Brookfield Renewable Announces Secondary Offering of C$325 Million of Exchangeable Shares By Brookfield Asset Management

October 05 2020 - 4:36PM

Brookfield Renewable Partners L.P. (the

“

Partnership”) (

NYSE:

BEP; TSX:

BEP.UN), Brookfield

Renewable Corporation

(“

BEPC” and

together with the Partnership, “

Brookfield

Renewable”) (

NYSE/TSX:

BEPC) and Brookfield

Asset Management Inc. (“

BAM”)

(

NYSE: BAM; TSX: BAM.A) today

announced a secondary offering (the “

Offering”) of

4,055,000 class A exchangeable subordinate voting shares (the

“

Exchangeable Shares”) of BEPC by a subsidiary of

BAM (the “

Selling

Securityholder”) on a bought deal basis to a

syndicate of underwriters co-led by Scotiabank, RBC Capital

Markets, TD Securities Inc., BMO Capital Markets and CIBC Capital

Markets (collectively, the “

Underwriters”) for

distribution to the public. The Selling Securityholder has agreed

to sell the Exchangeable Shares at a price of C$80.20 per

Exchangeable Share (the “

Offering Price”), for

gross proceeds of C$325 million. Brookfield Renewable is not

selling any Exchangeable Shares in the Offering and will not

receive any of the proceeds from the

Offering.

The Selling Securityholder has granted the

Underwriters an over-allotment option to purchase up to an

additional 15% of the Exchangeable Shares to be sold pursuant to

the Offering at the Offering Price (the “Over-Allotment

Option”). The Over-Allotment Option is exercisable for a

period of 30 days from the date of the final prospectus supplement

relating to the Offering. If the Over-Allotment Option is exercised

in full, the gross proceeds of the Offering will increase to C$374

million.

Each Exchangeable Share is structured with the

intention of providing an economic return equivalent to one

non-voting limited partnership unit (a “Unit”) of

the Partnership (subject to adjustment to reflect certain capital

events). Each Exchangeable Share will be exchangeable at the option

of the holder for one Unit (subject to adjustment to reflect

certain capital events) or its cash equivalent (the form of payment

to be determined at the election of Brookfield Renewable).

BAM currently owns an approximate 52% equity

interest in Brookfield Renewable, on a fully-exchanged basis.1 Upon

closing of the Offering, it is anticipated that BAM will own an

approximate 51% equity interest in Brookfield Renewable, on a fully

exchanged-basis (and 51% if the Over-Allotment Option is exercised

in full), which includes 35% of the issued and outstanding

Exchangeable Shares (and 35% if the Over-Allotment Option is

exercised in full).

The Offering is subject to a number of closing

conditions and is expected to close on or about October 13,

2020.

This news release

does not constitute an offer of securities

for sale in the United States. The Exchangeable Shares will not be

and have not been registered under the U.S. Securities Act

of 1933, as amended (the “U.S. Securities Act”)

and may not be offered or sold in the United

States or to “U.S. persons”

(within the meaning of Regulation S under the U.S. Securities Act)

except pursuant to a private resale exemption under the U.S.

Securities Act and in compliance with U.S. state securities laws,

to “qualified institutional buyers” (as defined in Rule 144A under

the U.S. Securities Act). There shall not be any public offering of

the Exchangeable Shares in the United States.

Brookfield

Renewable operates one of the world’s largest

publicly traded, pure-play renewable power platforms. Our portfolio

consists of hydroelectric, wind, solar and storage facilities in

North America, South America, Europe and Asia, and totals over

19,000 megawatts of installed capacity and an 18,000 megawatt

development pipeline. Investors can access our portfolio either

through Brookfield Renewable Partners L.P. (NYSE: BEP; TSX:

BEP.UN), a Bermuda-based limited partnership, or Brookfield

Renewable Corporation (NYSE, TSX: BEPC), a Canadian corporation.

Further information is available at www.bep.brookfield.com and

www.bep.brookfield.com/bepc. Important information may be

disseminated exclusively via the website; investors should consult

the site to access this information.Brookfield Renewable is the

flagship listed renewable power company of BAM, a leading global

alternative asset manager with over $515 billion of assets under

management.For more information, please contact:

|

Media:Claire HollandSenior Vice President,

Communications Tel: (416) 369-8236 Email:

claire.holland@brookfield.com |

Investors:Cara SilvermanManager – Investor

RelationsTel: (416) 649-8172Email:

cara.silverman@brookfield.com |

Cautionary Statement Regarding

Forward-looking

Statements

This news release contains forward-looking

statements and information within the meaning of applicable

securities laws. The words “will”, “intend”, “should”, “could”,

“target”, “growth”, “expect”, “believe”, “plan”, derivatives

thereof and other expressions which are predictions of or indicate

future events, trends or prospects and which do not relate to

historical matters identify the above mentioned and other

forward-looking statements. Forward-looking statements in this news

release include statements regarding the Offering, BAM’s expected

ownership interest in Brookfield Renewable upon closing of the

Offering and the expected closing date of the Offering. Although

Brookfield Renewable believes that these forward-looking statements

and information are based upon reasonable assumptions and

expectations, you should not place undue reliance on them, or any

other forward-looking statements or information in this news

release. The future performance and prospects of Brookfield

Renewable are subject to a number of known and unknown risks and

uncertainties. Factors that could cause actual results of

Brookfield Renewable to differ materially from those contemplated

or implied by the statements in this news release include (without

limitation) the failure to satisfy the customary closing conditions

the offering, our inability to identify sufficient investment

opportunities and complete transactions, including weather

conditions and other factors which may impact generation levels at

facilities; economic conditions in the jurisdictions in which

Brookfield Renewable operates; ability to sell products and

services under contract or into merchant energy markets; changes to

government regulations, including incentives for renewable energy;

ability to complete development and capital projects on time and on

budget; inability to finance operations or fund future acquisitions

due to the status of the capital markets; health, safety, security

or environmental incidents; regulatory risks relating to the power

markets in which Brookfield Renewable operates, including relating

to the regulation of our assets, licensing and litigation; risks

relating to internal control environment; contract counterparties

not fulfilling their obligations; changes in operating expenses,

including employee wages, benefits and training, governmental and

public policy changes, and other risks associated with the

construction, development and operation of power generating

facilities. For further information on these known and unknown

risks, please see “Risk Factors” included in (i) the Form 20-F of

the Partnership and (ii) the prospectus of BEPC dated June 29, 2020

in respect of the special distribution of Exchangeable Shares to

unitholders of the Partnership, and other risks and factors that

are described therein.

The foregoing list of important factors that may

affect future results is not exhaustive. The forward-looking

statements represent our views as of the date of this news release

and should not be relied upon as representing our views as of any

subsequent date. While we anticipate that subsequent events and

developments may cause our views to change, we disclaim any

obligation to update the forward-looking statements, other than as

required by applicable law.

1 Percentage assumes that all of the outstanding

redeemable/exchangeable partnership units of Brookfield Renewable

Energy L.P. (“BRELP”) and Exchangeable Shares are exchanged for

Units (on a one-for-one basis). Assuming that only all of the

redeemable/exchangeable partnership units of BRELP and Exchangeable

Shares beneficially owned by BAM are exchanged for Units (on a

one-for-one basis), the percentage would be approximately 61%.

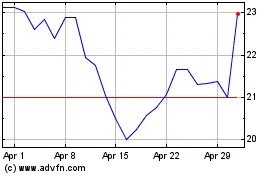

Brookfield Renewable Par... (NYSE:BEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brookfield Renewable Par... (NYSE:BEP)

Historical Stock Chart

From Apr 2023 to Apr 2024