Certificate of Accounting of Securities and Similar Investments in the Custody of Management Investment Companies Filed Pursuant to Rule 17f-2 (40-17f2)

March 23 2022 - 4:01PM

Edgar (US Regulatory)

Report of Independent Registered Public

Accounting Firm

The Board of Directors of

BNY Mellon High Yield Strategies Fund:

We have examined management's assertion, included in the

accompanying Management Statement Regarding

Compliance With Certain Provisions of the Investment

Company Act of 1940, that BNY Mellon High Yield

Strategies Fund (the "Fund"), the sole series of BNY

Mellon High Yield Strategies Fund, complied with the

requirements of subsections (b) and (c) of Rule 17f-2 under

the Investment Company Act of 1940 (the Act) as of

September 30, 2021. Management is responsible for its

assertion about the Fund's compliance with those

requirements of subsections (b) and (c) of Rule 17f-2 of the

Act (the specified requirements). Our responsibility is to

express an opinion on management's assertion about the

Fund's compliance based on our examination.

Our examination was conducted in accordance with

attestation standards established by the American Institute

of Certified Public Accountants. Those standards require

that we plan and perform the examination to obtain

reasonable assurance about whether management's

assertion about compliance with the specified requirements

is fairly stated, in all material respects. An examination

involves performing procedures to obtain evidence about

whether management's assertion is fairly stated in all

material respects. The nature, timing, and extent of the

procedures selected depend on our judgement, including an

assessment of the risks of material misstatement of

management's assertion, whether due to fraud or error. We

believe that the evidence we obtained is sufficient and

appropriate to provide a reasonable basis for our opinion.

Included among our procedures were the following tests

performed as of September 30, 2021, and with respect to

agreement of security purchases and sales, for the period

from June 30, 2021 (the date of the Fund's last

examination) through September 30, 2021:

1. Count and inspection of all securities located in the vault of

The Bank of New York Mellon Corporation in 570

Washington Blvd, Jersey City, NJ 07310 or where

inspection could not be performed, application of

alternative procedures;

2. Confirmation with the Custodian of all securities held,

hypothecated, pledged or placed in escrow or out for

transfer with brokers or pledgees, if any;

3. Obtained the Custodian reconciliation of security positions

held by institutions in book entry form (e.g., the Federal

Reserve Bank, The Depository Trust Company and various

sub-custodians) to Custodian records and verified that

reconciling items were cleared in a timely manner;

4. Reconciliation of the Fund's securities per the books and

records of the Fund to those of the Custodian;

5. Agreement of pending purchase and sale activity for the

Fund as of September 30, 2021, if any, to documentation of

corresponding subsequent bank statements;

6. Agreement of five security purchases and five security

sales or maturities, since the date of the last examination,

from the books and records of the Fund to corresponding

bank statements;

7. Confirmation of all repurchase agreements with

broker(s)/bank(s) and/or agreement of corresponding

subsequent cash receipts to bank statements and agreement

of underlying collateral with the Custodian records, if any;

8. Review of the BNY Mellon Asset Servicing Custody and

Securities Lending Services Service Organization Control

Report ("SOC 1 Report") for the period October 1, 2020 -

September 30, 2021 and noted no relevant findings were

reported in the areas of Asset Custody and Trade

Settlement.

We believe that our examination provides a reasonable

basis for our opinion. Our examination does not provide a

legal determination on the Fund's compliance with

specified requirements.

In our opinion, management's assertion that the Fund

complied with the requirements of subsections (b) and (c)

of Rule 17f-2 of the Investment Company Act of 1940 as of

September 30, 2021, with respect to securities reflected in

the investment accounts of the Fund is fairly stated, in all

material respects.

This report is intended solely for the information and use of

management and The Board of Directors of BNY Mellon

High Yield Strategies Fund, and the Securities and

Exchange Commission and is not intended to be and should

not be used by anyone other than these specified parties.

/s/ KPMG LLP

New York, New York

March 23, 2022

March 23, 2022

Management Statement Regarding Compliance With

Certain Provisions of the Investment Company Act of

1940

|

We, as members of management of BNY Mellon High

Yield Strategies Fund (the "Fund"), the sole series of BNY

Mellon High Yield Strategies Fund, are responsible for

complying with the requirements of subsections (b) and (c)

of Rule 17f-2, "Custody of Investments by Registered

Management Investment Companies" of the Investment

Company Act of 1940. We are also responsible for

establishing and maintaining effective internal controls

over compliance with those requirements. We have

performed an evaluation of the Fund's compliance with the

requirements of subsections (b) and (c) of Rule 17f-2 as of

September 30, 2021 and for the period from June 30, 2021

(the date of the Fund's last examination) through

September 30, 2021.

Based on the evaluation, we assert that the Fund was in

compliance with the requirements of subsections (b) and (c)

of Rule 17f-2 of the Investment Company Act of 1940 as of

September 30, 2021, and for the period from June 30, 2021

(the date of the Fund's last examination) through

September 30, 2021 with respect to securities reflected in

the investment accounts of the Fund.

BNY Mellon High Yield Strategies Fund

Jim Windels

Treasurer

1

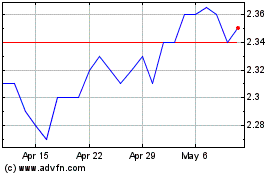

BNY Mellon High Yield St... (NYSE:DHF)

Historical Stock Chart

From Mar 2024 to Apr 2024

BNY Mellon High Yield St... (NYSE:DHF)

Historical Stock Chart

From Apr 2023 to Apr 2024