Filed Pursuant to 424(b)(5)

Registration No.

333-232167

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

Amount to be

Registered

(1)

|

Offering Price

Per Share

|

Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee

(2)

|

|

Common Shares, no par value

|

8,023,256

|

$43.00

|

$345,000,008

|

$41,814

|

(1) Includes 1,046,511 Common Shares that the underwriters have the option to purchase from the issuer.

(2) Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(r) under the Securities Act of 1933, and relates to the registration statement on Form S-3 (File No.

333-232167

) filed on June 17, 2019.

PROSPECTUS SUPPLEMENT

(To Prospectus dated June 17, 2019)

6,976,745

Common Shares

Biohaven Pharmaceutical Holding Company Ltd. is offering

6,976,745

of its common shares in this offering at an offering price per share of

$43.00

.

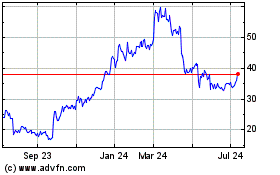

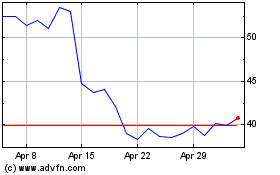

Our common shares are listed on the New York Stock Exchange under the symbol “BHVN.” The last reported sale price of our common shares on

June 18, 2019

was $

43.82

per share.

Investing in our common shares involves risks. Please see “Risk Factors” beginning on page S-14 of this prospectus supplement as well as the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, including the information contained under the caption entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2018

and in our Quarterly Report on Form 10-Q for the quarterly period ended

March 31, 2019

.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

PRICE

$43.00

A SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price to

Public

|

|

Underwriting

Discounts and

Commissions

(1)

|

|

Proceeds,

Before Expenses,

to Biohaven

|

|

Per Share

|

$

|

43.00

|

|

|

$

|

2.58

|

|

|

$

|

40.42

|

|

|

Total

|

$

|

300,000,035

|

|

|

$

|

18,000,002

|

|

|

$

|

282,000,033

|

|

_____________

|

|

|

|

(1)

|

See “Underwriting” in this prospectus supplement for a description of compensation payable to the underwriters.

|

The underwriters may offer the common shares from time to time for sale in one or more transactions on the New York Stock Exchange, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices.

We have granted the underwriters an option to purchase up to

1,046,511

additional common shares at

$40.42

per share, net of underwriting discounts and commissions. The underwriters can exercise this option at any time within 30 days after the date of this prospectus supplement.

The underwriters expect to deliver the common shares to purchasers on or about

June 21, 2019

.

|

|

|

|

|

|

|

|

|

GOLDMAN SACHS & CO. LLC

|

|

PIPER JAFFRAY

|

|

CANTOR

|

|

WILLIAM BLAIR

|

|

OPPENHEIMER & CO

|

The date of this prospectus supplement is

June 18, 2019

.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common shares and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement or any “free writing prospectus” we may authorize to be delivered to you and the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement or such free writing prospectus, as the case may be. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We have not authorized, and the underwriters have not authorized, anyone to provide you with information other than the information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into the prospectus supplement and the accompanying prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. The information contained in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our common shares. It is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference” in this prospectus supplement and in the sections entitled “Where You Can Find More Information" and "Incorporation by Reference” in the accompanying prospectus, respectively.

We are offering to sell, and seeking offers to buy, our common shares only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the common shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, this offering of the common shares and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

When we refer to “Biohaven,” “we,” “our,” “us” and the “Company” in this prospectus supplement, we mean Biohaven

Pharmaceutical Holding Company Ltd. and its subsidiaries, unless otherwise specified. When we refer to “you,” we mean the holders of the common shares offered hereby.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights and, in certain cases, updates some of the information contained elsewhere in or incorporated by reference into this prospectus supplement. Because this is only a summary, however, it does not contain all of the information that may be important to you. You should carefully read this entire prospectus supplement, including the information incorporated by reference herein, especially the matters discussed under “Risk Factors” beginning on page S-14 of this prospectus supplement and the “Risk Factors” sections of our Annual Report on Form 10-K for the year ended

December 31, 2018

and our Quarterly Report on Form 10-Q for the quarterly period ended

March 31, 2019

, along with our consolidated financial statements and notes thereto, before making an investment decision. All references to “Biohaven,” “we,” “us,” “our” or the “Company” mean Biohaven Pharmaceutical Holding Company Ltd. and its subsidiaries, except where it is made clear that the term means only the parent company.

Biohaven Pharmaceutical Holding Company Ltd.

Overview

We are a clinical-stage biopharmaceutical company with a portfolio of innovative, late-stage product candidates targeting neurological diseases, including rare disorders. Our product candidates are based on multiple mechanisms — calcitonin gene-related peptide, or CGRP, receptor antagonists, glutamate modulators and myeloperoxidase, or MPO, inhibition — which we believe have the potential to significantly alter existing treatment approaches across a diverse set of neurological indications with high unmet need in both large and orphan indications. Our programs include the following:

|

|

|

|

|

|

|

|

Product

|

Platform

|

Indication

|

Development Stage

|

|

Rimegepant

|

CGRP

|

Acute treatment and prevention of migraine

|

Three pivotal Phase 3 trials for acute treatment complete; long-term safety study ongoing. Phase 3 trial for prevention initiated in the fourth quarter of 2018. Advancing Zydis ODT and tablet formulation development programs towards potential commercialization for the acute treatment of migraine.

|

|

Rimegepant

|

CGRP

|

Trigeminal Neuralgia

|

Phase 2 proof of concept trial planned for second quarter of 2019.

|

|

BHV-3500

|

CGRP

|

Acute treatment and prevention of migraine

|

Phase 2/3 trial ongoing.

|

|

Troriluzole

|

Glutamate

|

Ataxias

|

Phase 2/3 randomization phase in spinocerebellar ataxia ("SCA") complete; extension trial ongoing. Phase 3 trial ongoing.

|

|

Troriluzole

|

Glutamate

|

Obsessive Compulsive Disorder (“OCD”)

|

Phase 2/3 ongoing.

|

|

Troriluzole

|

Glutamate

|

Alzheimer’s disease

|

Phase 2/3 ongoing.

|

|

Troriluzole

|

Glutamate

|

Generalized Anxiety Disorder (“GAD”)

|

Phase 2/3 ongoing.

|

|

Nurtec

|

Glutamate

|

Amyotrophic Lateral Sclerosis (“ALS”)

|

NDA filed with FDA in fourth quarter of 2018. Prescription Drug User Fee Act (“PDUFA”) date of July 21, 2019.

|

|

BHV-5000

|

Glutamate

|

Neuropsychiatric disorders

|

Phase 1 trial completed 2018; additional nonclinical studies anticipated in 2019.

|

|

Verdiperstat

|

MPO

|

Neuroinflammation

|

Phase 3 trial for the treatment of multiple system atrophy (“MSA”) expected to begin in third quarter of 2019.

|

CGRP Platform

In July 2016, we acquired exclusive, worldwide rights to our CGRP receptor antagonist platform, including rimegepant and BHV-3500, through a license agreement with Bristol-Myers Squibb Company (“BMS”), which was amended in March 2018.

Rimegepant

Study 301/Study 302

The most advanced product candidate from our CGRP receptor antagonist platform is rimegepant, an orally available, potent and selective small molecule human CGRP receptor antagonist that we are developing for the acute and preventive treatment of migraine. In March 2018, we announced positive topline data from our first two pivotal Phase 3 trials (“Study 301 and Study 302”) for the acute treatment of migraine. In each trial, treatment with a single 75 mg dose of rimegepant met the co-primary efficacy endpoints of the trial, which were superior to placebo, at two hours post-dose, on measures of pain freedom and freedom from the patient’s most bothersome symptom. In addition to achieving both co-primary endpoints in each of the trials, rimegepant also was observed to be generally safe and well-tolerated in the trials, with a safety profile similar to placebo. The efficacy and safety profile of rimegepant has now been observed across three randomized controlled trials to date. The co-primary endpoints achieved in the Phase 3 trials are consistent with regulatory guidance from the U.S. Food and Drug Administration (“FDA”) and provide the basis for the submission of a new drug application (“NDA”) to the FDA.

Study 303

A third Phase 3 clinical trial for the acute treatment of migraine with a bioequivalent orally dissolving tablet (“ODT”) formulation of rimegepant was commenced in February 2018. On December 3, 2018, we announced positive topline data from a randomized, controlled Phase 3 clinical trial (“BHV3000-303” or “Study 303”) evaluating the efficacy and safety of our Zydis ODT formulation of rimegepant for the acute treatment of migraine. Rimegepant differentiated from placebo on the two co-primary endpoints using a single dose, pain freedom and freedom from most bothersome symptom at 2 hours, as well as the first 21 consecutive primary and secondary outcome measures that were pre-specified. Patients treated with the rimegepant Zydis ODT formulation began to numerically separate from placebo on pain relief as early as 15 minutes, and this difference was statistically significant at 60 minutes. Additionally, a significantly greater percentage of patients treated with rimegepant Zydis ODT returned to normal functioning by 60 minutes and lasting clinical benefit compared to placebo was observed through 48 hours after a single dose of rimegepant on freedom from pain, pain relief, freedom from the most bothersome symptom, and freedom from functional disability. The safety and tolerability observations of rimegepant in Study 303 were consistent with our previous observations. The overall rates of adverse events were similar to placebo (13.2% with respect to rimegepant compared to 10.5% with placebo). The co-primary endpoints achieved in the Phase 3 trials are consistent with regulatory guidance from the FDA. We continue to advance the rimegepant Zydis ODT and tablet formulation development programs towards potential commercialization for the acute treatment of migraine.

Study 305

In November 2018, we initiated a double-blind, placebo-controlled Phase 3 clinical trial examining regularly scheduled dosing of rimegepant 75 mg to evaluate its efficacy and safety as a preventive therapy for migraine (“BHV3000-305” or “Study 305”). We anticipate receiving topline results in the fourth quarter of 2019.

Long-term Safety Study

In August 2017, we commenced a long-term safety study of rimegepant in patients with migraine. On December 10, 2018, we announced the results of an interim analysis from our ongoing long-term safety study (“BHV3000-201” or “Study 201”).

On May 8, 2019, we announced updated interim positive results from the long-term safety study. As of February 20, 2019 (the database cutoff date of the interim assessment), 105,192 doses of rimegepant 75 mg had been administered across 1,784 patients with migraine. As of February 20, 2019, approximately 527 patients have received near daily dosing (14 or more doses in 4 weeks) of rimegepant 75 mg to date for a duration ranging between 4 and 52 weeks. Interim hepatic data as of February 21, 2019 were reviewed by an external independent panel of liver experts who concluded that there was no liver safety signal detected through the data analysis cut-off date and, compared to placebo arms of other migraine treatments, there was a very low incidence of overall elevations of liver laboratory abnormalities (1% incidence of serum ALT or AST > 3x the upper limit of normal (ULN) through the data analysis cut-off date). Based on this interim analysis, there are indications that rimegepant may be safe and well tolerated with long-term dosing in patients with migraine.

On May 8, 2019, we also reported the safety and preliminary exploratory efficacy data from the scheduled dosing cohort in the study. In this cohort of patients with a history of 4 to 14 moderate to severe migraine attacks per month, patients were treated with rimegepant 75 mg every other day for up to 12 consecutive weeks. Patients in this cohort could also supplement their scheduled rimegepant dosing with additional as-needed dosing on nonscheduled dosing days. In this cohort, 286 patients received a total of 11,296 doses of rimegepant 75 mg tablets at least every other day, with a median number of 14.2 tablets per 4 week period. During the on-treatment period, no rimegepant-treated patients (n=281) experienced ALT or AST levels >3x the ULN. There were also no rimegepant-treated patients who experienced alkaline phosphatase or bilirubin >2x the ULN. With regard to efficacy, 48.4% of subjects in the scheduled dosing cohort experienced a ≥50% reduction in the frequency of monthly migraine days with moderate-to-severe pain intensity during the third month of treatment. This preliminary exploratory open-label efficacy data from Study 201 suggest that rimegepant may be associated with a reduction in migraine days per month (30 days) compared to the observational lead-in period, suggesting a potential preventive effect that warrants further study.

Subjects will continue to participate in Study 201 with additional data analyses submitted to the FDA in connection with the NDA submissions, including the required 120-day safety update. Additionally, this program for the acute treatment of migraine will be supported by results of 20 Phase 1/2 trials.

Pediatric Study Plan

In November 2017, the FDA agreed to our initial acute treatment pediatric study plan. In June 2019, the FDA provided amended agreed letter and initial Pediatric Study Plan.

Trigeminal Neuralgia

We plan to initiate a Phase 2 proof of concept trial in the second quarter of 2019 to evaluate the safety and efficacy of rimegepant in patients with treatment refractory trigeminal neuralgia. Trigeminal neuralgia is a chronic facial pain syndrome characterized by paroxysmal, severe, and lancinating episodes of pain in the distribution of one or more branches of the trigeminal nerve. The trigeminal nerve, or fifth cranial nerve, is the largest of the 12 cranial nerves and provides sensory innervation to the head and neck, as well as motor innervation to the muscles of mastication. These episodic bouts of severe facial pain can last seconds to minutes, occur several times per day, and often result in significant disability. Over the long-term course of the disease, symptoms often become refractory to medical therapy and current treatment options remain suboptimal.

International Health Authority Interactions

In February 2018, a request for scientific advice for rimegepant was submitted to the Committee for Medicinal Products for Human Use (“CHMP”), a committee of the European Medicines Agency (“EMA”), and feedback was received in June 2018. Based on this feedback, we believe we have several potential pathways to approval.

In January 2019, we and our wholly owned subsidiary, BioShin Consulting Services Company Ltd. ("BioShin"), a Shanghai based limited liability company, jointly announced that the National Medical Products Administration (“NMPA,” formerly, the China FDA) has accepted the investigational new drug (“IND”) application for rimegepant for the treatment of migraine. As previously announced, BioShin was established to develop and potentially commercialize our late-stage migraine and neurology portfolio in China and other Asia-Pacific markets. Following the results of Study 303, we also plan to submit a second IND application to the NMPA for the Zydis ODT formulation of rimegepant for the acute treatment of migraine. We expect to submit this IND in mid-2019.

BHV-3500

Administration of intranasal BHV-3500 in a Phase 1 clinical trial was initiated in October 2018 and has achieved targeted therapeutic exposures. We advanced BHV-3500 into a Phase 2/3 trial to evaluate its efficacy for the acute treatment of migraine in the first quarter of 2019. We believe that intranasal BHV-3500 may provide an ultra-rapid onset of action that could be used in a complimentary fashion with other migraine treatment when the speed of onset is critical to a patient. We anticipate reporting topline results from this trial in the fourth quarter of 2019.

Glutamate Platform

We are developing three product candidates that modulate the body’s glutamate system. Two of these product candidates, troriluzole (previously referred to as trigriluzole and BHV-4157) and Nurtec (previously BHV-0223), act as glutamate transporter modulators, while our product candidate BHV-5000 is an antagonist of the glutamate N-methyl-D-aspartate (“NMDA”) receptor.

Troriluzole

Ataxias

We are developing troriluzole for the treatment of ataxias; our initial focus has been spinocerebellar ataxia (“SCA”). We have received both orphan drug designation and fast track designation from the FDA for troriluzole for the treatment of SCA. A Phase 3 trial began enrollment in March 2019 to evaluate the efficacy of troriluzole in SCA. We believe that the non-statistically significant clinical observations from our first Phase 2/3 trial and open-label extension phase in SCA support our decision to advance troriluzole into a Phase 3 trial that could provide the data needed to serve as the basis for an NDA. We expect to complete enrollment in the Phase 3 trial of troriluzole in SCA in the first quarter of 2020.

Other Indications

A Phase 2/3 double-blind, randomized, controlled trial to assess the efficacy of troriluzole in Obsessive Compulsive Disorder (“OCD”) commenced in December 2017. We expect to complete the enrollment of this trial by the end of 2019. In addition, a Phase 2/3 double-blind, randomized, controlled trial of troriluzole in the treatment of mild-to-moderate Alzheimer’s disease has advanced with the Alzheimer’s Disease Cooperative Study, a consortium of sites funded by the National Institutes of Health. In July 2018, we received authorization to proceed from the FDA and subsequently commenced the trial. We expect to complete enrollment and announce interim futility results for this trial in the fourth quarter of 2019. We began enrollment in a Phase 2/3 clinical trial of troriluzole in Generalized Anxiety Disorder (“GAD”) in February 2019 and expect to complete enrollment of this trial by the end of 2019.

Nurtec

We are developing Nurtec for the treatment of Amyotrophic Lateral Sclerosis (“ALS”). In January 2018, we announced positive results of a bioequivalence study with Nurtec and marketed riluzole, thus providing pivotal data that we believe are sufficient for the filing of an NDA with the FDA, allowing us to pursue the regulatory approval of Nurtec for ALS under Section 505(b)(2) of the U.S. Federal Food, Drug, and Cosmetic Act. We submitted an NDA in September 2018, and the PDUFA date is in July 2019.

BHV-5000

We are also developing BHV-5000, an orally available, low-trapping NMDA receptor antagonist, for the treatment of neuropsychiatric diseases. One potential target indication includes Complex Regional Pain Syndrome (“CRPS”). CRPS is a rare, chronic pain condition typically affecting limbs and triggered by traumatic injury. Accompanying symptoms also include chronic inflammation and reduced mobility in the affected areas. Other disorders of interest include treatment-resistant major depressive disorder and Rett syndrome. Rett syndrome is a rare and severe genetic neurodevelopmental disorder for which no approved treatments are currently available. We acquired worldwide rights to BHV-5000 under an exclusive license agreement with AstraZeneca AB in October 2016. We selected a lead formulation at the end of 2017 and completed single dosing in a Phase 1 clinical trial of BHV-5000 in January 2018 to evaluate its pharmacokinetic properties. Nonclinical studies are ongoing to support future trials.

MPO Platform

Verdiperstat

We are developing verdiperstat (previously BHV-3241), an oral myeloperoxidase inhibitor for the treatment of MSA, a rare, rapidly progressive and fatal neurodegenerative disease with no cure or effective treatments. Verdiperstat was progressed through Phase 2 clinical trials by AstraZeneca AB. We have entered into an exclusive license agreement with AstraZeneca AB for the product candidate, we have reactivated the IND, and plan to initiate a Phase 3 clinical trial of verdiperstat for the treatment of MSA in the third quarter of 2019. In February 2019, verdiperstat received orphan drug designation from the FDA for the treatment of MSA.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making a decision to invest in our common shares. These risks are discussed more fully in the “Risk Factors” sections of this prospectus supplement, our Annual Report on Form 10-K for the year ended

December 31, 2018

and our Quarterly Report on Form 10-Q for the quarterly period ended

March 31, 2019

, and in the documents incorporated herein by reference. These risks include the following:

|

|

|

|

•

|

We have incurred significant operating losses since inception and anticipate that we will continue to incur substantial operating losses for the foreseeable future and may never achieve or maintain profitability.

|

|

|

|

|

•

|

Clinical trials are very expensive, time-consuming and difficult to design and implement and involve uncertain outcomes. Furthermore, results of earlier preclinical studies and clinical trials may not be predictive of results of future preclinical studies or clinical trials.

|

|

|

|

|

•

|

Our long-term safety study of rimegepant is ongoing and could result in adverse safety data in the future. In addition, the FDA may disagree with the interpretation of the results of, or the sufficiency of the data from, our clinical trials of rimegepant. There can be no assurance that our NDAs for rimegepant will be submitted in the time frame that we anticipate or that, if accepted for review, the NDAs will be approved by FDA.

|

|

|

|

|

•

|

If we fail to comply with our obligations under our existing and any future intellectual property licenses with third parties, we could lose license rights that are important to our business.

|

|

|

|

|

•

|

We rely in part on third parties to conduct our preclinical studies and clinical trials and if these third parties perform in an unsatisfactory manner, our business could be substantially harmed.

|

|

|

|

|

•

|

We currently rely on third parties for the production of our clinical supply of our product candidates and we intend to continue to rely on third parties for our clinical and commercial supply.

|

|

|

|

|

•

|

We have never commercialized a product candidate and we may lack the necessary expertise, personnel and resources to successfully commercialize any of our products that receive regulatory approval on our own or together with collaborators.

|

|

|

|

|

•

|

We currently have no marketing, sales or distribution infrastructure. If we are unable to develop sales, marketing and distribution capabilities on our own or through collaborations, or if we fail to achieve adequate pricing or reimbursement, we will not be successful in commercializing our product candidates, if approved.

|

|

|

|

|

•

|

If we are unable to obtain and maintain patent protection for our technology and product candidates, or if the scope of the patent protection obtained is not sufficiently broad, we may not be able to compete effectively in our markets.

|

|

|

|

|

•

|

An active trading market for our common shares may not continue to develop or be sustained, or be liquid enough for investors to resell our common shares quickly or at the market price.

|

|

|

|

|

•

|

We are dependent on licensed intellectual property. If we were to lose our rights to licensed intellectual property, we may not be able to continue developing or commercializing our product candidates, if approved. If we breach any of the agreements under which we license the use, development and commercialization rights to our product candidates or technology from third parties or, in certain cases, we fail to meet certain development deadlines, we could lose license rights that are important to our business.

|

|

|

|

|

•

|

You may have fewer protections as a shareholder of our company, as the rights of shareholders under British Virgin Islands law differ from those of shareholders under U.S. law.

|

|

|

|

|

•

|

We have previously identified material weaknesses in our internal control over financial reporting. We have concluded that as a result of actions taken during the year ended December 31, 2018, and the results of our testing over the design and operating effectiveness of controls, our remediation has been successful and the previously identified material weaknesses have been remediated as of December 31, 2018. If these or other material weaknesses exist in the future, we may not be able to accurately or timely report our financial condition or operating results, or comply with the accounting and reporting requirements applicable to public companies, which may adversely affect investor confidence in us and, as a result, the value of our common shares.

|

Corporate Information

We were incorporated as a business company limited by shares organized under the laws of the British Virgin Islands in September 2013. Our registered office is located at P.O. Box 173, Road Town, Tortola, British Virgin Islands and our telephone number is +1 (284) 852-3000. Our U.S. office and the office of our U.S. subsidiary is located at 215 Church Street, New Haven, Connecticut 06510 and our telephone number is (203) 404-0410. Our website address is

www.biohavenpharma.com

. The information contained on our website is not incorporated by reference into this prospectus supplement, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus supplement or in deciding whether to purchase our common shares.

We have six wholly owned subsidiaries, including Biohaven Pharmaceuticals, Inc., a Delaware corporation. We also expect to form one or more additional subsidiaries or move one of our existing subsidiaries to be incorporated under the laws of Ireland and resident for tax purposes in Ireland. We expect that an Irish subsidiary will be the principal operating company for conducting our business and the entity that will hold our intellectual property rights in certain of our product candidates. As a result, we expect that we will become subject to taxation in Ireland in the future.

We

have proprietary rights to a number of trademarks used in this prospectus supplement, which are important to our business, including the Biohaven logo. Solely for convenience, the trademarks and trade names in this prospectus supplement are referred to without the

®

and

TM

symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. All other trademarks, trade names and service marks appearing in this prospectus supplement are the property of their respective owners.

RECENT DEVELOPMENTS

In April 2019, we sold 2,495 Series A preferred shares (the “Series A Preferred Shares”) to RPI Finance Trust (“RPI”) at a price of $50,100 per preferred share pursuant to a Series A preferred share purchase agreement (the “Preferred Share Agreement”). The gross proceeds from the transaction with RPI were $125 million, with $105 million of the proceeds used to purchase a priority review voucher issued by the United States Secretary of Health and Human Services to potentially expedite the regulatory review of the NDA for the ODT formulation of rimegepant and the remainder of the proceeds to be used for other general corporate purposes. Pursuant to the Preferred Share Agreement, we may issue additional Series A Preferred Shares to RPI in up to three additional closings for an aggregate amount of $75 million subject to the acceptance by the FDA of both NDAs with respect to the tablet formulation of rimegepant and the NDA with respect to the ODT formulation of rimegepant. Subject to the satisfaction of the applicable conditions under the Preferred Share Agreement, the issuance of additional Series A Preferred Shares is entirely at the Company’s option, and the Company is not obligated to issue any additional Series A Preferred Shares.

Certain redemption rights are applicable to our outstanding Series A Preferred Shares in certain circumstances.

|

|

|

|

•

|

If a Change of Control (as defined in our memorandum and article of association) occurs on or before October 5, 2019, we will have the option to redeem the Series A Preferred Shares for one point five times (1.5x) the original purchase price of the Series A Preferred Shares upon the consummation of the Change of Control. If we do not elect to redeem the Series A Preferred Shares for 1.5x the original purchase price at the consummation of such Change of Control, then we would be required to redeem the Series A Preferred Shares for two times (2x) the original purchase price, payable in equal quarterly installments following consummation of the Change of Control through December 31, 2024.

|

|

|

|

|

•

|

If a Change of Control occurs after October 5, 2019 and the Series A Preferred Shares have not previously been redeemed, we must redeem the Series A Preferred Shares for two times (2x) the original purchase price of the Series A Preferred Shares payable in a lump sum at the closing of the Change of Control or in equal quarterly installments following the closing of the Change of Control through December 31, 2024.

|

|

|

|

|

•

|

If an NDA for rimegepant is not approved by December 31, 2021, the holder of the Series A Preferred Shares has the option at any time thereafter to require us to redeem the Series A Preferred Shares for one point two times (1.2x) the original purchase price of the Series A Preferred Shares.

|

|

|

|

|

•

|

If no Change of Control has been announced, the Series A Preferred Shares have not previously been redeemed and (i) rimegepant is approved on or before December 31, 2024, following

|

approval and starting one-year after approval, we must redeem the Series A Preferred Shares for two times (2x) the original purchase price, payable in a lump sum or in equal quarterly installments through December 31, 2024 (provided that if rimegepant is approved in 2024, the entire redemption amount must be paid by December 31, 2024) or (ii) rimegepant is not approved by December 31, 2024, we must redeem the Series A Preferred Shares for two times (2x) the original purchase price on December 31, 2024.

|

|

|

|

•

|

We may redeem the Series A Preferred Shares at our option at any time for two times (2x) the original purchase price, which redemption price may be paid in a lump sum or in equal quarterly installments through December 31, 2024.

|

|

|

|

|

•

|

Under all circumstances, the Series A Preferred Shares are required to be redeemed by December 31, 2024.

|

In the event that we default on any obligation to redeem Series A Preferred Shares when required, the redemption amount shall accrue interest at the rate of eighteen percent (18%) per annum. If any such default continues for at least one year, the holders of such shares shall be entitled to convert, subject to certain limitations, such Series A Preferred Shares into common shares, with no waiver of their redemption rights.

Based on the redemption provisions described above, we have concluded the Series A Preferred Shares are a mandatorily redeemable instrument and classified them as a liability. We initially measured the liability at fair value and subsequently will accrete the carrying value to the redemption value through interest expense using the effective interest rate method.

THE OFFERING

|

|

|

|

|

|

Common shares offered

|

6,976,745 shares

|

|

|

|

|

Common shares outstanding after this offering

|

51,259,739 shares (or 52,306,250 shares if the underwriters exercise their option to purchase additional shares in full)

|

|

|

|

|

Option to purchase additional shares

|

We have granted the underwriters the option, exercisable for 30 days from the date of this prospectus supplement, to purchase up to 1,046,511 additional common shares.

|

|

|

|

|

Use of proceeds

|

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, assuming the underwriters do not exercise their option to purchase up to an additional 1,046,511 shares, will be approximately $281.1 million, based on the public offering price of $43.00 per share.

We anticipate that the net proceeds from this offering, together with our existing cash, will be used to:

•

advance and expand the development of our CGRP receptor antagonist platform, including our planned regulatory filings, including our NDA submissions for rimegepant;

• advance and expand the development of glutamate modulation platform product candidates and continue development of our MPO platform; and

• for working capital and other corporate purposes, including satisfaction of any of our milestone payment obligations under our license agreements.

See “Use of Proceeds” on page S-17 for additional information.

|

|

|

|

|

Risk Factors

|

See “Risk Factors” on page S-14 of this prospectus supplement and the “Risk Factors” sections included our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q, which are incorporated by reference herein, for a discussion of factors to consider carefully before deciding to invest in our common shares.

|

|

|

|

|

NYSE symbol

|

BHVN

|

The number of common shares that will be outstanding after this offering is based on

44,282,994

common shares outstanding as of

March 31, 2019

, and excludes:

|

|

|

|

•

|

7,923,334

common shares issuable upon the exercise of stock options outstanding as of

March 31, 2019

, at a weighted average exercise price of

$18.23

per share;

|

|

|

|

|

•

|

221,751

common shares issuable upon the exercise of warrants outstanding as of

March 31, 2019

, at a weighted average exercise price of

$9.68

per share;

|

|

|

|

|

•

|

1,909,608

common shares reserved for future issuance of stock option grants under our 2017 Equity Incentive Plan, or the 2017 Plan, as of

March 31, 2019

(of which we granted stock options

|

to purchase an aggregate of

345,000

common shares, at a weighted average exercise price of

$58.23

per share, subsequent to

March 31, 2019

); and

|

|

|

|

•

|

1,141,691

common shares reserved for future issuance under our 2017 Employee Share Purchase Plan, or ESPP, as of

March 31, 2019

as well as any automatic increases in the number of common shares reserved for issuance under the 2017 Plan and the ESPP after the date of this prospectus supplement.

|

Except as otherwise indicated herein, all information in this prospectus supplement, including the number of shares that will be outstanding after this offering, assumes:

|

|

|

|

•

|

no exercise of the outstanding options and warrants described above; and

|

|

|

|

|

•

|

no exercise of the underwriters' option to purchase additional shares.

|

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables set forth our summary consolidated financial data as of and for the periods presented. We have derived the consolidated statement of operations data for the years ended December 31,

2016

,

2017

and

2018

from our audited consolidated financial statements included in our most recent Annual Report on Form 10-K, which is incorporated by reference into this prospectus supplement. We have derived the consolidated statement of operations data for the three months ended

March 31, 2018

and

2019

and the consolidated balance sheet data as of

March 31, 2019

from our unaudited condensed consolidated financial statements included in our most recent Quarterly Report on Form 10-Q, which is incorporated by reference into this prospectus supplement. Our historical results are not necessarily indicative of the results to be expected in the future. This information is only a summary and should be read together with our consolidated financial statements and accompanying notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q, which are incorporated by reference into this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

Three Months Ended March 31,

|

|

|

2016

|

|

2017

|

|

2018

|

|

2018

|

|

2019

|

|

|

(in thousands, except share and per share data)

|

|

Consolidated Statement of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

$

|

55,529

|

|

|

$

|

89,441

|

|

|

$

|

189,951

|

|

|

$

|

75,579

|

|

|

$

|

41,003

|

|

|

General and administrative

|

5,109

|

|

|

18,141

|

|

|

34,603

|

|

|

7,857

|

|

|

13,462

|

|

|

Total operating expenses

|

60,638

|

|

|

107,582

|

|

|

224,554

|

|

|

83,436

|

|

|

54,465

|

|

|

Loss from operations

|

(60,638

|

)

|

|

(107,582

|

)

|

|

(224,554

|

)

|

|

(83,436

|

)

|

|

(54,465

|

)

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

(385

|

)

|

|

(906

|

)

|

|

(38

|

)

|

|

—

|

|

|

—

|

|

|

Non-cash interest expense on liability related to sale of future royalties

|

—

|

|

|

—

|

|

|

(11,726

|

)

|

|

—

|

|

|

(6,813

|

)

|

|

Change in fair value of warrant liability

|

154

|

|

|

(3,241

|

)

|

|

(1,182

|

)

|

|

(1,182

|

)

|

|

—

|

|

|

Change in fair value of derivative liability

|

(65

|

)

|

|

512

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Change in fair value of contingent equity liability

|

(2,263

|

)

|

|

(13,082

|

)

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Loss from equity method investment

|

(247

|

)

|

|

(1,885

|

)

|

|

(2,808

|

)

|

|

(728

|

)

|

|

(900

|

)

|

|

Other

|

—

|

|

|

—

|

|

|

(147

|

)

|

|

(29

|

)

|

|

(17

|

)

|

|

Total other income (expense), net

|

(2,806

|

)

|

|

(18,602

|

)

|

|

(15,901

|

)

|

|

(1,939

|

)

|

|

(7,730

|

)

|

|

Loss before provision for income taxes

|

(63,444

|

)

|

|

(126,184

|

)

|

|

(240,455

|

)

|

|

(85,375

|

)

|

|

(62,195

|

)

|

|

Provision for income taxes

|

90

|

|

|

1,006

|

|

|

467

|

|

|

87

|

|

|

109

|

|

|

Net loss

|

(63,534

|

)

|

|

(127,190

|

)

|

|

(240,922

|

)

|

|

(85,462

|

)

|

|

(62,304

|

)

|

|

Less: Net (income) loss attributable to non‑controlling interests

|

143

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Accretion of beneficial conversion feature on Series A preferred shares

|

—

|

|

|

(12,006

|

)

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Net loss attributable to common shareholders of Biohaven Pharmaceutical Holding Company Ltd.

|

$

|

(63,677

|

)

|

|

$

|

(139,196

|

)

|

|

$

|

(240,922

|

)

|

|

$

|

(85,462

|

)

|

|

$

|

(62,304

|

)

|

|

Net loss per share attributable to common shareholders of Biohaven Pharmaceutical Holding Company Ltd. — basic and diluted

(1)

|

$

|

(5.05

|

)

|

|

$

|

(5.00

|

)

|

|

$

|

(6.15

|

)

|

|

$

|

(2.32

|

)

|

|

$

|

(1.41

|

)

|

|

Weighted average common shares outstanding — basic and diluted

(1)

|

12,608,366

|

|

|

27,845,576

|

|

|

39,188,458

|

|

|

36,793,090

|

|

|

44,242,070

|

|

________________

|

|

|

|

(1)

|

See Note 15 to our audited consolidated financial statements included in our most recent Annual Report on Form 10-K and Note 10 to our unaudited condensed consolidated financial statements included in our most recent Quarterly Report on Form 10‑Q, which are incorporated by reference into this prospectus supplement, for further details on the calculation of basic and diluted net loss per share attributable to common shareholders of Biohaven Pharmaceutical Holding Company Ltd.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2019

|

|

|

Actual

|

|

As Adjusted

(2)

|

|

|

(in thousands)

|

|

Consolidated Balance Sheet Data:

|

|

|

|

|

Cash

|

$

|

217,407

|

|

|

$

|

498,507

|

|

|

Working capital

(1)

|

203,680

|

|

|

484,780

|

|

|

Total assets

|

245,080

|

|

|

526,180

|

|

|

Liability related to sale of future royalties, net

|

124,332

|

|

|

124,332

|

|

|

Total liabilities

|

148,069

|

|

|

148,069

|

|

|

Total shareholders’ equity

|

97,011

|

|

|

378,111

|

|

________________

|

|

|

|

(1)

|

We define working capital as current assets less current liabilities.

|

|

|

|

|

(2)

|

The as adjusted balance sheet data give effect to our issuance and sale of

6,976,745

common shares in this offering at the public offering price of

$43.00

per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

|

RISK FACTORS

Investing in our common shares involves a high degree of risk. Before you invest in our common shares, you should carefully consider the risks described below, as well as general economic and business risks and the other information in this prospectus supplement and in the documents incorporated by reference herein, including those set forth under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2018

and under the heading “Risk Factors” in our Quarterly Report on Form 10-Q for the quarterly period ended

March 31, 2019

. The occurrence of any of the events or circumstances described below or other adverse events could have a material adverse effect on our business, results of operations and financial condition and could cause the trading price of our common shares to decline. Additional risks or uncertainties not presently known to us or that we currently deem immaterial may also harm our business. Any of the following risks as well as the risks discussed in the documents incorporated by reference herein, could have a material adverse effect on our business, operating results and financial condition and cause the trading price of our common shares to decline, which would cause you to lose all or part of your investment. When determining whether to invest, you should also refer to the other information contained or incorporated by reference in this prospectus supplement, including our financial statements and the related notes thereto. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us may also adversely affect our business.

Risks related to this offering and ownership of our common shares

If you purchase common shares in this offering, you will suffer immediate dilution of your investment.

The public offering price of our common shares is substantially higher than the net tangible book value per share. Therefore, if you purchase common shares in this offering, you will pay a price per share that substantially exceeds our net tangible book value per share after this offering. Based on the public offering price of

$43.00

per share, you will experience immediate dilution of $

35.62

per share, representing the difference between our as adjusted net tangible book value per share after giving effect to this offering and the public offering price.

In addition, as of

March 31, 2019

, we had outstanding stock options to purchase an aggregate of

7,923,334

common shares at a weighted average exercise price of

$18.23

per share and outstanding warrants to purchase an aggregate of

221,751

common shares at a weighted average exercise price of

$9.68

per share. The warrants were exercised in March 2019 and settled in common shares after March 31, 2019. In addition, we issued stock options to purchase

345,000

common shares, at a weighted average exercise price of

$58.23

per share, subsequent to

March 31, 2019

. To the extent these outstanding options or warrants are exercised, there will be further dilution to investors in this offering.

Sales of a substantial number of our common shares in the public market could occur at any time. This could cause the market price of our common shares to drop significantly, even if our business is doing well.

Sales of a substantial number of our common shares in the public market could occur at any time, subject to the restrictions and limitations described below. If we issue additional shares, or our shareholders sell, or the market perceives that our shareholders intend to sell, substantial amounts of our common shares in the public market, the market price of our common shares could decline significantly.

Upon the closing of this offering, based upon the number of shares outstanding as of

March 31, 2019

, we will have

51,259,739

outstanding common shares. These shares, including the

6,976,745

shares sold in this offering, will be freely tradable, subject, in the case of our affiliates, to the conditions of Rule 144 under the Securities Act of 1933.

Our officers and directors are subject to contractual lock‑up agreements with the underwriters for this offering for 30 days following this offering. The lead underwriters of this offering may release these shareholders from their lock-up agreements at any time and without notice, which would allow for earlier sales of shares in the public market subject to the conditions of Rule 144 under the Securities Act of 1933.

In addition, we have filed registration statements on Form S-8 registering the issuance of approximately

14.6 million

common shares subject to options or other equity awards issued or reserved for future issuance under our equity incentive plans. Shares registered under this registration statement on Form S-8 are available for sale in the public market subject to vesting arrangements and exercise of options, the lock-up agreements described above and, in the case of our affiliates, the restrictions of Rule 144.

Additionally, certain holders of our common shares, or their transferees, have rights, subject to some conditions, to require us to file one or more registration statements covering their shares or to include their shares in registration statements that we may file for ourselves or other shareholders. If we were to register the resale of these shares, they could be freely sold in the public market without limitation. If these additional shares are sold, or if it is perceived that they will be sold, in the public market, the trading price of our common shares could decline.

We will have broad discretion in the use of our existing cash, including the proceeds from this offering, and may invest or spend our cash in ways with which you do not agree and in ways that may not increase the value of your investment.

We will have broad discretion over the use of our cash, including the proceeds from this offering. You may not agree with our decisions, and our use of cash may not yield any return on your investment. We expect to use the net proceeds from this offering, together with our existing cash, to advance and expand the development of our CGRP receptor antagonist platform, including our planned FDA filings, and glutamate modulation platform product candidates, continue development of our MPO platform and for working capital and general corporate purposes, including satisfaction of any of our milestone payment obligations under our license agreements. In addition, we may use a portion of the proceeds from this offering to pursue our strategy to in-license or acquire additional drug candidates. Our failure to apply the net proceeds from this offering effectively could compromise our ability to pursue our growth strategy and we might not be able to yield a significant return, if any, on our investment of these net proceeds. You will not have the opportunity to influence our decisions on how to use our net proceeds from this offering.

Sales of our common shares through this or other equity offerings could trigger a limitation on our ability to use our net operating losses and tax credits in the future.

The Tax Reform Act of 1986 limits the annual use of net operating loss and tax credit carryforwards in certain situations where changes occur in stock ownership of a company. In the event we have certain changes in ownership, the annual utilization of such carryforwards could be limited. This or other equity issuances could trigger a limitation on our ability to use our net operating loss and tax credit carryforwards in the future under Sections 382 and 383 of the Internal Revenue Code as enacted by the Tax Reform Act of 1986.

INFORMATION REGARDING FORWARD‑LOOKING STATEMENTS

This prospectus supplement contains forward-looking statements that involve risks and uncertainties. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. All statements other than statements of historical facts contained in this prospectus supplement are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “expects”, “intends”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, “continue” or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

|

|

|

|

•

|

our plans to develop and commercialize our product candidates;

|

|

|

|

|

•

|

our ongoing and planned clinical trials for our rimegepant, troriluzole (previously referred to as trigriluzole or BHV-4157), BHV-0223, BHV-3500, BHV-5000 and verdiperstat (previously referred to as BHV-3241) development programs;

|

|

|

|

|

•

|

the timing of the availability of data from our clinical trials;

|

|

|

|

|

•

|

the timing of our planned regulatory filings, including our planned NDA submission for rimegepant;

|

|

|

|

|

•

|

the timing of and our ability to obtain and maintain regulatory approvals for our product candidates;

|

|

|

|

|

•

|

the clinical utility of our product candidates;

|

|

|

|

|

•

|

our commercialization, marketing and manufacturing capabilities and strategy;

|

|

|

|

|

•

|

our intellectual property position; and

|

|

|

|

|

•

|

our estimates regarding future revenues, expenses and needs for additional financing.

|

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described under the headings “Risk Factors” in this prospectus supplement, in our quarterly report on Form 10-Q for the quarterly period ended

March 31, 2019

and in our annual report on Form 10-K for the year ended

December 31, 2018

. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus supplement may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus supplement to conform these statements to actual results or to changes in our expectations.

You should read this prospectus supplement and the documents that we reference in this prospectus supplement and have filed with the U.S. Securities and Exchange Commission (“SEC”) as exhibits to the registration statement of which this prospectus supplement is a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

USE OF PROCEEDS

We estimate that the net proceeds from our issuance and sale of common shares in this offering will be approximately

$281.1 million

, or approximately

$323.4 million

if the underwriters exercise their option to purchase additional shares in full, based on the public offering price of

$43.00

per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We currently estimate that we will use the net proceeds from this offering, together with our existing cash, to:

|

|

|

|

•

|

advance and expand the development of our CGRP receptor antagonist platform, including our planned regulatory filings, including our planned NDA submissions for rimegepant;

|

|

|

|

|

•

|

advance and expand the development of glutamate modulation platform product candidates and continue development of our myeloperoxidase platform; and

|

|

|

|

|

•

|

for working capital and other corporate purposes, including satisfaction of any of our milestone payment obligations under our license agreements.

|

In the ordinary course of our business, we expect to from time to time evaluate the acquisition of, investment in or in-license of complementary products, technologies or businesses, and we could use a portion of the net proceeds from this offering for such activities. We currently do not have any agreements, arrangements or commitments with respect to any potential acquisition, investment or license.

This expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. Predicting the cost necessary to develop product candidates can be difficult and the amounts and timing of our actual expenditures may vary significantly depending on numerous factors, including the progress of our development, the status of and results from clinical trials, any collaborations that we may enter into with third parties for our product candidates and any unforeseen cash needs.

Based on our current operational plans and assumptions, we expect that the net proceeds from this offering, together with our existing cash, will be sufficient to fund our operations for at least the next 12 months. However, our plans and assumptions could be wrong, and we may need to raise additional capital in order to complete our planned and ongoing trials and any potential future trials that may be required by regulatory authorities. We may need to raise additional capital through public and private equity offerings, debt financings, strategic partnerships, alliances and licensing arrangements, or a combination of the above.

Our management will have broad discretion in the application of the net proceeds from this offering, and investors will be relying on the judgment of our management regarding the application of the net proceeds from this offering. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our business. Pending these uses, we plan to hold these net proceeds in non-interest bearing accounts, with the goal of capital preservation and liquidity so that such funds are readily available to fund our operations.

DIVIDEND POLICY

We have never declared or paid any dividends on our common shares. We anticipate that we will retain all of our future earnings, if any, for use in the operation and expansion of our business and do not anticipate paying cash dividends in the foreseeable future.

CAPITALIZATION

The following table sets forth our cash and our capitalization as of

March 31, 2019

:

|

|

|

|

•

|

on an actual basis; and

|

|

|

|

|

•

|

an as adjusted basis to give effect to our issuance and sale of

6,976,745

common shares in this offering at the public offering price of

$43.00

per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

|

You should read this table together with our condensed consolidated financial statements and accompanying notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our most recent Quarterly Report on Form 10-Q, which is incorporated by reference into this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2019

|

|

|

Actual

|

|

As Adjusted

|

|

|

(in thousands, except share and per share data)

|

|

Cash

|

$

|

217,407

|

|

|

$

|

498,507

|

|

|

|

|

|

|

|

Liability related to sale of future royalties, net

|

$

|

124,332

|

|

|

$

|

124,332

|

|

|

Shareholders’ equity:

|

|

|

|

|

Common shares, no par value; 200,000,000 shares authorized, 44,282,994 shares issued and outstanding, actual; 200,000,000 shares authorized, 51,259,739 shares issued and outstanding, as adjusted

|

556,345

|

|

|

837,445

|

|

|

Additional paid-in capital

|

46,538

|

|

|

46,538

|

|

|

Accumulated deficit

|

(505,872

|

)

|

|

(505,872

|

)

|

|

Total shareholders’ equity

|

97,011

|

|

|

378,111

|

|

|

Total capitalization

|

$

|

221,343

|

|

|

$

|

502,443

|

|

The number of common shares outstanding in the table above does not include:

|

|

|

|

•

|

7,923,334

common shares issuable upon the exercise of stock options outstanding as of

March 31, 2019

, at a weighted average exercise price of $

18.23

per share;

|

|

|

|

|

•

|

221,751

common shares issuable upon the exercise of warrants outstanding as of

March 31, 2019

, at a weighted average exercise price of $

9.68

per share;

|

|

|

|

|

•

|

1,909,608

common shares reserved for future issuance of stock option grants under our 2017 Equity Incentive Plan, or the 2017 Plan, as of

March 31, 2019

(of which we granted stock options to purchase an aggregate of

345,000

common shares, at a weighted average exercise price of $

58.23

per share, subsequent to

March 31, 2019

); and

|

|

|

|

|

•

|

1,141,691

common shares reserved for future issuance under our 2017 Employee Share Purchase Plan, or ESPP, as of

March 31, 2019

as well as any automatic increases in the number of common shares reserved for issuance under the 2017 Plan and the ESPP after the date of this prospectus supplement.

|

DILUTION

If you invest in our common shares in this offering, your ownership interest will be diluted immediately to the extent of the difference between the public offering price per common share and the as adjusted net tangible book value per common share immediately after this offering.

Our historical net tangible book value as of

March 31, 2019

was

$97.0 million

, or

$2.19

per common share. Our historical net tangible book value is the amount of our total tangible assets less our total liabilities. Historical net tangible book value per share represents historical net tangible book value divided by the

44,282,994

common shares outstanding as of

March 31, 2019

.

After giving effect to the issuance and sale of

6,976,745

common shares in this offering at the public offering price of

$43.00

per share and after deducting underwriting discounts and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of

March 31, 2019

would have been

$378.1 million

, or

$7.38

per common share. This represents an immediate increase in as adjusted net tangible book value of

$5.19

per share to existing shareholders and immediate dilution in as adjusted net tangible book value of

$35.62

per share to new investors purchasing common shares in this offering. The following table illustrates this per share dilution:

|

|

|

|

|

|

|

|

|

|

|

|

Public offering price per share

|

|

|

$

|

43.00

|

|

|

Historical net tangible book value per share as of March 31, 2019

|

$

|

2.19

|

|

|

|

|

Increase in as adjusted net tangible book value per share attributable to this offering

|

5.19

|

|

|

|

|

As adjusted net tangible book value per share after this offering

|

|

|

7.38

|

|

|

Dilution per share to new investors purchasing common shares in this offering

|

|

|

$

|

35.62

|

|

If the underwriters exercise their option to purchase additional shares in this offering in full, the as adjusted net tangible book value per share after this offering would be

$8.04

per share and the dilution in as adjusted net tangible book value per share to new investors purchasing common shares in this offering would be

$34.96

per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

The table and discussion above do not include:

|

|

|

|

•

|

7,923,334

common shares issuable upon the exercise of stock options outstanding as of

March 31, 2019

, at a weighted average exercise price of $

18.23

per share;

|

|

|

|

|

•

|

221,751

common shares issuable upon the exercise of warrants outstanding as of

March 31, 2019

, at a weighted average exercise price of $

9.68

per share;

|

|

|

|

|

•

|

1,909,608

common shares reserved for future issuance of stock option grants under our 2017 Plan as of

March 31, 2019

(of which we granted stock options to purchase an aggregate of

345,000

common shares, at a weighted average exercise price of $

58.23

per share, subsequent to

March 31, 2019

); and

|

|

|

|

|

•

|

1,141,691

common shares reserved for future issuance under our ESPP as of

March 31, 2019

as well as any automatic increases in the number of common shares reserved for issuance under the 2017 Plan and the ESPP after the date of this prospectus supplement.

|

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS FOR U.S. HOLDERS

The following is a summary of material U.S. federal income tax considerations relating to the acquisition, ownership and disposition of our common shares by a U.S. holder (as defined below). This summary addresses only the U.S. federal income tax considerations for U.S. holders that are initial purchasers of our common shares pursuant to this offering and that will hold such common shares as capital assets for U.S. federal income tax purposes. This summary does not address all U.S. federal income tax matters that may be relevant to a particular U.S. holder. This summary does not address tax considerations applicable to a U.S. holder of our common shares that may be subject to special tax rules including, without limitation, the following:

|

|

|

|

•

|

banks, financial institutions or insurance companies;

|

|

|

|

|

•

|

brokers, dealers or traders in securities, currencies, commodities, or notional principal contracts;

|

|

|

|

|

•

|

tax-exempt entities or organizations, including an “individual retirement account” or “Roth IRA” as defined in Section 408 or 408A of the Code, respectively;

|

|

|

|

|

•

|

real estate investment trusts, regulated investment companies or grantor trusts;

|

|

|

|

|

•

|

persons that hold the common shares as part of a “hedging,” “integrated” or “conversion” transaction or as a position in a “straddle” for U.S. federal income tax purposes;

|

|

|

|

|

•

|