BP Boosts Its Bet on Trees

December 16 2020 - 1:29AM

Dow Jones News

By Ryan Dezember

BP PLC has bought a controlling stake in the largest U.S.

producer of carbon offsets, doubling down on a bet that preserving

forests will be key to companies meeting their carbon-reduction

goals.

The oil giant in late 2019 made a $5 million venture investment

in Pennsylvania's Finite Carbon, which helps landowners sell their

forests as carbon sinks. With majority ownership of Finite, BP

plans to take global the business of paying landowners not to cut

down trees.

BP and Finite didn't disclose financial terms of the latest deal

but said that the forestry firm was now part of the energy

company's Launchpad. The unit functions similarly to a

private-equity firm by taking big economic stakes in businesses

with an eye toward steering them through expansion.

"Finite Carbon has the potential to build a global platform for

managing and financing natural climate solutions," said David

Eyton, BP's executive vice president of innovation and

engineering.

BP itself has been one of the world's biggest buyers of forest

carbon-offset credits, a type of climate-change currency. The

company has spent hundreds of millions of dollars on offsets to

comply with California regulators. They operate a so-called

cap-and-trade system that aims to reduce greenhouse gasses by

making it more expensive over time for companies operating in the

state to pollute.

In California's system, preserving forests with centurylong

conservation pacts is rewarded with credits, each representing a

metric ton of carbon sequestered in trees that landowners have been

paid not to cut.

BP is wagering that cap-and-trade will spread. Meanwhile, there

is a growing, speculative market for what are known as voluntary

offset credits. Such credits are created under guidelines similar

to California's strict rules but not used for regulatory compliance

-- at least not yet.

For now, voluntary offsets are mainly used by companies wanting

to cancel out emissions on their own carbon ledgers. The billions

of dollars piling up in ESG funds, which promise to invest with

ecological and social responsibility in mind, has sent companies

racing to reduce their emissions and make up for those they cannot

avoid. Companies including Amazon.com Inc., Apple Inc. and Royal

Dutch Shell PLC. have promised carbon neutrality in the coming

decades.

BP, targeting carbon neutrality by 2050, says it is annually

responsible for 415 million metric tons of carbon emissions,

between its operations and the burning of its oil-and-gas output by

drivers and power plants. Beyond ensuring ample supply of offsets,

energy firms like BP are equipped with trading desks that can

capitalize on broader demand for carbon credits.

Energy firms and others are working to develop carbon-capture

technology that sucks carbon dioxide from the atmosphere and

stashes it underground. Doing so is thus far uneconomical and

untested at scale, though. When it comes to carbon sequestration,

trees are nature's known quantity.

Like other forestry consultants, Finite sizes up trees on behalf

of landowners. But instead of estimating what sawmills will pay for

the timber, Finite's foresters measure trees to estimate biomass

and thus how much carbon is being stored on properties.

Finite has created and sold offset credits on behalf of

landowners. They include a railroad, Maine's Passamaquoddy tribe,

Appalachian coal concerns, land trusts and timberland management

organizations, which pool investors' cash to buy forests.

Finite says its clients have been paid more than $500 million

not to cut down trees, mostly by buyers using the offsets to

operate in California. Finite has been responsible for more than

45% of all forest offsets issued by the state since cap-and-trade

started in 2013, according to California Air Resources Board

data.

The firm used BP's earlier investment to hire foresters and

build an online platform that helps smaller landowners sell

voluntary credits by eliminating much of the legwork and expense of

enrolling large tracts in the California program.

Carbon-conscious companies' demand for voluntary credits has

lately swamped the 20-person firm, said Sean Carney, who founded

Finite with financial backers in 2009 and will remain chief

executive. BP's bigger investment will enable Finite to continue

adding foresters and expand into forests around the world.

"They're doubling down, and we're staffing up," Mr. Carney said.

"BP has operations in 70 countries; we're not planning to be in all

countries over night, but that's a start."

Write to Ryan Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

December 16, 2020 01:14 ET (06:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

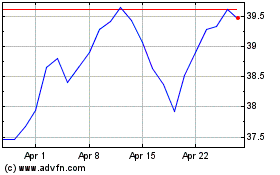

BP (NYSE:BP)

Historical Stock Chart

From Mar 2024 to Apr 2024

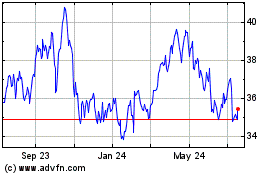

BP (NYSE:BP)

Historical Stock Chart

From Apr 2023 to Apr 2024