Current Report Filing (8-k)

August 05 2021 - 8:34AM

Edgar (US Regulatory)

BRINKS CO0000078890false00000788902021-08-042021-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 4, 2021

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Virginia

|

001-09148

|

54-1317776

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1801 Bayberry Court

P. O. Box 18100

Richmond, VA 23226-8100

(Address and zip code of

principal executive offices)

Registrant’s telephone number, including area code: (804) 289-9600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $1.00 per share

|

BCO

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Securities Act. ☐

|

|

|

|

|

|

|

|

Item 7.01

|

Regulation FD Disclosure.

|

On August 5, 2021, The Brink’s Company (the “Company”) issued a press release to announce that, pursuant to its previously authorized share repurchase program, it has entered into an accelerated share repurchase (“ASR”) agreement with J.P. Morgan Chase Bank, N.A. (“J.P. Morgan”) to repurchase an aggregate of $50 million of the Company’s common stock. A copy of the Company's press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific references in such a filing.

On August 4, 2021, the Company entered into a Supplemental Confirmation, supplementing a Master Confirmation, dated as of August 26, 2020, with J.P. Morgan (collectively, the “ASR Agreement”) to repurchase an aggregate of $50 million of the Company's common stock. The Company is repurchasing these shares under the authority granted by the Company’s Board of Directors in February 2020 to purchase up to an aggregate $250 million of the Company’s common stock, which expires December 31, 2021. Upon completion of the ASR transaction, the Company will have $150 million remaining for share repurchases under this authorization.

Under the terms of the ASR Agreement, the Company will pay $50 million to J.P. Morgan and will receive approximately 524,315 shares based on market prices, representing approximately 80% of the total shares that the Company expects to repurchase under the ASR Agreement. The Company expects to receive additional shares representing the balance of 20% of the remaining shares under the ASR Agreement by no later than November 24, 2021, when the ASR transaction is expected to be completed. The final number of shares to be repurchased will be based on the average of the daily volume-weighted average prices of the Company's common stock during the term of the transaction, less a discount and subject to adjustments pursuant to the terms of the ASR Agreement. At settlement, under certain circumstances, J.P. Morgan may be required to deliver additional shares of common stock to the Company, or, under certain circumstances, the Company may be required to deliver shares of its common stock or may elect to make a cash payment to J.P. Morgan. The ASR Agreement contains customary terms for these types of transactions, including the mechanisms to determine the number of shares or the amount of cash that will be delivered at settlement, the required timing of delivery upon settlement, the specific circumstances under which adjustments may be made to the transactions, the specific circumstances under which the transactions may be cancelled prior to the scheduled maturity and various acknowledgments, representations and warranties made by the Company and J.P. Morgan to one another.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

(d)

|

Exhibits

|

|

|

|

|

|

|

|

99.1

|

|

|

|

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

THE BRINK’S COMPANY

(Registrant)

|

|

|

|

|

|

|

|

Date: August 5, 2021

|

By:

|

/s/ Ronald J. Domanico

|

|

|

|

Ronald J. Domanico

|

|

|

|

Executive Vice President and

Chief Financial Officer

|

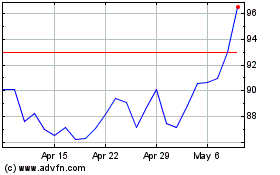

Brinks (NYSE:BCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

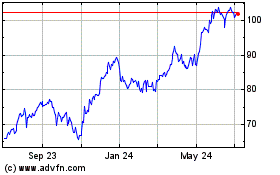

Brinks (NYSE:BCO)

Historical Stock Chart

From Apr 2023 to Apr 2024