Current Report Filing (8-k)

July 29 2019 - 6:45AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 26, 2019

Build-A-Bear Workshop, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

(State or Other Jurisdiction

of Incorporation)

|

001-32320

(Commission

File Number)

|

43-1883836

(IRS Employer

Identification No.)

|

|

1954 Innerbelt Business Center Drive

St. Louis, Missouri

(Address of Principal Executive Offices)

|

63114

(Zip Code)

|

(314) 423-8000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act.

☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

BBW

|

New York Stock Exchange

|

|

Item 1.01.

|

Entry Into a Material Definitive Agreement.

|

On July 26, 2019, Build-A-Bear Workshop, Inc., a Delaware corporation (the “Company”), entered into a cooperation agreement (the “Agreement”) with Kanen Wealth Management, LLC and certain of its affiliates (collectively,

“Kanen”). Kanen beneficially owns approximately 9.6% of the Company’s outstanding common stock. Pursuant to the Agreement, the Board of Directors of the Company (the “Board”) agreed, among other things, to appoint David Kanen as a director of the

Company.

Under the terms of the Agreement, Kanen has agreed to abide by customary standstill restrictions until fifteen (15) days prior to the deadline for submission of a notice of stockholder nomination of individuals for

election as directors of the Company at the Company’s 2021 annual meeting of stockholders (the “2021 Annual Meeting”) (the “Standstill Period”); provided that if the Board offers to nominate Mr. Kanen for election to the Board at the 2021 Annual

Meeting and Mr. Kanen agrees to stand for election to the Board at the 2021 Annual Meeting, then the Standstill Period will be automatically extended for such period as Mr. Kanen remains on the Board. Pursuant to the Agreement, Mr. Kanen has delivered

to the Company an irrevocable advance resignation letter, tendering his resignation from the Board upon the occurrence of certain events specified in such resignation letter (which resignation may be accepted by the Board in its sole discretion), and a

written waiver of the right to receive any compensation from the Company for service as an independent director of the Company.

The parties also agreed to customary mutual non-disparagement obligations, and the Company agreed to reimburse Kanen for its reasonable, documented out-of-pocket fees and expenses (including legal expenses) incurred in

connection with the negotiation and execution of the Agreement, up to a cap of $35,000 in the aggregate.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the Agreement, a copy of which is attached hereto as Exhibit 10.1 to this Current Report on Form 8-K and is

incorporated herein by reference.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 5.02 by reference.

(b)

On July 26, 2019, Michael Shaffer resigned from the Board, effective immediately, so that he can devote more time to his role as the Executive Vice President and Chief

Operating & Financial Officer of PVH, Corp. Mr. Shaffer has served on the Board since 2014. At the time of his resignation, Mr. Shaffer served as the Chairman of the Audit Committee of the Board (the “Audit Committee”) and as a member of the

Compensation and Development Committee of the Board (the “Compensation Committee”). Mr. Shaffer’s resignation is not due to any disagreements with the Company.

(d)

On July 26, 2019, the Board increased the size of the Board to eight (8) members and appointed each of George Carrara and David Kanen to the Board.

Each of Messrs. Carrara and Kanen will serve as a Class II director with a term expiring at the 2021 Annual Meeting.

There is no arrangement or understanding between Mr. Carrara and any other person pursuant to which Mr. Carrara was elected as a director. Mr. Carrara was determined by the Board to be independent under the applicable

rules of the New York Stock Exchange (“NYSE”) and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) and he will serve as Chairman of the Audit Committee of the Board and as a member of the Compensation and Development

Committee of the Board. In addition, Mr. Kanen was determined by the Board to be independent under the applicable rules of the NYSE and the rules and regulations of the SEC and he will serve as a member of the Compensation and Development Committee of

the Board.

In addition, in connection with his election to the Board and in accordance with the Company’s non-employee director compensation policies, the Compensation Committee approved an award to Mr. Carrara of 15,529 shares of

restricted stock under the Company’s 2017 Omnibus Incentive Plan. Pursuant to his restricted stock award agreement, the shares will vest June 6, 2020, subject to Mr. Carrara’s continued service on the Board. Mr. Carrara’s ongoing annual compensation

will be consistent with that provided to the Company’s other non-employee directors, as described in the Company’s most recent proxy statement filed with the SEC.

The Company is not aware of any transactions, proposed transactions or series of either to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000 and in which

either of Messrs. Carrara or Kanen had, or will have, a direct or indirect material interest.

On July 29, 2019, the Company issued a press release announcing the appointment of Messrs. Carrara and Kanen to the Board and the resignation of Mr. Shaffer from the Board, a copy of which is filed as Exhibit 99.1 to

this Current Report on Form 8-K.

|

Item 9.01

|

Financial Statements and Exhibits

.

|

(d)

Exhibits

Exhibit Number

|

Description of Exhibit

|

|

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

BUILD-A-BEAR WORKSHOP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: July 29, 2019

|

By:

|

/s/ Eric Fencl

|

|

|

|

|

Name:

|

Eric Fencl

|

|

|

|

|

Title:

|

Chief Administrative Officer,

|

|

|

|

|

|

General Counsel and Secretary

|

|

5

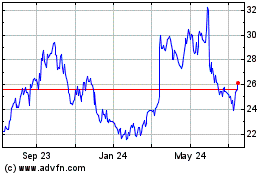

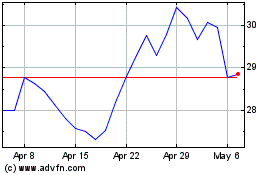

Build A Bear Workshop (NYSE:BBW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Build A Bear Workshop (NYSE:BBW)

Historical Stock Chart

From Apr 2023 to Apr 2024