Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

June 27 2022 - 11:22AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2022

Commission File Number: 001-36206

BIT Mining Limited

Units 813 & 815, Level 8, Core F,

Cyberport 3, 100 Cyberport Road,

Hong Kong

(852) 2596 3098

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained

in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ¨

No x

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

On June 23, 2022, BIT

Mining Limited (the “Company”) entered into a securities purchase agreement (the “Securities Purchase

Agreement”) with certain institutional investors (the “Purchasers”) pursuant to which the Company

agreed to sell (1) 11,200,000 American depositary shares (the “ADSs”), (2) certain pre-funded warrants to

purchase 4,800,000 ADSs (the “Pre-Funded Warrants”) in lieu of the ADSs being offered, and (3) certain

warrants including (i) certain Series A warrants to purchase up to 16,000,000 ADSs (the “Series A Warrants”) and

(ii) certain Series B warrants to purchase up to 16,000,000 ADSs (the “Series B Warrants”) (collectively, the

“Warrants”) (the “Offering”). The combined purchase price of each ADS and the accompanying

Warrants is US$1.00. The combined purchase price of each Pre-Funded Warrant and the accompanying Warrants is US$0.99. The Offering

will result in gross proceeds to the Company of approximately

US$16.0 million (without taking into account any proceeds from any future exercises of

the Warrants), before deducting the placement agent's fees and other estimated offering expenses payable by the Company. The

Company currently intends to use the net proceeds from the Offering for to invest in mining

machines, build new data centers, expand infrastructure, and improve working capital position. The Offering is expected to

close on June 27, 2022.

Each

Series A Warrant is exercisable for one ADS at an exercise price of US$1.10 per ADSs. The Series A Warrants will be immediately exercisable

and will expire on the fifth anniversary of the original issuance date. Each Series B Warrant is exercisable for one ADS at an exercise

price of US$1.00 per ADSs. The Series B Warrants will be immediately exercisable and will expire on the 2½th anniversary of the

original issuance date. Each Pre-Funded Warrant is exercisable for one ADS at an exercise price of US$0.01. We

are offering the Pre-Funded Warrants to certain purchasers whose purchase of the ADSs in this Offering would otherwise result in

such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of

the purchaser, 9.99%) of our outstanding Class A ordinary shares immediately following the consummation of this Offering. The Pre-Funded

Warrants are exercisable immediately and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

In connection with the

Offering, the Company entered into certain engagement letter dated June 10, 2022 (the “Letter Agreement”), with

H.C. Wainwright & Co., LLC, as exclusive placement agent (the “Placement Agent”), pursuant to which the

Placement Agent agreed to act as the exclusive placement agent in connection with the Offering. The Company agreed to pay the

Placement Agent a cash fee equal to 7.0% of the gross proceeds raised in this Offering. In addition, the Company will pay the

Placement Agent a cash fee equal to 6.0% of the aggregate gross proceeds received from the cash exercise of any Warrants issued in

in the Offering. In addition, the Company has agreed to issue to the Placement Agent as compensation, certain warrants (the

“Placement Agent Warrants”) to purchase up to 960,000 ADSs (equal to 6.0% of the aggregate number of ADSs and

Pre-Funded Warrants sold in this Offering). Each Placement Agent Warrant will have an exercise price of US$1.25, which represents

125% of the offering price per ADS, will become exercisable immediately upon issuance and will expire five years from the commencement of

the sales pursuant to the Securities Purchase Agreement.

Copies of the forms of

Pre-Funded Warrants, Series A Warrants, Series B Warrants, Placement Agent Warrants and Securities Purchase Agreement, and the

Letter Agreement are attached hereto as Exhibits 4.1, 4.2, 4.3, 4.4, 10.1 and 10.2, respectively, and are incorporated herein by

reference. The foregoing summaries of the terms of the Pre-Funded Warrants, the Series A Warrants, the Series B Warrants, the

Placement Agent Warrants and the Securities Purchase Agreement and the Letter Agreement are subject to, and qualified in their entirety by, such

documents.

EXPLANATORY NOTE

The documents attached

as Exhibits 4.1, 4.2, 4.3, 4.4, 5.1, 5.2, 10.1, 10.2 and 99.1 to this report on Form 6-K are hereby incorporated by reference

into the Company’s Registration Statement on Form F-3, as amended, initially filed with the U.S. Securities and Exchange

Commission on July 30, 2021 (Registration No. 333-258329) and a prospectus supplement dated June 23, 2022 thereunder, and

shall be a part thereof from the date on which this current report is furnished, to the extent not superseded by documents or reports

subsequently filed or furnished.

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

BIT Mining Limited |

| |

|

|

| |

By: |

/s/ Xianfeng Yang |

| |

Name: |

Xianfeng Yang |

| |

Title: |

Chief Executive Officer |

Date: June 27, 2022

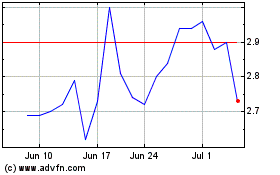

Bit Mining (NYSE:BTCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bit Mining (NYSE:BTCM)

Historical Stock Chart

From Apr 2023 to Apr 2024