BlueLinx Holdings Inc. (NYSE: BXC), a leading distributor of

building and industrial products in the United States, today

announced that it has completed sale-leaseback transactions for

aggregate net cash proceeds of $27.2 million, which were used to

repay indebtedness under the Company’s term loan. The

transactions closed on December 31, 2019.

The four facilities included in these

sale-leaseback transactions are located in Kansas City, Missouri;

Nashville, Tennessee; Richmond, Virginia; and St. Louis,

Missouri. As a part of the transactions, the Company entered

into lease agreements for each of the properties for initial terms

of 18 years, demonstrating its long-term commitment to each of

these local markets.

Management Commentary

Mitch Lewis, President and Chief Executive

Officer, stated, “I am very pleased to announce the closing of

these latest sale-leaseback transactions, which generated $27.2

million in net cash proceeds for debt repayment. As we have

consistently stated, deleveraging is a priority, and a key path to

achieving this objective has been through the successful

monetization of our owned real estate portfolio.

"We remain in active and ongoing discussions

with other sale-leaseback and outright sale opportunities, and

believe these efforts should generate additional meaningful debt

reduction in the first quarter.”

Term Loan Amendment

Concurrent with the sale-leaseback transactions,

the Company entered into an amendment to its term loan facility

that gives the Company until March 27, 2020, to satisfy the

designated term loan principal balance of $95.3 million to maintain

the leverage covenant levels established in the third amendment to

the facility. The amount of additional principal repayment to

reach that level was reduced to approximately $23.7 million

following the term loan repayment described above, and can be

satisfied with proceeds from real estate transactions and asset

sales, as well as voluntary prepayments using cash on hand or funds

from its revolving credit facility. Among other things, the

amendment provides the Company additional flexibility and time to

maximize sale proceeds and obtain better cap rates for the other

sale-leaseback and outright sale opportunities that it is currently

pursuing.

Supplemental Information

As the Company has noted previously, the

calculation of the leverage ratio under its term loan facility for

any period is generally determined by taking the Company’s

“Consolidated Total Debt” and dividing it by the Company’s

“Consolidated EBITDA,” as those terms are defined in the term loan

agreement.

“Consolidated Total Debt” is generally

determined by adding the balance of the Company’s term loan, the

prior month’s average balance of its revolving credit facility, and

its equipment finance lease liability, and reducing that amount by

unrestricted cash up to $10.0 million. At September 28, 2019,

the Company’s term loan balance was $147.2 million, the average

balance of its revolving credit facility was $357.9 million, its

equipment finance lease liability was $34.4 million, and its

unrestricted cash was $10.0 million. Liabilities related to

sale-leaseback transactions are excluded from the calculation.

Following the term loan repayment described above, the

Company’s term loan balance is approximately $119.0 million.

Consolidated EBITDA is generally determined by

taking the Adjusted EBITDA that the Company reports, and adding

additional adjustments and add-backs specified by the term loan

agreement. The Company anticipates that the adjustments and

add-backs to Adjusted EBITDA for calculating Consolidated EBITDA

under the term loan will be approximately $5 million to $7 million

at the Company’s 2019 fiscal year end.

About BlueLinx Holdings Inc.

BlueLinx (NYSE: BXC) is a leading wholesale

distributor of building and industrial products in the United

States with over 50,000 branded and private-label SKUs, and a broad

distribution footprint servicing 40 states. BlueLinx has a

differentiated distribution platform, value-driven business model

and extensive cache of products across the building products

industry. Headquartered in Marietta, Georgia, BlueLinx has over

2,200 associates and distributes its comprehensive range of

structural and specialty products to approximately 15,000 national,

regional, and local dealers, as well as specialty distributors,

national home centers, industrial, and manufactured housing

customers. BlueLinx encourages investors to visit its website,

www.BlueLinxCo.com, which is updated regularly with financial and

other important information about BlueLinx.

Contacts

Susan O’Farrell, SVP, CFO & TreasurerBlueLinx Holdings

Inc.(770) 953-7000

Mary Moll, Investor Relations(866)

671-5138investor@bluelinxco.com

Forward-Looking Statements

This press release contains forward-looking

statements. Forward-looking statements include, without limitation,

any statement that predicts, forecasts, indicates or implies future

results, performance, liquidity levels or achievements, and may

contain the words “believe,” “anticipate,” “expect,” “estimate,”

“intend,” “project,” “plan,” “will be,” “will likely continue,”

“will likely result” or words or phrases of similar meaning.

These forward-looking statements include, but are not limited to,

statements about our commitment to local markets; the status of our

discussions and efforts with respect to sale-leaseback and real

estate sale transactions; our ability to consummate additional real

estate monetization transactions on favorable terms, if at all, and

their ability to generate debt reduction; and the amount of

anticipated adjustments and add-backs for calculating Consolidated

EBITDA under our term loan agreement at our 2019 fiscal year

end.

Forward-looking statements in this press release

are based on estimates and assumptions made by our management that,

although believed by us to be reasonable, are inherently uncertain.

Forward-looking statements involve risks and uncertainties

that may cause our business, strategy, or actual results to differ

materially from the forward-looking statements. These risks

and uncertainties include those listed under the heading “Risk

Factors” in Item 1A of our Annual Report on Form 10-K for the year

ended December 29, 2018, and those discussed in our Quarterly

Reports on Form 10-Q and in our periodic reports led with the SEC

from time to time. We operate in a changing environment in

which new risks can emerge from time to time. It is not possible

for management to predict all of these risks, nor can it assess the

extent to which any factor, or a combination of factors, may cause

our business, strategy, or actual results to differ materially from

those contained in forward-looking statements. Factors that

may cause these differences include, among other things: our

ability to monetize real estate assets; our ability to integrate

and realize anticipated synergies from acquisitions; loss of

material customers, suppliers, or product lines in connection with

acquisitions; operational disruption in connection with the

integration of acquisitions; our indebtedness and its related

limitations; sufficiency of cash flows and capital resources;

changes in interest rates; fluctuations in commodity prices;

adverse housing market conditions; disintermediation by customers

and suppliers; changes in prices, supply and/or demand for our

products; inventory management; competitive industry pressures;

industry consolidation; product shortages; loss of and dependence

on key suppliers and manufacturers; new tariffs; our ability to

successfully implement our strategic initiatives; fluctuations in

operating results; sale-leaseback transactions and their effects;

real estate leases; exposure to product liability claims; our

ability to complete offerings under our shelf registration

statement on favorable terms, or at all; changes in our product

mix; petroleum prices; information technology security and business

interruption risks; litigation and legal proceedings; natural

disasters and unexpected events; activities of activist

stockholders; labor and union matters; limits on net operating loss

carryovers; pension plan assumptions and liabilities; risks related

to our internal controls; retention of associates and key

personnel; federal, state, local and other regulations, including

environmental laws and regulations; and changes in accounting

principles. Given these risks and uncertainties, we caution

you not to place undue reliance on forward-looking statements.

We expressly disclaim any obligation to update or revise any

forward-looking statement as a result of new information, future

events or otherwise, except as required by law.

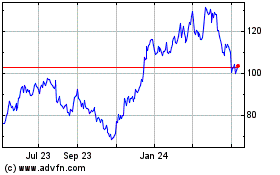

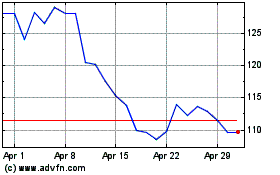

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Apr 2023 to Apr 2024