Vice President and Chief Financial Officer |

|

| | | | | | | | | | | | | | |

| Professional Experience | Tenure with BWXT: 5 years |

•Mr. McCabe, age 68, served as our Senior Vice President, General Counsel, Chief Compliance Officer and Secretary from July 2018 through January 2023, when he transitioned to Special Advisor to the CEO. •Prior to joining BWXT, Mr. McCabe served as Executive Vice President, General Counsel, Chief Compliance Officer and Secretary (or similar roles) of Orbital ATK, Inc. (and its predecessor, Orbital Sciences Corporation) from 2014 to 2018. •He served as Senior Vice President, General Counsel and Secretary of Alion Science and Technology Corp., an advanced engineering and technology solutions provider, from 2010 to 2014. From 2008 to 2010, he was Executive Vice President and General Counsel, and President of the federal business, of Braintech, Inc., an automated vision system for industrial and military robots. •Previously, Mr. McCabe held legal roles with XM Satellite Radio, COBIS Corporation and what is now AT&T Public Sector, and was CEO and a member of the board of directors of COBIS Corporation (and its predecessor, MicroBanx). •Earlier in his career, Mr. McCabe was an attorney in private practice. •Mr. McCabe has a bachelor’s degree from Georgetown University and a juris doctorate and masters of business administration from the University of Notre Dame. |

|

|

|

|

|

Thomas E. McCabe Former Senior Vice President, General Counsel, Chief Compliance Officer and Secretary

|

|

| | | | | | | | | | | | | | |

| Professional Experience | Tenure with BWXT: 1 year |

•Adm. McCoy, age 66, has served as our President, Government Operations since February 2022. •He has more than 35 years of leadership experience in shipyard operations, nuclear industrial operations and senior engineering positions in the U.S. Navy and private sector. •Prior to joining BWXT, Adm. McCoy served as president of Irving Shipbuilding Inc. in Nova Scotia, Canada from 2013 to 2021, chief engineer of the U.S. Navy from 2005 to 2008 and commander of the Naval Sea Systems Command (NAVSEA) from 2008 to 2013. •He earned a bachelor degree in mechanical engineering from SUNY at Stony Brook, a masters degree in mechanical engineering from the Massachusetts Institute of Technology ("MIT"), an engineer's degree (post masters) in naval architecture and marine engineering from MIT, and a masters in business administration from Emory University.

|

|

|

|

|

|

Kevin M. McCoy

President, BWXT Government Group |

|

20  2023 PROXY STATEMENT

2023 PROXY STATEMENT

| | | | | | | | | | | | | | |

| Professional Experience | Tenure with BWXT: <1 year |

•Mr. Duffy, age 55, has served as our Senior Vice President and Chief Administrative Officer since August 2022. •Prior to joining BWXT, Mr. Duffy had served as senior vice president and chief human resources and administrative officer for Harris Corporation (now known as L3Harris Technologies) from 2012 to 2019. •Prior to that, Mr. Duffy held human resources leadership positions of increasing responsibility for several business units within United Technologies, including Sikorsky Aircraft, UTC Fire & Security, Carrier Corporation, Hamilton Sundstrand and Pratt & Whitney, from 1998 to 2012. •He holds a master’s degree in management and technology from Rensselaer Polytechnic Institute and a bachelor’s degree in human resources management from Muhlenberg College.

|

|

|

|

|

|

Robert L. Duffy

Senior Vice President and Chief Administrative Officer

|

|

PROPOSAL 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION

| | |

| In accordance with Section 14A of the Exchange Act, we are asking stockholders to approve an advisory resolution on our executive compensation as reported in this proxy statement. Our Board has adopted a policy to hold annual advisory votes on executive compensation. It is our belief that our ability to hire, retain and motivate employees is essential to the success of the Company and its stockholders. Therefore, we generally seek to provide reasonable and competitive compensation for our executives with a substantial portion in the form of performance-based compensation. |

|

Accordingly, we submit the following resolution to stockholders at the Annual Meeting: RESOLVED, that the stockholders of BWX Technologies, Inc. approve, on an advisory basis, the compensation of executives, as such compensation is disclosed pursuant to Item 402 of Regulation S-K in this proxy statement under the sections entitled “Compensation Discussion and Analysis” and “Compensation of Executive Officers.” |

|

EFFECT OF PROPOSAL |

| Although the resolution to approve our executive compensation is non-binding, it serves as an opportunity for us, our Board and Compensation Committee to gain valuable stockholder feedback on our executive compensation decisions and practices. Even in years when the resolution is approved, the Board and Compensation Committee retain discretion to change executive compensation from time to time if they conclude that such a change would be in the best interests of the Company and its stockholders. Our Board and Compensation Committee value the opinions of stockholders on important matters such as executive compensation and will carefully consider the results of this advisory vote when evaluating our executive compensation programs. |

|

RECOMMENDATION AND VOTE REQUIRED Our Board recommends that stockholders vote “FOR” the approval of executive compensation. The proxy holders will vote all proxies received "FOR" approval of this proposal unless instructed otherwise. Approval of this proposal requires the affirmative vote of a majority of our shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on this proposal. Because abstentions are counted as present for purposes of the vote on this matter but are not votes “FOR” this proposal, they have the same effect as votes “AGAINST” this proposal. Broker non-votes will not have any effect on this proposal. |

2023 PROXY STATEMENT 21

2023 PROXY STATEMENT 21

| | | | | | | | |

| COMPENSATION DISCUSSION AND ANALYSIS | |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (the “CD&A”) provides detailed information and analysis regarding the compensation of our Named Executives as reported in the Summary Compensation Table and other tables located in the “Compensation of Executive Officers” section of this proxy statement.

This CD&A is divided into four sections:

Section 1: Executive Summary. In this section, we highlight our company performance, key compensation decisions and outcomes during 2022.

Section 2: Compensation Structure. In this section, we review our 2022 compensation philosophy, elements and processes.

Section 3: Compensation Analysis and Outcomes. In this section, we review the elements of 2022 total direct compensation, including annual base salary, annual incentive compensation and long-term incentive compensation.

Section 4: Other Benefits and Practices. In this section, we review perquisites, post-employment arrangements and other compensation-related practices.

SECTION 1: EXECUTIVE SUMMARY

2022 PERFORMANCE HIGHLIGHTS*

•Consolidated revenue was over $2.2 billion, a 5% increase over the prior year.

•Net income and adjusted EBITDA were $238.6 million and $439.4 million, respectively.

•GAAP and non-GAAP earnings per share were $2.60 and $3.13, respectively.

•In 2022, we returned $81.1 million to stockholders in the form of dividends.

•As of December 31, 2022, our backlog was $4.1 billion.

| | |

* Please refer to Appendix A, "Reconciliation of Reported (GAAP) to Adjusted (Non-GAAP) Results," for a reconciliation of adjusted results, including adjusted EBITDA and non-GAAP earnings per share, to reported results. |

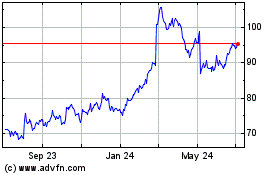

TOTAL STOCKHOLDER RETURN

The following graph depicts the cumulative total stockholder return of BWXT for the one, three and five years ended December 31, 2022 relative to those of the S&P 500 Index ("S&P 500"), the S&P Aerospace and Defense Select Index ("S&P A&D Select") and our custom compensation peer group for 2022 (see below).

One-Year, Three-Year and Five-Year Total Stockholder Return as of December 31, 2022(1)

| | | | | |

| (1) | Measured by dividing (i) the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the applicable share price at the end and the beginning of the measurement period by (ii) the share price at the beginning of the measurement period. |

22  2023 PROXY STATEMENT

2023 PROXY STATEMENT

| | | | | | | | |

| COMPENSATION DISCUSSION AND ANALYSIS | |

STOCKHOLDER ENGAGEMENT

Our executive compensation plan for 2022 is consistent with our historical pay-for-performance approach that incorporates feedback from our stockholder outreach efforts and metrics designed to drive the performance of BWXT. We engage directly with our stockholders on executive compensation, governance, environmental, social and other topics. See "Stockholder Engagement" above for more information on our engagement process.

Based on feedback from our stockholders, our Compensation Committee continued with a market-based, pay-for-performance structure for our executive compensation program and also enhanced the performance-based components of the program. In addition, the Compensation Committee incorporated a double-trigger vesting requirement for equity awards in the event of a change in control in our 2020 Omnibus Incentive Plan ("2020 Plan"), approved by stockholders at our 2020 Annual Meeting. We have received feedback from stockholders regarding the use of ESG metrics in our incentive plans. The Compensation Committee has included safety metrics in our annual incentive plan each year since our spin-off in 2015 and will evaluate other possible ESG metrics.

As a result of discussions with stockholders as part of the Company's annual outreach program, in February 2022 the Compensation Committee included total shareholder return as a performance metric in the 2022 performance restricted stock unit grants to participants, including the Named Executives, in order to align Named Executive and stockholder interests.

STRONG COMPENSATION GOVERNANCE PRACTICES

The following are practices we follow to incentivize performance and foster strong corporate governance on our compensation program:

| | | | | |

| WHAT WE DO: | WHAT WE DON’T DO: |

ü Pay for Performance. Significant emphasis on incentive- and performance-based compensation, with 60% of annual long-term incentive awards comprised of performance RSUs. ü Compensation Program Responsive to Stockholder Feedback. We seek stockholder input and perspective on our compensation program. ü Benchmarking to Similarly Sized Companies. We avoid benchmarking executive pay to oversized peers by ensuring that the market data reflects companies of similar revenue size. ü Clawbacks. We can recover compensation under our annual and long-term incentive plans in appropriate circumstances. ü “Double Trigger” Vesting in a Change in Control. ü Limited Perquisites and Tax Reimbursements. ü Stock Ownership Requirements. We maintain robust requirements for our executive officers and directors. ü Independent Compensation Consultant. | X No Hedging or Pledging. We do not permit hedging or pledging of our securities by our executive officers and directors. X No Excise Tax Gross-ups. There are no tax gross-ups on change-in-control benefits. X No Employment Agreements for our Executive Officers. X No Excessive Risk-Taking in Incentive Compensation. Our annual and long-term incentive programs use multiple performance metrics and capped pay-outs and other features intended to minimize the incentive to take overly risky actions. X No Guaranteed Minimum Pay-out for our Annual or Long-term Performance-based Awards. |

2023 PROXY STATEMENT 23

2023 PROXY STATEMENT 23

| | | | | | | | |

| COMPENSATION DISCUSSION AND ANALYSIS | |

2022 EXECUTIVE COMPENSATION PLAN DESIGN

Following a comprehensive review of our executive compensation program with Exequity, our executive compensation consultant, we made the following design changes to the 2022 executive compensation program: (i) adding total shareholder return ("TSR") as a metric for our long-term incentive plan, and (ii) replacing adjusted earnings per share with adjusted earnings before interest, tax, depreciation and amortization ("EBITDA") as a metric in our long-term incentive plan. The following are some of the key design attributes and components of BWXT's 2022 incentive program.

| | | | | | | | |

| 2022 Executive Compensation Plan Design Overview |

| Pay Philosophy | | Base salary, annual incentive and long-term incentive compensation designed to attract and retain leadership talent and incent a strong focus on operating results and alignment with stockholder interests |

| Annual Incentive Program | | 90% financial performance (75% operating income and 15% operating cash flow) and 10% individual performance (including 3% for safety) weighting of the total award opportunity |

| Long-Term Incentive Program | | 40% time-based restricted stock units and 60% performance RSUs with performance based on 40% adjusted EBITDA, 40% return on invested capital and 20% relative TSR performance metrics to align incentives with strategic initiatives to drive growth, promote efficient capital management and align with shareholder returns |

| | | | | | | | | | | | | | |

| | Financial Performance Metrics

for Performance-Based RSUs | | Financial Performance Metrics

for Annual Incentive Awards | |

| 40% Adjusted EBITDA

40% Return on Invested Capital

20% Relative Total Shareholder Return | | 75% Operating Income

15% Operating Cash Flow | |

| | | | |

24  2023 PROXY STATEMENT

2023 PROXY STATEMENT

| | | | | | | | |

| COMPENSATION DISCUSSION AND ANALYSIS | |

SECTION 2: COMPENSATION STRUCTURE

PHILOSOPHY AND OBJECTIVES OF EXECUTIVE COMPENSATION

We seek to provide reasonable and competitive compensation to executives through programs structured to:

•attract and retain well-qualified executives;

•incent and reward short- and long-term company performance, as well as individual contributions; and

•align the interests of our executives with those of our stockholders.

We also subscribe to a “pay-for-performance” philosophy when designing executive compensation. This means a substantial portion of an executive’s target compensation should be “at risk” and performance-based, where the value of one or more elements of compensation is tied to the achievement of pre-determined financial and/or other measures we consider important drivers in the creation of stockholder value. Our compensation philosophy requires that a substantial portion of total compensation be designed to appropriately balance short- and long-term performance incentives to align our Named Executives’ interests with those of our stockholders.

ELEMENTS OF EXECUTIVE COMPENSATION

To support our compensation philosophy and objectives, our executive compensation program consists of base salary, annual incentives and long-term incentives, which we refer to as Total Direct Compensation. In addition to the elements of Total Direct Compensation, we also offer other benefits and practices consistent with the market. See “Section 3: Other Benefits and Practices” on the following pages of this CD&A for additional information on these benefits and practices.

The Compensation Committee does not set a specific target allocation among the elements of total direct compensation; however, long-term incentive compensation typically represents the largest single element of target total direct compensation, and performance-based compensation constitutes the substantial majority of a Named Executive’s target total direct compensation.

The following table and chart reflect the key elements and proportion of each Named Executive’s target total direct compensation for 2022, the rationale for each element, and the financial performance metrics selected for our 2022 annual incentive awards.

2022 TOTAL DIRECT COMPENSATION ELEMENTS

| | | | | | | | |

| Element | Description | Primary Design Objectives |

Base Salary | •Annual fixed cash compensation | •Attract and retain leadership talent •Compensate for role and responsibilities |

Annual

Incentive | •Annual incentive award based on 90% financial performance goals and 10% individual goals, which includes safety goals •Financial performance metrics include: ◦Operating income (75%) and ◦Operating cash flow (15%) •Financial results determine payout multiplier •No payout unless at least threshold operating income goal is achieved | •Emphasize operating results by heavily weighting financial performance •Select financial performance metrics that align our short-term performance with our long-term performance objectives •Align compensation with safety, which we view as a key component for the success of our business •Retain individual performance component to ensure focus on specific goals unique to each executive's role and responsibilities |

Long-Term Incentive | •Long-term incentive grant weighted towards performance, including: ◦40% restricted stock units with 3-year ratable vesting ◦60% performance-based restricted stock units with 3-year cliff vesting based on 40% adjusted EBITDA, 40% ROIC and 20% relative TSR | •Alignment with stockholder interest •Promote executive focus on long-term company performance •Utilize performance metrics that are meaningful drivers of long-term value creation and align with shareholder returns |

2023 PROXY STATEMENT 25

2023 PROXY STATEMENT 25

| | | | | | | | |

| COMPENSATION DISCUSSION AND ANALYSIS | |

2022 TOTAL DIRECT COMPENSATION MIX

COMPENSATION PROGRAM RISK MITIGATION

We believe our compensation program is designed to retain and motivate our Named Executives at appropriate levels of business risk, which is generally mitigated through the following features of the compensation program.

| | | | | | | | |

| Program Elements Mitigating Risk |

Reasonable and Balanced Compensation Program | | Using the elements of total direct compensation, the Compensation Committee seeks to provide compensation opportunities for Named Executives targeted at or near the median compensation through benchmarking. As a result, we believe the total direct compensation of Named Executives provides reasonable compensation opportunities with an appropriate mix of cash and equity, annual and long-term incentives and performance metrics. |

Emphasis on Long-Term Incentive over Annual Incentive Compensation | | Long-term incentive compensation typically makes up a larger percentage of a Named Executive’s target total direct compensation than annual incentive compensation. Incentive compensation helps drive performance and align the interests with those of stockholders. By tying a significant portion of total direct compensation to long-term incentives, typically over a three-year period, we promote longer-term perspectives regarding Company performance. |

Long-Term Incentive Compensation subject to Forfeiture for Bad Acts | | The Compensation Committee may terminate any outstanding stock award if the recipient (i) is convicted of a misdemeanor involving fraud, dishonesty or moral turpitude or a felony, or (ii) engages in conduct that adversely affects or may reasonably be expected to adversely affect the business reputation or economic interests of the Company. |

Annual and Long-Term Incentive Compensation subject to Clawback | | Incentive compensation awards include provisions allowing us to recover excess amounts paid to individuals who knowingly engaged in a fraud resulting in a restatement. |