Certified Annual Shareholder Report for Management Investment Companies (n-csr)

January 28 2021 - 12:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

|

Investment Company Act file number

|

811- 05877

|

|

|

|

|

|

BNY Mellon Strategic Municipal Bond Fund, Inc.

|

|

|

|

(Exact name of Registrant as specified in charter)

|

|

|

|

|

|

|

|

c/o BNY Mellon Investment Adviser, Inc.

240 Greenwich Street

New York, New York 10286

|

|

|

|

(Address of principal executive offices) (Zip code)

|

|

|

|

|

|

|

|

Bennett A. MacDougall, Esq.

240 Greenwich Street

New York, New York 10286

|

|

|

|

(Name and address of agent for service)

|

|

|

|

|

Registrant's telephone number, including area code:

|

(212) 922-6400

|

|

|

|

|

Date of fiscal year end:

|

11/30

|

|

|

Date of reporting period:

|

11/30/2020

|

|

|

|

|

|

|

|

|

|

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Strategic Municipal Bond Fund, Inc.

|

|

|

ANNUAL REPORT

November 30, 2020

|

|

|

|

BNY Mellon Strategic Municipal Bond Fund, Inc.

Protecting Your Privacy

Our Pledge to You

THE FUND IS COMMITTED TO YOUR PRIVACY. On this page, you will find the fund’s policies and practices for collecting, disclosing, and safeguarding “nonpublic personal information,” which may include financial or other customer information. These policies apply to individuals who purchase fund shares for personal, family, or household purposes, or have done so in the past. This notification replaces all previous statements of the fund’s consumer privacy policy, and may be amended at any time. We’ll keep you informed of changes as required by law.

YOUR ACCOUNT IS PROVIDED IN A SECURE ENVIRONMENT. The fund maintains physical, electronic and procedural safeguards that comply with federal regulations to guard nonpublic personal information. The fund’s agents and service providers have limited access to customer information based on their role in servicing your account.

THE FUND COLLECTS INFORMATION IN ORDER TO SERVICE AND ADMINISTER YOUR ACCOUNT. The fund collects a variety of nonpublic personal information, which may include:

• Information we receive from you, such as your name, address, and social security number.

• Information about your transactions with us, such as the purchase or sale of fund shares.

• Information we receive from agents and service providers, such as proxy voting information.

THE FUND DOES NOT SHARE NONPUBLIC PERSONAL INFORMATION WITH ANYONE, EXCEPT AS PERMITTED BY LAW.

Thank you for this opportunity to serve you.

|

|

|

|

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds.

|

|

|

|

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

|

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period of December 1, 2019 through November 30, 2020, as provided by Daniel Rabasco and Jeffrey Burger, Portfolio Managers

Fund and Market Performance Overview

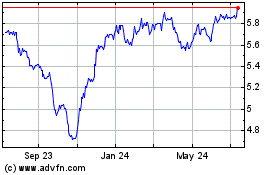

For the 12-month period ended November 30, 2020, BNY Mellon Strategic Municipal Bond Fund, Inc. achieved a total return of 4.16% on a net-asset-value basis and a total return of -1.87% on a market price basis.1 Over the same period, the fund provided aggregate income dividends of $0.36 per share, which reflects a distribution rate of 4.70%.2

During the reporting period, municipal bonds bounced back from the market turmoil resulting from COVID-19 and the government efforts to contain it. The fund’s performance was driven by its duration and yield curve positioning, and its asset allocation and security selection decisions.

The Fund’s Investment Approach

The fund seeks to maximize current income exempt from federal income tax to the extent believed by BNY Mellon Investment Adviser, Inc. to be consistent with the preservation of capital. In pursuing this goal, the fund invests at least 80% of its assets in municipal bonds. Under normal market conditions, the weighted average maturity of the fund’s portfolio is expected to exceed 10 years. Under normal market conditions, the fund invests at least 80% of its net assets in municipal bonds considered investment grade or the unrated equivalent as determined by BNY Mellon Investment Adviser, Inc.

The fund also has issued auction-rate preferred stock (ARPS), a percentage of which remains outstanding from its initial public offering, and has invested the proceeds in a manner consistent with its investment objective. This, along with the fund’s participation in secondary, inverse floater structures, has the effect of “leveraging” the portfolio, which can magnify gain and loss potential depending on market conditions.

Over time, many of the fund’s older, higher-yielding bonds have matured or were redeemed by their issuers. We have attempted to replace those bonds with investments consistent with the fund’s investment policies. We have also sought to upgrade the fund with newly issued bonds that, in our opinion, have better structural or income characteristics than existing holdings. When such opportunities arise, we usually look to sell bonds that are close to their optional redemption date or maturity.

Market Continues to Recover

Early in the reporting period, the municipal bond market benefited from strong demand resulting from concerns about economic momentum. Demand was also driven by investors in states with high income-tax rates who moved into municipal bonds as a way to reduce their federal income tax liability, which rose as a result of the cap on the federal deductibility of state and local taxes in the Tax Cuts and Jobs Act of 2017.

Actions by the Federal Reserve (the “Fed”) prior to the period, including an October 2019 rate cut, also helped the municipal bond market. This contributed to a decline in yields across the municipal bond yield curve.

The municipal bond market experienced unprecedented volatility later in the reporting period, as the COVID-19 virus spread, and government shutdowns caused the economy to slow dramatically. Yields on municipal bonds had reached record lows when the pandemic hit, but

2

large outflows from municipal bond mutual funds, combined with illiquidity, caused yields to soar.

In response to COVID-19, the Fed made two emergency interest rate reductions in March 2020 and also launched a $500 billion Municipal Liquidity Facility (MLF) to purchase short-term municipal securities. This, combined with the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act, dramatically changed investor sentiment, which helped the municipal bond market to bounce back relatively quickly.

While new issuance dried up during the height of the crisis in the first quarter of 2020, it rebounded along with the market, as issuers sought to take advantage of record-low funding costs. Much of the new issuance was in taxable bonds, as low yields have made taxable issuance attractive. Late in the reporting period, issuers sought to secure financing ahead of the November 2020 election. The market softened somewhat as a result, before recovering late in the period on robust reinvestment demand.

For the entire period, with the pandemic and its economic slowdown as a backdrop, higher-quality bonds outperformed; the investment-grade market outperformed the high-yield market; general obligation bonds outperformed revenue bonds; and AAA and AA rated bonds outperformed those with lower ratings. Demand remained strong late in the period, as both retail and institutional investors continued to find the yields attractive.

Asset Allocation and Yield Curve Positioning Hampered Fund Results

The fund’s performance was hindered by an overweight position in revenue bonds, as investors moved into higher quality general obligation bonds during the COVID-19-related turmoil. In addition, certain lower-rated general obligation bonds in the fund underperformed significantly, including those issued by the state of Illinois and the city of Chicago. Security selection overall was a negative for fund performance results as healthcare, special tax and education bonds lagged. The fund implemented a hedge by shorting long-term Treasury yields, and this also detracted from performance. The hedge was subsequently removed during the spring of 2020.

On the other hand, the fund’s performance was supported by its duration and yield curve positioning. The fund maintained a longer duration, aided by leverage, which benefited returns when interest rates declined. Also, yield curve positioning added to performance, as the fund had an overweight position in shorter bonds, and those outperformed longer bonds. In addition, security selections in the tobacco, housing and water and sewer segments did well, especially Buckeye Ohio Tobacco bonds and Phoenix, Arizona Charter Schools.

An Optimistic Investment Posture

We are relatively optimistic about the municipal bond market in the short-to-medium term. The fiscal condition of states and municipalities is better than projected, and they also have the ability to raise tax rates and implement fees, which should further support their fiscal health. Further out, we believe that widespread distribution of vaccines will lead to further opening of the economy, which will support continued recovery in the market over the long term.

The election results could also support the market. An increase in infrastructure spending could be beneficial, and states and municipalities are likely to receive more financial support under a Biden administration. In addition, if individual and corporate tax rates are raised, the tax-exempt income offered by municipal bonds could become even more attractive. At this time, we anticipate no significant change to the cap on deductibility of state and local taxes implemented in 2018, which should contribute to strong demand. The supply of tax-exempt municipal bonds should remain manageable, as a significant portion of new issuance is likely to be in taxable

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

municipals. We will continue to emphasize revenue bonds possessing strong fundamentals which provide attractive incremental yield to the Fund.

We expect to maintain the level of leverage in the fund and to keep the fund’s duration slightly long versus the benchmark, and we will continue to overweight revenue bonds and look for opportunities to add incremental yield.

December 15, 2020

1 Total return includes reinvestment of dividends and any capital gains paid, based upon net asset value per share or market price per share, as applicable. Past performance is no guarantee of future results. Income may be subject to state and local taxes, and some income may be subject to the federal alternative minimum tax (AMT) for certain investors. Capital gains, if any, are fully taxable. Return figures provided reflect the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an undertaking in effect through May 31, 2021, at which time it may be extended, terminated or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

2 Distribution rate per share is based upon dividends per share paid from net investment income during the period, divided by the market price per share at the end of the period, adjusted for any capital gain distributions.

Bonds are subject generally to interest-rate, credit, liquidity and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

High-yield bonds are subject to increased credit risk and are considered speculative in terms of the issuer’s perceived ability to continue making interest payments on a timely basis and to repay principal upon maturity.

The use of leverage may magnify the fund’s gains or losses. For derivatives with a leveraging component, adverse changes in the value or level of the underlying asset can result in a loss that is much greater than the original investment in the derivative.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

4

SELECTED INFORMATION

November 30, 2020 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Price per share November 30, 2020

|

|

$ 7.66

|

|

|

|

Shares Outstanding November 30, 2020

|

|

49,421,511

|

|

|

|

New York Stock Exchange Ticker Symbol

|

|

DSM

|

|

|

|

MARKET PRICE (NEW YORK STOCK EXCHANGE)

|

|

|

|

|

Fiscal Year Ended November 30, 2020

|

|

|

|

|

Quarter

|

|

Quarter

|

|

Quarter

|

|

Quarter

|

|

|

Ended

|

|

Ended

|

|

Ended

|

|

Ended

|

|

|

February 29, 2020

|

|

May 31, 2020

|

|

August 31, 2020

|

|

November 30, 2020

|

|

High

|

$8.31

|

|

$8.18

|

|

$7.78

|

|

$7.66

|

|

Low

|

7.95

|

|

5.83

|

|

7.17

|

|

7.23

|

|

Close

|

7.95

|

|

7.17

|

|

7.52

|

|

7.66

|

|

PERCENTAGE GAIN (LOSS) based on change in Market Price†

|

|

November 22, 1989 (commencement of operations)

through November 30, 2020

|

483.98%

|

|

December 1, 2010 through November 30, 2020

|

78.56

|

|

December 1, 2015 through November 30, 2020

|

26.89

|

|

December 1, 2019 through November 30, 2020

|

(1.87)

|

|

March 1, 2020 through November 30, 2020

|

(0.03)

|

|

June 1, 2020 through November 30, 2020

|

9.45

|

|

September 1, 2020 through November 30, 2020

|

3.10

|

|

|

|

|

|

|

|

NET ASSET VALUE PER SHARE

|

|

|

November 22, 1989 (commencement of operations)

|

$9.32

|

|

November 30, 2019

|

8.30

|

|

February 29, 2020

|

|

|

8.62

|

|

May 31, 2020

|

7.73

|

|

August 31, 2020

|

8.14

|

|

November 30, 2020

|

8.24

|

|

PERCENTAGE GAIN (LOSS) based on change in Net Asset Value†

|

|

|

November 22, 1989 (commencement of operations)

through November 30, 2020

|

574.03%

|

|

December 1, 2010 through November 30, 2020

|

93.78

|

|

December 1, 2015 through November 30, 2020

|

26.33

|

|

December 1, 2019 through November 30, 2020

|

4.16

|

|

March 1, 2020 through November 30, 2020

|

(0.82)

|

|

June 1, 2020 through November 30, 2020

|

9.21

|

|

September 1, 2020 through November 30, 2020

|

2.46

|

|

† With dividends reinvested.

|

|

5

STATEMENT OF INVESTMENTS

November 30, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity

Date

|

|

Principal

Amount ($)

|

|

Value ($)

|

|

|

Bonds and Notes - .3%

|

|

|

|

|

|

|

Collateralized Municipal-Backed Securities - .3%

|

|

|

|

|

|

|

Arizona Industrial Development Authority, Revenue Bonds, Ser. 2019-2

(cost $1,400,890)

|

|

3.63

|

|

5/20/2033

|

|

1,276,332

|

|

1,350,615

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-Term Municipal Investments - 147.5%

|

|

|

|

|

|

|

Alabama - 5.3%

|

|

|

|

|

|

|

Alabama Special Care Facilities Financing Authority, Revenue Bonds (Methodist Home for the Aging Obligated Group)

|

|

5.50

|

|

6/1/2030

|

|

1,800,000

|

|

1,889,478

|

|

|

Alabama Special Care Facilities Financing Authority, Revenue Bonds (Methodist Home for the Aging Obligated Group)

|

|

5.75

|

|

6/1/2045

|

|

1,250,000

|

|

1,278,913

|

|

|

Alabama Special Care Facilities Financing Authority, Revenue Bonds (Methodist Home for the Aging Obligated Group)

|

|

6.00

|

|

6/1/2050

|

|

1,500,000

|

|

1,548,060

|

|

|

Jefferson County, Revenue Bonds, Refunding, Ser. F

|

|

7.75

|

|

10/1/2046

|

|

6,000,000

|

a

|

6,048,600

|

|

|

The Lower Alabama Gas District, Revenue Bonds, Ser. A

|

|

5.00

|

|

9/1/2046

|

|

5,000,000

|

|

7,432,650

|

|

|

University of Alabama at Birmingham, Revenue Bonds, Ser. B

|

|

4.00

|

|

10/1/2036

|

|

2,745,000

|

|

3,302,400

|

|

|

|

21,500,101

|

|

|

Arizona - 7.1%

|

|

|

|

|

|

|

Arizona Industrial Development Authority, Revenue Bonds (Equitable School Revolving Fund Obligated Group) Ser. A

|

|

4.00

|

|

11/1/2050

|

|

1,500,000

|

|

1,730,280

|

|

|

Arizona Industrial Development Authority, Revenue Bonds (Legacy Cares Project) Ser. A

|

|

7.75

|

|

7/1/2050

|

|

4,305,000

|

b

|

4,353,776

|

|

|

Arizona Industrial Development Authority, Revenue Bonds (Phoenix Children's Hospital Obligated Group)

|

|

4.00

|

|

2/1/2050

|

|

1,500,000

|

|

1,703,070

|

|

|

Arizona Industrial Development Authority, Revenue Bonds, Refunding (BASIS Schools Projects) Ser. A

|

|

5.25

|

|

7/1/2047

|

|

1,500,000

|

b

|

1,655,160

|

|

6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Arizona - 7.1% (continued)

|

|

|

|

|

|

|

Glendale Industrial Development Authority, Revenue Bonds, Refunding (Sun Health Services Obligated Group) Ser. A

|

|

5.00

|

|

11/15/2054

|

|

1,500,000

|

|

1,680,645

|

|

|

Maricopa County Industrial Development Authority, Revenue Bonds, Refunding (Legacy Traditional Schools Project)

|

|

5.00

|

|

7/1/2049

|

|

1,775,000

|

b

|

1,976,392

|

|

|

Salt Verde Financial Corp., Revenue Bonds

|

|

5.00

|

|

12/1/2037

|

|

1,345,000

|

|

1,903,269

|

|

|

Tender Option Bond Trust Receipts (Series 2018-XF2537), (Salt Verde Financial Corporation, Revenue Bonds) Recourse, Underlying Coupon Rate (%) 5.00

|

|

17.37

|

|

12/1/2037

|

|

4,550,000

|

b,c,d

|

6,345,409

|

|

|

The Phoenix Industrial Development Authority, Revenue Bonds (Legacy Traditional Schools Project) Ser. A

|

|

6.75

|

|

7/1/2044

|

|

1,000,000

|

b

|

1,136,580

|

|

|

The Phoenix Industrial Development Authority, Revenue Bonds, Refunding (BASIS Schools Projects) Ser. A

|

|

5.00

|

|

7/1/2046

|

|

3,000,000

|

b

|

3,228,300

|

|

|

The Pima County Industrial Development Authority, Revenue Bonds (American Leadership Academy Project)

|

|

5.00

|

|

6/15/2047

|

|

3,000,000

|

b

|

3,050,040

|

|

|

|

28,762,921

|

|

|

California - 7.4%

|

|

|

|

|

|

|

California, GO

|

|

6.00

|

|

3/1/2033

|

|

545,000

|

|

545,087

|

|

|

Golden State Tobacco Securitization Corp., Revenue Bonds, Refunding, Ser. A1

|

|

5.00

|

|

6/1/2047

|

|

1,000,000

|

|

1,032,110

|

|

|

Jefferson Union High School District, COP (Teacher & Staff Housing Project) (Insured; Build America Mutual)

|

|

4.00

|

|

8/1/2055

|

|

1,500,000

|

|

1,729,545

|

|

|

San Buenaventura, Revenue Bonds (Community Memorial Health System)

|

|

7.50

|

|

12/1/2041

|

|

1,500,000

|

|

1,588,140

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0379), (Los Angeles Department of Water & Power, Revenue Bonds, Refunding) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.97

|

|

7/1/2043

|

|

5,000,000

|

b,c,d

|

5,349,650

|

|

7

STATEMENT OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

California - 7.4% (continued)

|

|

|

|

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0387), (Los Angeles Department of Airports, Revenue Bonds (Los Angeles International Airport)) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.88

|

|

5/15/2038

|

|

6,000,000

|

b,c,d

|

6,514,605

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0390), (The Regents of the University of California, Revenue Bonds, Refunding) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.97

|

|

5/15/2036

|

|

6,260,000

|

b,c,d

|

6,917,738

|

|

|

Tender Option Bond Trust Receipts (Series 2020-XF2876), (San Francisco California City & County Airport Commission, Revenue Bonds, Refunding) Ser. E, Recourse, Underlying Coupon Rate (%) 5.00

|

|

17.52

|

|

5/1/2050

|

|

5,190,000

|

b,c,d

|

6,338,212

|

|

|

|

|

|

|

|

|

|

|

30,015,087

|

|

|

Colorado - 6.5%

|

|

|

|

|

|

|

Belleview Station Metropolitan District No. 2, GO, Refunding

|

|

5.13

|

|

12/1/2046

|

|

2,375,000

|

|

2,433,995

|

|

|

Colorado Educational & Cultural Facilities Authority, Revenue Bonds, Refunding (Johnson & Wales University) Ser. B

|

|

5.00

|

|

4/1/2031

|

|

2,685,000

|

|

2,895,611

|

|

|

Colorado Health Facilities Authority, Revenue Bonds, Refunding (Covenant Living Communities & Services Obligated Group) Ser. A

|

|

4.00

|

|

12/1/2050

|

|

4,000,000

|

|

4,415,400

|

|

|

Denver City & County Airport System, Revenue Bonds, Refunding, Ser. A

|

|

5.00

|

|

12/1/2048

|

|

2,300,000

|

|

2,755,216

|

|

|

Dominion Water & Sanitation District, Revenue Bonds

|

|

6.00

|

|

12/1/2046

|

|

3,145,000

|

|

3,284,386

|

|

|

Sterling Ranch Community Authority Board, Revenue Bonds (Insured; Municipal Government Guaranteed) Ser. A

|

|

5.00

|

|

12/1/2047

|

|

1,250,000

|

|

1,289,225

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0385), (Board of Governors of the Colorado State University, Revenue Bonds) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.91

|

|

3/1/2038

|

|

4,960,000

|

b,c,d

|

5,246,924

|

|

8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Colorado - 6.5% (continued)

|

|

|

|

|

|

|

Tender Option Bond Trust Receipts (Series 2020-XM0829), (Colorado Health Facilities Authority, Revenue Bonds, Refunding (CommonSpirit Health Obligated Group)) Ser. A1, Recourse, Underlying Coupon Rate (%) 4.00

|

|

16.92

|

|

8/1/2044

|

|

3,260,000

|

b,c,d

|

4,329,630

|

|

|

|

|

|

|

|

|

|

|

26,650,387

|

|

|

Connecticut - .9%

|

|

|

|

|

|

|

Connecticut, Special Tax Bonds, Ser. A

|

|

5.00

|

|

5/1/2038

|

|

1,000,000

|

|

1,306,020

|

|

|

Connecticut Housing Finance Authority, Revenue Bonds, Refunding, Ser. A1

|

|

3.65

|

|

11/15/2032

|

|

2,000,000

|

|

2,198,720

|

|

|

|

3,504,740

|

|

|

District of Columbia - 4.2%

|

|

|

|

|

|

|

Metropolitan Washington Airports Authority, Revenue Bonds, Refunding, Ser. B

|

|

4.00

|

|

10/1/2049

|

|

1,000,000

|

|

1,117,070

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0437), (District of Columbia, Revenue Bonds) Recourse, Underlying Coupon Rate (%) 5.00

|

|

17.89

|

|

12/1/2035

|

|

14,834,680

|

b,c,d

|

16,065,955

|

|

|

|

|

|

|

|

|

|

|

17,183,025

|

|

|

Florida - 8.8%

|

|

|

|

|

|

|

Alachua County Health Facilities Authority, Revenue Bonds (Shands Teaching Hospital & Clinics Obligated Group)

|

|

4.00

|

|

12/1/2049

|

|

1,600,000

|

|

1,790,112

|

|

|

Atlantic Beach, Revenue Bonds (Fleet Landing Project) Ser. A

|

|

5.00

|

|

11/15/2048

|

|

2,500,000

|

|

2,703,600

|

|

|

Florida Higher Educational Facilities Financial Authority, Revenue Bonds (Ringling College Project)

|

|

5.00

|

|

3/1/2049

|

|

2,000,000

|

|

2,179,820

|

|

|

Greater Orlando Aviation Authority, Revenue Bonds, Ser. A

|

|

4.00

|

|

10/1/2044

|

|

1,500,000

|

|

1,717,395

|

|

|

Lee County Industrial Development Authority, Revenue Bonds (Shell Point/Waterside Health Project)

|

|

5.00

|

|

11/15/2049

|

|

1,540,000

|

|

1,680,587

|

|

|

Mid-Bay Bridge Authority, Revenue Bonds, Ser. A

|

|

7.25

|

|

10/1/2021

|

|

1,800,000

|

e

|

1,904,472

|

|

|

Palm Beach County Health Facilities Authority, Revenue Bonds (ACTS Retirement-Life Communities Obligated Group)

|

|

5.00

|

|

11/15/2045

|

|

5,775,000

|

|

6,570,506

|

|

9

STATEMENT OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Florida - 8.8% (continued)

|

|

|

|

|

|

|

Palm Beach County Health Facilities Authority, Revenue Bonds (Lifespace Communities Obligated Group) Ser. B

|

|

4.00

|

|

5/15/2053

|

|

2,000,000

|

|

2,010,440

|

|

|

Seminole County Industrial Development Authority, Revenue Bonds, Refunding (Legacy Pointe at UCF Project)

|

|

5.75

|

|

11/15/2054

|

|

1,000,000

|

|

940,680

|

|

|

Tender Option Bond Trust Receipts (Series 2019-XF0813), (Fort Myers Florida Utility, Revenue Bonds) Non-recourse, Underlying Coupon Rate (%) 4.00

|

|

14.11

|

|

10/1/2049

|

|

2,980,000

|

b,c,d

|

3,463,907

|

|

|

Tender Option Bond Trust Receipts (Series 2019-XM0782), (Palm Beach County Florida Health Facilities Authority, Revenue Bonds, Refunding (Baptist Health South Florida Obligated Group)) Recourse, Underlying Coupon Rate (%) 4.00

|

|

13.98

|

|

8/15/2049

|

|

5,535,000

|

b,c,d

|

6,280,019

|

|

|

Tender Option Bond Trust Receipts (Series 2020-XF2877), (Greater Orlando Aviation Authority, Revenue Bonds) Ser. A, Recourse, Underlying Coupon Rate (%) 4.00

|

|

13.91

|

|

10/1/2049

|

|

4,065,000

|

b,c,d

|

4,602,605

|

|

|

|

|

|

|

|

|

|

|

35,844,143

|

|

|

Georgia - 5.4%

|

|

|

|

|

|

|

Atlanta Water & Wastewater, Revenue Bonds, Ser. D

|

|

3.50

|

|

11/1/2028

|

|

800,000

|

b

|

871,952

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0435), (Private Colleges & Universities Authority, Revenue Bonds, Refunding (Emory University)) Recourse, Underlying Coupon Rate (%) 5.00

|

|

17.89

|

|

10/1/2043

|

|

6,000,000

|

b,c,d

|

6,600,960

|

|

|

Tender Option Bond Trust Receipts (Series 2019-XF2847), (Municipal Electric Authority of Georgia, Revenue Bonds (Plant Vogtle Unis 3&4 Project)) Ser. A, Recourse, Underlying Coupon Rate (%) 5.00

|

|

17.71

|

|

1/1/2056

|

|

2,720,000

|

b,c,d

|

3,243,131

|

|

|

Tender Option Bond Trust Receipts (Series 2020-XM0825), (Brookhaven Development Authority, Revenue Bonds (Children's Healthcare of Atlanta)) Ser. A, Recourse, Underlying Coupon Rate (%) 4.00

|

|

15.38

|

|

7/1/2044

|

|

4,220,000

|

b,c,d

|

5,265,199

|

|

10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Georgia - 5.4% (continued)

|

|

|

|

|

|

|

The Atlanta Development Authority, Revenue Bonds, Ser. A1

|

|

5.25

|

|

7/1/2040

|

|

1,000,000

|

|

1,106,490

|

|

|

The Burke County Development Authority, Revenue Bonds, Refunding (Oglethorpe Power Corp.) Ser. D

|

|

4.13

|

|

11/1/2045

|

|

4,200,000

|

|

4,718,028

|

|

|

|

21,805,760

|

|

|

Hawaii - .7%

|

|

|

|

|

|

|

Hawaii Department of Budget & Finance, Revenue Bonds, Refunding (Hawaiian Electric Co.)

|

|

4.00

|

|

3/1/2037

|

|

2,500,000

|

|

2,684,200

|

|

|

Illinois - 14.5%

|

|

|

|

|

|

|

Chicago Board of Education, GO, Refunding, Ser. A

|

|

5.00

|

|

12/1/2033

|

|

1,250,000

|

|

1,358,063

|

|

|

Chicago Board of Education, GO, Refunding, Ser. B

|

|

5.00

|

|

12/1/2031

|

|

500,000

|

|

552,160

|

|

|

Chicago Board of Education, GO, Refunding, Ser. B

|

|

5.00

|

|

12/1/2032

|

|

400,000

|

|

438,820

|

|

|

Chicago II, GO, Refunding, Ser. A

|

|

6.00

|

|

1/1/2038

|

|

3,000,000

|

|

3,388,200

|

|

|

Chicago II, GO, Refunding, Ser. C

|

|

5.00

|

|

1/1/2024

|

|

1,265,000

|

|

1,341,064

|

|

|

Chicago II, GO, Ser. A

|

|

5.00

|

|

1/1/2044

|

|

3,000,000

|

|

3,195,150

|

|

|

Chicago II Wastewater Transmission, Revenue Bonds, Refunding, Ser. C

|

|

5.00

|

|

1/1/2039

|

|

2,330,000

|

|

2,658,344

|

|

|

Chicago O'Hare International Airport, Revenue Bonds

|

|

5.63

|

|

1/1/2035

|

|

580,000

|

|

582,558

|

|

|

Chicago O'Hare International Airport, Revenue Bonds, Refunding, Ser. A

|

|

5.00

|

|

1/1/2048

|

|

4,000,000

|

|

4,787,760

|

|

|

Chicago Transit Authority, Revenue Bonds, Refunding, Ser. A

|

|

5.00

|

|

12/1/2045

|

|

1,000,000

|

|

1,206,280

|

|

|

Illinois, GO, Refunding, Ser. A

|

|

5.00

|

|

10/1/2029

|

|

1,000,000

|

|

1,112,000

|

|

|

Illinois, GO, Refunding, Ser. A

|

|

5.00

|

|

10/1/2028

|

|

2,000,000

|

|

2,242,400

|

|

|

Illinois, GO, Ser. A

|

|

5.00

|

|

5/1/2038

|

|

2,850,000

|

|

3,066,315

|

|

|

Illinois, GO, Ser. B

|

|

5.00

|

|

11/1/2030

|

|

1,500,000

|

|

1,676,175

|

|

|

Illinois, GO, Ser. D

|

|

5.00

|

|

11/1/2028

|

|

3,000,000

|

|

3,287,400

|

|

|

Illinois Finance Authority, Revenue Bonds, Refunding (Plymouth Place Obligated Group)

|

|

5.25

|

|

5/15/2045

|

|

1,000,000

|

|

1,034,420

|

|

|

Metropolitan Pier & Exposition Authority, Revenue Bonds (McCormick Place Expansion Project)

|

|

5.00

|

|

6/15/2057

|

|

2,500,000

|

|

2,737,075

|

|

11

STATEMENT OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Illinois - 14.5% (continued)

|

|

|

|

|

|

|

Metropolitan Pier & Exposition Authority, Revenue Bonds (McCormick Place Project) (Insured; National Public Finance Guarantee Corp.) Ser. A

|

|

0.00

|

|

12/15/2036

|

|

2,500,000

|

f

|

1,462,450

|

|

|

Metropolitan Pier & Exposition Authority, Revenue Bonds, Refunding (McCormick Place Project) Ser. B

|

|

5.00

|

|

12/15/2028

|

|

2,500,000

|

|

2,603,975

|

|

|

Metropolitan Pier & Exposition Authority, Revenue Bonds, Refunding (McCormick Place Project) Ser. B

|

|

5.00

|

|

6/15/2052

|

|

3,550,000

|

|

3,637,401

|

|

|

Railsplitter Tobacco Settlement Authority, Revenue Bonds

|

|

6.00

|

|

6/1/2021

|

|

3,600,000

|

e

|

3,704,256

|

|

|

Sales Tax Securitization Corp., Revenue Bonds, Refunding, Ser. A

|

|

4.00

|

|

1/1/2039

|

|

2,250,000

|

|

2,483,212

|

|

|

Tender Option Bond Trust Receipts (Series 2017-XM0492), (Illinois Finance Authority, Revenue Bonds, Refunding (The University of Chicago)) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.91

|

|

10/1/2040

|

|

9,000,000

|

b,c,d

|

10,475,392

|

|

|

|

59,030,870

|

|

|

Indiana - 2.1%

|

|

|

|

|

|

|

Indiana Finance Authority, Revenue Bonds (Green Bond) (RES Polyflow Indiana)

|

|

7.00

|

|

3/1/2039

|

|

4,575,000

|

b

|

4,414,783

|

|

|

Indiana Finance Authority, Revenue Bonds (Parkview Health System Obligated Group) Ser. A

|

|

5.00

|

|

11/1/2043

|

|

3,500,000

|

|

4,319,385

|

|

|

|

8,734,168

|

|

|

Iowa - 1.4%

|

|

|

|

|

|

|

Iowa Finance Authority, Revenue Bonds, Refunding (Iowa Fertilizer Co. Project)

|

|

5.25

|

|

12/1/2025

|

|

5,125,000

|

|

5,573,027

|

|

|

Kentucky - 1.5%

|

|

|

|

|

|

|

Christian County, Revenue Bonds, Refunding (Jennie Stuart Medical Center Obligated Group)

|

|

5.50

|

|

2/1/2044

|

|

2,800,000

|

|

3,126,760

|

|

|

Kentucky Public Energy Authority, Revenue Bonds, Ser. A1

|

|

4.00

|

|

6/1/2025

|

|

2,560,000

|

|

2,916,966

|

|

|

|

6,043,726

|

|

12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Louisiana - 3.0%

|

|

|

|

|

|

|

Louisiana Local Government Environmental Facilities & Community Development Authority, Revenue Bonds, Refunding (Westlake Chemical Project)

|

|

3.50

|

|

11/1/2032

|

|

2,400,000

|

|

2,629,728

|

|

|

Tender Option Bond Trust Receipts (Series 2018-XF2584), (Louisiana Public Facilities Authority, Revenue Bonds (Franciscan Missionaries of Our Lady Health System Project)) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.51

|

|

7/1/2047

|

|

8,195,000

|

b,c,d

|

9,576,331

|

|

|

|

|

|

|

|

|

|

|

12,206,059

|

|

|

Maine - .5%

|

|

|

|

|

|

|

Maine Health & Higher Educational Facilities Authority, Revenue Bonds (Maine General Medical Center Obligated Group)

|

|

7.50

|

|

7/1/2032

|

|

2,000,000

|

|

2,053,280

|

|

|

Maryland - 2.0%

|

|

|

|

|

|

|

Maryland Health & Higher Educational Facilities Authority, Revenue Bonds (Adventist Healthcare Obligated Group) Ser. A

|

|

5.50

|

|

1/1/2046

|

|

3,250,000

|

|

3,703,407

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0391), (Mayor & City Council of Baltimore, Revenue Bonds, Refunding (Water Projects)) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.91

|

|

7/1/2042

|

|

4,000,000

|

b,c,d

|

4,570,680

|

|

|

|

8,274,087

|

|

|

Massachusetts - 8.7%

|

|

|

|

|

|

|

Massachusetts Development Finance Agency, Revenue Bonds, Refunding (UMass Memorial Health Care Obligated Group) Ser. K

|

|

5.00

|

|

7/1/2038

|

|

2,130,000

|

|

2,494,422

|

|

|

Massachusetts Development Finance Agency, Revenue Bonds, Refunding, Ser. A

|

|

5.00

|

|

7/1/2029

|

|

1,000,000

|

|

1,244,070

|

|

|

Massachusetts Development Finance Agency, Revenue Bonds, Refunding, Ser. I

|

|

7.25

|

|

1/1/2021

|

|

505,000

|

e

|

507,873

|

|

13

STATEMENT OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Massachusetts - 8.7% (continued)

|

|

|

|

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0368), (Massachusetts Development Finance Agency, Revenue Bonds, Refunding (Harvard University)) Non-recourse, Underlying Coupon Rate (%) 5.25

|

|

18.93

|

|

2/1/2021

|

|

10,000,000

|

b,c,d

|

10,081,950

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0372), (Massachusetts, GO) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.91

|

|

4/1/2027

|

|

6,400,000

|

b,c,d

|

6,500,176

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0386), (University of Massachusetts Building Authority, Revenue Bonds, Refunding) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.89

|

|

5/1/2043

|

|

7,409,991

|

b,c,d

|

8,224,280

|

|

|

Tender Option Bond Trust Receipts (Series 2018-XF0610), (Massachusetts Transportation Fund, Revenue Bonds (Rail Enhancement & Accelerated Bridge Programs)) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

18.21

|

|

6/1/2047

|

|

5,250,000

|

b,c,d

|

6,396,009

|

|

|

|

|

|

|

|

|

|

|

35,448,780

|

|

|

Michigan - 6.4%

|

|

|

|

|

|

|

Detroit Water Supply System, Revenue Bonds, Ser. A

|

|

5.00

|

|

7/1/2021

|

|

3,290,000

|

e

|

3,382,745

|

|

|

Detroit Water Supply System, Revenue Bonds, Ser. A

|

|

5.00

|

|

7/1/2021

|

|

2,280,000

|

e

|

2,344,273

|

|

|

Great Lakes Water Authority Sewage Disposal System, Revenue Bonds, Refunding, Ser. C

|

|

5.00

|

|

7/1/2036

|

|

2,000,000

|

|

2,403,400

|

|

|

Michigan Building Authority, Revenue Bonds, Refunding

|

|

4.00

|

|

4/15/2054

|

|

2,500,000

|

|

2,869,950

|

|

|

Michigan Finance Authority, Revenue Bonds, Refunding (Insured; National Public Finance Guarantee Corp.) Ser. D6

|

|

5.00

|

|

7/1/2036

|

|

1,000,000

|

|

1,135,120

|

|

|

Michigan Strategic Fund, Revenue Bonds (AMT-I-75 Improvement Project)

|

|

5.00

|

|

6/30/2048

|

|

5,000,000

|

|

5,880,650

|

|

|

Pontiac School District, GO

|

|

4.00

|

|

5/1/2050

|

|

3,000,000

|

|

3,453,150

|

|

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Michigan - 6.4% (continued)

|

|

|

|

|

|

|

Tender Option Bond Trust Receipts (Series 2019-XF2837), (Michigan State Finance Authority, Revenue Bonds (Henry Ford Health System)) Recourse, Underlying Coupon Rate (%) 4.00

|

|

13.83

|

|

11/15/2050

|

|

3,900,000

|

b,c,d

|

4,456,745

|

|

|

|

|

|

|

|

|

|

|

25,926,033

|

|

|

Minnesota - 1.1%

|

|

|

|

|

|

|

Duluth Economic Development Authority, Revenue Bonds, Refunding (Essentia Health Obligated Group) Ser. A

|

|

5.00

|

|

2/15/2058

|

|

4,000,000

|

|

4,668,520

|

|

|

Missouri - 2.3%

|

|

|

|

|

|

|

Missouri Health & Educational Facilities Authority, Revenue Bonds (Lutheran Senior Services Projects) Ser. A

|

|

5.00

|

|

2/1/2042

|

|

1,000,000

|

|

1,105,030

|

|

|

Missouri Health & Educational Facilities Authority, Revenue Bonds (Lutheran Senior Services Projects) Ser. B

|

|

2.88

|

|

2/1/2022

|

|

1,365,000

|

|

1,365,027

|

|

|

Missouri Health & Educational Facilities Authority, Revenue Bonds, Refunding (Lutheran Senior Services Projects)

|

|

5.00

|

|

2/1/2046

|

|

1,200,000

|

|

1,318,188

|

|

|

St. Louis Land Clearance for Redevelopment Authority, Revenue Bonds

|

|

5.13

|

|

6/1/2046

|

|

4,845,000

|

|

5,451,642

|

|

|

|

9,239,887

|

|

|

Multi-State - .7%

|

|

|

|

|

|

|

Federal Home Loan Mortgage Corp. Multifamily Variable Rate Certificates, Revenue Bonds, Ser. M048

|

|

3.15

|

|

1/15/2036

|

|

2,450,000

|

b

|

2,803,878

|

|

|

Nevada - 1.6%

|

|

|

|

|

|

|

Clark County School District, GO (Insured; Assured Guaranty Municipal Corp.) Ser. A

|

|

4.00

|

|

6/15/2039

|

|

950,000

|

|

1,125,399

|

|

|

Reno, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.)

|

|

4.00

|

|

6/1/2058

|

|

5,000,000

|

|

5,359,100

|

|

|

|

6,484,499

|

|

|

New Jersey - 4.4%

|

|

|

|

|

|

|

New Jersey, GO, Ser. A

|

|

4.00

|

|

6/1/2031

|

|

1,000,000

|

|

1,220,240

|

|

|

New Jersey Housing & Mortgage Finance Agency, Revenue Bonds, Refunding, Ser. D

|

|

4.00

|

|

10/1/2024

|

|

2,370,000

|

|

2,624,325

|

|

15

STATEMENT OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

New Jersey - 4.4% (continued)

|

|

|

|

|

|

|

New Jersey Transportation Trust Fund Authority, Revenue Bonds

|

|

5.00

|

|

6/15/2046

|

|

1,365,000

|

|

1,571,879

|

|

|

New Jersey Transportation Trust Fund Authority, Revenue Bonds

|

|

5.25

|

|

6/15/2043

|

|

1,500,000

|

|

1,778,940

|

|

|

South Jersey Port Corp., Revenue Bonds, Ser. B

|

|

5.00

|

|

1/1/2042

|

|

2,025,000

|

|

2,268,445

|

|

|

Tender Option Bond Trust Receipts (Series 2018-XF2538), (New Jersey Economic Development Authority, Revenue Bonds) Recourse, Underlying Coupon Rate (%) 5.25

|

|

18.38

|

|

6/15/2040

|

|

4,250,000

|

b,c,d

|

4,758,761

|

|

|

Tobacco Settlement Financing Corp., Revenue Bonds, Refunding, Ser. A

|

|

5.25

|

|

6/1/2046

|

|

1,500,000

|

|

1,810,320

|

|

|

Tobacco Settlement Financing Corp., Revenue Bonds, Refunding, Ser. B

|

|

5.00

|

|

6/1/2046

|

|

1,670,000

|

|

1,924,224

|

|

|

|

|

|

|

|

|

|

|

17,957,134

|

|

|

New York - 11.0%

|

|

|

|

|

|

|

Monroe County Industrial Development Corp., Revenue Bonds, Refunding (University of Rochester Project) Ser. A

|

|

4.00

|

|

7/1/2050

|

|

1,500,000

|

|

1,748,070

|

|

|

New York City, GO, Ser. D1

|

|

4.00

|

|

3/1/2050

|

|

2,500,000

|

|

2,892,625

|

|

|

New York City Educational Construction Fund, Revenue Bonds, Ser. A

|

|

6.50

|

|

4/1/2028

|

|

2,785,000

|

|

2,841,229

|

|

|

New York Convention Center Development Corp., Revenue Bonds (Insured; Assured Guaranty Municipal Corp.) Ser. B

|

|

0.00

|

|

11/15/2049

|

|

5,600,000

|

f

|

2,179,968

|

|

|

New York Liberty Development Corp., Revenue Bonds, Refunding (Class 1-3 World Trade Center Project)

|

|

5.00

|

|

11/15/2044

|

|

3,400,000

|

b

|

3,524,372

|

|

|

New York State Dormitory Authority, Revenue Bonds, Refunding (Montefiore Obligated Group) Ser. A

|

|

4.00

|

|

9/1/2045

|

|

1,000,000

|

|

1,101,790

|

|

|

New York Transportation Development Corp., Revenue Bonds (LaGuardia Airport Terminal B Redevelopment Project) Ser. A

|

|

5.25

|

|

1/1/2050

|

|

3,000,000

|

|

3,295,140

|

|

|

New York Transportation Development Corp., Revenue Bonds, Refunding (JFK International Air Terminal) Ser. A

|

|

5.00

|

|

12/1/2035

|

|

1,100,000

|

|

1,355,805

|

|

16

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

New York - 11.0% (continued)

|

|

|

|

|

|

|

Niagara Area Development Corp., Revenue Bonds, Refunding (Covanta Holding Project) Ser. A

|

|

4.75

|

|

11/1/2042

|

|

1,000,000

|

b

|

1,027,820

|

|

|

Port Authority of New York & New Jersey, Revenue Bonds (JFK International Air Terminal Project)

|

|

6.00

|

|

12/1/2036

|

|

4,710,000

|

|

4,740,615

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0436), (New York City Municipal Water Finance Authority, Revenue Bonds, Refunding) Recourse, Underlying Coupon Rate (%) 5.00

|

|

17.89

|

|

6/15/2044

|

|

12,600,000

|

b,c,d

|

13,173,111

|

|

|

Tender Option Bond Trust Receipts (Series 2020-XM0826), (Metropolitan Transportation Authority, Revenue Bonds, Refunding (Green Bond) (Insured; Assured Guaranty Municipal Corp.)) Ser. C, Non-recourse, Underlying Coupon Rate (%) 4.00

|

|

13.87

|

|

11/15/2046

|

|

6,100,000

|

b,c,d

|

6,835,563

|

|

|

|

|

|

|

|

|

|

|

44,716,108

|

|

|

North Carolina - .4%

|

|

|

|

|

|

|

North Carolina Turnpike Authority, Revenue Bonds (Insured; Assured Guaranty Municipal Corp.)

|

|

4.00

|

|

1/1/2055

|

|

1,500,000

|

|

1,713,855

|

|

|

Ohio - 4.0%

|

|

|

|

|

|

|

Buckeye Tobacco Settlement Financing Authority, Revenue Bonds, Refunding, Ser. A2

|

|

4.00

|

|

6/1/2048

|

|

1,250,000

|

|

1,413,288

|

|

|

Buckeye Tobacco Settlement Financing Authority, Revenue Bonds, Refunding, Ser. B2

|

|

5.00

|

|

6/1/2055

|

|

10,750,000

|

|

12,089,665

|

|

|

Centerville, Revenue Bonds, Refunding (Graceworks Lutheran Services Obligated Group)

|

|

5.25

|

|

11/1/2047

|

|

1,500,000

|

|

1,552,635

|

|

|

Cuyahoga County, Revenue Bonds, Refunding (The MetroHealth System)

|

|

5.00

|

|

2/15/2052

|

|

1,000,000

|

|

1,130,750

|

|

|

|

|

|

|

|

|

|

|

16,186,338

|

|

|

Oregon - .3%

|

|

|

|

|

|

|

Medford Hospital Facilities Authority, Revenue Bonds, Refunding (Asante Project) Ser. A

|

|

4.00

|

|

8/15/2039

|

|

1,000,000

|

|

1,176,480

|

|

|

Pennsylvania - 4.0%

|

|

|

|

|

|

|

Allentown School District, GO, Refunding (Insured; Build America Mutual) Ser. B

|

|

5.00

|

|

2/1/2031

|

|

1,510,000

|

|

1,948,112

|

|

17

STATEMENT OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Pennsylvania - 4.0% (continued)

|

|

|

|

|

|

|

Crawford County Hospital Authority, Revenue Bonds, Refunding (Meadville Medical Center Project) Ser. A

|

|

6.00

|

|

6/1/2046

|

|

1,000,000

|

|

1,094,230

|

|

|

Franklin County Industrial Development Authority, Revenue Bonds (Menno-Haven Project)

|

|

5.00

|

|

12/1/2054

|

|

1,000,000

|

|

1,044,880

|

|

|

Pennsylvania Higher Educational Facilities Authority, Revenue Bonds, Refunding (University of Sciences)

|

|

5.00

|

|

11/1/2033

|

|

2,805,000

|

|

3,002,500

|

|

|

Pennsylvania Housing Finance Agency, Revenue Bonds, Refunding, Ser. 114A

|

|

3.35

|

|

10/1/2026

|

|

2,000,000

|

|

2,037,820

|

|

|

Philadelphia Water & Wastewater, Revenue Bonds, Ser. A

|

|

5.00

|

|

11/1/2050

|

|

1,500,000

|

|

1,917,975

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0373), (Geisinger Authority, Revenue Bonds (Geisinger Health System)) Non-recourse, Underlying Coupon Rate (%) 5.13

|

|

18.24

|

|

6/1/2041

|

|

3,000,000

|

b,c,d

|

3,051,855

|

|

|

The Philadelphia School District, GO (Insured; State Aid Withholding) Ser. A

|

|

4.00

|

|

9/1/2039

|

|

2,000,000

|

|

2,298,420

|

|

|

|

|

|

|

|

|

|

|

16,395,792

|

|

|

Rhode Island - .1%

|

|

|

|

|

|

|

Providence Public Building Authority, Revenue Bonds (Insured; Assured Guaranty Municipal Corp.) Ser. A

|

|

5.00

|

|

9/15/2037

|

|

500,000

|

|

625,825

|

|

|

South Carolina - 3.1%

|

|

|

|

|

|

|

South Carolina Jobs-Economic Development Authority, Revenue Bonds (Bishop Gadsden Episcopal Retirement Community Obligated Group)

|

|

5.00

|

|

4/1/2054

|

|

1,000,000

|

|

1,095,190

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0384), (South Carolina Public Service Authority, Revenue Bonds, Refunding (Santee Cooper)) Non-recourse, Underlying Coupon Rate (%) 5.13

|

|

13.57

|

|

12/1/2043

|

|

10,200,000

|

b,c,d

|

11,348,724

|

|

|

|

|

|

|

|

|

|

|

12,443,914

|

|

18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Tennessee - .8%

|

|

|

|

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0388), (Metropolitan Government of Nashville & Davidson County, Revenue Bonds, Refunding) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.67

|

|

7/1/2040

|

|

3,000,000

|

b,c,d

|

3,294,180

|

|

|

Texas - 11.4%

|

|

|

|

|

|

|

Central Texas Regional Mobility Authority, Revenue Bonds

|

|

5.00

|

|

1/1/2048

|

|

2,500,000

|

|

3,004,975

|

|

|

Central Texas Regional Mobility Authority, Revenue Bonds, Ser. A

|

|

5.00

|

|

1/1/2045

|

|

1,500,000

|

|

1,711,170

|

|

|

Clifton Higher Education Finance Corp., Revenue Bonds (Uplift Education) Ser. A

|

|

4.50

|

|

12/1/2044

|

|

2,500,000

|

|

2,615,050

|

|

|

Clifton Higher Education Finance Corp., Revenue Bonds, Ser. A

|

|

5.75

|

|

8/15/2045

|

|

2,500,000

|

|

2,841,625

|

|

|

Clifton Higher Education Finance Corp., Revenue Bonds, Ser. D

|

|

6.13

|

|

8/15/2048

|

|

3,000,000

|

|

3,455,100

|

|

|

Grand Parkway Transportation Corp., Revenue Bonds, Refunding

|

|

4.00

|

|

10/1/2049

|

|

2,000,000

|

|

2,349,460

|

|

|

Harris County-Houston Sports Authority, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. A

|

|

0.00

|

|

11/15/2051

|

|

7,500,000

|

f

|

1,971,450

|

|

|

Love Field Airport Modernization Corp., Revenue Bonds (Southwest Airlines Co. Project)

|

|

5.00

|

|

11/1/2028

|

|

1,000,000

|

|

1,073,850

|

|

|

Tarrant County Cultural Education Facilities Finance Corp., Revenue Bonds (Buckingham Senior Living Community Project)

|

|

5.50

|

|

11/15/2045

|

|

3,000,000

|

g

|

1,950,000

|

|

|

Tarrant County Cultural Education Facilities Finance Corp., Revenue Bonds, Refunding (MRC Stevenson Oaks Project)

|

|

6.75

|

|

11/15/2051

|

|

1,000,000

|

|

1,060,940

|

|

|

Tender Option Bond Trust Receipts (Series 2016-XM0377), (San Antonio, Revenue Bonds) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

17.91

|

|

2/1/2043

|

|

12,450,000

|

b,c,d

|

13,681,484

|

|

|

Texas Private Activity Bond Surface Transportation Corp., Revenue Bonds (Segment 3C Project)

|

|

5.00

|

|

6/30/2058

|

|

6,150,000

|

|

7,278,156

|

|

|

Texas Private Activity Bond Surface Transportation Corp., Revenue Bonds, Refunding (LBJ Infrastructure Group)

|

|

4.00

|

|

6/30/2040

|

|

1,350,000

|

|

1,554,269

|

|

19

STATEMENT OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Texas - 11.4% (continued)

|

|

|

|

|

|

|

Texas Private Activity Bond Surface Transportation Corp., Revenue Bonds, Refunding (LBJ Infrastructure Group)

|

|

4.00

|

|

6/30/2039

|

|

1,500,000

|

|

1,732,995

|

|

|

|

46,280,524

|

|

|

U.S. Related - 1.2%

|

|

|

|

|

|

|

Puerto Rico, GO, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. A

|

|

5.00

|

|

7/1/2035

|

|

2,500,000

|

|

2,623,500

|

|

|

Puerto Rico Highway & Transportation Authority, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. CC

|

|

5.25

|

|

7/1/2034

|

|

2,000,000

|

|

2,366,020

|

|

|

|

4,989,520

|

|

|

Utah - .5%

|

|

|

|

|

|

|

Utah Infrastructure Agency, Revenue Bonds, Refunding, Ser. A

|

|

5.00

|

|

10/15/2037

|

|

2,000,000

|

|

2,241,020

|

|

|

Virginia - 5.6%

|

|

|

|

|

|

|

Chesterfield County Economic Development Authority, Revenue Bonds, Refunding (Brandermill Woods Project)

|

|

5.13

|

|

1/1/2043

|

|

700,000

|

|

703,878

|

|

|

Henrico County Economic Development Authority, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.)

|

|

11.33

|

|

8/23/2027

|

|

4,700,000

|

c

|

6,573,702

|

|

|

Tender Option Bond Trust Receipts (Series 2018-XM0593), (Hampton Roads Transportation Accountability Commission, Revenue Bonds) Non-recourse, Underlying Coupon Rate (%) 5.50

|

|

20.26

|

|

7/1/2057

|

|

7,500,000

|

b,c,d

|

9,403,294

|

|

|

Virginia College Building Authority, Revenue Bonds (Green Bond) (Marymount University Project)

|

|

5.00

|

|

7/1/2045

|

|

1,000,000

|

b

|

1,005,650

|

|

|

Virginia Small Business Financing Authority, Revenue Bonds (Transform 66 P3 Project)

|

|

5.00

|

|

12/31/2052

|

|

4,350,000

|

|

4,968,918

|

|

|

|

|

|

|

|

|

|

|

22,655,442

|

|

|

Washington - 6.4%

|

|

|

|

|

|

|

King County School District No. 210, GO (Insured; School Bond Guaranty)

|

|

4.00

|

|

12/1/2034

|

|

2,000,000

|

|

2,382,600

|

|

|

Port of Seattle, Revenue Bonds

|

|

4.00

|

|

4/1/2044

|

|

1,000,000

|

|

1,100,570

|

|

20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

Coupon

Rate (%)

|

|

Maturity Date

|

|

Principal Amount ($)

|

|

Value ($)

|

|

|

Long-Term Municipal Investments - 147.5% (continued)

|

|

|

|

|

|

|

Washington - 6.4% (continued)

|

|

|

|

|

|

|

Tender Option Bond Trust Receipts (Series 2017-XF2423), (King County, Revenue Bonds, Refunding) Recourse, Underlying Coupon Rate (%) 5.00

|

|

18.03

|

|

1/1/2029

|

|

8,575,000

|

b,c,d

|

8,608,634

|

|

|

Tender Option Bond Trust Receipts (Series 2018-XM0680), (Washington Convention Center Public Facilities District, Revenue Bonds) Non-recourse, Underlying Coupon Rate (%) 5.00

|

|

9.02

|

|

7/1/2058

|

|

10,000,000

|

b,c,d

|

11,311,600

|

|

|

Washington Higher Education Facilities Authority, Revenue Bonds (Seattle University Project)

|

|

4.00

|

|

5/1/2050

|

|

1,200,000

|

|

1,315,980

|

|

|