Watermark Lodging Trust Agrees to be Acquired by Brookfield in $3.8 Billion Deal

May 06 2022 - 5:11PM

Dow Jones News

By Stephen Nakrosis

Watermark Lodging Trust Inc. said Friday it entered a deal with

private real estate funds managed by Brookfield Asset Management

that will see Brookfield acquire Watermark.

Under the terms of the deal, Brookfield will acquire all

outstanding shares of Watermark's common stock. Brookfield will pay

$6.768 per Class A share and $6.699 per Class T share in an

all-cash transaction valued at $3.8 billion, including the

assumption of debt and preferred equity, the companies said.

The purchase price is a premium of over 7.5% from Watermark's

most recently published Net Asset Values per share of $6.29 per

Class A share and $6.22 per Class T share as of December 31, 2021,

according to the companies.

The Watermark portfolio consists of 25 properties totaling over

8,100 rooms. These assets "are located in drive-to leisure

destinations and gateway urban cities across 14 states with a high

concentration in the Sun Belt region," the companies said.

The deal is expected to close in the fourth quarter of this

year.

Write to Stephen Nakrosis at stephen.nakrosis@wsj.com

(END) Dow Jones Newswires

May 06, 2022 16:56 ET (20:56 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

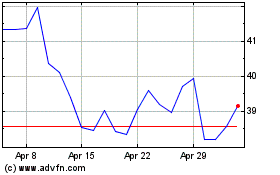

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Apr 2023 to Apr 2024