Current Report Filing (8-k)

March 06 2023 - 4:34PM

Edgar (US Regulatory)

0000768835false00007688352023-02-282023-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2023

BIG LOTS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| | |

| Ohio | 001-08897 | 06-1119097 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

4900 E. Dublin-Granville Road, Columbus, Ohio 43081

(Address of principal executive offices) (Zip Code)

(614) 278-6800

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common shares | BIG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 2, 2023, Big Lots, Inc. (“we,” “us,” “our” or “Company”) issued a press release (the “Earnings Press Release”) and conducted a conference call, both of which: (i) reported our unaudited results for the fourth quarter of fiscal 2022; (ii) provided guidance for the first quarter of fiscal 2023; (iii) provided guidance for fiscal 2023; (iv) directed listeners to an investor presentation published on our website on our results for the fourth quarter of fiscal 2022 (the “Investor Presentation”); and (v) provide an update on the status of our quarterly cash dividend program.

The Earnings Press Release, the conference call and the Investor Presentation included “non-GAAP financial measures,” as that term is defined by Rule 101 of Regulation G (17 CFR Part 244) and Item 10 of Regulation S-K (17 CFR Part 229). Specifically, the following non-GAAP financial measures were included: (i) adjusted selling and administrative expenses; (ii) adjusted selling and administrative expense rate; (iii) adjusted depreciation expense; (iv) adjusted depreciation rate; (v) adjusted operating (loss) profit; (vi) adjusted operating (loss) profit rate; (vii) adjusted income tax (benefit) expense; (viii) adjusted effective income tax rate; (ix) adjusted net (loss) income; (x) adjusted diluted (loss) earnings per share; (xi) adjusted operating expenses; and (xii) adjusted operating expense rate.

The non-GAAP financial measures exclude from the most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) the following items for the periods noted:

| | | | | | | | | | | | | | |

| Item | Fiscal 2022 Fourth Quarter | Fiscal 2022 Full Year | Fiscal 2021 Fourth Quarter | Fiscal 2021 Full Year |

After-tax adjustment to exclude store asset impairment charges and a gain on sale of real estate and related expenses of $4.4 million, or $0.15 per diluted share | X | | | |

After-tax adjustment to exclude store asset impairment charges and a gain on sale of real estate and related expenses of $38.9 million, or $1.35 per diluted share | | X | | |

After-tax adjustment to exclude store asset impairment charges of $3.8 million, or $0.12 per diluted share | | | X | |

After-tax adjustment to exclude store asset impairment charges of $3.8 million, or $0.11 per diluted share | | | | X |

The Earnings Press Release and the Investor Presentation posted in the Investor Relations section of our website contain a presentation of the most directly comparable financial measure calculated and presented in accordance with GAAP and a reconciliation of the difference between the non-GAAP financial measures and the most directly comparable financial measures calculated and presented in accordance with GAAP.

Our management believes that disclosure of the non-GAAP financial measures provides useful information to investors because the non-GAAP financial measures present an alternative and more relevant method for measuring our operating performance, excluding special items included in the most directly comparable GAAP financial measures, which our management believes are more indicative of our ongoing operating results and financial condition. These non-GAAP financial measures, along with the most directly comparable GAAP financial measures, are used by our management to evaluate our operating performance.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in accordance with GAAP. Non-GAAP financial measures as reported by us may not be comparable to similarly titled items reported by other companies.

Attached as exhibits to this Form 8-K are copies of the Earnings Press Release (Exhibit 99.1), the transcript of our March 2, 2023 conference call (Exhibit 99.2) and the Investor Presentation (Exhibit 99.3), including information concerning forward-looking statements and factors that may affect our future results. The information in Exhibits 99.1, 99.2 and 99.3 is being furnished, not filed, pursuant to Item 2.02 of this Form 8-K. By furnishing the information in this Form 8-K and the attached exhibits, we are making no admission as to the materiality of any information in this Form 8-K or the exhibits.

Item 8.01 Other Events.

On March 2, 2023, the Company issued a press release announcing that our Board of Directors declared a quarterly cash dividend on February 28, 2023 for the first quarter of fiscal 2023 of $0.30 per common share payable on March 31, 2023, to shareholders of record as of the close of business on March 17, 2023. This press release is filed herewith as Exhibit 99.4 hereto and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | | | | | | | | | | |

| (d) | Exhibits | | | |

| | | | | |

| | Exhibit No. | | Description | |

| | | | | |

| | | | Big Lots, Inc. press release on operating results and guidance dated March 2, 2023. |

| | | | | |

| | | | Big Lots, Inc. edited conference call transcript dated March 2, 2023. |

| | | | | |

| | | | Big Lots, Inc. investor presentation on our results for the fourth quarter of fiscal 2022 dated March 2, 2023. |

| | | | | |

| | | | Big Lots, Inc. press release on dividend declaration dated March 2, 2023. |

| | | | | |

| | 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

| | | | | |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | BIG LOTS, INC. |

| | | |

| Date: March 6, 2023 | By: | /s/ Ronald A. Robins, Jr. |

| | | Ronald A. Robins, Jr. |

| | | Executive Vice President, Chief Legal and Governance Officer, General Counsel and Corporate Secretary |

| | | | |

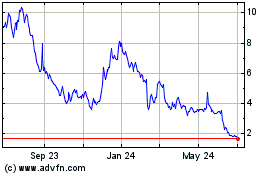

Big Lots (NYSE:BIG)

Historical Stock Chart

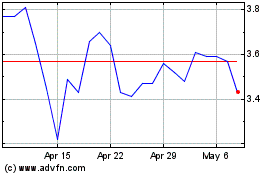

From Mar 2024 to Apr 2024

Big Lots (NYSE:BIG)

Historical Stock Chart

From Apr 2023 to Apr 2024