UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

BigBear.ai

Holdings, Inc.

(Name of Issuer)

Common Stock, $0.0001 par value

(Title of Class of Securities)

08975B109

(CUSIP Number)

Jeffrey C. Selman

DLA Piper LLP (US)

555

Mission Street, Suite 2400

San Francisco, CA 94105-2933

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

June 13, 2022

(Date

of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d- l(e),

240.13d-l(f) or 240.13d- l(g), check the following box. ☐

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 08975B109

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

GigAcquisitions4, LLC |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (See Instructions) (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See

Instructions) WC |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization Delaware,

USA |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

0 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

0 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

0 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13. |

|

Percent of

Class Represented by Amount in Row (11) 0.00% |

| 14. |

|

Type of Reporting Person

(See Instructions) PN |

Note: All share numbers on these cover pages are presented as shares of Common Stock, $0.0001 par value, of

BigBear.ai Holdings, Inc., a Delaware corporation, as further described herein.

2

CUSIP No. 08975B109

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

GigFounders, LLC |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (See Instructions) (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See

Instructions) WC |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization Delaware,

USA |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

0 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

0 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

0 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13. |

|

Percent of

Class Represented by Amount in Row (11) 0.00% |

| 14. |

|

Type of Reporting Person

(See Instructions) PN |

3

CUSIP No. 08975B109

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

Avi S. Katz |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (See Instructions) (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See

Instructions) WC |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization United States and

Israel |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

1,375,990(1) |

| |

8. |

|

Shared Voting Power

0 |

| |

9. |

|

Sole Dispositive Power

1,375,990 |

| |

10. |

|

Shared Dispositive Power

0 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,375,990 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13. |

|

Percent of

Class Represented by Amount in Row (11) 1.08%(2) |

| 14. |

|

Type of Reporting Person

(See Instructions) IN |

| (1) |

This number of shares of Common Stock consists of: (i) 1,368,907 shares of Common Stock owned directly by the

Reporting Person and (ii) 7,083 warrants to purchase shares of Common Stock. |

| (2) |

Calculation is based upon 127,113,451 shares of Common Stock outstanding as of June 16, 2022, as reported

in Prospectus Supplement (to Prospectus dated May 23, 2022) filed pursuant to Rule 424(b)(7) on June 17, 2022, included in the registration statement on Form S-1

(File No. 333- 261887), as amended. |

4

CUSIP No. 08975B109

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

Raluca Dinu |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (See Instructions) (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See

Instructions) WC |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization United

States |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

1,375,990(1) |

| |

8. |

|

Shared Voting Power

0 |

| |

9. |

|

Sole Dispositive Power

1,375,990 |

| |

10. |

|

Shared Dispositive Power

0 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,375,990 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13. |

|

Percent of

Class Represented by Amount in Row (11) 1.08%(2) |

| 14. |

|

Type of Reporting Person

(See Instructions) IN |

| (1) |

This number of shares of Common Stock consists of: (i) 1,368,907 shares of Common Stock owned directly by the

Reporting Person and (ii) 7,083 warrants to purchase shares of Common Stock. |

| (2) |

Calculation is based upon 127,113,451 shares of Common Stock outstanding as of June 16, 2022, as reported

in Prospectus Supplement (to Prospectus dated May 23, 2022) filed pursuant to Rule 424(b)(7) on June 17, 2022, included in the registration statement on Form S-1

(File No. 333- 261887), as amended. |

5

This Amendment No. 1 (this “Amendment”) relates to Schedule 13D is filed

jointly by GigAcquisitions4, LLC, (“GigAcquisitions4” or the “Sponsor”), GigFounders, LLC, Dr. Avi S. Katz and Dr. Raluca Dinu (each a “Reporting Person” and,

collectively, the “Reporting Persons”) with respect to the Common Stock, pursuant to their Joint Filing Agreement dated December 21, 2021 (“Joint Filing Agreement”), filed as Exhibit 7.4 to

Schedule 13D originally filed on behalf of the Reporting Persons with the United States Securities and Exchange Commission (the “SEC”) on December 21, 2021 (the “Original Schedule 13D”).

Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to them in the Original Schedule 13D. Except specifically provided herein, this Amendment does not modify any of the information previously reported in the

Original Schedule 13D. This is the final amendment to the Schedule 13D and constitutes an “exiting filing” for the Reporting Persons.

Item 1. Security and Issuer

This statement on

Schedule 13D (the “Schedule 13D”) relates to the shares of Common Stock, $0.0001 par value (the “Common Stock”) of BigBear.ai Holdings, Inc., a Delaware corporation (the “Issuer”). The

address of the Issuer’s principal executive offices is 6811 Benjamin Franklin Drive, Suite 200, Columbia, Maryland 21046.

Item 2. Identity

and Background

| |

(a) |

This Schedule 13D is being filed by the following Reporting Persons: (i) GigAcquisitions4, LLC, a Delaware

limited liability company, (ii) GigFounders, LLC, a Delaware limited liability company and affiliate of the Sponsor (“GigFounders”), (iii) Dr. Avi S. Katz, a citizen of the United States and Israel who is an

investor and the manager of the Sponsor and the managing and co-founding member of GigFounders, and (iv) Dr. Raluca Dinu, a citizen of the United States who is an investor, chief executive officer of

special purpose acquisition companies and the co-founding member of GigFounders. Dr. Katz and Dr. Dinu are currently members of the board of directors of the Issuer. |

| |

(b) |

The business address of the Reporting Persons is 1731 Embarcadero Road, Suite 200, Palo Alto, California 94303.

|

| |

(c) |

The Reporting Persons may be deemed to constitute a group for purposes of Rule

13d-3 under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). |

| |

(d) |

During the last five years, none of the Reporting Persons (i) has been convicted in any criminal

proceeding (excluding traffic violations or similar misdemeanors) or (ii) was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment,

decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. |

Item 3. Source and Amount of Funds or Other Consideration

Not applicable.

Item 4. Purpose of Transaction

The Reporting Persons acquired the securities described in this Schedule 13D for investment purposes and intend to review their investments in the Issuer on a

continuing basis. Any actions the Reporting Persons might undertake may be made at any time and from time to time without prior notice and will be dependent upon the Reporting Persons’ review of numerous factors, including, but not limited to:

an ongoing evaluation of the Issuer’s business, financial condition, operations and prospects; price levels of the Issuer’s securities; general market, industry and economic conditions; the relative attractiveness of alternative business

and investment opportunities; and other future developments.

Subject to the terms of that certain amended & restated investor rights agreement

(the “Investor Rights Agreement”), a copy of which was filed as Exhibit 7.3 to the Original Schedule 13D, the Reporting Persons may acquire additional securities of the Issuer, or retain or sell all or a portion of the

securities then held, in the open market or in privately negotiated transactions. In addition, the Reporting Persons may engage in discussions with management, the Board, and securityholders of the Issuer and other relevant parties or encourage,

cause or seek to cause the Issuer or such persons to consider or explore extraordinary corporate transactions, such as: a merger, reorganization or other transaction that could result in the de-listing or de-registration of the Common Stock; sales or acquisitions of assets or businesses; changes to the capitalization or distribution policy of the Issuer; or other material changes to the Issuer’s business or

corporate structure, including changes in management or the composition of the Board. There can be no assurance, however, that any Reporting Person will propose such a transaction, that any proposed transaction would receive the requisite approvals

from the respective governing bodies, as applicable, or that any such transaction would be successfully implemented.

Except as disclosed in this Item 4, the Reporting Persons do not have any current plans or proposals that

relate to or would result in any of the events described in clauses (a) through (j) of the instructions to Item 4 of Schedule 13D. The Reporting Persons, however, will take such actions with respect to the Reporting Persons’ investments in

the Issuer as deemed appropriate in light of existing circumstances from time to time and reserve the right to acquire or dispose of securities of the Issuer, to enter into hedging relationships with respect to such securities, or to formulate other

purposes, plans, or proposals in the future depending on market conditions and/or other factors.

Item 5. Interest in Securities of the Issuer

Item 5 of this Schedule 13D is amended and supplemented as follows:

(a) See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of shares of Common Stock and percentages of

the shares of Common Stock beneficially owned by each of the Reporting Persons.

(b) See rows (7) through (10) of the cover pages to

this Schedule 13D for the number of shares of Common Stock as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition.

(c) On May 20, 2022, the Sponsor distributed shares of Common Stock and warrants to purchase shares of Common Stock of the Issuer to its

members, which included GigFounders. GigFounders, in its turn, distributed the same securities to its members, which included Dr. Avi S. Katz and Dr. Raluca Dinu. Such shares of Common Stock and warrants were acquired by the Sponsor

in connection with the closing of the Issuer’s initial public offering in a private placement of units containing one share of Common Stock and one-third of a warrant for a purchase price of

$10.00 per unit. On June 13, 2022, the Sponsor distributed the remaining shares of Common Stock held by the Sponsor to its members, which included GigFounders. GigFounders, in its turn, distributed the same securities to its members, included

Dr. Avi S. Katz and Dr. Raluca Dinu. Such shares of Common Stock were acquired by the Sponsor in connection with the formation of the Issuer for approximately $0.0027927 per share.

(d) No person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or

proceeds from the sale of, such shares of Common Stock.

(e) June 13, 2022.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

The Sponsor, GigFounders, Dr. Avi. S. Katz and Dr. Raluca Dinu entered into the Joint Filing Agreement attached as Exhibit 7.4 to the Original

Schedule 13D with respect to the joint filing of this Schedule 13D.

Except as set forth herein, none of the Reporting Persons has any contracts,

arrangements, understandings or relationships (legal or otherwise) with any person with respect to any securities of the Issuer, including but not limited to any contracts, arrangements, understandings or relationships concerning the transfer or

voting of such securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or losses, or the giving or withholding of proxies.

Item 7. Material to Be Filed as Exhibits

None.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, each of the undersigned certifies that the information set forth in the

Statement is true, complete and correct.

Date: June 24, 2022

|

|

|

| GIGACQUISITIONS4, LLC |

|

|

| By: |

|

/s/ Dr. Avi S. Katz |

|

|

Dr. Avi S. Katz |

|

|

Manager |

|

| GIGFOUNDERS, LLC |

|

|

| By: |

|

/s/ Dr. Avi S. Katz |

|

|

Dr. Avi S. Katz |

|

|

Manager |

|

| /s/ Dr. Avi S. Katz |

| Dr. Avi S. Katz |

|

| /s/ Dr. Raluca Dinu |

| Dr. Raluca Dinu |

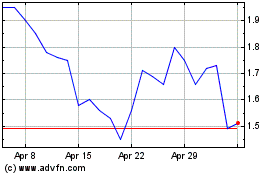

BigBear ai (NYSE:BBAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

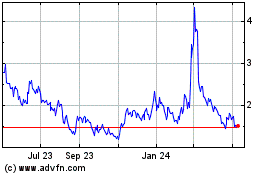

BigBear ai (NYSE:BBAI)

Historical Stock Chart

From Apr 2023 to Apr 2024