Current Report Filing (8-k)

June 02 2022 - 4:20PM

Edgar (US Regulatory)

false 0001836981 0001836981 2022-06-02 2022-06-02 0001836981 bbai:CommonStockParValue0.0001PerShare2Member 2022-06-02 2022-06-02 0001836981 bbai:RedeemableWarrantsEachFullWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50PerShare1Member 2022-06-02 2022-06-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): June 2, 2022

BigBear.ai Holdings, Inc.

(Exact name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-40031 |

|

85-4164597 |

| (State or Other Jurisdiction of Incorporation or Organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

6811 Benjamin Franklin Drive, Suite 200

Columbia, Maryland 21046

(Address of principal executive offices, including Zip Code)

(410) 312-0885

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

BBAI |

|

New York Stock Exchange |

| Redeemable warrants, each full warrant exercisable for one share of common stock at an exercise price of $11.50 per share |

|

BBAI.WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On June 2, 2022, BigBear.ai Holdings, Inc. (the “Company”) announced Julie Peffer as the new Chief Financial Officer of the Company, effective June 13, 2022. She will succeed Joshua Kinley, who has served as the Company’s Chief Financial Officer since December 2020. Mr. Kinley’s resignation from his role as Chief Financial Officer was not the result of any disagreement with the Company and he will continue to serve the Company as Chief Corporate Development Officer, reporting to the Chief Executive Officer. The Company thanks Mr. Kinley for his service to the Company and its stockholders.

Ms. Peffer, age 55, joins the Company from MedeAnalytics where she served as Chief Financial Officer beginning in January 2021. Prior to that, Ms. Peffer served as Vice President, Finance at Amazon Web Services from February 2017 to March 2020. Before that, Ms. Peffer served as Vice President, Finance at Flowserve Corporation from April 2014 to September 2016. Ms. Peffer has also held a variety of executive financial leadership positions encompassing P&L ownership as well as corporate and business level financial planning and analysis across multiple industries, including at Raytheon Space & Airborne Systems, ITT Geospatial Systems, Lennox International, and Textron. Ms. Peffer earned her Bachelor of Business Administration degree in Finance and Management from Texas Tech University and a Master of Business Administration degree from Baker University.

There are no arrangements or understandings between Ms. Peffer and any other person pursuant to which Ms. Peffer was appointed as Chief Financial Officer. There are no family relationships among any of the Company’s directors or executive officers and Ms. Peffer.

Ms. Peffer will be entitled to the following compensation: (i) an annualized base salary of $400,000 per year; (ii) eligibility to participate in the Company’s short term incentive program with an annual cash bonus of up to 100% of her annual base salary, based upon mutually developed performance objectives; (iii) an up-front time-based long-term incentive award with a grant date value of $400,000 and delivered 50% in the form of restricted stock units and 50% in the form of stock options, 25% of which will vest on the first anniversary of the grant date and the remaining 75% will vest in equal quarterly installments on each quarterly anniversary of the grant date thereafter; (iv) beginning in 2023 and subject to compensation committee approval, a recurring annual grant valued at 75% of base compensation and split (at the compensation committee’s discretion) between restricted stock units, performance stock units and stock options; and (v) eligibility to participate in the Company’s employee benefit plans and programs in accordance with the terms and conditions of the applicable plans and programs.

In connection with her appointment, the Company will enter into its standard form of indemnification agreement with Ms. Peffer, a copy of which is attached as Exhibit 10.1 and incorporated by reference herein.

| Item 7.01 |

Regulation FD Disclosure. |

On June 2, 2022, the Company issued a press release with respect to the management changes described in Item 5.02 of this Current Report on Form 8-K. The press release is included in this report as Exhibit 99.1 and is incorporated herein by reference. This information shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: June 2, 2022 |

|

|

|

BIGBEAR.AI HOLDINGS, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Carolyn Blankenship |

|

|

|

|

|

|

Carolyn Blankenship |

|

|

|

|

|

|

General Counsel and Secretary |

4

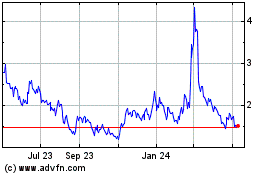

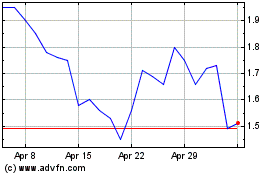

BigBear ai (NYSE:BBAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

BigBear ai (NYSE:BBAI)

Historical Stock Chart

From Apr 2023 to Apr 2024