BlackRock® Canada Announces January Cash Distributions for the iShares® ETFs

January 15 2021 - 7:15AM

BlackRock Asset Management Canada Limited (“BlackRock Canada”), an

indirect, wholly-owned subsidiary of BlackRock, Inc. (NYSE: BLK),

today announced the January 2021 cash distributions for the iShares

ETFs listed on the TSX or NEO which pay on a monthly basis.

Unitholders of record of a fund on January 26, 2021 will receive

cash distributions payable in respect of that fund on

January 29, 2021.

Details regarding the “per unit” distribution

amounts are as follows:

|

Fund Name |

Fund Ticker |

Cash Distribution Per Unit ($) |

|

iShares 1-10 Year Laddered Corporate Bond Index ETF |

CBH |

0.046 |

|

iShares 1-5 Year Laddered Corporate Bond Index ETF |

CBO |

0.041 |

|

iShares S&P/TSX Canadian Dividend Aristocrats Index ETF |

CDZ |

0.079 |

|

iShares Equal Weight Banc & Lifeco ETF |

CEW |

0.042 |

|

iShares U.S. High Yield Fixed Income Index ETF (CAD-Hedged) |

CHB |

0.077 |

|

iShares 1-5 Year Laddered Government Bond Index ETF |

CLF |

0.030 |

|

iShares 1-10 Year Laddered Government Bond Index ETF |

CLG |

0.039 |

|

iShares Premium Money Market ETF |

CMR |

0.000 |

|

iShares S&P/TSX Canadian Preferred Share Index ETF |

CPD |

0.048 |

|

iShares Short Duration High Income ETF (CAD-Hedged) |

CSD |

0.067 |

|

iShares US Dividend Growers Index ETF (CAD-Hedged) |

CUD |

0.090 |

|

iShares Convertible Bond Index ETF |

CVD |

0.070 |

|

iShares Global Monthly Dividend Index ETF (CAD-Hedged) |

CYH |

0.066 |

|

Dynamic Active Tactical Bond ETF |

DXB |

0.042 |

|

Dynamic Active Canadian Dividend ETF |

DXC |

0.040 |

|

Dynamic Active Crossover Bond ETF |

DXO |

0.057 |

|

Dynamic Active Preferred Shares ETF |

DXP |

0.072 |

|

Dynamic Active Investment Grade Floating Rate ETF |

DXV |

0.011 |

|

iShares Canadian Financial Monthly Income ETF |

FIE |

0.040 |

|

iShares Core Canadian Universe Bond Index ETF |

XBB |

0.069 |

|

iShares Canadian Corporate Bond Index ETF |

XCB |

0.051 |

|

iShares Core MSCI Global Quality Dividend Index ETF |

XDG |

0.039 |

|

iShares Core MSCI Global Quality Dividend Index ETF(1) |

XDG.U |

0.031 |

|

iShares Core MSCI Global Quality Dividend Index ETF

(CAD-Hedged) |

XDGH |

0.039 |

|

iShares Core MSCI Canadian Quality Dividend Index ETF |

XDIV |

0.079 |

|

iShares Core MSCI US Quality Dividend Index ETF |

XDU |

0.054 |

|

iShares Core MSCI US Quality Dividend Index ETF(1) |

XDU.U |

0.046 |

|

iShares Core MSCI US Quality Dividend Index ETF (CAD-Hedged) |

XDUH |

0.054 |

|

iShares Canadian Select Dividend Index ETF |

XDV |

0.089 |

|

iShares J.P. Morgan USD Emerging Markets Bond Index ETF

(CAD-Hedged) |

XEB |

0.053 |

|

iShares S&P/TSX Composite High Dividend Index ETF |

XEI |

0.075 |

|

iShares S&P/TSX Capped Financials Index ETF |

XFN |

0.112 |

|

iShares Floating Rate Index ETF |

XFR |

0.006 |

|

iShares Canadian Government Bond Index ETF |

XGB |

0.039 |

|

iShares Global Government Bond Index ETF (CAD-Hedged) |

XGGB |

0.028 |

|

iShares Canadian HYBrid Corporate Bond Index ETF |

XHB |

0.062 |

|

iShares U.S. High Dividend Equity Index ETF (CAD-Hedged) |

XHD |

0.077 |

|

iShares U.S. High Dividend Equity Index ETF |

XHU |

0.065 |

|

iShares U.S. High Yield Bond Index ETF (CAD-Hedged) |

XHY |

0.075 |

|

iShares U.S. IG Corporate Bond Index ETF (CAD-Hedged) |

XIG |

0.049 |

|

iShares Core Canadian Long Term Bond Index ETF |

XLB |

0.065 |

|

iShares S&P/TSX North American Preferred Stock Index ETF

(CAD-Hedged) |

XPF |

0.065 |

|

iShares High Quality Canadian Bond Index ETF |

XQB |

0.042 |

|

iShares S&P/TSX Capped REIT Index ETF |

XRE |

0.042 |

|

iShares ESG Canadian Aggregate Bond Index ETF |

XSAB |

0.041 |

|

iShares Core Canadian Short Term Bond Index ETF |

XSB |

0.048 |

|

iShares Conservative Short Term Strategic Fixed Income ETF |

XSC |

0.041 |

|

iShares Conservative Strategic Fixed Income ETF |

XSE |

0.045 |

|

iShares Core Canadian Short Term Corporate Bond Index ETF |

XSH |

0.043 |

|

iShares Short Term Strategic Fixed Income ETF |

XSI |

0.045 |

|

iShares Short Term High Quality Canadian Bond Index ETF |

XSQ |

0.032 |

|

iShares ESG Canadian Short Term Bond Index ETF |

XSTB |

0.032 |

|

iShares Diversified Monthly Income ETF |

XTR |

0.040 |

|

iShares S&P/TSX Capped Utilities Index ETF |

XUT |

0.068 |

(1) Distribution per unit amounts are USD for

XDG.U, XDU.U

Further information on the iShares Funds can be found at

http://www.blackrock.com/ca.

About BlackRockBlackRock’s purpose is to help

more and more people experience financial well-being. As a

fiduciary to investors and a leading provider of financial

technology, our clients turn to us for the solutions they need when

planning for their most important goals. As of September 30, 2020,

the firm managed approximately US$7.81 trillion in assets on behalf

of investors worldwide. For additional information on BlackRock,

please visit www.blackrock.com/corporate | Twitter:

@BlackRockCA

About iShares ETFsiShares unlocks opportunity

across markets to meet the evolving needs of investors. With more

than twenty years of experience, a global line-up of 900+ exchange

traded funds (ETFs) and US$2.32 trillion in assets under management

as of September 30, 2020, iShares continues to drive progress for

the financial industry. iShares funds are powered by the expert

portfolio and risk management of BlackRock, trusted to manage more

money than any other investment firm1.

1 Based on US$7.81 trillion in AUM as of

9/30/20

iShares® ETFs are managed by BlackRock Asset

Management Canada Limited.

Commissions, trailing commissions, management

fees and expenses all may be associated with investing in iShares

ETFs. Please read the relevant prospectus before investing. The

funds are not guaranteed, their values change frequently and past

performance may not be repeated. Tax, investment and all other

decisions should be made, as appropriate, only with guidance from a

qualified professional.

Contact for

Media: Maeve

Hannigan T

–

416-643-4058

Email: Maeve.Hannigan@blackrock.com

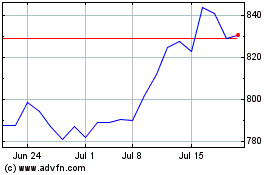

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

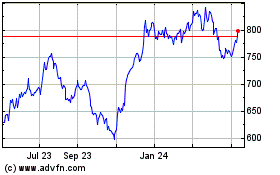

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024