For the first quarter of fiscal 2019:

- Total Revenues increase to $84.4

million from $83.2 million in the first quarter of fiscal

2018

- Pre-Tax Income rises to $2.4 million

from $0.6 million in the first quarter of fiscal 2018

Build-A-Bear Workshop, Inc. (NYSE: BBW) today reported results

for the first quarter, 13-weeks ended May 4, 2019.

Sharon Price John, Build-A-Bear Workshop President and Chief

Executive Officer, commented, “We have had a solid start to the

year with growth in total revenues, expansion in gross margin and

disciplined expense management resulting in a $1.8 million increase

in first quarter pre-tax income compared to the same period in the

prior fiscal year. Other highlights in this year’s first quarter

include a significant increase in commercial revenue as strategies

to diversify revenue streams by leveraging the power of our brand

continued to gain traction. We also delivered our sixth consecutive

quarter of double-digit e-commerce growth as initiatives in both

gifting and affinity programs gained momentum. In addition, we

continue to focus on our Count Your Candles birthday program which

has consistently driven new guest acquisition and Bonus Club

membership. As we expected, a stronger slate of family-centric

movies had a positive impact on sales of products tied to the

films, and we saw traffic levels at Build-A-Bear Workshop stores

outpace national trends although still slightly negative versus the

prior year. Sales growth in North America was partially offset by

ongoing double-digit sales declines in our largest international

market, the United Kingdom, which is expected to have uncertainty

throughout the year.

“Although we will be up against heavy promotional activity that

occurred last year, we are encouraged by the positive trends thus

far in the second quarter and expect to benefit from additional

movie releases slated throughout the year. Furthermore, we are

actively working to expand a number of key relationships that are

expected to positively impact the business. Overall, we remain

confident that the ongoing implementation of our strategy to

leverage the power of the Build-A-Bear brand will result in

long-term profitable growth and enhanced value for our

shareholders,” concluded Ms. John.

First Quarter 2019 Highlights (13 weeks ended May 4, 2019

compared to the 13 weeks ended May 5, 2018):

- Total revenues were $84.4 million

compared to $83.2 million in the fiscal 2018 first quarter;

- Consolidated net retail sales were

$81.0 million compared to $81.4 million in the fiscal 2018 first

quarter;

- Retail gross margin expanded 90 basis

points to 45.2%, this increase was mainly driven by merchandise

margin expansion and lower occupancy costs;

- Selling, general and administrative

expenses (“SG&A”) were $35.8 million, or 42.4% of total

revenues, compared to $36.3 million, or 43.7% of total revenues, in

the fiscal 2018 first quarter;

- Pre-tax income was $2.4 million

compared to $0.6 million in the fiscal 2018 first quarter;

- Income tax expense was $1.2 million

with an effective tax rate of 50.3% compared to $0.3 million with

an effective rate of 45.2% in the fiscal 2018 first quarter. The

income tax expense in the first quarter of fiscal 2019 was higher

than the statutory rate primarily because no tax benefit was

recorded on losses in certain foreign jurisdictions; and

- Net income was $1.2 million, or $0.08

per diluted share, compared to $0.4 million, or $0.02 per diluted

share, in the fiscal 2018 first quarter.

Store Activity:

In the first quarter of fiscal 2019, the Company did not open

any new stores, reformatted two stores and closed 5 locations. As

of May 4, 2019, the Company operated 366 corporately-managed

locations, including 307 in North America and 59 outside of North

America. In addition, the Company ended the first quarter of fiscal

2019 with four seasonal locations compared to two seasonal

locations at the end of the first quarter of fiscal 2018. The

Company’s international franchisees ended the quarter with 90

stores in 12 countries.

Balance Sheet:

At quarter end, the Company had cash and cash equivalents of

$20.2 million, an increase of $1.4 million compared to the prior

year quarter end and had no borrowings under its revolving credit

facility. Total inventory at quarter-end was $56.0 million compared

to $49.4 million at the end of the fiscal 2018 first quarter due to

an increase in inventory related to the timing of new movie

launches as well as in-transit inventory to support new product

introductions. In the first quarter of fiscal 2019, capital

expenditures totaled $2.7 million and depreciation and amortization

totaled $3.5 million.

On February 3, 2019, the Company recorded lease liabilities of

$177.5 million upon adoption of the new lease accounting standard,

also referred to as ASC Topic 842, based on the present value of

remaining lease payments. A corresponding right-to-use asset of

$150.8 million was recorded on the balance sheet which was net of

accrued and prepaid rent, deferred lease incentives and impairment

charges. Impairment charges of $7.4 million (net of tax) were

recorded as a reduction to retained earnings in adopting the new

standard. The recognition of rent expense and payments associated

with these lease assets and liabilities will not result in material

differences to operating income or cash flows compared to the

previous accounting rules, nor does it impact the Company’s bank

agreement covenants.

Fiscal 2019 (52 weeks ended February 1, 2020 compared to the

52 weeks ended February 2, 2019) GAAP Expectations for the

Company currently include:

- Total revenues to increase in the range

of mid- to high-single digits;

- Pre-tax income to be slightly positive,

reflecting the increased sales as well as improved gross profit

margin;

- Capital expenditures to be in the range

of $13 to $15 million; and

- Depreciation and amortization to be in

the range of $15 to $17 million.

The Company notes that the above guidance assumes that there are

no material changes to current tariff rates or policies.

Today’s Conference Call Webcast:

Build-A-Bear Workshop will host a live internet webcast of its

quarterly investor conference call at 9 a.m. ET today. The audio

broadcast may be accessed at the Company’s investor relations

website, http://IR.buildabear.com. The call is expected to conclude

by 10 a.m. ET.

A replay of the conference call webcast will be available in the

investor relations website for one year. A telephone replay will be

available beginning at approximately noon ET today until midnight

ET on June 7, 2019. The telephone replay is available by calling

(844) 512-2921. The access code is 13691030.

About Build-A-Bear:

Build-A-Bear is a global brand kids love and parents trust that

seeks to add a little more heart to life. Build-A-Bear Workshop has

more than 450 stores worldwide where Guests can create customizable

furry friends, including corporately-managed stores in the United

States, Canada, China, Denmark, Ireland, Puerto Rico, and the

United Kingdom, and franchise stores in Africa, Asia, Australia,

Europe, Mexico and the Middle East. Build-A-Bear Workshop, Inc.

(NYSE:BBW) posted total revenue of $336.6 million in fiscal 2018.

For more information, visit the Investor Relations section of

buildabear.com.

Forward-Looking Statements:

This press release contains certain statements that are, or may

be considered to be, “forward-looking statements” for the purpose

of federal securities laws, including, but not limited to,

statements that reflect our current views with respect to future

events and financial performance. We generally identify these

statements by words or phrases such as “may,” “might,” “should,”

“expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,”

“predict,” “future,” “potential” or “continue,” the negative or any

derivative of these terms and other comparable terminology. All of

the information concerning our future liquidity, future revenues,

margins and other future financial performance and results,

achievement of operating of financial plans or forecasts for future

periods, sources and availability of credit and liquidity, future

cash flows and cash needs, success and results of strategic

initiatives and other future financial performance or financial

position, as well as our assumptions underlying such information,

constitute forward-looking information.

These statements are based only on our current expectations and

projections about future events. Because these forward-looking

statements involve risks and uncertainties, there are important

factors that could cause our actual results, level of activity,

performance or achievements to differ materially from the results,

level of activity, performance or achievements expressed or implied

by these forward-looking statements, including those factors

discussed under the caption entitled “Risks Related to Our

Business” and “Forward-Looking Statements” in our Annual Report on

Form 10-K filed with the Securities and Exchange Commission (“SEC”)

on April 18, 2019 and other periodic reports filed with the SEC

which are incorporated herein.

All of our forward-looking statements are as of the date of this

Press Release only. In each case, actual results may differ

materially from such forward-looking information. We can give no

assurance that such expectations or forward-looking statements will

prove to be correct. An occurrence of or any material adverse

change in one or more of the risk factors or other risks and

uncertainties referred to in this Press Release or included in our

other public disclosures or our other periodic reports or other

documents or filings filed with or furnished to the SEC could

materially and adversely affect our continuing operations and our

future financial results, cash flows, available credit, prospects

and liquidity. Except as required by law, the Company does not

undertake to publicly update or revise its forward-looking

statements, whether as a result of new information, future events

or otherwise.

All other brand names, product names, or trademarks belong to

their respective holders.

BUILD-A-BEAR WORKSHOP, INC. AND

SUBSIDIARIES Unaudited Condensed Consolidated Statements of

Operations (dollars in thousands, except share and per share

data)

13 Weeks 13 Weeks Ended

Ended May 4, % of Total May 5,

% of Total

2019 Revenues (1) 2018 Revenues

(1) Revenues: Net retail sales $ 81,048 96.0 $ 81,425 97.9

Commercial revenue 2,754 3.3 1,019 1.2 International franchising

560 0.7 740 0.9 Total revenues 84,362 100.0

83,184 100.0 Cost of merchandise sold: Cost of merchandise

sold - retail (1) 44,421 54.8 45,385 55.7 Cost of merchandise sold

- commercial (1) 1,264 45.9 479 47.0 Cost of merchandise sold -

international franchising (1) 439 78.4 332 44.9 Total

cost of merchandise sold 46,124 54.7 46,196 55.5

Consolidated gross profit 38,238 45.3 36,988 44.5 Selling,

general and administrative expense 35,808 42.4 36,337 43.7 Interest

expense, net 20 0.0 5 0.0 Income (loss) before income

taxes 2,410 2.9 646 0.8 Income tax expense 1,213 1.4

292 0.4 Net income (loss) $ 1,197 1.4 $ 354 0.4 Income

(loss) per common share: Basic $ 0.08 $ 0.02 Diluted $ 0.08 $ 0.02

Shares used in computing common per share amounts: Basic 14,612,575

14,582,573 Diluted 14,738,240 14,722,989 (1) Selected

statement of operations data expressed as a percentage of total

revenues, except cost of merchandise sold - retail, cost of

merchandise sold - commercial and cost of merchandise sold -

international franchising that are expressed as a percentage of net

retail sales, commercial revenue and international franchising,

respectively. Percentages will not total due to cost of merchandise

sold being expressed as a percentage of net retail sales,

commercial revenue or international franchising and immaterial

rounding.

BUILD-A-BEAR WORKSHOP, INC. AND

SUBSIDIARIES Unaudited Condensed Consolidated Balance

Sheets (dollars in thousands, except per share data)

May 4, February 2, May 5, 2019

2019 2018 ASSETS Current assets: Cash and cash

equivalents $ 20,238 $ 17,894 $ 18,881 Inventories, net 56,004

58,356 49,423 Receivables, net 8,836 10,588 8,968 Prepaid expenses

and other current assets 8,587 12,960

11,493 Total current assets 93,665 99,798 88,765

Operating lease right-of-use asset 145,025 - - Property and

equipment, net 65,357 66,368 76,410 Deferred tax assets 3,241 3,099

4,102 Other intangible assets, net 607 731 950 Other assets, net

2,224 2,050 2,427 Total

Assets $ 310,119 $ 172,046 $ 172,654

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Accounts payable $ 20,996 $ 22,551 $ 12,965 Accrued

expenses 7,608 10,047 8,739 Operating lease liability short term

29,769 - - Gift cards and customer deposits 19,026 21,643 17,007

Deferred revenue and other 2,006 1,936

1,893 Total current liabilities 79,405

56,177 40,604 Operating lease

liability long term 139,407 - - Deferred rent liability long term -

18,440 17,697 Deferred franchise revenue 1,580 1,625 1,142 Other

liabilities 1,287 1,490 1,794 Stockholders' equity:

Common stock, par value $0.01 per share 149 150 151 Additional

paid-in capital 69,550 69,088 66,908 Accumulated other

comprehensive loss (12,120 ) (12,018 ) (11,546 ) Retained earnings

30,861 37,094 55,904

Total stockholders' equity 88,440 94,314

111,417 Total Liabilities and Stockholders'

Equity $ 310,119 $ 172,046 $ 172,654

BUILD-A-BEAR WORKSHOP, INC. AND SUBSIDIARIES

Unaudited Selected Financial and Store Data (dollars in

thousands)

13 Weeks 13 Weeks

Ended Ended May 4, May 5, 2019

2018 Other financial data: Retail gross

margin ($) (1) $ 36,627 $ 36,040 Retail gross margin (%) (1) 45.2 %

44.3 % Capital expenditures (2) $ 2,733 $ 3,030 Depreciation and

amortization $ 3,512 $ 4,115

Store data

(3): Number of corporately-managed retail locations

at end of period North America 307 292 Europe 58 57 Asia 1 1

Total corporately-managed retail locations 366 350

Number of franchised stores at end of period 90 96

Corporately-managed store square footage at end of period

(4) North America 712,782 715,197 Europe 83,344 79,236 Asia 1,750

1,750 Total square footage 797,876 796,183

(1) Retail gross margin represents net retail

sales less cost of merchandise sold - retail. Retail gross margin

percentage represents retail gross margin divided by net retail

sales. Store impairment is excluded from retail gross margin. (2)

Capital expenditures represents cash paid for property, equipment,

other assets and other intangible assets. (3) Excludes e-commerce.

North American stores are located in the United States, Canada and

Puerto Rico. In Europe, stores are located in the United Kingdom,

Ireland and Denmark. In Asia, the store is located in China.

Seasonal locations not included in store count. (4) Square footage

for stores located in North America is leased square footage.

Square footage for stores located in Europe is estimated selling

square footage. Seasonal locations not included in the store count.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190531005108/en/

Investors:Voin TodorovicBuild-A-Bear Workshop(314) 423-8000

x5221

Media:PR@buildabear.com

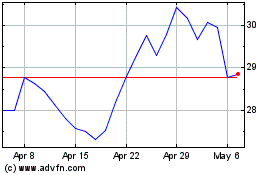

Build A Bear Workshop (NYSE:BBW)

Historical Stock Chart

From Mar 2024 to Apr 2024

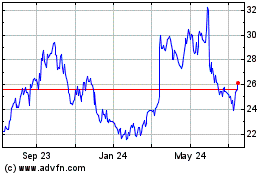

Build A Bear Workshop (NYSE:BBW)

Historical Stock Chart

From Apr 2023 to Apr 2024