Current Report Filing (8-k)

April 24 2020 - 5:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): April 20, 2020

BRAEMAR HOTELS & RESORTS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARYLAND

|

|

001-35972

|

|

46-2488594

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

|

|

|

|

|

|

|

14185 Dallas Parkway, Suite 1100

|

|

|

|

Dallas, Texas

|

|

75254

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

BHR

|

|

New York Stock Exchange

|

|

Preferred Stock, Series B

|

|

BHR-PB

|

|

New York Stock Exchange

|

|

Preferred Stock, Series D

|

|

BHR-PD

|

|

New York Stock Exchange

|

Item 1.01 Entry into a Material Definitive Agreement.

Certain subsidiaries of Braemar Hotels & Resorts Inc. (the “Company”) recently applied for loans (collectively, the “PPP Loans,” and each loan, a “PPP Loan”) from Key Bank, N.A., under the Paycheck Protection Program (“PPP”) which was established under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). In addition to the executed PPP Loans previously disclosed on our Form 8-K dated April 15, 2020, the Company has applied for a loan for each of the entities listed in Exhibit 99.1 to this Current Report (each such entity, a “Borrower”). Each Borrower owns a hotel, and the proceeds from each PPP Loan will be used in accordance with the terms of the CARES Act program, as described further below. The aggregate amount of the five PPP Loans set forth on Exhibit 99.1 is approximately $18.5 million. As of April 24, 2020, two loans set forth on Exhibit 99.1 with an aggregate principal amount of $7.4 million have been approved and funded. The remainder of the loans set forth on Exhibit 99.1 are in various stages of the loan application process and there can be no assurances that the Borrowers will receive any funds from any of the PPP loans which have not yet been funded.

The term of each PPP Loan is two years. The interest rate on each PPP Loan is 1.00%, which shall be deferred for the first six months of the term of the loan. Pursuant to the terms of the CARES Act, the proceeds of each PPP Loan may be used for payroll costs, mortgage interest, rent or utility costs. The promissory note evidencing each PPP Loan contains customary events of default relating to, among other things, payment defaults, breach of representations and warranties, or provisions of the promissory note. The occurrence of an event of default may result in a claim for the immediate repayment of all amounts outstanding under such PPP Loan, collection of all amounts owing from the respective Borrower, filing suit and obtaining judgment against the respective Borrower.

Under the terms of the CARES Act, each Borrower can apply for and be granted forgiveness for all or a portion of the PPP Loan. Such forgiveness will be determined, subject to limitations, based on the use of loan proceeds in accordance with the terms of the CARES Act, as described above, during the 8-week period after loan origination and the maintenance or achievement of certain employee levels. No assurance is provided that any Borrower will obtain forgiveness under any relevant PPP Loan in whole or in part.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off Balance Sheet Arrangement of the Registrant.

The disclosure in Item 1.01 of this Current Report is incorporated herein by reference.

Forward-Looking Statements

This Current Report contains various forward-looking statements within the meaning of federal securities laws. Such forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. The Company can give no assurances that such plans will be attained or achieved. Potential risks and uncertainties include, but are not limited to, the potential that Key Bank does not fund the PPP Loans in accordance with the terms of such loans, potential delays or failure to fund the PPP Loans as a result of administrative issues related to the PPP Loan program implementation or the Small Business Administration no longer having sufficient money to fund such loans, economic conditions, concerns with or threats of, or the consequences of, pandemics, contagious diseases or health epidemics, including COVID-19, the potential that we are not able to negotiate forbearance agreements with lenders for indebtedness at certain subsidiaries of the Company, competition and other uncertainties detailed from time to time in the Company’s Securities and Exchange Commission filings. These forward-looking statements are based upon the current expectations and beliefs of the Company’s management as of the date of this Current Report on Form 8-K, and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Except as required by applicable law, the Company assumes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit

Number Exhibit Description

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: April 24, 2020

|

|

|

|

|

|

|

|

BRAEMAR HOTELS & RESORTS INC.

|

|

|

|

|

|

|

By:

|

/s/ Deric S. Eubanks

|

|

|

|

Deric S. Eubanks

|

|

|

|

Chief Financial Officer

|

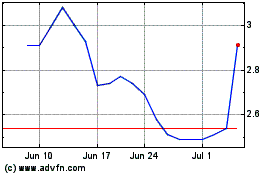

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Apr 2023 to Apr 2024