BrightSpire Capital Announces Pricing of $675 Million BRSP 2024-FL2 Commercial Real Estate CLO and the Redemption of CLNC 2019-FL1

August 09 2024 - 8:00AM

Business Wire

BrightSpire Capital, Inc. (NYSE: BRSP) (“BrightSpire Capital” or

the “Company”) announced that the Company priced BRSP 2024-FL2, a

$675 million managed Commercial Real Estate Collateralized Loan

Obligation (the “2024-FL2 CLO”) on August 1, 2024. The transaction

is scheduled to close on August 15, 2024. The 2024-FL2 CLO is

collateralized by interests in 22 first-lien floating-rate

mortgages secured by 25 properties, with an 86.50% initial advance

rate at a weighted average coupon at issuance of Term SOFR+2.47%,

before transaction costs.

The asset collateral is located across 9 states and primarily

consists of multifamily properties (74.3%), mixed-use (13.8%),

hospitality (7.1%), office (2.8%) and industrial (2.0%). All loans

were originated by subsidiaries of the Company. The structure

features a two-year reinvestment period and available proceeds of

approximately $85 million to be used within a six-month ramp up

period from closing.

Moody's Investor Service, Inc. and Fitch Ratings, Inc. assigned

a “Aaa” and “AAA” rating, respectively, to the seniormost

certificates, with Fitch Ratings, Inc. providing ratings to the

remaining classes of the transaction.

“The successful execution of our third managed CRE CLO evidences

the strength of the platform and business strategy. The transaction

was well received by a broad base of investors. We look forward to

investing the liquidity generated from the transaction in new loan

originations opportunities,” highlighted Andy Witt, President and

Chief Operating Officer of BrightSpire Capital.

Matthew Heslin, Chief Credit Officer and Head of Debt Capital

Markets at BrightSpire Capital, added, “This transaction further

diversifies our funding sources, while generating valuable

liquidity and providing additional non-recourse, non

mark-to-market, match term financing; the transaction serves as a

cornerstone as we pivot toward deploying capital through new loan

originations. As a seasoned and respected issuer and collateral

manager, CRE CLOs will continue to be an important financing source

for our business moving forward.”

Morgan Stanley & Co. LLC and Wells Fargo Securities, LLC

acted as co-structuring agents. Morgan Stanley & Co. LLC, Wells

Fargo Securities, LLC, Barclays Capital Inc. and Citigroup Global

Markets Inc. acted as co-lead managers and joint bookrunners.

The Company also announced it will redeem its CLNC 2019-FL1

securitization on August 19, 2024.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About BrightSpire Capital, Inc.

BrightSpire Capital, Inc. (NYSE: BRSP), formerly Colony Credit

Real Estate, Inc. (NYSE: CLNC), is one of the largest publicly

traded commercial real estate (CRE) credit REITs, focused on

originating, acquiring, financing and managing a diversified

portfolio consisting primarily of CRE debt investments and net

leased properties predominantly in the United States. CRE debt

investments primarily consist of first mortgage loans, which we

expect to be the primary investment strategy. BrightSpire Capital

is organized as a Maryland corporation and taxed as a REIT for U.S.

federal income tax purposes. For additional information regarding

the Company and its management and business, please refer to

www.brightspire.com.

Cautionary Statement Regarding Forward-Looking

Statements

This press release may contain forward-looking statements within

the meaning of the federal securities laws. Forward- looking

statements relate to expectations, beliefs, projections, future

plans and strategies, anticipated events or trends and similar

expressions concerning matters that are not historical facts. In

some cases, you can identify forward-looking statements by the use

of forward-looking terminology such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” or “potential” or the negative of these

words and phrases or similar words or phrases which are predictions

of or indicate future events or trends and which do not relate

solely to historical matters. Forward-looking statements involve

known and unknown risks, uncertainties, assumptions and

contingencies, many of which are beyond our control, and may cause

actual results to differ significantly from those expressed in any

forward- looking statement. Factors that could cause actual results

to differ materially from BrightSpire Capital’s expectations

include, but are not limited to, the ability to generate additional

liquidity and repatriate such proceeds in senior mortgage loans;

the ability to issue CRE CLO’s on a go forward basis, including at

a reduced cost of capital. The foregoing list of factors is not

exhaustive. Additional information about these and other factors

can be found in Part I, Item 1A of the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2023, as well as

in BrightSpire Capital’s other filings with the U.S. Securities and

Exchange Commission. Moreover, each of the factors referenced above

are likely to also be impacted directly or indirectly by the

ongoing impact of COVID-19 and investors are cautioned to interpret

substantially all of such statements and risks as being heightened

as a result of the ongoing impact of the COVID-19. Additional

information about these and other factors can be found in

BrightSpire Capital’s reports filed from time to time with the

Securities and Exchange Commission.

BrightSpire Capital cautions its investors not to unduly rely on

any forward-looking statements. The forward-looking statements

speak only as of the date of this press release. BrightSpire

Capital is under no duty to update any of these forward-looking

statements after the date of this press release, nor to conform

prior statements to actual results or revised expectations, and

BrightSpire Capital does not intend to do so.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240809334712/en/

Investor Relations BrightSpire Capital, Inc. Addo

Investor Relations Anne McGuinness 310-829-5400 brsp@addo.com

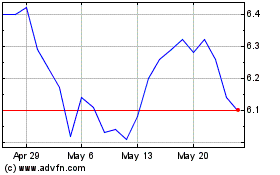

BrightSpire Capital (NYSE:BRSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

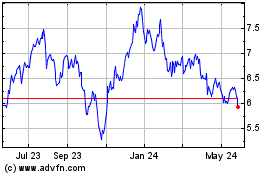

BrightSpire Capital (NYSE:BRSP)

Historical Stock Chart

From Nov 2023 to Nov 2024