Current Report Filing (8-k)

September 24 2020 - 5:27PM

Edgar (US Regulatory)

false0001574085

0001574085

us-gaap:SeriesBPreferredStockMember

2020-09-24

2020-09-24

0001574085

us-gaap:SeriesDPreferredStockMember

2020-09-24

2020-09-24

0001574085

us-gaap:CommonStockMember

2020-09-24

2020-09-24

0001574085

2020-09-24

2020-09-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): September 24, 2020

BRAEMAR HOTELS & RESORTS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-35972

|

|

46-2488594

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(IRS employer identification number)

|

|

|

|

|

|

|

|

14185 Dallas Parkway

|

|

|

|

|

|

Suite 1100

|

|

|

|

|

|

Dallas

|

|

|

|

|

|

Texas

|

|

|

|

75254

|

|

(Address of principal executive offices)

|

|

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

BHR

|

|

New York Stock Exchange

|

|

Preferred Stock, Series B

|

|

BHR-PB

|

|

New York Stock Exchange

|

|

Preferred Stock, Series D

|

|

BHR-PD

|

|

New York Stock Exchange

|

ITEM 8.01 OTHER EVENTS.

In January 2019, Braemar Hotels & Resorts Inc. (the “Company”) refinanced its $186.8 million mortgage loan secured by the Capital Hilton and Hilton La Jolla Torrey Pines, which are held in a joint venture in which the Company has a 75% equity interest, for a new mortgage loan that totaled $195.0 million. The loan has a maturity date in February 2024, is interest only and bears interest at a rate of LIBOR + 1.70%.

On April 6, 2020, the Company failed to make the interest payment due on the loan. On September 24, 2020, the Company entered into a loan forbearance agreement with its lender (the “Forbearance Agreement”). Pursuant to the Forbearance Agreement, its lender consented to: (i) the deferral of interest payments for a period of six months beginning in April 2020 through September 2020, with interest payments resuming in October 2020; (ii) repayment of all deferred interest on a 1/12th monthly basis starting January 5, 2021; and (iii) the utilization of FF&E reserve funds (from the furniture, fixtures and equipment reserve account generally reserved to finance capital improvements to the property) for the payment of operating expenses at the hotels, with suspension of all required payments to be made to the FF&E reserve through December 31, 2020. The FF&E reserve is subject to replenishment on a 1/24th monthly basis starting March 2021.

Lismore Capital LLC (“Lismore”), a subsidiary of Ashford Inc., was paid a $731,250 fee in connection with this forbearance, which was due under the Braemar Loan Modification/Forbearance Agreement, dated as of March 20, 2020, by and among Lismore and the Company (the “Lismore Agreement”). This fee was comprised of the following components (i) a $182,813 fee which was paid upfront upon execution of the Lismore Agreement and was not subject to clawback, (ii) a $182,813 fee which has been paid pursuant to the monthly installments and was previously subject to clawback and (iii) a $365,625 success fee which was only payable to Lismore upon acceptance by the applicable lender.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 24, 2020

|

|

|

|

|

|

|

|

BRAEMAR HOTELS & RESORTS INC.

|

|

|

|

|

|

|

By:

|

/s/ ROBERT G. HAIMAN

|

|

|

|

Robert G. Haiman

|

|

|

|

Executive Vice President, General Counsel & Secretary

|

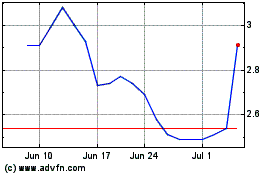

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Apr 2023 to Apr 2024